3 min read

I was 18 years old when I first heard the quote “The average millionaire has seven streams of income.”

At the time, it seemed like an obvious fact. It’s certainly easier to get rich if you have multiple sources of income.

Unfortunately, I thought this meant working more hours at multiple jobs. For example:

- Work for 10 hours per week as a soccer referee.

- Another 10 hours as a tutor.

- Another 10 as a cashier.

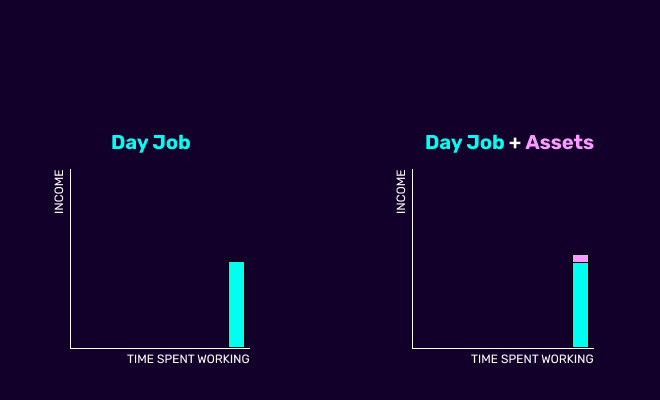

I didn’t realize that the quote implied millionaires own seven streams of income, on average. It wasn’t about working in seven different jobs. It was about owning seven different assets that earn income for you.

Fortunately, this dawned on me years later. That’s why, when I landed my first job as a data scientist, I started investing a portion of each paycheck into stock index funds.

I can still recall the thrill of receiving my first dividend payment in my brokerage account. I think it was 12 bucks.

It wasn’t much, but it showed me that it was possible to own assets that earned income for me without my attention.

This meant that I could keep working the same number of hours per week as a data scientist with a fixed salary, yet every three months I’d earn an extra $12 just for owning assets in my brokerage account.

I quickly realized that the more I invested in assets, the more income I could earn without actually working more hours.

This was the real path to financial freedom. Not working more hours, but owning more assets that work for you.

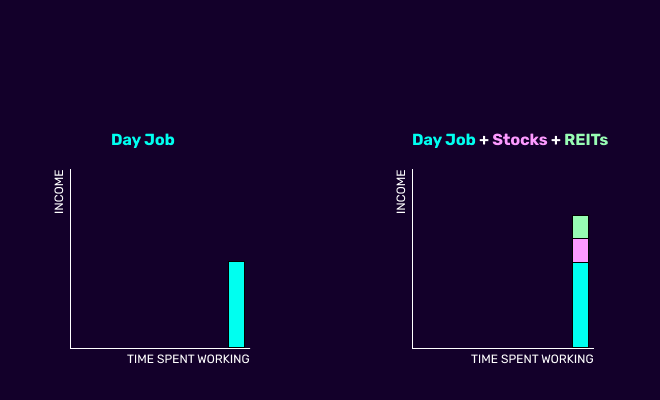

Over time, I began to buy more stock index funds and branched out into REITs (real estate investment trusts) that also paid dividends every three months.

After a couple years, my dividend income from stocks and REITs reached about $300 per month.

This was a wonderful form of passive income, but it wouldn’t allow me to quit my day job any time soon. That’s why I dove into the world of creating profitable websites.

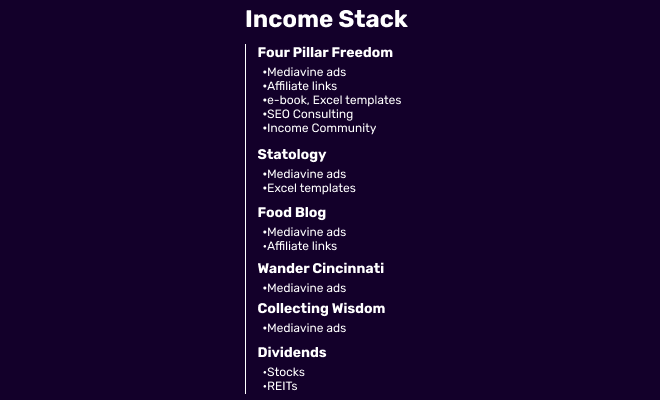

First, I created Four Pillar Freedom in late 2016. I followed this up with Collecting Wisdom and Statology in 2018, along with Wander Cincinnati in mid 2019 and the purchase of a food blog in late 2019.

My total monthly income surpassed my monthly expenses last summer, so I quit my day job to go full-time on my sites.

Since then, I’ve grown my total income from my sites to about $6,000 per month and my total income from dividends still sits at around $300.

Here’s what my complete income stack looks like today:

I receive income from five different sites each month along with dividends from both stock and REIT index funds.

My plan moving forward with this income stack is as follows:

- Spend most of my time adding content to Statology, Wander Cincinnati, and Four Pillar Freedom.

- Invest excess cash into more stock and REIT index funds.

As opposed to adding new income streams, my focus over the next year will be on increasing the total income from my existing streams.

As I continue to add more content to my sites, my income will increase and I’ll be able to invest more excess cash into stocks and REITs, which will add to my total monthly passive income.

I firmly believe that websites offer the best way for anyone to build their own income stream from scratch. If you’re interested in learning how to start and grow your own profitable website, check out the Income Community – a private community that teaches you the exact strategy that I personally use to build income-producing websites.

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.