4 min read

Investor and author Meb Faber once shared an excellent tweetstorm on international investing that covered three main points:

- Most U.S. investors are highly concentrated in U.S. stocks.

- This high concentration will likely lead to sub-optimal returns over the long-run.

- An easy solution to this problem is to add foreign stocks to your portfolio.

Check out this post for a full summary of the tweetstorm.

From the studies that Meb cites, there’s clear evidence that adding international stocks to your investment portfolio is likely to lead to similar returns with less volatility and less exposure to extreme drawdowns that occasionally happen in individual countries.

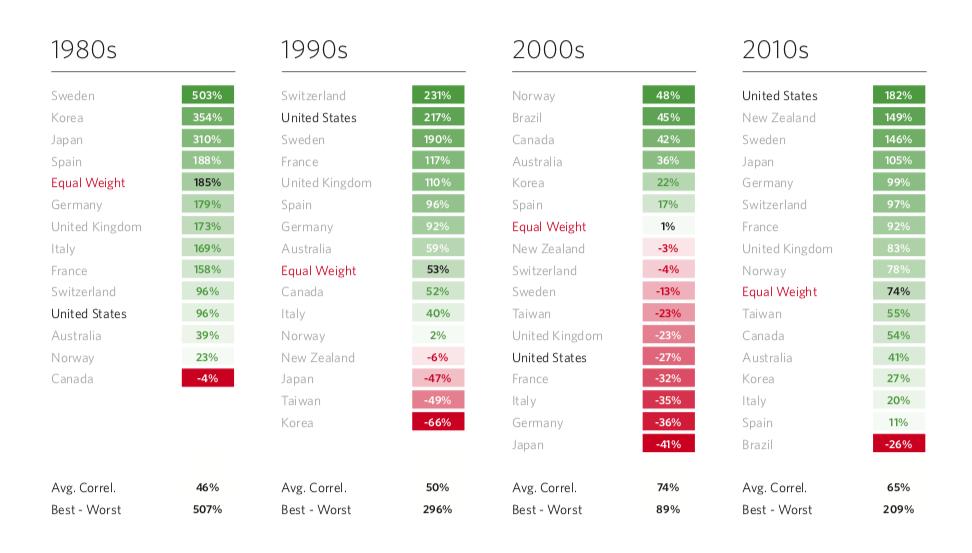

As evidence, he shares the following chart that shows stock market performance over the past 40 years of individual countries compared to an equal weight portfolio that held a mix of all of the countries:

The equal weight portfolio provided a much smoother ride and offered downside protection during each decade.

