4 min read

I currently work as a data scientist and earn $80k per year. With a little under three years of full-time experience, most companies would classify me as either a junior data scientist or a data scientist.

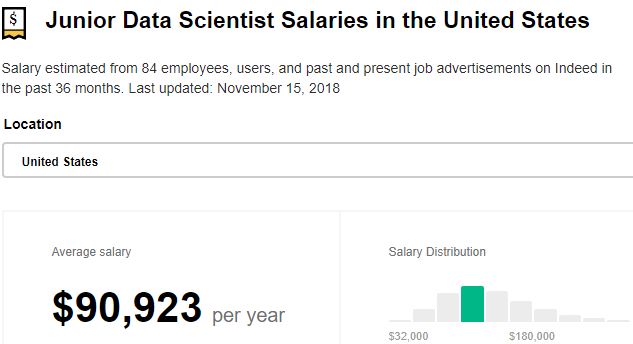

According to the job site indeed, the average salary in the U.S. for a junior data scientist is $90,923:

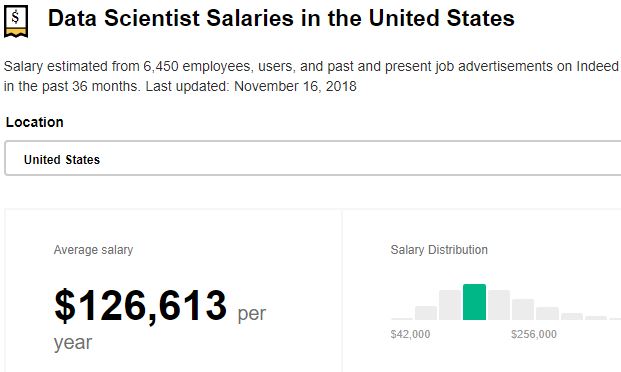

And for data scientists, the average salary in the U.S. is $126,613:

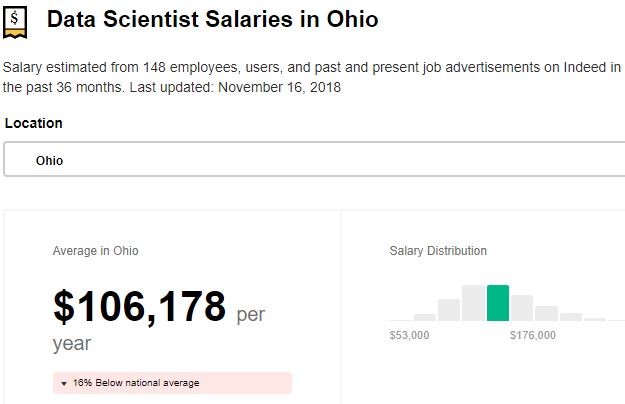

If I narrow down my search results to just my home state of Ohio, I see that the average salary for a data scientist is $106,178:

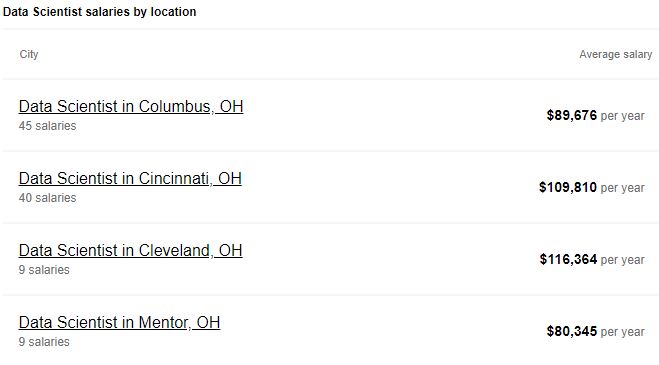

And within Ohio, the average salary fluctuates quite a bit from city to city:

Average salaries for data scientists range from $80,345 in Mentor up to $116,364 in Cleveland:

Yet, none of these cities come close to the national average salary of $126,613 for data scientists.

