6 min read

Did you know that South America is located south of North America?

Hopefully you did.

But did you know that virtually the entire continent of South America is located east of Florida?

You probably didn’t.

In a fascinating article I recently read on National Geographic, cartographer John Nelson shares the most common geographic misconceptions people hold. Along with the misconception about the placement of the Americas, here are a few more interesting ones he shares:

Africa is located mostly in the northern hemisphere, not the southern hemisphere.

According to Nelson:

“Most of Africa is north of the equator, though on many mental maps it is mostly in the southern hemisphere directly across the Atlantic from South America.”

See for yourself:

Europe lines up more closely with Canada than the U.S. in terms of latitude

The reason for this misconception is fascinating: when most people think of Europe, they consider how similar the climate is to the U.S. and conclude that it must be located near the same latitude. However, according to Nelson, Europe has a deceivingly warmer climate thanks to the gulf stream:

“Western Europe is relatively warm for its latitude thanks to the Gulf Stream, which brings warmer water from the Gulf of Mexico across the Atlantic and gives Europe its so-called Mediterranean climate. The warmer temperatures are more similar to the climate of the lower 48 states than Canada’s.”

Geographically, Europe actually lines up better with Canada. Nelson shares:

“Paris is further north than Montreal, Barcelona is at a similar latitude as Chicago, and Venice lines up with Portland, Oregon.”

The size of countries are greatly exaggerated in certain map projections

This last geographic misconception is the most mind-boggling. Many 2-dimensional maps use what is known as the mercator projection, which essentially flattens a 3-dimensional globe onto a flat surface. The problem with doing this is that it inflates the size of land near the poles.

For example, on most maps, Greenland appears to be similar in size to South America, when in fact South America is more than eight times larger than Greenland.

Climate data scientist Neil Kaye once shared a GIF on Twitter that shows the actual size of countries compared to their size on the mercator projection:

Animating the Mercator projection to the true size of each country in relation to all the others.

Focusing on a single country helps to see effect best.#dataviz #maps #GIS #projectionmapping #mapping pic.twitter.com/clpCiluS1z

— Neil Kaye (@neilrkaye) October 12, 2018

It’s incredible to see how much smaller the countries near the poles are than most people think. In particular, when we look at the actual size of countries we see that Africa is massive and that Brazil is actually larger than the United States!

Misconceptions Abound

Why are these geographical misconceptions so common? Partly because it’s easier for humans to think in simple terms. It’s easier to assume that South America is directly south of North America and that Europe is directly east of the United States. It’s also easier to assume that the mercator projection is accurate since it’s so widely used.

However, when you dig a little deeper, you find that these common beliefs are inaccurate and not supported by data. I think we can also use data to debunk some common misconceptions people have about money.

Money Misconceptions

Here are a few common misconceptions people have about money that aren’t supported by data.

Renting is throwing away your money

This might be the biggest money misconception out there: most people assume that buying a house is always a better financial decision than renting a place. Unfortunately, data doesn’t support this belief.

Most people don’t consider property taxes, closing costs, maintenance costs, or investment opportunity costs when they decide to buy a house.

To actually compare renting vs. buying, I recommend checking out this calculator from Nerdwallet or this one from The Upshot. When you play around with the numbers, you’ll likely find that renting is actually a better financial decision if you plan on staying in a place for less than 8-10 years while buying tends to be a better financial decision if you’re committed to staying in one place for more than 10 years.

With that said, there are many factors that could affect this like location, interest rates, housing price trends, etc.

The best way to get ahead financially is to move to a big city that can offer you a higher salary

Many people mistakenly believe that they need to live in a big city to earn a high salary to get ahead financially. Unfortunately, most people forget that big cities come with higher costs of living, which could actually cancel out a high income.

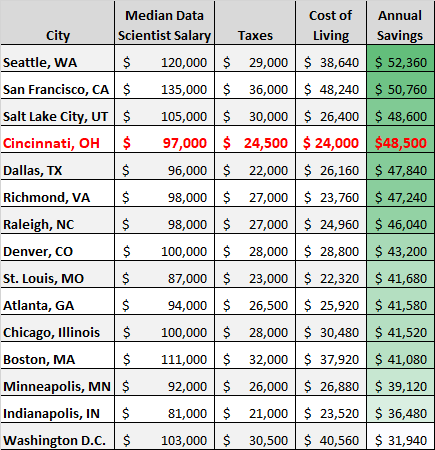

I once ran the numbers for myself to find out if I could benefit from moving to a new city and earning a higher salary. I looked at the median salary for my profession in 15 different cities along with the cost of living in those cities.