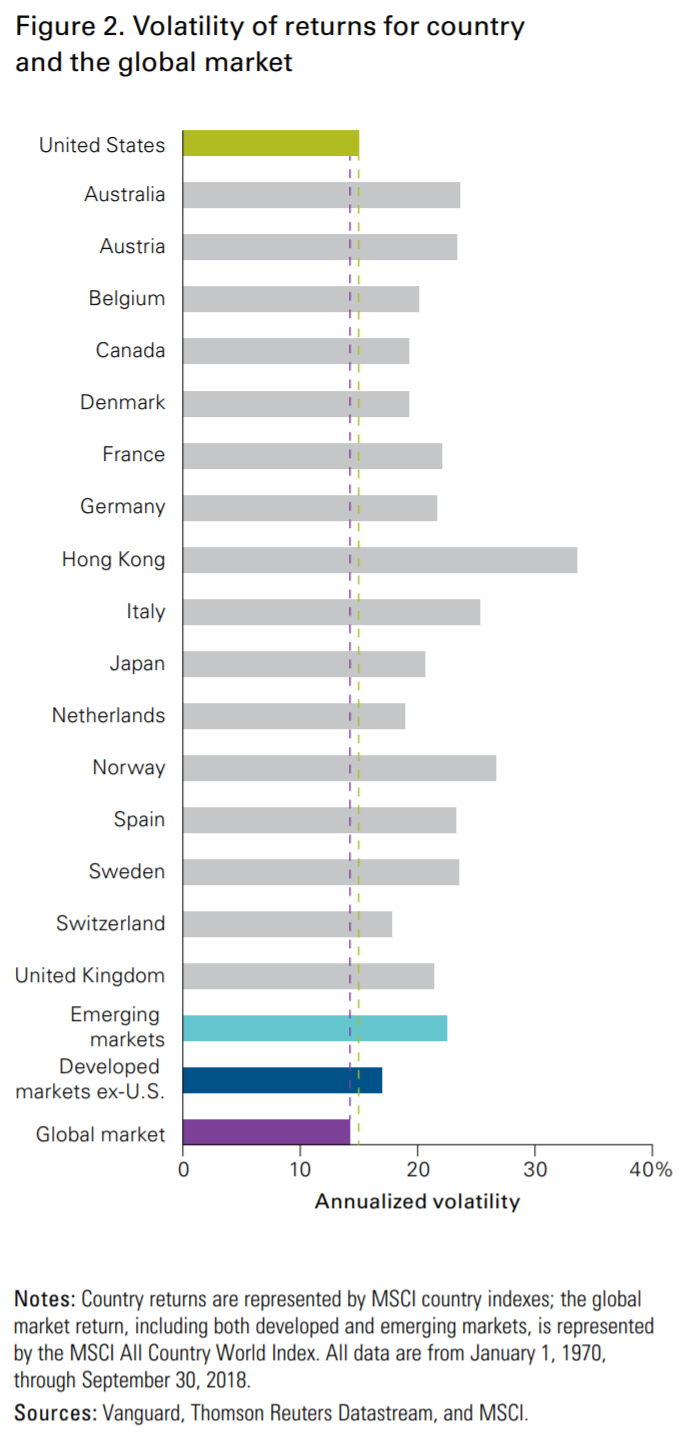

A 2019 analysis by Vanguard also confirmed that an internationally diversified portfolio provided noticeably lower volatility compared to portfolio that held stocks in just one country:

For most investors, the easiest way to gain exposure to international stocks is through a total international ex-U.S. stock index fund. For example, Vanguard offers VXUS – a total international stock ETF that offers exposure to over 7,000 stocks in both developed and emerging markets outside of the U.S.

Today I want to explore the similarities and differences between the following two stock market ETFs:

VTI – Vanguard Total U.S. Stock Market ETF

VXUS – Vanguard Total International Stock ETF

I’ll take a look at the composition and historical performance of both funds, and offer some helpful advice on how you can decide which mix of the two funds might be optimal for you.

Comparing VTI vs. VXUS

First, let’s get a brief overview of both funds:

| VTI | VXUS | |

|---|---|---|

| Fund Type | Exchange Traded Fund (ETF) | Exchange Traded Fund (ETF) |

| Expense Ratio | 0.03% | 0.08% |

| Minimum Investment | The price of one share | The price of one share |

| Number of Stocks | 3,551 | 7,429 |

| Net Assets of 10 Largest Holdings | 20.7% | 9.8% |

The funds have the following similarities:

- VTI and VXUS are both exchange traded funds

- Both require a minimum investment equal to the price of one share

The funds have the following differences:

- VXUS has a slightly higher expense ratio (.08%) than VTI (.03%)

- VXUS holds significantly more stocks (7,429) than VTI (3,551)

- The top ten holdings of VXUS account for a much smaller percentage (9.8%) of total fund assets compared to VTI (20.7%)

In a nutshell: Both funds have low fees, but VXUS holds far more stocks and has a lower concentration of its fund held in the top 10 stocks.

Next, let’s take a look a closer look at these differences in composition.

VTI vs. VXUS: Differences in Composition

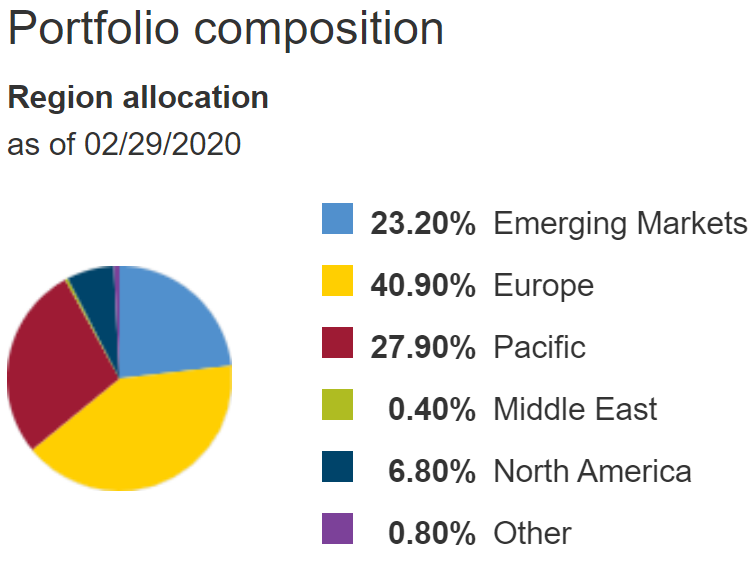

Because VXUS is an international stock index fund, it holds stocks from a wide variety of regions. Here’s a look at the allocation by region:

Check out this article to see which countries are classified as “Emerging Markets.”