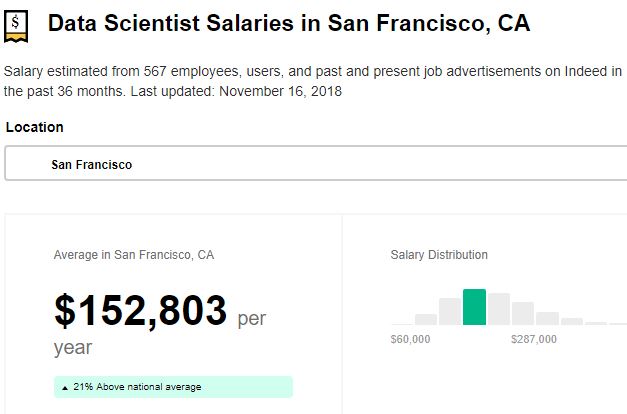

Does this mean I should move to a bigger city like San Francisco where the average salary for data scientists is over $152k?

To answer this, let’s run some numbers.

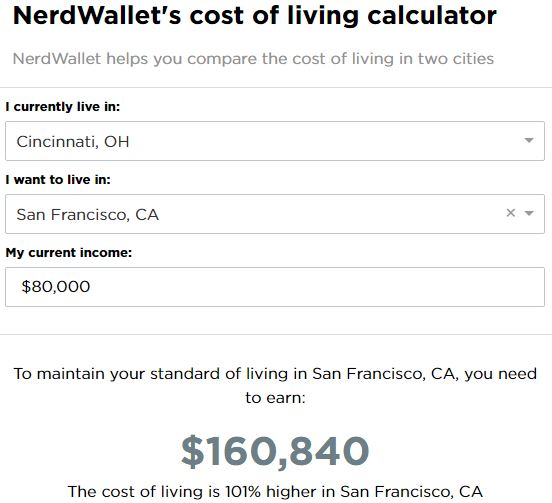

Cost of Living: The One Factor That Can Cancel Out a High Salary

The financial site Nerdwallet has a neat Cost of Living Calculator that lets you compare the cost of living between two different cities. If I type in my current city of Cincinnati, OH and compare it with San Francisco, CA based on my salary of $80,000, I find that I would need to earn $160,840 to maintain my same standard of living:

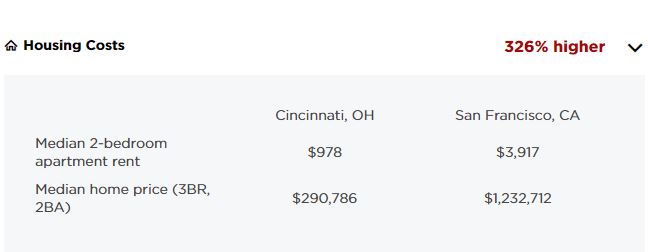

This is because the cost of living is twice as high in San Francisco as it is in Cincinnati. In particular, the housing costs are 326% higher according to Nerdwallet:

The median two-bedroom rent in Cincinnati is $978 while the median two-bedroom rent in San Francisco is $3,917. Likewise, the median home price in Cincy is $290k compared to over $1.2 million for San Francisco:

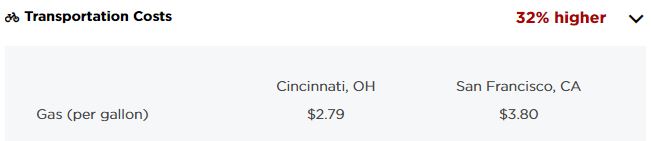

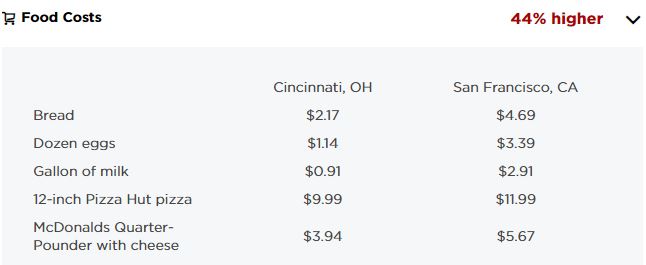

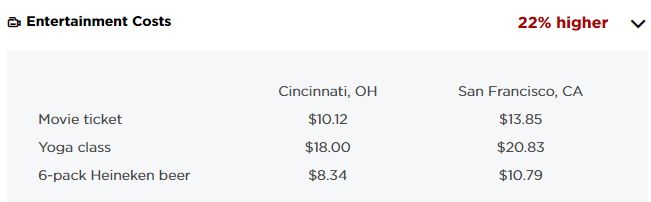

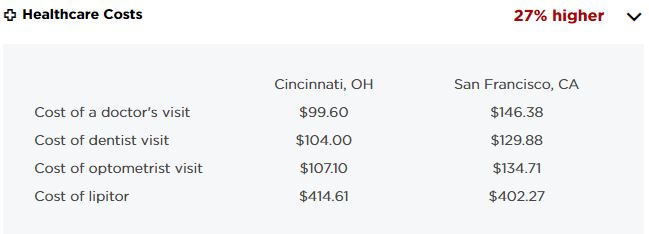

Along with higher housing costs, it turns out that gas, food, entertainment, and healthcare are all considerably more expensive in San Francisco too:

Comparing Savings Rates

I currently bring home around $60,000 per year after taxes from my day job. I also spend around $24,000 per year. This means I’m able to save around $36,000 per year and my savings rate is about 60%.

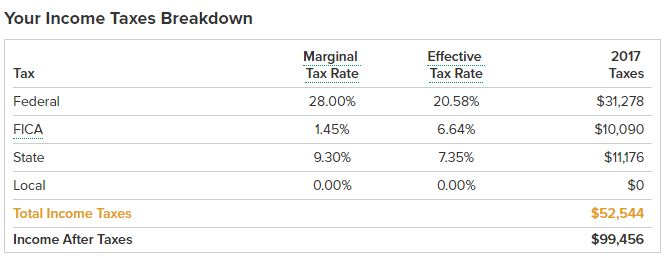

Let’s assume that I could move to San Francisco and land a job as a data scientist earning the median salary of $152k. According to the SmartAsset Income Tax Calculator, I would bring home roughly $100,000 after taxes.

Let’s also assume that my annual expenses would double to $48,000 since the cost of living is about twice as high in San Francisco as Cincinnati. This means I would be able to save about $52k per year and my savings rate would be about 52%.

In summary, I can save about $36,000 per year from my current salary in Cincinnati and maintain a savings rate of 60%. If I moved to San Francisco and earned the median salary for a data scientist, I could potentially save $52,000 per year but my savings rate would drop to 52%.

Location Makes a Difference

One potential strategy I could use is move to San Francisco (or a similar tech hub) and increase the amount I’m able to save each year, then simply leave the city and move somewhere cheaper (like Cincinnati) once I decide to quit my 9-5 job. I have met several people in the personal finance community who are currently living in expensive cities simply to earn a high income for a few years before they decide to quit and relocate to a cheaper location.

This idea is appealing to me and I would potentially consider it. It’s important to keep in mind, though, that I’m using a ton of assumptions when I run these numbers. It’s possible that I wouldn’t earn such a high salary in San Francisco.

For example, if I was only able to land a salary of $120k, I would only bring in about $82k after taxes. With annual expenses of $48k, I would only be able to save $34k per year in San Francisco, which is actually less than I’m able to currently save in Cincinnati.

In theory, it sounds like a great idea to move to a tech hub like San Francisco and double my salary, but it’s important to keep in mind that I would only benefit financially if I was able to save as much of that salary as I’m able to save currently in Cincy.

If you’re someone who is considering moving to a different city to earn a more lucrative income, I encourage you to run the numbers first.

It’s certainly possible that you could boost your savings and turbo-charge your path to financial independence with a higher salary in a new city, but keep in mind that the amount you save matters more than the amount you earn. You might actually be able to save more on a lower income in a cheaper city compared to a higher income in an expensive city.

