10 min read

When you work for an employer, there are four big things that are taken care of for you that, until you’re self-employed, you might take for granted:

1. Taxes – your employer automatically takes out the necessary taxes you must pay for federal income tax, state income tax, Social Security tax, and Medicare tax from each pay check.

2. Health Care – most employers offer an employee health care plan so that you don’t have to search around on the open market for a plan.

3. Retirement Accounts – most employers offer a 401(k) plan with a company match that you can invest in and set up regular contributions to come out of each pay check.

4. Personal Productivity – most employees work for a boss who works for a boss who works for a boss who works for a boss…basically, someone up the chain of command tells you what you should be working on, how many hours you should be working on it, where you should be working, and which tasks you should prioritize.

When you’re self-employed, you have to figure out all of this stuff on your own.

It can seem daunting, but it’s actually not as scary as it all sounds. I know because I personally figured out how to handle all four of these things after I quit my day job as a data scientist and started working for myself.

In this post, I share the exact details of how I pay my taxes, how I chose a health care provider, how I handle retirement accounts, and how I optimize my personal productivity now that I have nobody telling me what to work on.

I hope that this post is insightful and helpful for anyone out there who is considering taking the leap to self-employment, but feels intimidated by all of the unknowns.

1. On Handling Taxes.

Suppose you work for an employer, you earn $20 per hour, and you work a standard 40 hours per week. If you’re like most people, you receive a pay check every two weeks. However, you don’t receive ($20/hour * 80 hours) $1,600 because you must pay federal taxes, state taxes, Social Security tax, and Medicare tax. So, your total income will be more like $1,300:

| Gross Income | $1,600 |

|---|---|

| Federal Income Tax | $150 |

| State Income Tax | $40 |

| Social Security | $90 |

| Medicare | $20 |

| Net Income | $1,300 |

The nice part about this is that you don’t actually have to think about how much you should pay in taxes; your employer does that for you. But when you’re self-employed, you have to handle taxes yourself.

To handle this, I created an LLC and I now pay quarterly taxes.

Setting Up an LLC

As an entrepreneur, you have three choices on how you’d like to structure your business:

Option 1: Sole Proprietorship – This is how everyone starts out. There is no paperwork you need to file online. This makes filing taxes easy, but offers no protection over your assets or tax advantages.

Option 2: Limited Liability Company (LLC) – This is the simplest business structure to set up and the one that I personally chose to set up (more on this in a minute).

Option 3: LLC Taxed as an S Corp: This offers additional tax benefits, but it comes with more costs and more paperwork to file. It really only makes financial sense to set up an S Corp once you’re earning a significant amount of income (e.g. $100k+). I won’t go into the details about S Corps, but The Mad Fientist has a great post about it on his site.

Here’s how I personally think about these three options:

- When first starting out, don’t worry about forming a business entity. Focus on building your online business and learning all the ins and outs of earning income online.

- Once you’ve reached a consistent $500 per month, it makes sense to create your LLC.

- And when your income has grown so much that you are looking to optimize for tax purposes, consider electing to be taxed as an S Corporation with your CPA.

I personally chose to set up an LLC because it offered the following benefits:

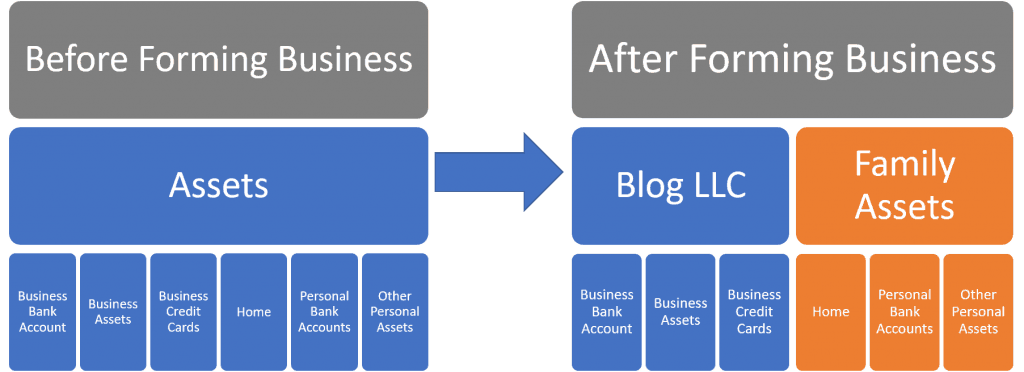

Benefit 1: Forming a business entity protects your family’s assets. So, if you ever get sued or have legal action taken against you, you would not be expected to pay your debt using any of your personal assets. This visual from Start a Mom Blog is a nice way to think about how a LLC separates your personal and business assets:

Benefit 2: Forming a business entity offers tax advantages.

- You gain access to a solo 401(k).