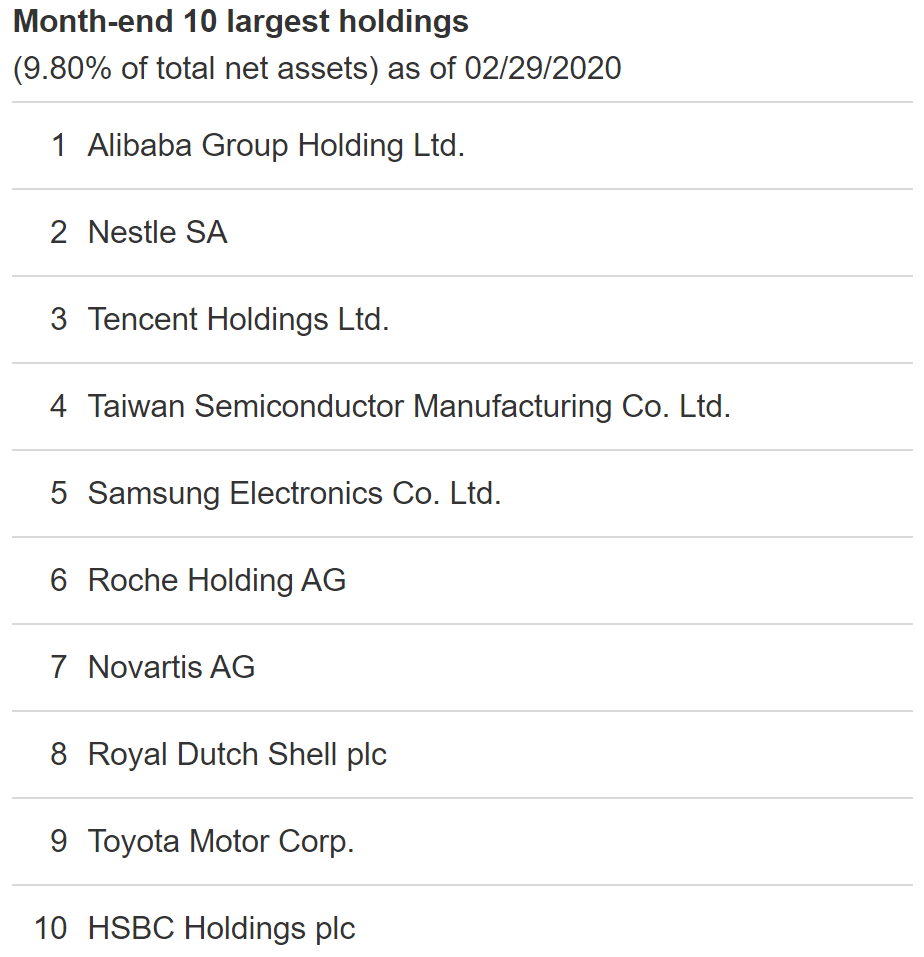

And here’s a look at the top 10 holdings for VXUS:

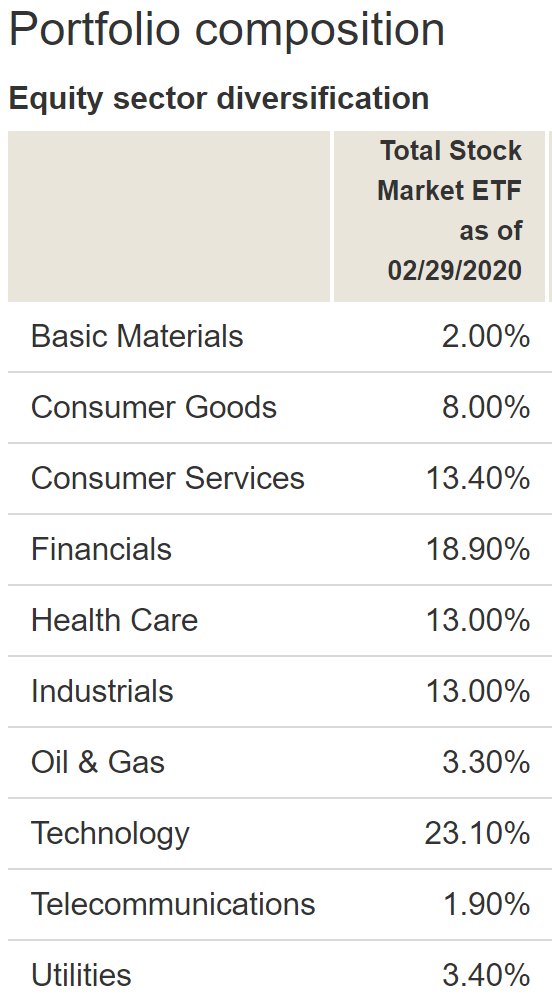

As mentioned earlier, VTI only holds U.S. stocks which means there is no diversification across different regions. However, there is diversification across sectors. Here’s a look at the sector composition of VTI:

And here’s a look at the top 10 holdings for VTI:

While it might seem a bit extreme for just 10 individual stocks to make up 20% of the entire fund, it’s important to keep in mind that these companies – Microsoft, Apple, Amazon, Google, Facebook, etc. – all operate internationally and in different regional markets around the U.S. In this sense, these companies are diversified across many different markets, despite being individual companies.

Next, let’s check out the historical performance between the two funds.

VTI vs. VXUS: Differences in Performance

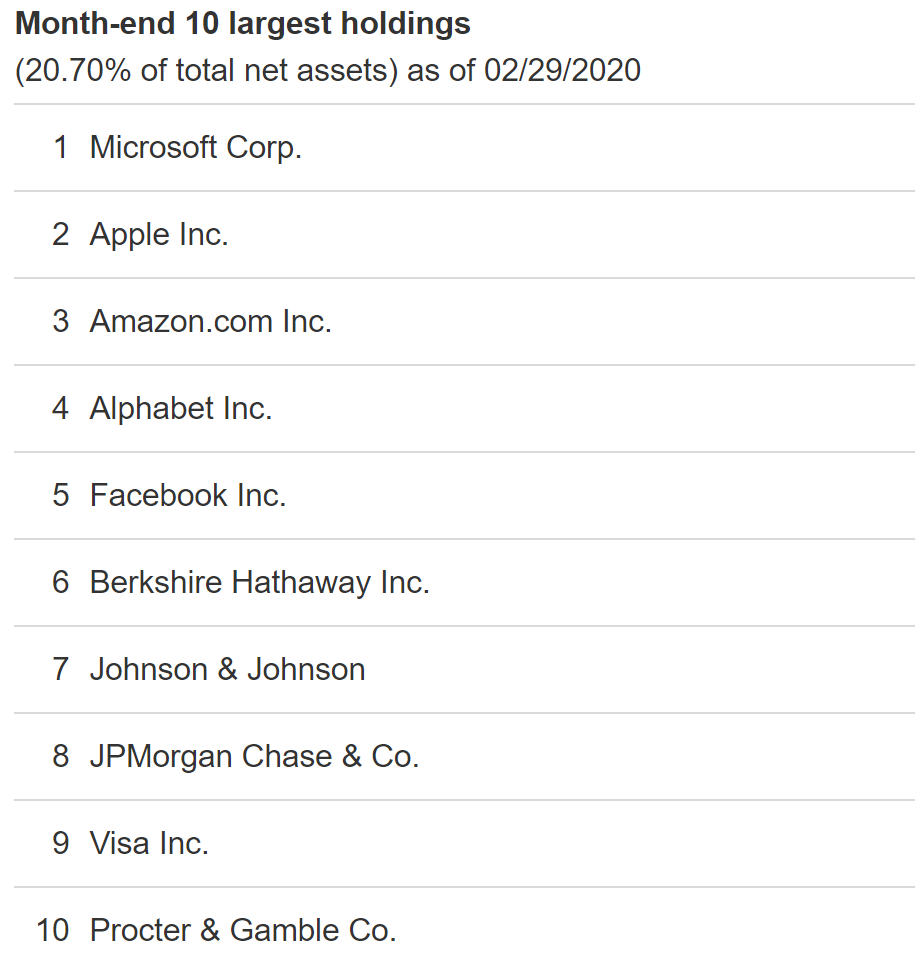

The following image from the 2019 Vanguard analysis on global diversification shows the relative performance of the rolling 5-year returns for total international stocks vs. the total U.S. stock market dating back to 1970:

From the chart, we can see that the U.S. market and international markets took turns outperforming during different time periods.

