4 min read

I recently listened to an excellent podcast where Chris Williamson asked financial writer Morgan Housel about the impact of the Coronavirus on the stock market.

Halfway through the podcast, Housel began to talk about his own style of portfolio management. He shared that he holds far more cash in his portfolio than most investors his age because he prefers to sleep well at night rather than attempt to maximize his returns.

“I do not manage my money to achieve the highest returns. I manage my money to get the best night of sleep.”

Housel said he knew this would lead to lower returns over the long haul, but it was worth it for the sense of security that he could feel during market downturns like the one we’re experiencing now.

His statement serves as a nice reminder that the whole point of personal finance – earning, saving, investing, etc. – is to maximize your quality of life. That’s not always the same thing as maximizing your portfolio value.

Depending on your age, your family situation, the stability of your job, and a variety of other factors, it could make sense to hold a more conservative portfolio so that you have peace of mind when times get tough.

Historical data tells us that stocks deliver significantly higher returns than cash over the long term, but with much higher volatility. And although cash drags your total returns lower, it provides stability during market drops.

This brings up an interesting question: What percentage of your portfolio should be in cash?

Let’s run some numbers to answer this question.

Analyzing Historical Data

I used Portfolio Visualizer to analyze the returns of six different portfolios, dating back to 1972:

Portfolio 1: 100% Total U.S. Stock Market, 0% Cash

Portfolio 2: 90% Total U.S. Stock Market, 10% Cash

Portfolio 3: 80% Total U.S. Stock Market, 20% Cash

Portfolio 4: 70% Total U.S. Stock Market, 30% Cash

Portfolio 5: 60% Total U.S. Stock Market, 40% Cash

Portfolio 6: 50% Total U.S. Stock Market, 50% Cash

For simplicity, I assumed a portfolio could only hold either stocks or cash.

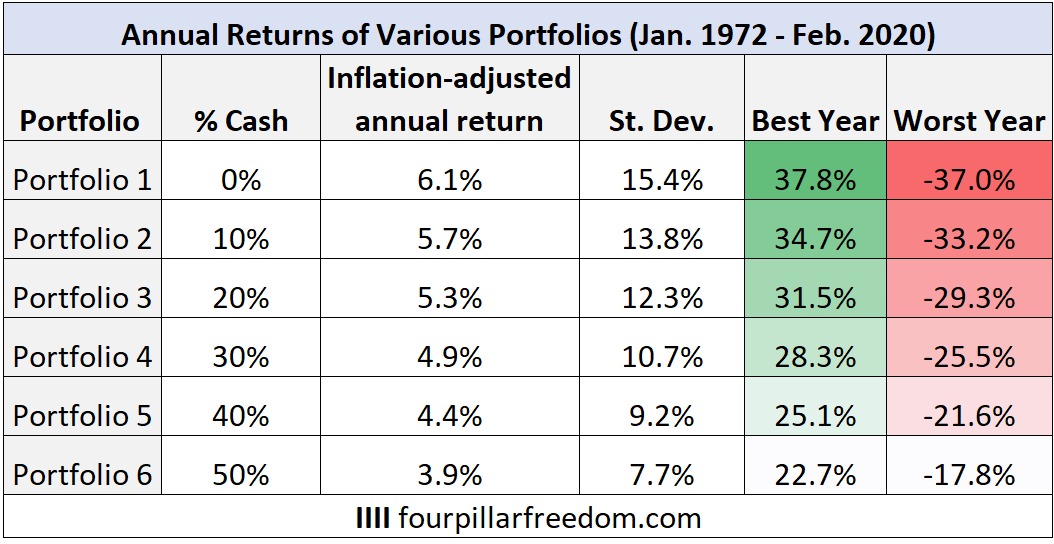

The following table shows the performance of each portfolio from Jan. 1972 to Feb. 2020:

Unsurprisingly, the more cash you hold in your portfolio, the lower your total returns but the lower your overall volatility as well. Simply put, more cash means less upside and less downside.

There’s also a neat pattern we can observe from this table: For each additional 10% of cash in your portfolio, you can expect your annual return to decrease by about 0.4% and your annual standard deviation to decrease by about 1.5%.

