3 min read

Here are 8 thoughts regarding the current state of the stock market and the Coronavirus.

1. Low Returns Now = High Returns Later

Historical stock market data tells us that low returns in the present are correlated with higher returns in the future.

Michael Batnick confirmed this in a recent post by making the following table that shows the average returns over different time periods based on how far stocks are from their high:

It sucks to see your account balances drop so dramatically in such a short period of time, but data tells us that extreme market drops are typically followed up by excellent returns in the future.

2. Less News, More Data

One of the most surefire ways to increase your anxiety and fear during this time is to check the news constantly.

Sure, keep tabs on major events playing out in your country, state, and city, but make sure you’re actually looking at the raw data about the situation. In particular, I’ve found this interactive map from John Hopkins to be one of the most helpful in regards to tracking global Coronavirus cases.

3. Denial Won’t Help

Pretending that the virus will simply go away on its own is not a good mindset to hold. It’s here to stay until we either develop herd immunity (~70% of people catch it) or develop a vaccine. In either case, the situation isn’t likely to clear up any time soon.

This is a tough pill to swallow, but it’s better to accept it and focus on what you can control rather than deny that the problem is real. Myles Udland wrote an excellent piece recently about denial and how it’s an ineffective strategy. I highly recommend reading it.

4. You Haven’t Lost Money (Yet)

Your investment account balances may have dropped substantially over the past couple of weeks, but you haven’t actually lost money if you haven’t sold. After all, stock prices only tell you how much money you can receive if you sell now. But if you have no interest in selling for several years or decades, you shouldn’t care about how much you can get for them now.