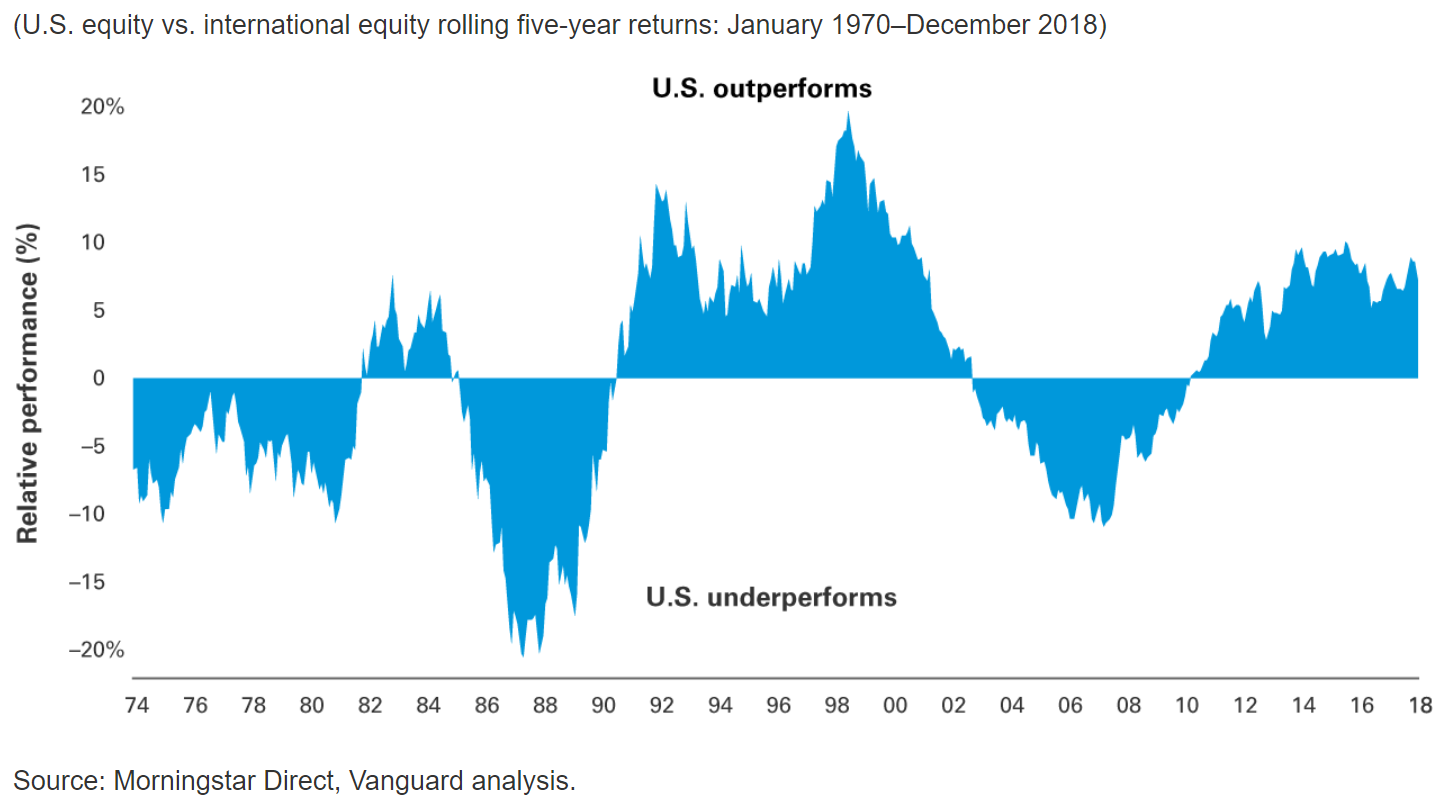

However, a globally diversified portfolio – one that held both U.S. stocks and international stocks – provided the best risk adjusted return, which is shown in the chart below:

A portfolio that was globally diversified from 1970 through 2018 earned 9% annual returns with a standard deviation of 14.3% compared to a U.S.-only portfolio that earned 9% annual returns with a standard deviation of 15.1%.

VTI vs. VXUS: Which Mix is Optimal for You?

Investing internationally might not increase your overall returns, but it’s likely to increase your risk-adjusted returns. This means you can earn similar returns with less volatility, which is a benefit that most investors would love to enjoy.

Ultimately it’s up to you as an individual investor to decide which mix of domestic and international stocks is right for you. Based on the research, though, you’re likely doing yourself a favor by mixing in at least some international exposure to your portfolio.

It’s important to note that most major investment platforms like Fidelity, Merrill Lynch, Schwab, etc. all have ETFs that are similar to the Vanguard ETFs I wrote about in this post. I simply chose to use the Vanguard versions of these ETFs since it’s my investment platform of choice. No matter which investment platform you decide to use, you should easily be able to find similar low-cost funds to invest in.

And, as always, keep in mind that investing in index funds is a way to build long-term wealth. The simplest way to actually earn returns is to avoid actively buying and selling funds. Choose your asset allocation, automate your investments, then be patient.

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.