- You can deduct business expenses from your taxable income. For me, running websites is a low-cost business, but there are still significant deductions I can make (more on this later).

Benefit 3: Brand advantages. There are a bunch of special business credit cards that are only available to businesses, not individuals.

Once I decided that a LLC was the right business structure for me, here are the steps I actually took to set it up:

Note: To set up an LLC, I followed the steps at LLC University for my state.

Step 1: E-file for an LLC with my state. I filled out some quick forms, chose an arbitrary name that I thought sounded cool for my LLC, and payed the one-time $99 registration fee. Once I was approved, I was given a Document Number, which I needed for step 2.

Step 2: Apply for an EIN (Employer Identification Number)

I went to the IRS website here and filled out the quick application to receive my business’s EIN. I need this number for filing taxes, setting up payments to my LLC, and getting other business assets like business checking accounts.

Step 3: Set up a separate business checking account.

Lastly, I set up a business checking account at a local bank using the name of my LLC, not my personal name. I can now funnel all of my earnings straight to this checking account and use it to pay for business-related expenses, which makes tracking my income and expenses easy.

Paying Taxes

Anyone who is self-employed and expects to earn more than $1,000 per year must pay estimated quarterly taxes on the following dates: April 15th, June 15th, September 15th, and January 15th. You do so by setting up an account at eftps.gov, where you can pay these quarterly taxes online.

The general process for calculating estimated payments is as follows:

Step 1: Estimate taxable income for the year

Suppose Bob expects to make $50k this year. He then subtracts any above-the-line deductions (say, $10k) that he’ll incur for the year. Then he subtracts the standard deduction for individuals ($12,200), and is left with a total estimated taxable income of $27,800.

Step 2: Calculate income tax

Next, Bob calculates his income tax using the 2020 tax brackets and finds that it comes out to $3,240.

Step 3: Calculate self-employment tax

Next, Bob calculates his self-employment tax by taking his estimated total income ($50,000) and multiplying by 92.35%, then multiplying by 15.3% (which comes from Social Security tax of 12.4% plus Medicare tax of 2.9%), which comes out to $7,064.

This brings his total annual taxes to $7,064 (self-employment tax) + $3,240 (income tax) = $10,304.

Step 4: Divide by four.

Lastly, Bob divides by four to get his estimated quarterly taxes of $10,304 = $2,576. He’ll pay this amount by the four due dates mentioned above on eftps.gov.

I personally chose to hire a local personal accountant just to be sure that I file everything correctly. Plus, it frees up my time so that I can spend more time thinking about my businesses and less about taxes.

A Note on Single-Member LLCs

Since I’m a single-member LLC (I have no employees), I actually still file my income under my personal tax return, not through a separate business tax return. I simply use what’s called a Form 1040 Schedule C to do so. You can read more about that here.

2. On Handling Health Care

As an employee, you can usually just elect to use your employer’s health care plan. However, when you’re self employed, you have to find your own health care plan. After searching around, I decided that the best option for me was Medi-Share.

What is Medi-Share?

Medi-Share is something known as a “Christian care ministry.” The concept is simple – every month you pay a fixed amount into a pool of money that all of the other members pay into. When a member gets sick and has to pay a medical bill, funds from the group are used.

In order to join the program, I had to provide answers to a variety of questions that basically said I would not do drugs and that I would adhere to a Christian lifestyle. Once approved, I was able to choose a monthly plan by entering my age, my household size (just “1” in my case), and my state of residence.

Here were the plan options I was presented with:

The “standard monthly share” is how much you pay each month, regardless of whether or not you use any services. The “healthy monthly share” is a discounted price you can pay if you pass some exams that prove you’re healthy. The “annual household portion” is how much you would have to pay out of pocket before you’re allowed to use the funds from the shared pool.

How Much I Pay per Month

I personally chose the cheapest monthly plan for $87 since I rarely get sick.

There is a one-time $120 fee you must pay when you enroll with Medi-Share. They allow you to set up automatic recurring payments through your bank so each month $87 is taken out of my account on my chosen day of the month. Pretty simple.

If you want to join Medi-Share yourself, feel free to do so here. (Yes, that’s an affiliate link – I receive a referral fee if you sign up using my link)

Disclosure: Obviously my monthly payments are quite low since I’m only paying for myself. To see what a family of four would pay on Medi-Share, check out this excellent detailed guide from Dough Roller.

3. On Retirement Accounts

When you work for an employer, you likely have access to a company-sponsored 401(k) retirement account. When you work for yourself, though, you will have to handle retirement investing yourself.

There are three main ways you can save for retirement when you’re self employed:

Use a brokerage account: Anybody can open one on any brokerage platform (Vanguard, Fidelity, Schwab, etc.) and invest in any funds they’d like. There are no tax advantages for these accounts, though.

