6 min read

Suppose your goal is to accumulate $1 million in 20 years or less. There are two factors that will determine whether or not you’re able to achieve this goal:

1. The amount you save and invest each year

2. The investment returns you earn each year

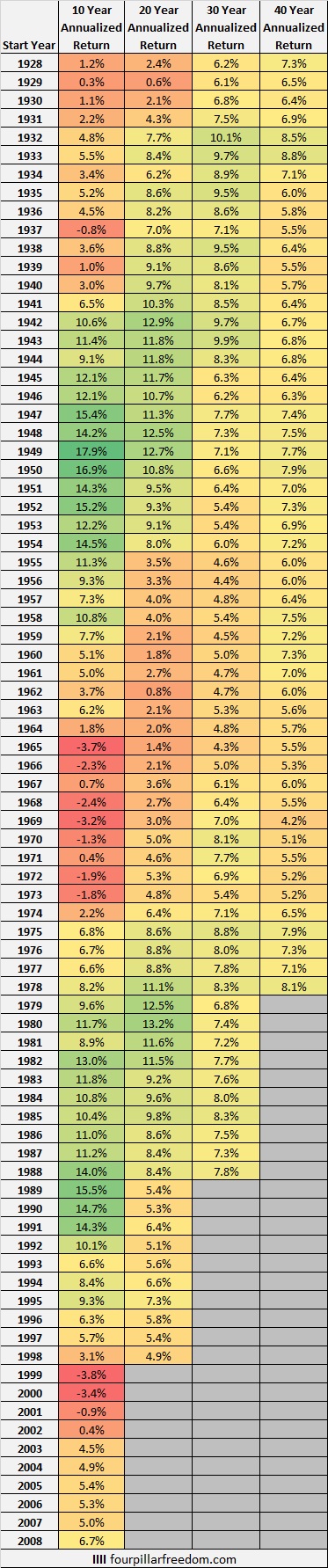

For simplicity, let’s assume you invest all of your savings each year into an S&P 500 index fund. I recently analyzed how the S&P 500 performed during every 10, 20, 30, and 40-year investment period since 1928. Here’s the summary of that analysis:

The annual returns for a 20-year period ranged from 0.6% up to 13.2%, with a median annual return of 7.3%.

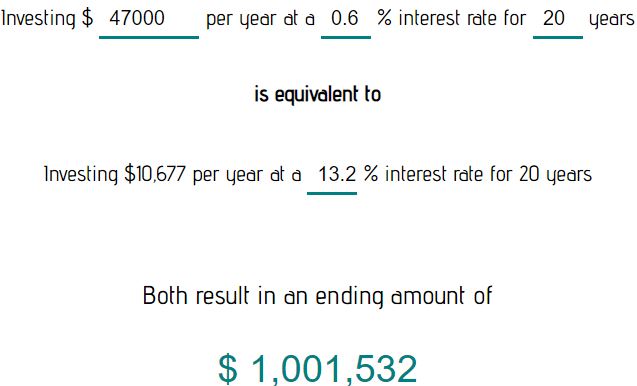

According to this investment calculator I built, you would need to invest $47,000 every year for 20 years to accumulate at least $1 million if you only earned 0.6% returns each year. Conversely, you would only need to invest $10,677 every year for 20 years to accumulate at least $1 million if you earned 13.2% returns each year:

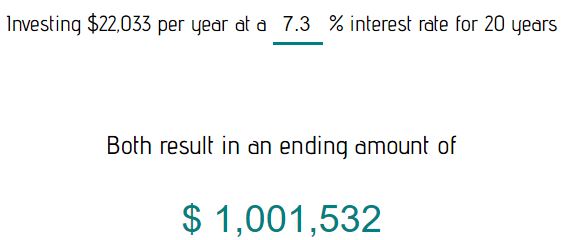

And if you caught the median 20-year period with 7.3% annual returns, you would have needed to invest $22,033 per year to accumulate at least $1 million:

This shows just how much of a difference investment returns can make. If you happen to invest during a wonderful 20-year stretch, you may only need to save and invest a little over $10,000 per year to become a millionaire. But if you happen to invest during a horrible 20-year stretch, you may need to invest over $47,000 every year to become a millionaire.

