4 min read

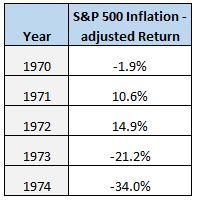

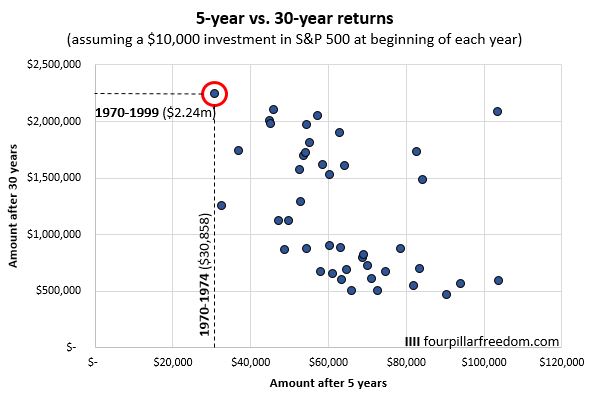

The worst five-year investment period ever for the S&P 500 since 1928 was from 1970 to 1974. Here’s a look at the annual inflation-adjusted returns during these five years:

During this period, if someone invested $10,000 in the S&P 500 at the beginning of each year, for a total investment of $50,000 over the course of five years, they would have been left with just $30,858 by the end of 1974.

Ouch.

That would have been a brutal five-year stretch. But we all know that the stock market tends to increase over time and poor investment periods don’t last forever. This brings up an interesting thought experiment:

Consider someone who invested $10,000 in the S&P 500 at the beginning of each year for 30 years, starting in 1970. Despite beginning their investment journey with the worst five-year stretch ever, how would this investor have fared over the course of 30 years?

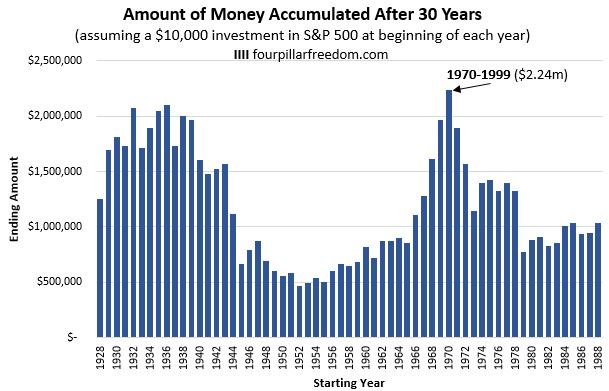

It turns out that this investor would have accumulated $2.24 million by the end of the 30-year period in 1999. It also turns out that this was the best 30-year period that someone could have possibly dollar-cost average invested in the S&P 500 since 1928.

That’s incredible.

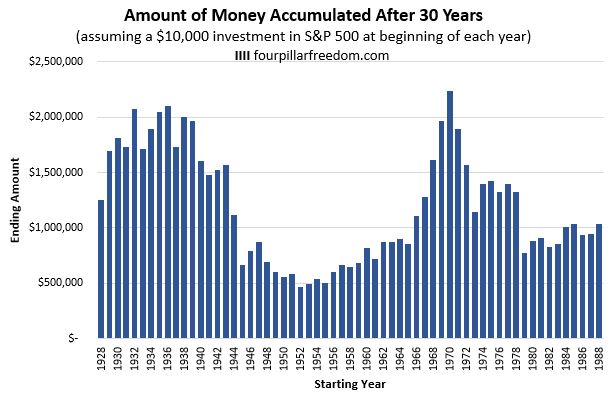

For some perspective, here’s how much someone would have accumulated during every 30-year period since 1928, assuming they invested $10,000 in the S&P 500 at the beginning of each year:

Notice how the starting year of 1970 has the highest ending amount:

So, despite 1970 to 1974 being a horrific way to start one’s investment journey, it turned out to be an excellent time to start investing for someone who had a 30-year time horizon.

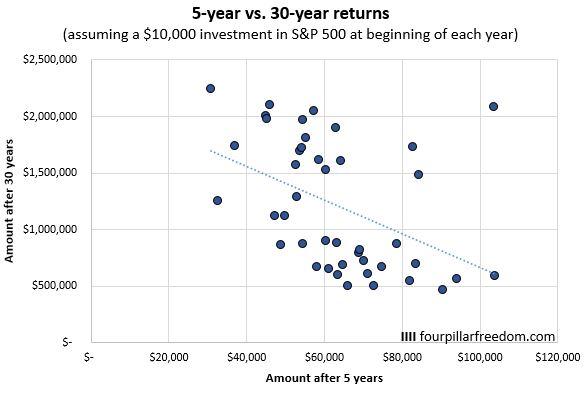

This brings up an interesting question: do initial poor five-year return periods lead to better 30-year return periods?