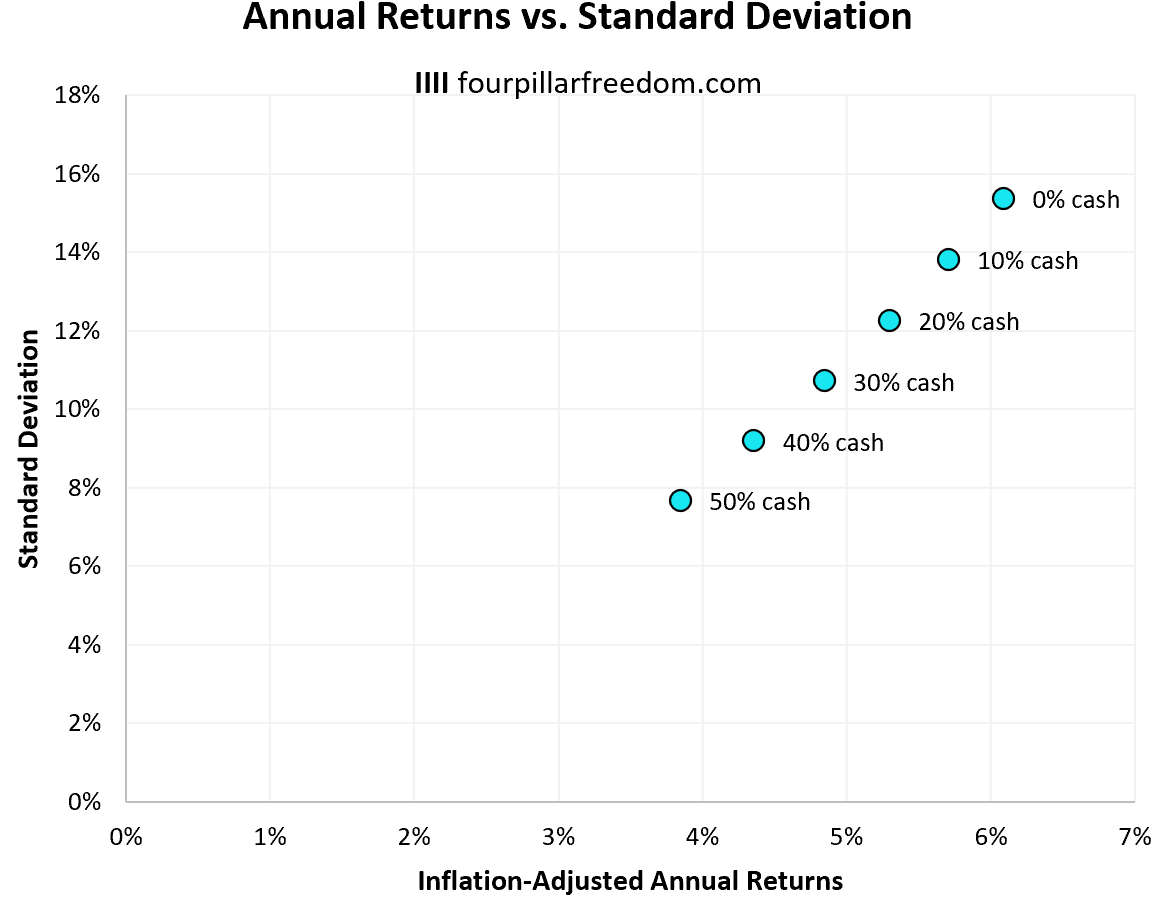

Here’s a look at the inflation-adjusted annual returns vs. the standard deviation for each portfolio:

As expected, portfolios with more cash have experienced both lower annual returns and lower volatility over the years.

