4 min read

The basic formula to build wealth is as follows:

1. Earn income.

2. Save a portion of that income.

3. Investing those savings into assets that grow without your time and attention.

That third step – invest in assets – can be as simple or as complex as you make it to be.

On one hand, you could invest in 50 individual stocks and attempt to buy and sell each of them based on when you think they’ll rise or fall.

On the other hand, you could buy one total stock market index fund composed of 3,000+ individual stocks and hold it for several decades.

Two strategies that both seek to earn investment returns, yet use opposing tactics to do so. One is an active approach and the other is passive.

Personally I prefer to use a passive investment approach using index funds because it offers the following advantages:

- Saves me time since I don’t have to actively buy and sell stocks.

- Minimizes trading fees and management fees.

- Maximizes diversification.

- Likely leads to higher returns than active investing.

I like to think of this investing style as lazy because it involves minimal effort on my part. I simply choose which index funds to invest in, automate my investments, then sit back and enjoy the returns.

In the investment world, there are many different lazy portfolios that you can invest in to build wealth. These are portfolios that invest in passive index funds, avoid market timing, involve low fees, and are simple to compose.

In this post, I’ll share seven examples of these types of portfolios along with how they’ve performed over the years and how you can easily construct these portfolios using Vanguard index funds.

Note: Annual returns are calculated using Portfolio Visualizer.

Examples of Lazy Portfolios

Total World Stock Portfolio

The most simple lazy portfolio that you could possibly invest in holds just one fund – a total world stock ETF. This single fund holds over 8,000 individual stocks from all around the world, including stocks from well-established and still-developing markets.

Composition:

- 100% Vanguard Total World Stock ETF [VT] (expense ratio: 0.09%)

Performance:

- 8.68% inflation-adjusted annual returns (2009-2019)

- 15.20% standard deviation

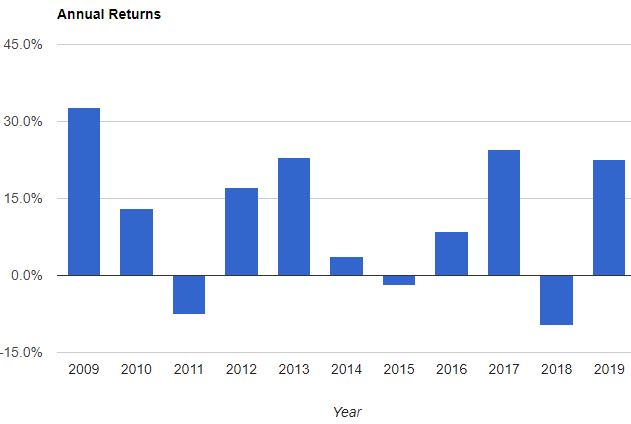

Total U.S. Stock Portfolio

There’s another lazy portfolio that you create using just one fund – a total U.S. stock ETF. This single fund holds all 3,600+ individual stocks in the United States, perfect for investors who only want to invest in one country (although this comes with some risk).

Composition:

- 100% Vanguard Total U.S. Stock Market ETF [VTI] (expense ratio: 0.03%)

Performance:

- 12.48% inflation-adjusted annual returns (2009-2019)

- 14.03% standard deviation

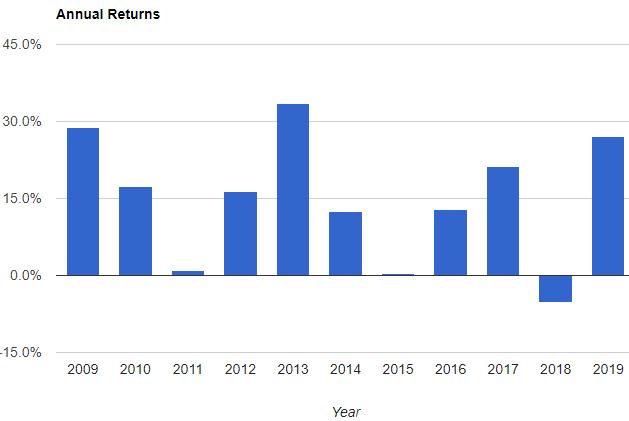

60/40 Portfolio

One of the most popular two-fund lazy portfolios is composed of a 60% total U.S. stock market index fund and a 40% total U.S. bond market index fund. This portfolio offers lower volatility (and usually lower returns) than a total world stock fund and a total U.S. stock fund.

