4 min read

A reader recently emailed me with the following question:

Hey Zach,

Quick question for you. On your Finances page you mention that you’re invested in both stocks and REITs. I’m curious if you know how correlated these two asset classes are and if any potential correlation is worrisome for you?

For example, would both REITs and stocks drop roughly the same during market crashes? And would one of these two lag behind during economic booms?

Would love to hear your thoughts. Thanks!

I do invest in both stocks and REITs (real estate investment trusts) and I have looked into the correlation between these two asset classes a bit before, but I’ve never formally written a post on it. Fortunately, this question gives me an excuse to do so.

So, let’s take a look at some historical data to answer the question: Are stocks and REITs correlated?

Historical Performance: Stocks vs. REITs

Nerd notes: I used historical data from Portfolio Visualizer for this analysis.

The returns used for U.S. stocks are based on the Vanguard Total Stock Market Index Fund (VTSMX) for 1994-2018.

The returns used for REITs are based on DFA Real Estate Securities I (DFREX) for 1994-1996 and the Vanguard REIT Index Fund (VGSIX) for 1997-2018.

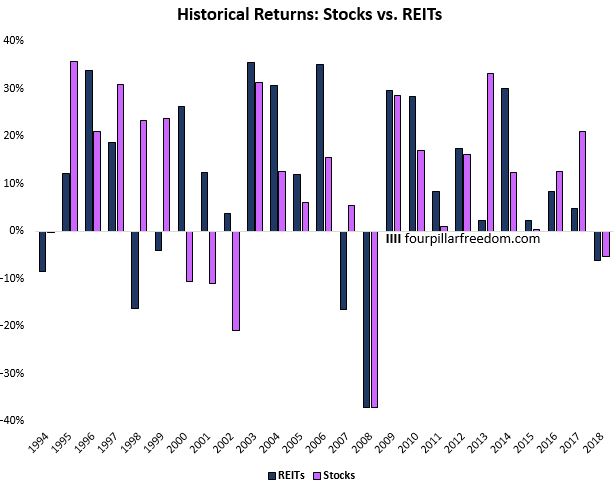

First, let’s take a look at the annual returns of both stocks and REITs since 1994:

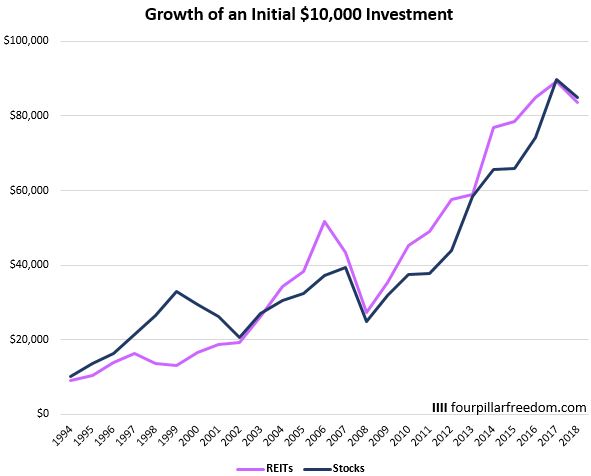

The following chart shows how an initial investment in each asset class grew from 1994 through 2018:

During this time frame, stocks delivered 8.94% annual returns with a standard deviation of 18.00% while REITs delivered 8.87% annual returns with a standard deviation of 18.72%. The correlation between these two asset classes was 0.45.

So, stocks and REITs are mildly positively correlated. When stocks go up, REITs have a tendency to go up as well. Likewise, when stocks drop, REITs have a tendency to drop.

It’s interesting, though, to look at how the two asset classes behaved during the two most recent market crashes of 2000 and 2008.

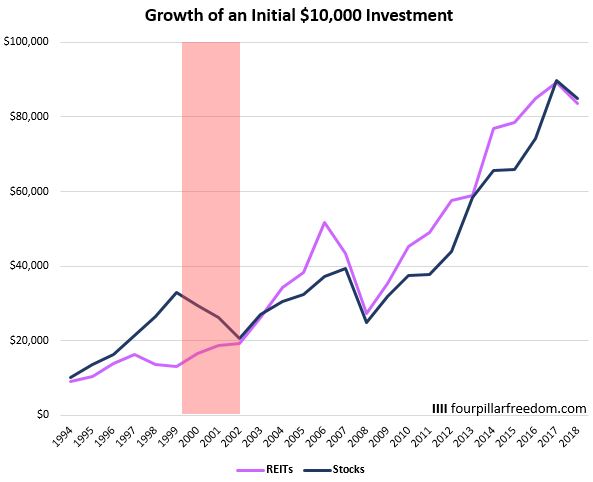

During 2000 – 2002, stocks got crushed while REITs delivered highly positive returns:

The following table displays the annual returns during these three years:

| Year | Stocks | REITs |

|---|---|---|

| 2000 | -10.57% | 26.35% |

| 2001 | -10.97% | 12.35% |

| 2002 | -20.96% | 3.75% |

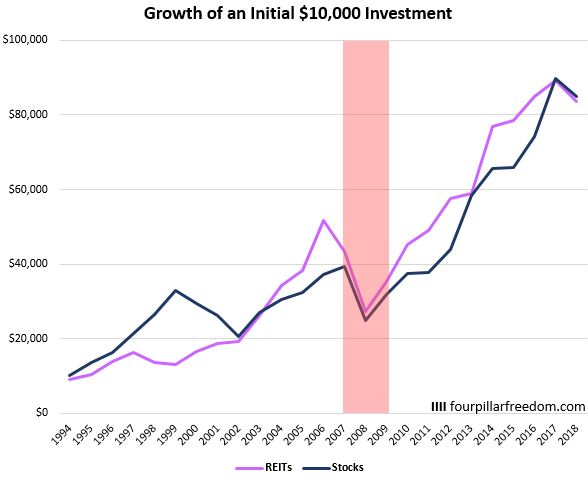

However, during the crash of 2008 and the subsequent rebound in 2009, the two asset classes behaved nearly identically:

Both stocks and REITs dropped significantly in 2008 and rebounded strong in 2009:

| Year | Stocks | REITs |

|---|---|---|

| 2008 | -37.04% | -37.05% |

| 2009 | 28.70% | 29.58% |

So, during the 2000 crash, the two asset classes were highly uncorrelated but during the 2008 crash, the two were highly correlated.

The Benefits of Diversification

Although stocks and REITs delivered nearly identical returns from 1994 through 2018, owning both asset classes would have offered a smoother overall ride since they were only mildly correlated.

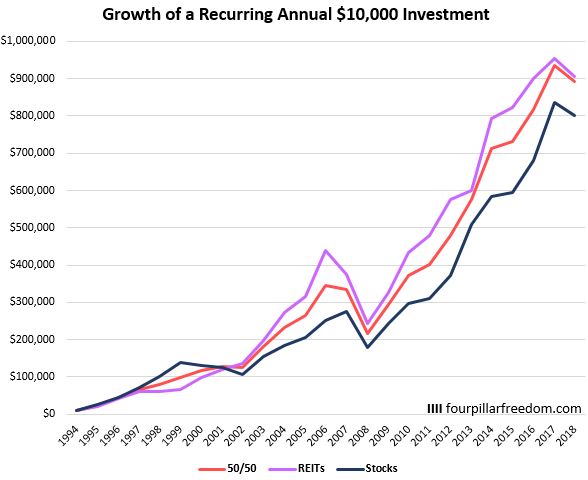

To illustrate this, check out the following graph that shows the growth of a $10,000 investment into the following three portfolios each year from 1994 through 2018:

- 100% stock portfolio

- 100% REIT portfolio

- 50/50 stock/REIT portfolio

Notice how the 50/50 portfolio was much less volatile during this time frame. In particular, the standard deviation of returns for the three portfolios were as follows: 18.7% for REITs, 18.0% for stocks, and 15.6% for a 50/50 portfolio.

This is one potential benefit of adding REITs into a portfolio: They have the potential to reduce overall volatility without reducing overall returns.

A Few Caveats

Here are a few caveats to keep in mind:

1. I used the time frame of 1994 through 2018 for this analysis because it’s the furthest back that Portfolio Visualizer offered back-testing data for. This isn’t the longest time frame in the world, so be careful with extrapolating results from this analysis into the future.

2. The decision to invest in REITs is a personal decision. However, REITs make up about 4% of total stock market funds like VTI, so investors who own these type of funds actually do have some REIT exposure whether they realize it or not.

3. REITs are required by law to pay out 90% of their taxable income to investors in the form of dividends. These dividends are often taxed at a higher tax rate than dividends from stocks, so this is something to look into before you decide to invest in REITs that have juicy dividends.

4. As we saw in this analysis, REITs performed wonderfully during the 2000-2002 slump for stocks, while they performed nearly identically to stocks during the 2008-2009 crash and recovery. Thus, it’s tough to say how REITs will perform during future stock market crashes.

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.