Use an IRA: Anybody can open a traditional or Roth IRA on any brokerage platform and invest in any funds they’d like. These come with tax advantages.

Use a Solo 401(k): Any individual who owns their own business and has no employees can open a solo 401(k) on any brokerage platform, but you need an EIN number to do so (recall that if you set up an LLC, you will get an EIN associated with it).

The total solo 401(k) contribution limit is $57,000 in 2020. To understand how this works, think of yourself as both an employee and an employer:

- As the employee, you can contribute up to $19,500 in 2020.

- As the employer, you can make an additional profiting-sharing contribution of up to 25% of your net self-employment income, which has a limit of $285,000 in 2020.

I personally haven’t set up my own solo 401(k) for my business yet because most of my earnings are being used just to pay the bills, but I plan on setting one up in the future as my online income increases.

4. On Productivity

Lastly, when you work for an employer, you don’t really have to think about what you should be working on. Instead, someone above you simply tells you what project to work on along with when the work needs to be done by.

As someone who is self-employed, I now have to make these decisions myself.

Since I earn all of my income from five different websites, my cash flow follows a simple process:

(1) Get traffic to my websites.

(2) Monetize that traffic through ads, affiliate links, or my own paid products & courses.

Step (1) involves researching articles to write about and writing those articles. The more articles I write, the more traffic my sites get and the more income I earn. To ensure that I’m producing enough content on a weekly basis, I stick to the following routine:

Monday, Wednesday, Friday: Write 2 articles for Statology from 8AM to 12PM-ish. Take a break, go for a walk, lift weights, eat lunch. Do random work from 2PM to 5PM-ish, including researching future articles and scheduling Collecting Wisdom posts. Hang out with girlfriend, friends, or family for rest of evening.

Tuesday, Thursday: Write 1 article for Four Pillar Freedom from 8AM to 12PM-ish. Take a break, go for a walk, lift weights, eat lunch. Do random work from 2PM to 5PM-ish. Hang out with girlfriend, friends, or family for rest of evening.

Weekends: Some weekends I work and others I don’t. It depends on my schedule. If I do work, it’s often writing an article for my food website I recently bought or writing an article for the smallest site in my portfolio, Wander Cincinnati.

By sticking with this schedule, I’m able to produce around 10 new articles per week across my portfolio of websites. As the traffic on each site grows, my income grows as well. For those interested, I share my exact monthly income on this page.

How Do I Get Motivated?

One of the most common questions I receive is “How do I stay motivated when nobody is making me get up in the morning and work?”

My honest answer is that I enjoy working on websites so much that it doesn’t feel like work for me, so I don’t need to use any motivation hacks to get moving in the morning. It’s fun to create new articles and it’s a thrill to see my traffic and income grow.

On a more general level, my master life & money plan looks something like this:

1. Get out of debt – done

2. Earn enough money online to quit day job – done

3. Earn enough money to provide for a whole family – in progress

4. Earn enough money to help my parents & siblings – to be done

5. Earn enough money to help friends – to be done

6. Earn enough money to help my community – to be done

It feels amazing to earn enough income online that I don’t need a day job, but I’m nowhere close to achieving steps 4, 5, or 6, which serves as my long-term motivation to keep working and growing my income.

How Do I Do Deep Work?

I don’t work 16-hour days. I rarely even work 8-hour days. It’s my belief that most people can only do about 4 hours of deep work per day. For me, I try to hammer out these 4 hours of deep work each morning through the week and I follow a pretty boring process to do so:

- Wake up (no alarm clock – just whenever I get up, which happens to be around 7AM), meditate for 20 minutes, take a cold shower, walk out the door.

- Drive to the coffee shop ~7 minutes down the road.

- Order a small dark roast coffee, put in my headphones, and type away on my laptop for about 4 hours, stopping only once or twice to go to the bathroom.

That’s the simple underlying process that has helped me grow my online income over the past three years from $0 per month to $3,000+ per month.

Bonus: On Figuring Shit Out

The biggest hurdle that many people face when deciding to become self-employed is simply conquering all of the unknowns.

I would work for myself, but I’m just not sure how taxes would work.

I would become self-employed, but I’m not sure how health care works.

I would quit my job, but I’m not sure how investing in retirement accounts would work without an employer.

I would become an entrepreneur, but I don’t know how I’d motivate myself every day.

These are valid questions and concerns, but the truth is that you can figure all of it out pretty quickly and easily with a bit of effort. I didn’t know the answer to any of those questions when I quit my day job, but now it all seems quite simple and obvious.

To anyone who is considering self-employment, I’d encourage you to be optimistic about your ability to learn and figure things out. It’s certainly a different world compared to traditional employment, but it’s conquerable if you’re willing to look like an idiot at times, ask tons of questions, learn from failures, and do your own research.

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.