4 min read

It’s no secret that income varies significantly among both individuals and households in the United States. But what does the distribution look like? What’s the median household income? How many individuals earn $50,000 or more per year? How many earn $100,000 or more?

In this post, I provide answers to these questions and many more. Using 2019 income data from IPUMS CPS, I share some interesting numbers and charts that highlight the individual and household income distributions in the U.S.

Let’s take a look!

U.S. Individual Income Percentiles

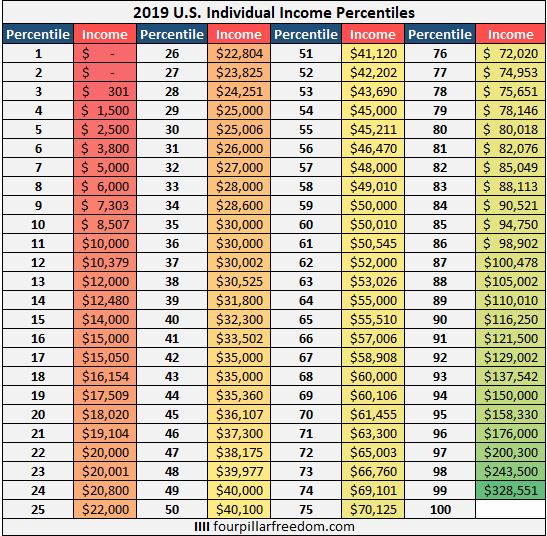

The following table displays the 2019 U.S. individual income percentiles.

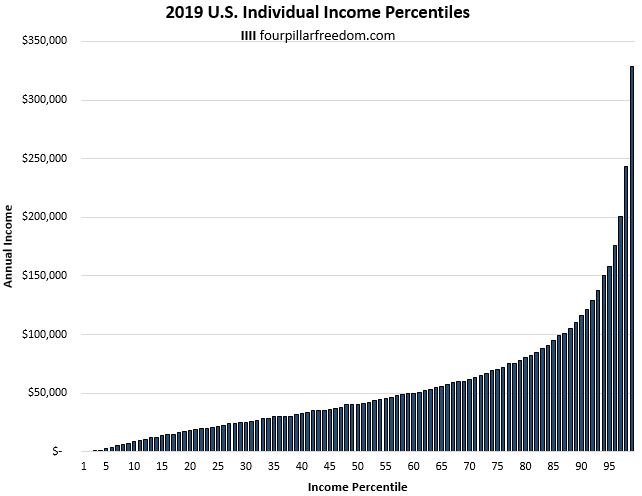

The following chart displays these individual income percentiles visually:

What is the median individual income?

The median individual income is $40,100. This means half of all individuals earn less than this amount and half earn more.

How much do you need to earn to be in the top 10%, 5%, and 1%?

To be in the top 10% of all individual income-earners in the United States, you must earn at least $116,250.

To be in the top 5%, you must earn at least $158,330.

To be in the top 1%, you must earn at least $328,551.

What is considered to be a “middle class” income for individuals?

The Pew Research Center defines Americans to be “middle class” if they earn two-thirds to double the median income. Since the median income is $40,100, any American who earns between $26,733 and $80,200 is considered to be middle class.

What percentage of individuals earn $50,000 or more per year?

Approximately 41% of individuals earn $50k or more per year.

What percentage of individuals earn $100,000 or more per year?

Approximately 13% of individuals earn $100k or more per year.

If you had a room full of 100 people and split them up based on who earns $100k or more, you’d have 13 standing on one side of the room and 87 on the other. It might seem like a six-figure income is becoming more common among individuals, but a relatively small number of people actually earn that much.

U.S. Household Income Percentiles

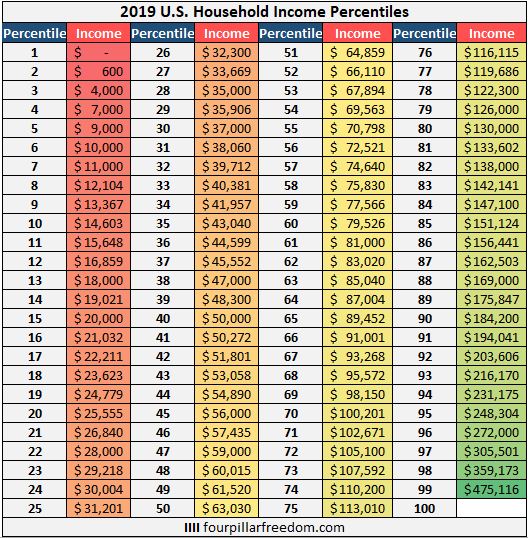

The following table displays the 2019 U.S. household income percentiles.

