3 min read

Suppose you work for an employer, you earn $20 per hour, and you work a standard 40 hours per week.

If you’re like most people, you receive a paycheck every two weeks. However, you don’t receive ($20* 80 hours) $1,600 each pay period because the following four things are deducted from each paycheck:

- Federal taxes

- State taxes

- Social Security tax

- Medicare tax

Instead of receiving $1,600, you’ll receive $1,297:

| Gross Income | $1,600 |

|---|---|

| Federal Income Tax | $144 |

| State Income Tax | $37 |

| Social Security | $99 |

| Medicare | $23 |

| Net Income | $1,297 |

One nice aspect of working for an employer is that you don’t have to calculate these taxes yourself. Instead, the employer automatically makes these deductions each paycheck and simply gives you whatever is left over.

However, people who are self-employed have to perform these calculations themselves. I found this out when I quit my job as a data scientist last summer to pursue entrepreneurship.

While I knew something called a “self-employment tax” existed, I didn’t actually know what it referred to or exactly how to calculate it. Through a bit of research, though, I learned the ins and outs of it and found that it wasn’t as bad as it sounded.

In this post, I share what the self-employment tax is, how to calculate it, and why it’s not so bad after all.

What is the Self-Employment Tax?

When you work for an employer, a portion of your wages are withheld to pay for Social Security and Medicare taxes.

Specifically, you pay 6.2% of your wages for Social Security tax and 1.45% for the Medicare tax for a total of 7.65%. Your employer then matches the amount you pay in these taxes for a total of 7.65% + 7.65% = 15.3%.

However, when you’re self-employed you have to pay the whole 15.3% yourself since you don’t have an “employer” to match the amount you pay.

These two taxes that you have to pay as a self-employed person – Social Security and Medicare – are collectively called “the self-employment tax.”

At first glance, paying 15.3% of your total income in self-employment tax seems like a lot, but the good news is that certain deductions and business expenses can actually reduce this amount quite a bit.

How to Calculate Self-Employment Tax

If your net earnings from self-employment in a given year are over $400, you’re required to pay self-employment taxes.