The worst part is that you can’t control how the stock market will perform during a given 20-year stretch. You might receive tremendous help from investment returns, but you might not.

Fortunately, there’s a way to become a millionaire without depending on stock market returns: create your own investment returns.

Create Your Own Investment Returns

Typically when you think of “investment returns”, you think of stocks, bonds, or real estate. And while I advocate investing in these asset classes and personally invest my own savings in them, the returns can be largely outside of your control.

Sure, you can decide which type of assets to invest in (large-cap stocks, mid-cap stocks, small-cap stocks, apartment REITS, storage unit REITs, short-term bonds, long-term bonds, etc.) and you can pick investments with low fees, but you can’t ultimately control how these investments will perform over a given period.

The one type of investment you can largely control is an investment in yourself. Some examples include:

- Investing in degrees

- Investing in your own skill set

- Investing your time into building a business

- Investing your time into side hustles

Here is how I have personally invested my own time and energy into these four types of investments and how I have earned returns on each:

Investing in degrees

I spent four years in college earning a bachelor’s degree in applied statistics. Since I majored in a technical subject that most people hate, I was able to land a job straight out of college as a data analyst with a salary of $52k.

Immediately after finishing my bachelor’s degree, I completed a one-year program to obtain my Master’s degree in statistics. This opened up my employment options even more. With this degree, I was able to land a new job as a data scientist with a salary of $80k.

Although I believe there are plenty of ways to earn a decent income with an associate’s degree in certain fields or even no degree at all, I can only speak from my own experience. Earning degrees in statistics helped me achieve a fairly high income while still in my early 20s, which is the main factor that helped me achieve a net worth of $100k by age 24.

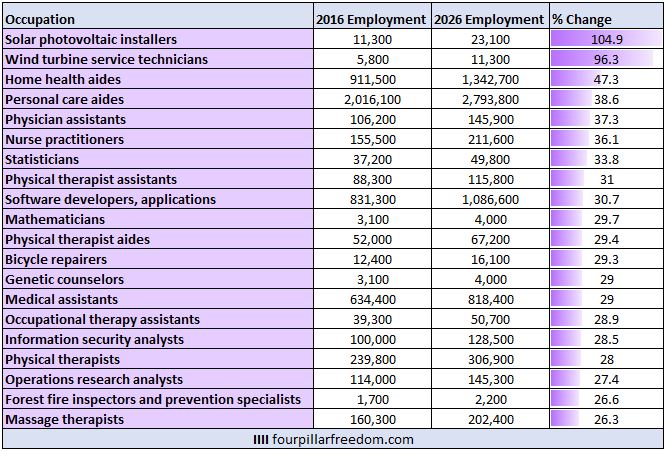

If you are considering getting a degree to boost your income and your opportunities, research tells us that degrees in tech/math/engineering and healthcare are expected to deliver the highest return on investment over the coming years.

For reference, here are the occupations with the highest expected growth in the U.S. from 2016 to 2026:

Investing in your own skill set

Using just the internet, I have personally been able to teach myself R, D3.js, HTML, CSS, and JavaScript. Using these skills, I was able to:

- Build a statistics educational website called Statology that actually helped me land my first corporate job.

- Build interactive data visualizations that have driven serious traffic to this blog, which has increased my blogging income.

- Successfully answer programming questions about R in an interview that helped me land my current job as a data scientist.

Ultimately I spent $0 on courses or books to build up my technical skill set. I simply spent time learning these various programming languages mostly with the help of Google, which have all helped me boost my income in one way or another.

Related: Build Something. It’s the Fastest Way to Acquire New Skills.

Investing your time into building a business

About two years ago I wrote my first ever blog post on Four Pillar Freedom. For the first few months, I received very little traffic and earned no income whatsoever. Fortunately, I decided to start a daily writing habit, which has helped me publish articles more consistently and has increased both my traffic and revenue over time. Now, over 560 blog posts later, I have a sizable audience and last month alone earned over $1,600 through this blog.