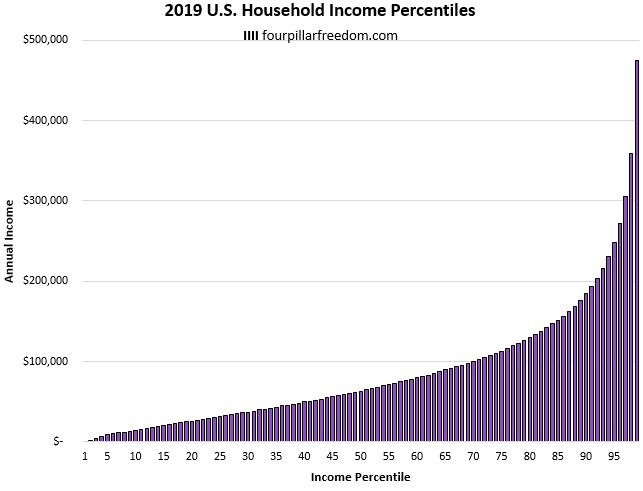

The following chart displays these individual income percentiles visually:

What is the median household income?

The median household income is $63,030. This means half of all households earn less than this amount and half earn more.

How much does a household need to earn to be in the top 10%, 5%, and 1%?

To be in the top 10% of all incomes in the United States, a household must earn at least $184,200.

To be in the top 5%, a household must earn at least $248,304.

To be in the top 1%, a household must earn at least $475,116.

What is considered to be a “middle class” household income?

The Pew Research Center defines Americans to be “middle class” if they earn two-thirds to double the median income. Since the median household income is $63,030, any household that earns between $42,020 and $126,060 is considered to be middle class.

What percentage of households earn $50,000 or more per year?

Approximately 60% of households earn $50k or more per year.

What percentage of households earn $100,000 or more per year?

Approximately 30% of households earn $100k or more per year.

Zooming in on the top 1%

It’s pretty crazy to see just how much the top 1% earns relative to everyone else.

We saw earlier that to be in the top 1% of income-earners, an individual needed to make at least $328,551 per year. It turns out that this is more than the bottom 27% of individuals combined.

To put this in perspective, imagine a room full of 100 people. If you line them up according to their annual income, from smallest to largest, the person at the end of the line who earns the most has an income equivalent to that of the 27 people at the opposite end of the line combined.

Not only that, but the person with the highest income ($328,551) earns twice as much as the person with the fifth highest income ($158,330) in the room.

Even crazier, if you take the people in the 87th, 88th, and 89th position in line who all earn six-figure incomes, their total combined income is still less than the person with the highest income at the end of the line.

That’s a bit mind-boggling.

Things to Keep in Mind

When looking at these income percentiles, keep a few things in mind.

1. Income is not the only variable that leads to wealth.

It can be interesting to see how your individual or household income stacks up against others in the United States, but keep in mind that income only represents one variable of wealth-building.

The other important variable – your spending – dictates how much you’re able to actually save and invest each year. A programmer in San Francisco might earn twice as much as a programmer in Cincinnati, but the cost of living in the Bay Area may completely offset this difference.

The way to build wealth is to create a gap between your income and your spending, then invest the difference. It’s entirely possible that you could create a larger gap in a city that offers you a low cost of living, despite a lower salary. Keep this in mind when comparing your income to others around the country.

2. Income varies with age.

It’s no secret that income tends to increase with age. The average 50-year-old earns more than the average 25-year-old. However, the numbers in this post don’t account for age so if you’re a young person and you’re discouraged by the income percentile you’re currently in, keep in mind that you’re comparing yourself to many 40 and 50-year-olds who are in their peak earning years.

3. Income is not everything.

Lastly, keep in mind that income is not everything. You may be much happier earning $40k working at a low-stress job than you would be earning $100k at a high-stress, demanding job. Don’t be envious of those who earn more than you – you have no idea what their quality of life is actually like.

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.