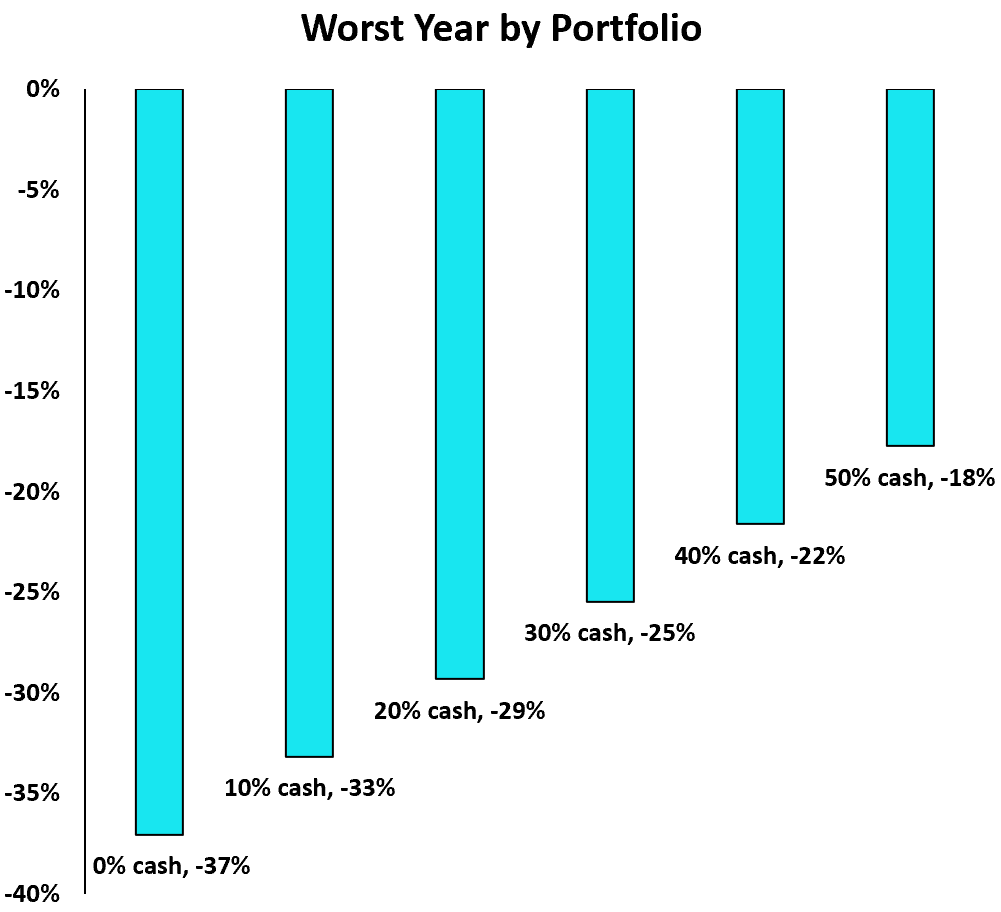

And here’s a look at the worst-performing years for each portfolio:

To put some context around these numbers, here’s the value that a $1 million portfolio dropped to during these worst years:

- 0% cash portfolio: $630,000

- 10% cash portfolio: $670,000

- 20% cash portfolio: $710,000

- 30% cash portfolio: $750,000

- 40% cash portfolio: $780,000

- 50% cash portfolio: $820,000

Analyzing the Current Century

During bull markets, portfolios with more cash will underperform. And during bear markets, portfolios with more cash will outperform.

