5 min read

Saving $1 million might seem like a daunting task, but it basically comes down to three factors:

1. How much you invest each year.

2. The investment returns you earn each year.

3. The number of years you spend investing.

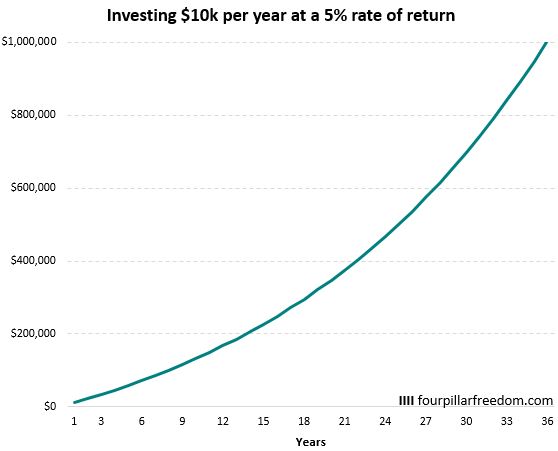

For example, one way to accumulate $1 million is to invest $10,000 each year at a 5% rate of return for 36 years:

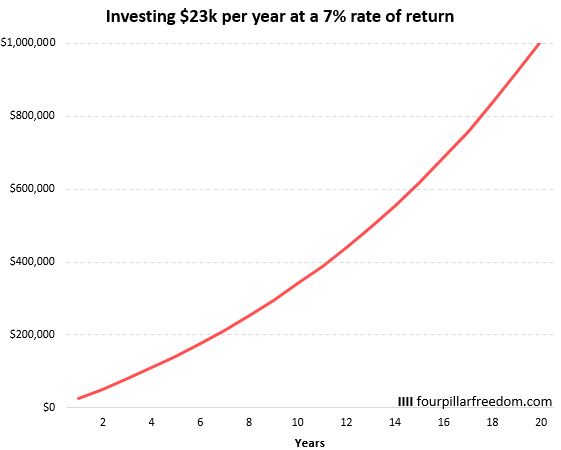

Another way is to invest $23,000 each year at a 7% rate of return for 20 years:

Another way is to invest $23,000 each year at a 7% rate of return for 20 years:

There are an infinite number of combinations of yearly investment amounts and annual returns that will lead to $1 million.

In this post, I want to visualize the different combinations of investments and returns that lead to a total savings of $1 million for the following time periods:

- 5 years

- 10 years

- 15 years

- 20 years

- 25 years

Let’s jump in!

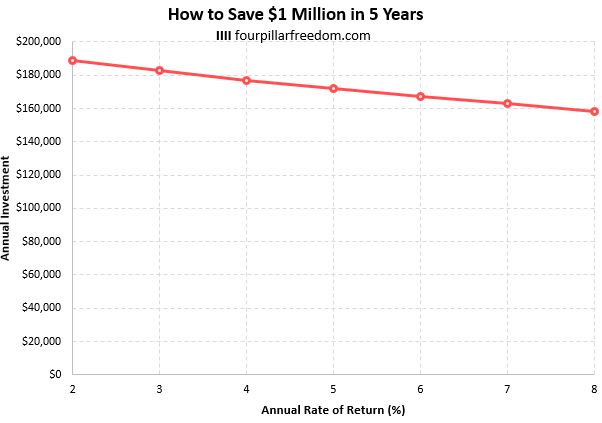

How to Save $1 Million in 5 Years

To save $1 million in 5 years, you need to invest a ton of money each year.

The following table shows the different combinations of investment amounts and annual rates of returns that lead to $1 million in just five years:

| Annual Rate of Return | Annual Investment |

|---|---|

| 2% | $189,000 |

| 3% | $183,000 |

| 4% | $177,000 |

| 5% | $172,000 |

| 6% | $167,000 |

| 7% | $163,000 |

| 8% | $158,000 |

The following chart displays these numbers visually:

Put simply, you need to generate a serious amount of money each year even after paying taxes and after paying for your lifestyle expenses in order to have enough cash to invest to accumulate $1 million.

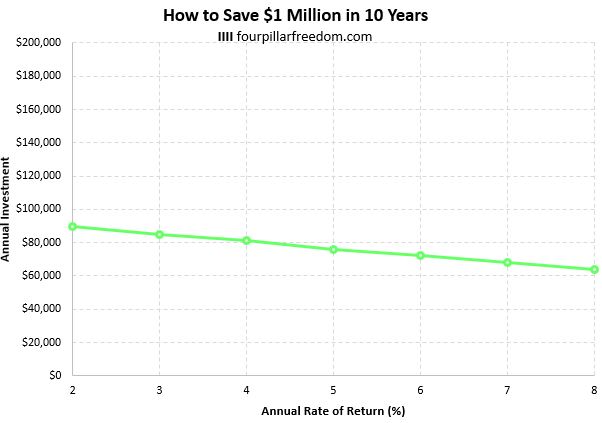

How to Save $1 Million in 10 Years

The following table shows the different combinations of investment amounts and annual rates of returns that lead to $1 million in 10 years:

| Annual Rate of Return | Annual Investment |

|---|---|

| 2% | $90,000 |

| 3% | $85,000 |

| 4% | $81,000 |

| 5% | $76,000 |

| 6% | $72,000 |

| 7% | $68,000 |

| 8% | $64,000 |

The following chart displays these numbers visually:

If you earn paltry 2% annual returns, then you need to invest at least $90,000 each year to save $1 million in 10 years. On the other hand, if you’re able to earn 8% annual returns, then you need to invest just $64,000 per year to hit $1 million in 10 years.