Composition:

- 60% Vanguard Total U.S. Stock Market ETF [VTI] (expense ratio: 0.03%)

- 40% Vanguard Total U.S. Bond Market ETF [BND] (expense ratio: 0.035%)

Performance:

- 8.32% inflation-adjusted annual returns (2009-2019)

- 8.41% standard deviation

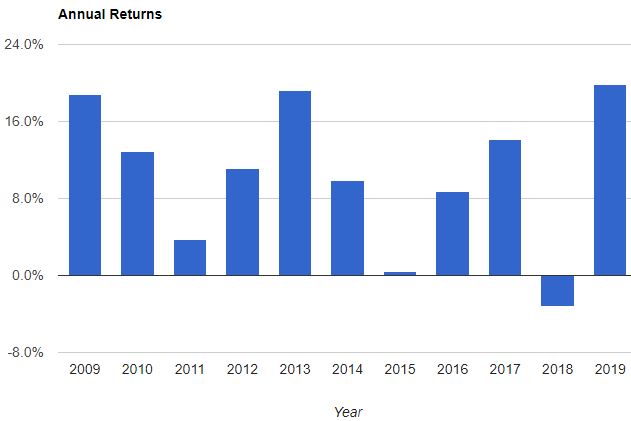

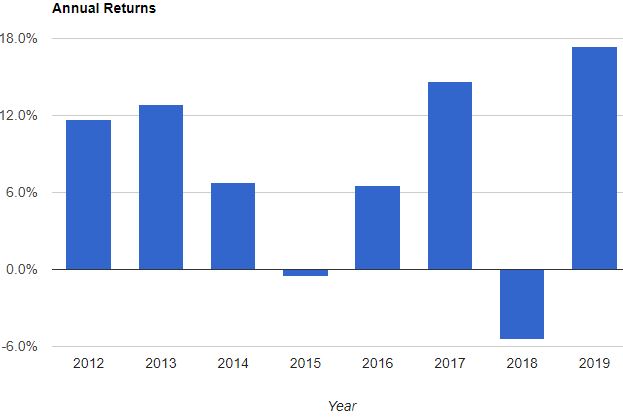

Three-Fund Portfolio

Popularized by Taylor Larimore, the three-fund portfolio offers a simple way to gain exposure to U.S. stocks, U.S. bonds, and international stocks using just three ETFs.

Composition:

- 40% Vanguard Total U.S. Stock Market ETF [VTI] (expense ratio: 0.03%)

- 40% Vanguard Total U.S. Bond Market ETF [BND] (expense ratio: 0.035%)

- 20% Vanguard Total International Stock Market ETF [VXUS] (expense ratio: 0.09%)

Performance:

- 6.56% inflation-adjusted annual returns (2012-2019)

- 6.85% standard deviation

Core-Four Portfolio

Building upon the three-fund portfolio, the core-four portfolio adds in a total U.S. real estate ETF for those who want more exposure to real estate in their portfolio. The composition below shows the traditional allocation for this portfolio, but you can fiddle around with the percentages if you’d like more or less exposure to real estate.

Composition:

- 30% Vanguard Total U.S. Stock Market ETF [VTI] (expense ratio: 0.03%)

- 40% Vanguard Total U.S. Bond Market ETF [BND] (expense ratio: 0.035%)

- 24% Vanguard Total International Stock Market ETF [VXUS] (expense ratio: 0.09%)

- 6% Vanguard Total Real Estate ETF [VNQ] (expense ratio: 0.12%)

Performance:

- 6.05% inflation-adjusted annual returns (2012-2019)

- 6.73% standard deviation

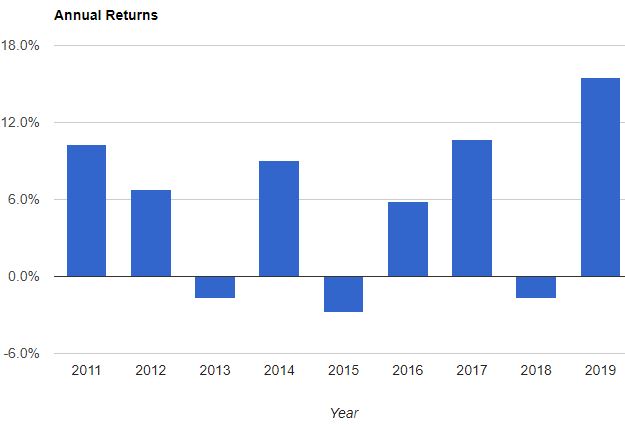

Permanent Portfolio

Another lazy portfolio that holds just four funds is the Permanent Portfolio. Created by free-market investment analyst Harry Browne, this portfolio is dubbed “perfect for people who hate to lose money.” It’s composed of equal allocations to a total U.S. stock market fund, a long-term U.S. treasury fund, a money market or short-term treasury fund, and a gold bullion fund.