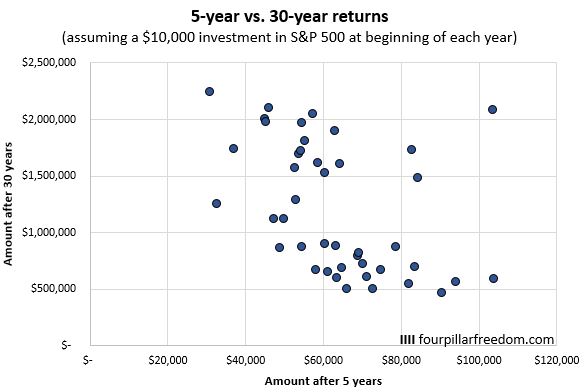

To answer this question, I looked at the dollar-cost average returns of every five-year period since 1928 along with the corresponding 30-year returns. This scatterplot shows every five-year and thirty-year combination:

Here’s an example of how to interpret this chart: For someone who invested $10k in the S&P 500 in the beginning of each year for five years from 1970-1974, they would have had $30,858 after five years. But if they kept investing for 30 years from 1970 through 1999, they would have ended up with $2.24 million. The dot highlighted below represents that 5-year and 30-year combination:

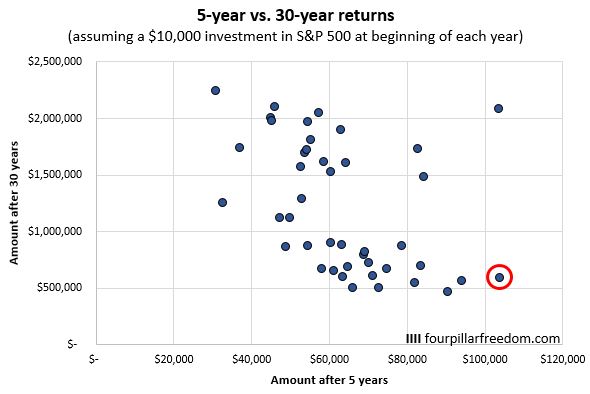

On the flip side, the best five-year dollar-cost averaging period ever was from 1951 to 1955. Someone who invested $10,000 in the S&P 500 at the beginning of each year would have been left with a whopping $103,960 by the end of 1955.

However, someone who invested $10k each year from 1951 through 1979 would have ended up with just $585k, one of the worst 30-year dollar-cost averaging periods since 1928:

In general, this scatterplot illustrates an interesting phenomenon: higher initial five-year returns tend to have lower 30-year returns. The trend is clear:

This isn’t a perfect relationship, of course. There have certainly been times when five-year returns and 30-year returns have both been high. Likewise, there have been times when five-year returns and 30-year returns have both been fairly low. But in general, the lower returns you earn during your first five years, the higher returns you can expect over a 30-year period.

Here’s one possible explanation for this phenomenon: Historical data tells us that the S&P 500 typically delivers 6 – 7% annual returns over the long run, even after inflation. This means that poor returns during an initial five-year period leaves more room for growth over the coming 25 years. In addition, better returns in later years are more influential since most growth from compound interest occurs in later years.

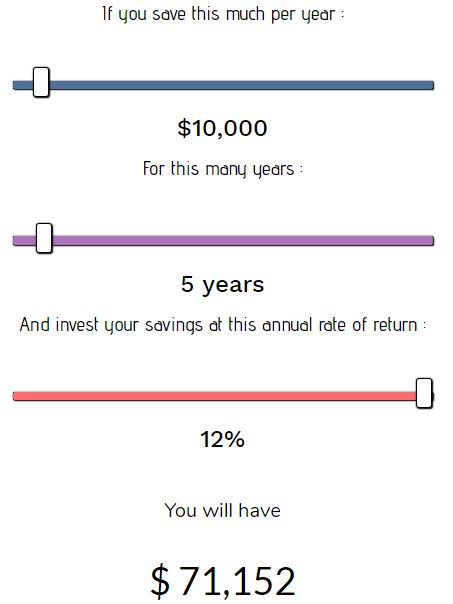

For example, according to the Savings vs. Investment Returns Calculator, someone who invests $10,000 per year and earns incredible 12% annual returns for their first five years would only be left with $71,152 after those five years:

This means they invested $50,000 just to earn $21,152 in investment returns. That’s not exactly a life-changing amount of money.

Since the typical investor doesn’t have much money invested during their first five years, it doesn’t matter if they earn incredible returns because the actual dollar amounts still aren’t substantial.

This is why it could be a blessing in disguise to earn poor returns early on because it leaves more room for better returns in the future, hopefully when you have more money to work with and when investment returns can actually make a noticeable difference in your net worth.

Conclusion

Lower initial five-year investment returns are typically associated with higher 30-year returns.

So, don’t stress out as an investor if you earn pathetic returns early on. Investment returns mostly matter in later years anyway.

Conversely, if you earn stellar returns during your first five years, expect returns to be lower at some point in the future.

And no matter what type of investment returns you earn both now and in the future, keep in mind that the amount you invest is largely within your control while the returns you earn are largely outside of your control.

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.