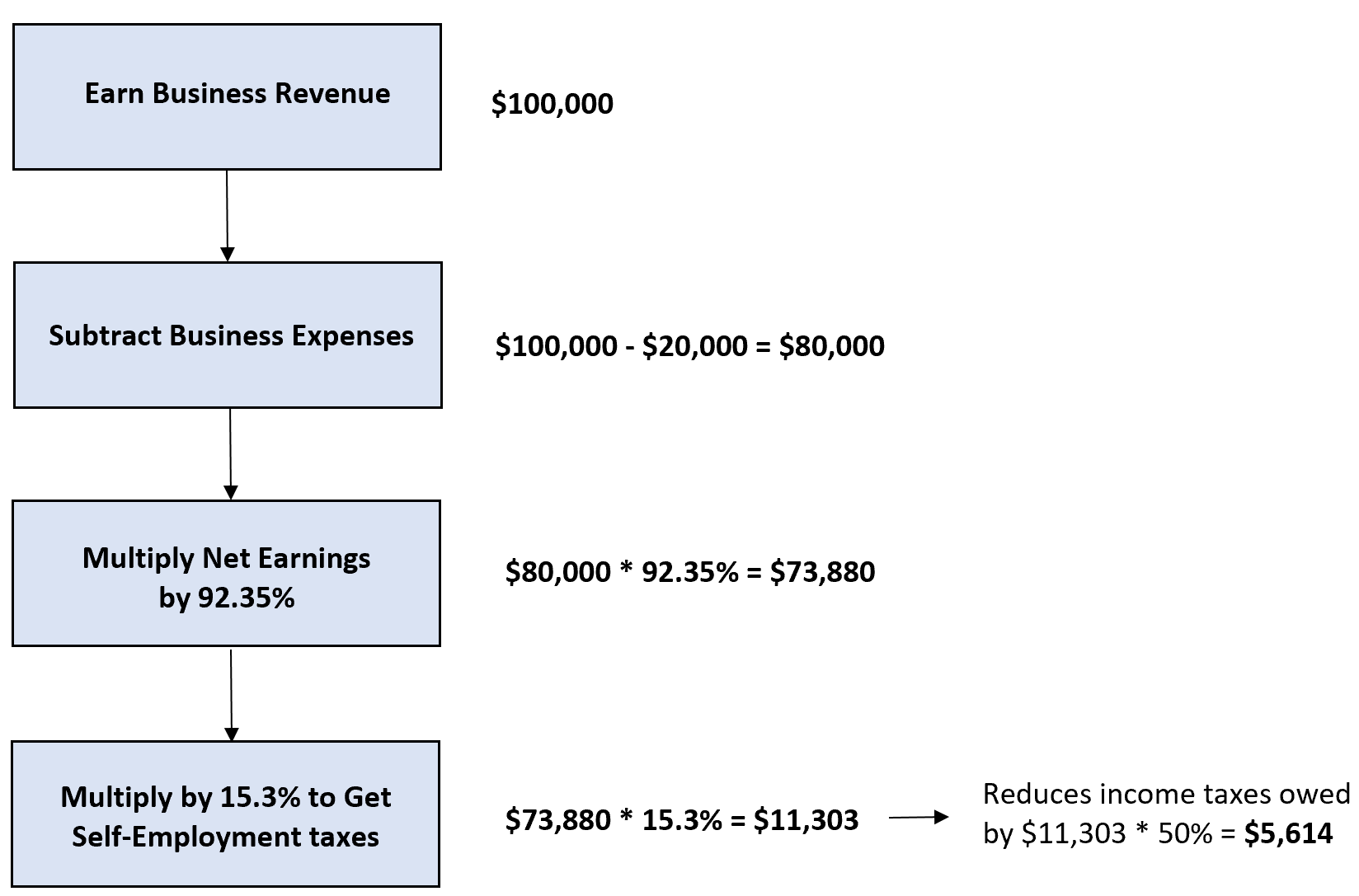

To calculate your net earnings from self-employment, you follow a simple two-step process.

Step 1: Subtract business expenses from business revenue.

First subtract your business-related expenses from your total business revenue.

Net earnings = Business revenue – Business expenses

Step 2: Multiply this number by 92.35%.

You are allowed to deduct 50% of the total 15.3% self-employment tax. This means you can deduct 7.65%. Thus, you only have to pay self-employment taxes on 100% – 7.65% = 92.35% of your net earnings.

The resulting number is what you have to pay 15.3% taxes on.

Note: The 12.4% Social Security tax only has to be paid on the first $132,900 (as of 2019) that you earn in a given year. There is no upper limit for the 2.9% Medicare tax, though.

Bonus: Tax Deduction

You are allowed to claim 50% of whatever you pay in self-employment tax as an income tax deduction. For example, suppose you pay $10,000 in self-employment taxes. You’re then allowed to reduce your taxable income by $5,000.*

*This is referred to as “an adjustment to income.”

Example of Calculating Self-Employment Taxes

Suppose Bob earns $100,000 in self-employment revenue in a given year and incurs $20,000 in business-related expenses. Thus, his net earnings are $80,000. He then multiplies this number by 92.35% to get $80,000 * 92.35% = $73,880. He has to pay 15.3% of this amount in self-employment taxes.

Thus, Bob has to pay $73,880 * 15.3% = $11,303 in self-employment taxes.

He then gets to claim half of that amount ($11,229 * 50% = $5,614) as an income tax deduction when he goes to file his income taxes (e.g. federal, state, and local taxes).

Why Business Expenses Can Make a Huge Difference

When you’re self-employed, there is one factor that can reduce your taxes more than any other: business expenses. Business expenses reduce your total income tax along with the amount you have to pay in self-employment tax.

In order for a certain expenses to be considered a business expense, it must be both “ordinary” and “necessary” for your business:

- Ordinary expense: one that is common and accepted in your particular field

- Necessary expense: one that is considered helpful for running your business

If an expense matches both of these criteria, then it can be considered a business expense, which then reduces your total net earnings that you have to pay tax on.

These expenses can range depending on the field you’re in, but common business expenses include a home office, travel expenses that are necessary for business, portions of internet and phone bills, education-related expenses like courses or conferences, and the list goes on.

These deductions can make a pretty big difference on the amount of tax you have to pay, depending on the field you’re in.

Disclaimer: I’m not a certified tax accountant and you shouldn’t take anything I write here as advice. Consult with a tax professional if you have any specific questions related to self-employment taxes.

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.