It turned out that while my current city of Cincinnati doesn’t offer the highest salary, it does offer a high salary relative to the cost of living:

Although I could earn a higher income in many cities around the United States, the taxes on this higher income along with higher living expenses would actually mean I’d be able to save less than I can right now in Cincinnati.

To anyone who is considering moving to a new city for a salary boost: it could be the right move for you, but make sure you run the numbers first.

You should go back to college for another degree to earn a higher income

In a one analysis, the company Talent Works found that having a 2nd college degree boosted your chances of getting an interview by 21.9%. By comparison, they discovered that using more distinct action words on your resume boosted your chances of getting an interview by 139.6%.

They explain exactly what they mean by “using action verbs:”

If you did anything worthy at a company, you’ll have done something.

If you start the sentence describing what you did with an action verb, you’re off to a strong start. And if you describe the different things that you did at that company with different action verbs, you’ll have finished strong.

In short, say this:

“Developed a world-positive, high-impact student loan product that didn’t screw over people after 100+ customer interviews.”

Not this:

“After 100+ customer interviews, the world-positive, high-impact student loan product was developed by me.”

While getting a 2nd degree can certainly make sense in some cases, it’s much easier to simply polish your resume to boost your chances of landing an interview.

From Talent Works:

Many folks think to get a better job they have to fundamentally change as a person, gain new skills, learn new habits, network for weeks, etc. And, sure, all of that helps.

But, look again at the #1 most effective tip: it’s about changing the words on your resume for a +139.6% boost. (And not even all of the words — it’s literally about changing the first word of each job achievement.)

On the other hand, look at what a second degree buys you: a +21.9% boost. It’ll cost you tens of thousands of dollars and years of effort, but you’ll get 6.4x more impact for something that’ll take you a few minutes.

Don’t automatically assume that more degrees is the answer to earning a higher income.

You need strong investment returns from stocks, bonds, REITs, etc. to reach your financial goals

Earning investment returns will obviously help you reach your financial goals faster, but you can’t always rely on them. In one post, I shared the hypothetical scenario of someone who wanted to accumulate $1 million in 20 years.

I assumed that this individual would invest all of their savings in an S&P 500 index fund during these 20 years. I also analyzed how the S&P 500 performed over every 20-year-period since 1928 to see what type of investment returns this individual could expect to receive.

The median annual return during a 20-year-period was 7.3% after inflation. However, there was one 20-year stretch (1929-1948) where the S&P 500 delivered awful 0.6% annual returns.

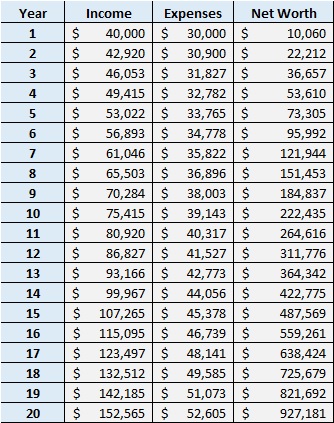

So, I considered a situation where an individual invested all of their savings into an S&P 500 fund each year and only earned 0.6% returns each year for 20 years.

I then assumed that this individual could increase their income by 7.3% each year (equivalent to the median annualized 20-year S&P 500 return) through building up their skill set, pursuing side hustles, starting small businesses, etc. I also assumed that they would increase their spending each year by 3% and that they would start their journey with a yearly income of $40,000. Then I ran the numbers:

This individual would be able to accumulate $927,181, just a bit short of $1 million, during the worst 20-year investment period ever. With very little help from S&P 500 investment returns, this person would be able to nearly reach their net worth goal of $1 million purely through creating their own investment returns and increasing their own income each year.

This proves that you don’t necessarily need investment returns from traditional investments like stocks, bonds, REITs, etc. to reach your financial goals. It’s possible to generate your own investment returns each year by investing in yourself and your skill set to increase your income over time.

Run the Numbers

The problem with these common money misconceptions is that very few people run the numbers themselves to find out what is true and what is false.

If you just blindly assume that renting is throwing money away, that you need to move to a new city to increase your savings, that you need to get a 2nd degree to increase your income, or that you need traditional investment returns to reach your financial goals, you may mistakenly waste your time and energy.

Question your common beliefs. Run the numbers. Analyze data. Doing these things will help you avoid common money misconceptions that plague most people.

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.