5. Individual Stocks Are Still Risky

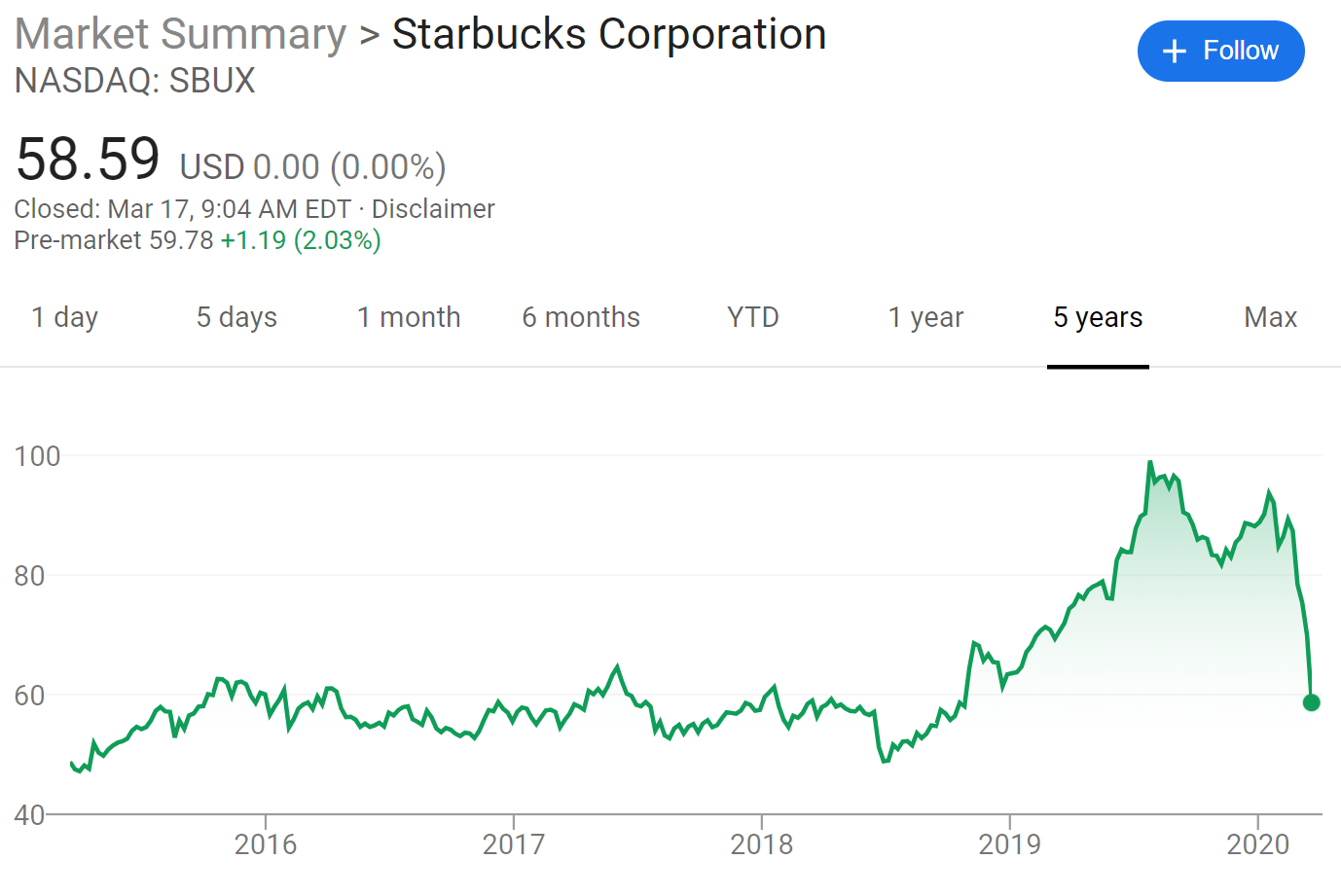

Yesterday I had a friend ask if he should buy a couple shares of Starbucks stock since it’s now trading at levels we haven’t seen in nearly five years.

I said he could, but I’d recommend simply investing in stock market index funds. When you invest in an individual stock like Starbucks, you’re making a bet on a single company. When you invest in an index fund, you’re making a bet on thousands of companies – i.e. the economy as a whole.

Some companies will survive the next 12-18 months just fine while others will have a much harder time and potentially even go out of business. You could certainly get lucky and invest in one of the individual companies that will survive and continue to thrive, but data tells us that most individual stocks underperform index funds over the long haul.

By investing in an index fund, you don’t have to attempt to pick the winners and losers. You can bet on the economy as a whole.

Something else to keep in mind is that not all stocks bounce back. You might think a particular stock looks attractive at current prices, but there is no guarantee that it will actually bounce back to its former price.

Consider AIG, the massive financial and insurance company that many people invested in when its price plummeted following the financial crisis:

You may have felt like a genius if you invested after the price dropped from $1,000 to $500. But once it dropped below $50 and never bounced back, you were stuck. Keep this in mind when you think some individual stocks look like bargains now. They might bounce back, but they might not.

6. Disaster Produces Growth

When disaster strikes, innovation surges. People and societies become problem-solvers.

Morgan Housel recently wrote a piece about how innovation and productivity growth went through the roof during the Great Depression:

The 1920s were the era of leisure because people could afford to relax. The 1930s were the era of frantic problem solving because people had no other choice.

The Great Depression brought unimaginable financial pain. It also brought us supermarkets, microwaves, sunscreen, jets, rockets, electron microscopes, magnetic recording, nylon, photocopying, teflon, helicopters, color TV, plexiglass, commercial aviation, most forms of plastic, synthetic rubber, laundromats, and countless other discoveries.

This situation stings right now, but I’m confident that it will make society better over the long-term. We’ll be more prepared for the next pandemic, we’ll have better procedures and policies in place for vaccine development and emergency response, and remote work will become more widely adopted and produce an overall increase in the quality of people’s lives.

7. Keep Playing the Long Game

Nobody has a clue how the next 12-18 months will play out, but one thing is certain: the world will still be here in 2022. And 2023. And beyond.

While it might feel like this crisis will never end, it will. The stock market will recover. The economy will return to full capacity. Life will return to normal.

This means you should keep playing the long game. Keep working on your small business, keep investing in assets, and keep improving and optimizing your daily habits. Your future self will thank you.

8. Get Out in Nature

There’s no better time to go for a walk or a hike outside than when most businesses, restaurants, and shops are closed. Plus, there are tons of physical, mental, and psychological benefits to getting out in nature. Florence Williams shares a few in her book The Nature Fix:

“We benefit cognitively and psychologically from having trees, bodies of water, and green spaces just to look at; short exposures to nature can make us less aggressive, more creative, more civic minded and healthier overall.”

Go for a walk. Preferably with no technology. You’ll feel better.

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.