Composition:

- 25% Vanguard Total U.S. Stock Market ETF [VTI] (expense ratio: 0.03%)

- 25% Vanguard Long-Term Treasury ETF [VGLT] (expense ratio: 0.07%)

- 25% Vanguard Short-Term Treasury ETF [VGSH] (expense ratio: 0.07%)

- 25% iShares Gold Trust ETF [IAU] (expense ratio: 0.25%)

Performance:

- 3.75% inflation-adjusted annual returns (2011-2019)

- 5.94% standard deviation

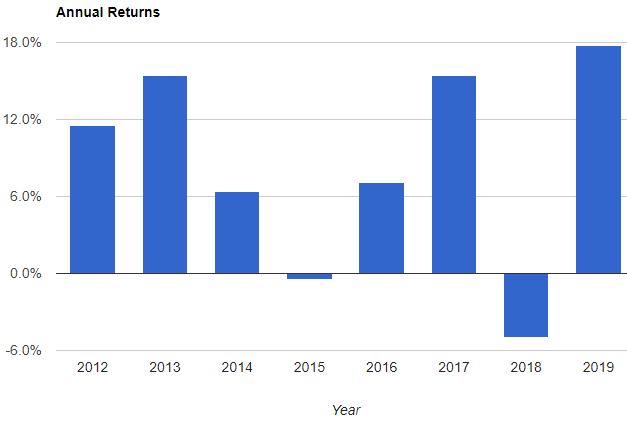

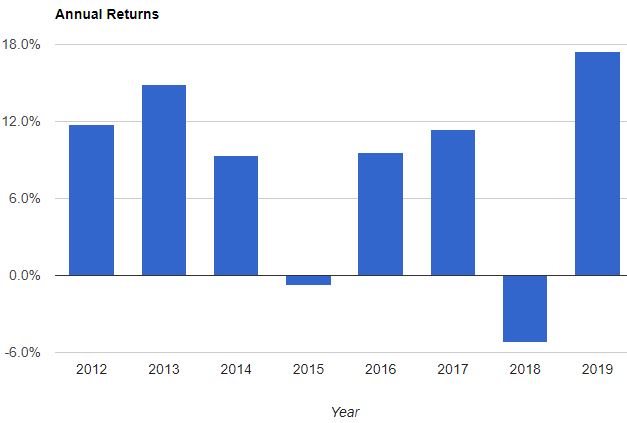

Coffeehouse Portfolio

Another popular lazy portfolio is the Coffeehouse Portfolio, popularized by financial advisor Bill Schultheis. This portfolio consists of seven funds that offer exposure to U.S. stocks, international stocks, and U.S. bonds.

Composition:

- 10% Vanguard Large-Cap ETF [VV] (expense ratio: 0.04%)

- 10% Vanguard Value ETF [VTV] (expense ratio: 0.04%)

- 10% Vanguard Small-Cap ETF [VB] (expense ratio: 0.05%)

- 10% Vanguard Small-Cap Value ETF [VBR] (expense ratio: 0.07%)

- 10% Vanguard Total International Stock ETF [VXUS] (expense ratio: 0.09%)

- 10% Vanguard Total Real Estate ETF [VNQ] (expense ratio: 0.12%)

- 40% Vanguard Total U.S. Bond Market ETF [BND] (expense ratio: 0.035%)

Performance:

- 6.60% inflation-adjusted annual returns (2012-2019)

- 6.80% standard deviation

The Importance of Automation

Each of the lazy portfolios shared in this post provide a simple approach to investing: choose your allocation, automate your investments, then sit back and wait for the returns.

One crucial part of lazy investing, though, is to actually be lazy with your investments. Don’t attempt to buy and sell funds based on how you think the market will perform, otherwise you’re just following an active investment approach with index funds.

Lazy investing is designed to deliver satisfactory long-term gains. This means your portfolio might occasionally drop in value, but as long as you stick with your asset allocation you’ll be okay.

To make your life easier, automate your investments. Choose a portfolio based on your risk tolerance, decide on a specific amount of money you want to invest every two weeks or each month, then set it and forget it. This is the way to minimize trading fees, taxes, and investing-related stress.

How to Create Each Portfolio From Scratch

The easiest way to create each of the lazy portfolios from scratch is by using M1 Finance, a site that allows you to build a custom portfolio for free. Setting up an account is dead simple and only requires three steps:

1. Set up an account by choosing an email and password.

2. Choose which funds to include in your portfolio.

3. Choose a type of investment account (IRA or brokerage account) and fund it.

Once your portfolio is set up, you can set up automated recurring investments, then sit back and be lazy.

I personally recommend using M1 Finance to build a lazy portfolio because it offers the following perks:

No annual fee. Some financial platforms charge an annual maintenance fee on your account; M1 Finance does not.

Fractional shares. Since M1 Finance invests using fractional shares, this means your money will never be sitting in your account idle until you have enough to purchase a full share.

Automatic target-allocated investing. Each time more funds are added to your account, M1 Finance automatically invests in the appropriate securities to ensure that you’re invested in the exact allocation that you specified.

Sleek interface. M1 Finance has one of the best interfaces of any financial platform out there. Their pie charts make it easy to visualize your portfolio and the entire site is easy to navigate and understand.

You can get started with M1 Finance and build a lazy portfolio in a matter of minutes by using this link.

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.