An excellent way to increase your income is to simply build your own business and create your own income stream. Blogging can be one way to do this, but there are plenty of other ways to create businesses:

- Dave from Accidental FIRE sells graphic designs online.

- Cody from Fly to FI started his own disc golf manufacturing company.

- Millionaire Dojo has an eBay store that he uses to earn hundreds of dollars in extra income each month.

Investing your time into side hustles

Side hustles can be another excellent investment that can help you increase your income. Personally I earn $40-50 per hour tutoring college students in statistics. Some examples of other bloggers I’ve met who have successfully found side hustles include:

Jennifer Chan, a full-time lawyer, found a way to turn freelance writing into an income stream.

Kenzi from Kenzi Writes was able to turn freelance writing into her full-time job.

Kevin from Financial Panther frequently earns over $3,000 each month with side hustles like Airbnb hosting, Rover dogsitting, and DoorDash food delivery.

Young FIRE Knight found a way to earn over $300 per month charging electric scooters.

Accumulating $1 Million Without the Help of the Stock Market

Earlier we saw that the median annual return for the S&P 500 over a 20-year period was 7.3% per year. Let’s consider an individual who is able to use the four types of investments I outlined earlier to increase their own income by 7.3% per year, without the help of investment returns.

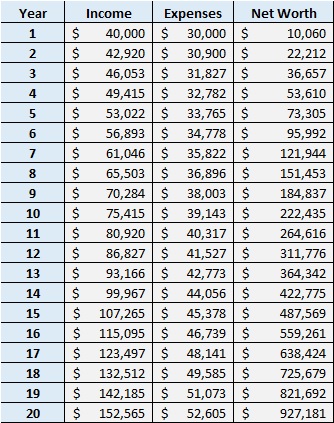

Suppose this individual earns a salary of $40,000 per year in year 1 and increases their income by 7.3% each year. We’ll assume they increase their spending each year by 3%. We’ll also assume that they invest the difference between their income and expenses each year in the S&P 500 and earn the worst annual returns of any 20-year period ever: 0.6% annual returns.

Here is how their net worth would grow over the course of 20 years:

This individual would be able to accumulate $927,181, just a bit short of $1 million, during the worst 20-year investment period ever. With very little help from S&P 500 investment returns, this person would be able to nearly reach their net worth goal of $1 million purely through creating their own investment returns and increasing their own income each year. That’s incredible.

To see how investment returns could impact your net worth journey, feel free to fiddle around with the interactive chart below where you can enter your starting net worth, starting income, annual income growth, starting expenses, annual expenses growth, and annual investment returns:

Conclusion

Earning investment returns on things like stocks, bonds, and real estate is great, but not always within your control. The one type of investment you can make that you have ultimate control over is an investment in yourself through earning degrees, building up your skill set, building your own business, and pursuing side hustles.

Don’t leave investment returns up to chance. Create your own investment returns.

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.

I can completely see the logic in this. The 4% rule is followed a little too uncritically by most of us, but as your numbers show returns can vary hugely.

I love the idea of creating your own returns. I’ve intuitively believed this but your numbers prove what is also logical.

For me I’ve always felt that investing in yourself – and in particular investing in your main hustle will have the best return on investment for most people. Although if you have the skills, mindset and personality that will allow you to start a business or a side hustle then I doff my cap to you.

Within the envelope of investing in yourself, I agree that you should invest in the qualifications that will further your career. But, I would also add that people should hold their nose and invest time in the networking that can lead to promotions or new jobs. Sadly those connections, rather than ability, is often what leads to career success.

I agree that connections play a big role in career opportunities and advancement. It’s all about who you know. With that said, you can always have 100% control over your personal development and the skills you choose to acquire, which also play a huge role in how much income you can earn.

Completely agree with this. In life, the only thing you can truly control is your own actions and attitude. Go out and invest in yourself to get the best returns out of life! Best advice I’ve gotten is to read as much as possible and always been willing to try something new.

Reading books, listening to podcasts, and then actually implementing what I’ve learned has paid huge dividends for me. I agree – invest in yourself if you want the best returns possible!