As Dave from Accidental FIRE recently wrote, there doesn’t exist one “correct” path to financial independence. Perhaps moving to a new city and boosting your salary could be the right financial move for you. Perhaps not. No matter what you decide to do, always run the numbers first.

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.

Great analysis on this topic. It definitely depends on a lot of different factors.

One thing I did when I moved to Sydney was to change my expectations compared to when I lived in Chicago. In Sydney I had a higher income along with higher cost of living, however, I changed my expectations to keep my savings rate and savings numbers higher than they would’ve been in Chicago. I lived in an un-renovated 1-bedroom apartment, rarely went out to eat and spent most time just enjoying the outdoors. So my living situation didn’t seem as “nice” as Chicago, but I was living by the beach with a farmers markets a few blocks away.

I love that strategy – living in a cheap place with low expenses despite earning a higher income. That’s the path to real wealth-building. Also kudos to you for finding joy in things that are free (the outdoors, the beach, farmers market, etc.), that’s one of the best ways to keep spending low!

This is a great analysis Zach, well done. Being that I live in the Bay Area, this topic is very relevant to my day-to-day life. The cost of living here is obviously brutal, and as you explained, even though the salaries are higher there are many times when you’re not coming out ahead. There are many benefits to living in the Bay Area including the weather and the centralized location to everything (beach, snow, major cities, hiking, etc). I also think the benefit of how much opportunity being available here, with so many incredible companies so close together, is even more important than the high salaries.

I really like the strategy of living in a big city to build your career and then moving somewhere else for cheaper cost of living. We’re still in the Bay Area mainly because of family and friends, but this career opportunity is another reason. Our plan is ultimately to stick it out here for a few more years and then move a few hours north to a cheaper city. This will lead to lower salaries, but I think even higher quality of life.

I really like the strategy of living in a pricey city just to earn a high salary for a few years. After all, it’s not about your savings rate as much as the actual amount you’re able to save each year, since when you move to a lower cost of living area, you’ll still have all those dollars in your bank account.

I would seriously consider moving to a place to earn more money for a couple years before moving back. As you said, in general your FIRE path is dictated by your savings rate, not your savings amount. But if you plan to move back to a LCOL area, the amount is more important than the percentage, since it buys you more “life” in your LCOL area.

I’m from The Netherlands, but am considering (loosely) to move to Manhattan, NYC in the next couple years, for two or three years. The main reason is the life experience of living in a metropole for a couple years, but it would also accelerate my FIRE.

Doing quick back of the envelope math, my savings rate would probably be a bit lower than it is here in The Netherlands, but the pure euro or dollar amount saved would be higher in Manhattan, and that is money that I would bring back home when I return.

Interesting stuff for sure!

You nailed it – the AMOUNT of income you save is more important than the PERCENTAGE of income you save because you can use those dollars to buy more freedom in a LCOL area once you decide to stop working. Manhattan is one of the most expensive cities in the U.S. but I imagine it compensates residents with fairly high salaries, depending on the industry you’re working in.

Correct, while Manhattan is stupidly expensive to live in (rent alone is twice my total monthly expenses in The Netherlands, or about four times rent-only), the salary I will be looking at is also significantly higher. Even though my savings percentage might not be the 40% it is right now, if I can double the savings amount it’s worth it. Plus, I get to live in the coolest city on the planet. Definitely looking into doing this in the next couple of years. I only have to convince the girlfriend now… 😉

So wise to consider the bottom line.

It’s worth noting tho for young ppl just out of school, taking a yr or 2 as a gap year to experience those HCOL cities (NY, HK, SF, London) is totally worthwhile too in terms of the intangible experiences, while opportunity cost is low. Those unique experiences shouldn’t be discounted either esp for ppl who want to experience that @least once in a lifetime.

I spent a yr in Hong Kong when I came out of school. While I made close to nothing, it significantly impacted how my future path forward. I’m so glad I did it even if it deferred wealth building by a yr or 2. You know, fun jobs when living in a shack is still bearable at a younger age =)