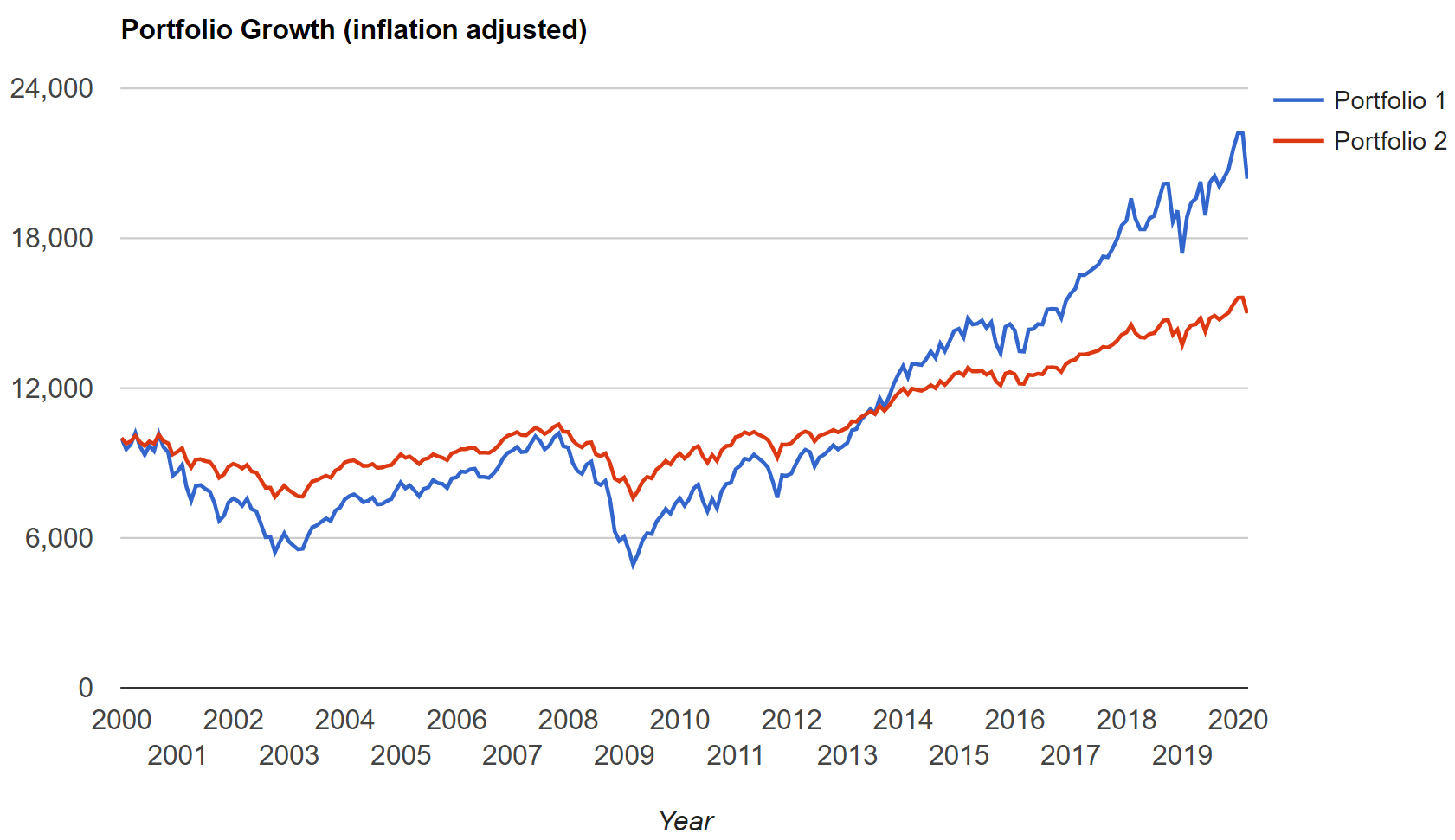

We can see this illustrated by viewing how a $10k investment in a 100% U.S. stock portfolio performed during the 2000’s compared to a 50% U.S. stock / 50% cash portfolio:

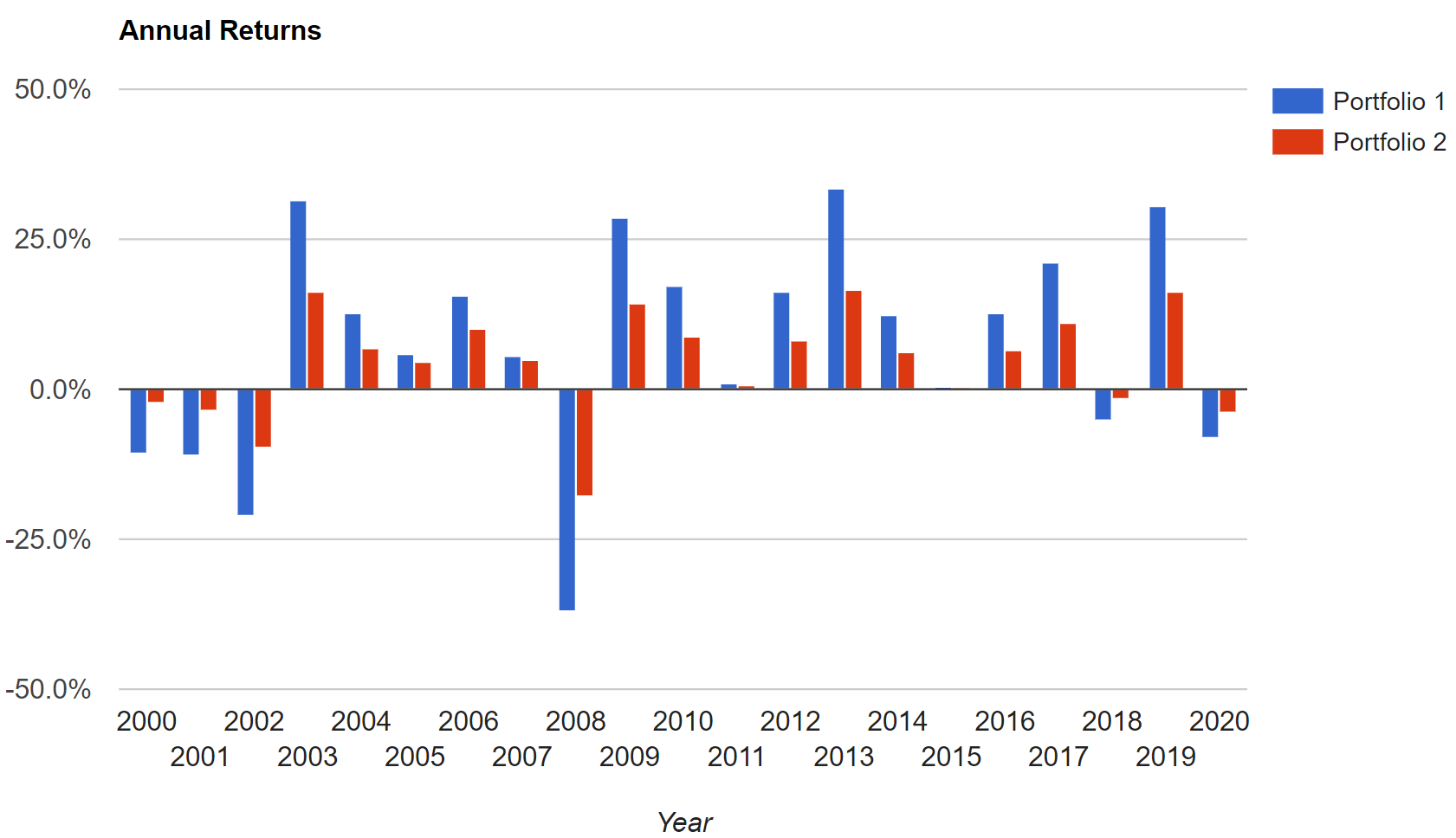

Note: Portfolio 1 is the all-stock portfolio and Portfolio 2 is the 50/50 portfolio.

Notice how smooth the ride is for the 50/50 portfolio compared to the 100% stocks portfolio. Of course, the drawback of the heavy-cash portfolio is that it delivered just 2% inflation-adjusted annualized returns compared to 3.6% returns for the all-stock portfolio during this 20-year stretch.

And here’s a look at the individual annual returns for each portfolio:

During each market decline, a heavy-cash portfolio has provided some protection from the downside.

How Much Cash Should You Hold?

There’s no universal answer to how much cash you should hold in your portfolio. It depends on a variety of factors including:

Your income reliability/stability: If you earn reliable income from a variety of sources, you may prefer to hold less cash in your portfolio since you don’t have to worry about cash flow.

Your family situation: If you’re the sole breadwinner in your family and you have people to support in your life, you may prefer to hold more cash in your portfolio so you can sleep well at night knowing that you’ll be able to survive market downturns with that extra cash.

Your risk tolerance: If you can’t stand the thought of your portfolio dropping by 40% during a bear market, you probably shouldn’t have a 100%-stock portfolio.

At the end of the day, cash provides stability and reassurance during tough economic times. For some people, this reassurance is worth the cost of lower returns over the long haul. Ultimately you have to decide how much cash you should hold in your portfolio based on your unique situation and circumstances.

Just keep in mind that the whole point of personal finance is to maximize your quality of life. And sometimes the best way to do so is to take less risk.

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.