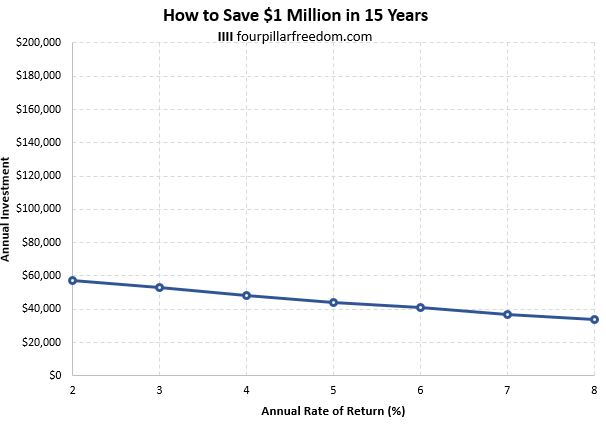

How to Save $1 Million in 15 Years

The following table shows the different combinations of investment amounts and annual rates of returns that lead to $1 million in 15 years:

| Annual Rate of Return | Annual Investment |

|---|---|

| 2% | $57,000 |

| 3% | $53,000 |

| 4% | $48,000 |

| 5% | $44,000 |

| 6% | $41,000 |

| 7% | $37,000 |

| 8% | $34,000 |

The following chart displays these numbers visually:

If you earn 2% annual returns, then you need to invest at least $57,000 each year to save $1 million in 15 years. Conversely, if you’re able to earn 8% annual returns, then you need to invest just $34,000 per year to reach $1 million in 15 years.

For a household that earns $100k+ per year with a decent savings rate, the numbers here show that it starts to become more reasonable for them to save $1 million in just 15 years.

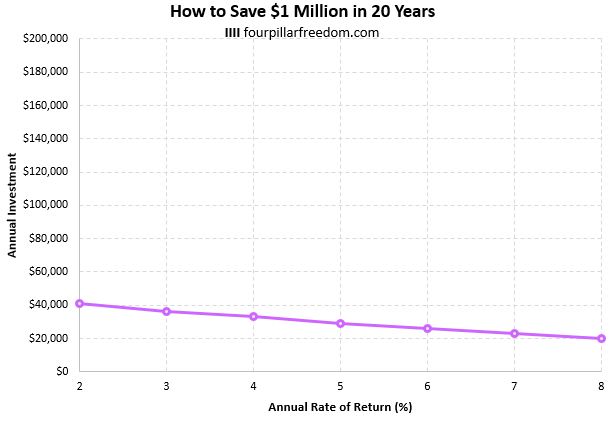

How to Save $1 Million in 20 Years

The following table shows the different combinations of investment amounts and annual rates of returns that lead to $1 million in 20 years:

| Annual Rate of Return | Annual Investment |

|---|---|

| 2% | $41,000 |

| 3% | $36,000 |

| 4% | $33,000 |

| 5% | $29,000 |

| 6% | $26,000 |

| 7% | $23,000 |

| 8% | $20,000 |

The following chart displays these numbers visually:

If you earn 2% annual returns, then you need to invest at least $41,000 each year to save $1 million in 20 years. On the other hand, if you’re able to earn 8% annual returns, then you need to invest just $20,000 per year to reach $1 million in 20 years.

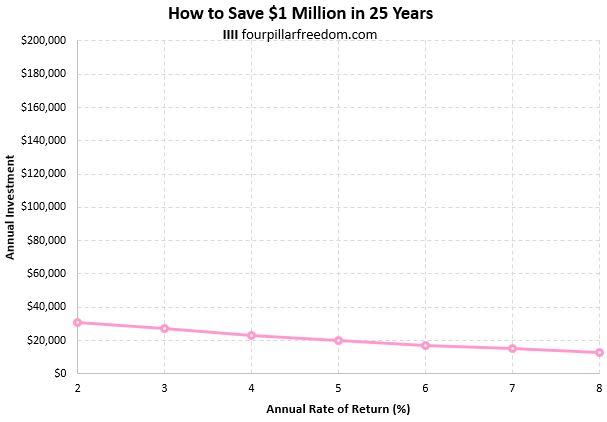

How to Save $1 Million in 25 Years

The following table shows the different combinations of investment amounts and annual rates of returns that lead to $1 million in 25 years:

| Annual Rate of Return | Annual Investment |

|---|---|

| 2% | $31,000 |

| 3% | $27,000 |

| 4% | $23,000 |

| 5% | $20,000 |

| 6% | $17,000 |

| 7% | $15,000 |

| 8% | $13,000 |

The following chart displays these numbers visually:

For households with a 25-year investment horizon, the numbers here become reasonable. For example, a household that invests $15,000 per year at a 7% annual return can achieve millionaire status in 25 years.

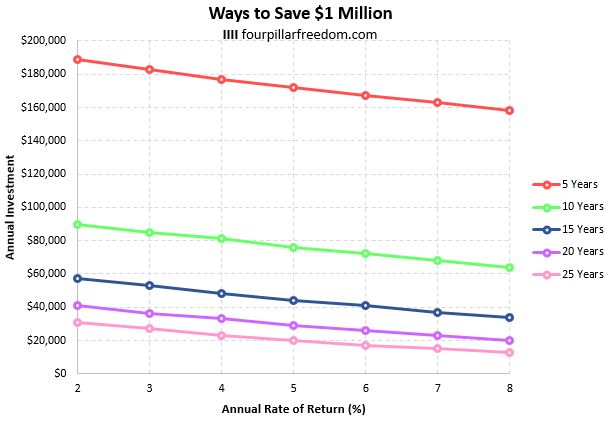

How to Save $1 Million

The following chart shows how long it takes to acquire $1 million based on the different time periods discussed above:

Notice the two obvious trends:

1. The longer your time horizon, the less you have to invest each year to become a millionaire.

2. The higher your annual investment returns, the less you have to invest each year to become a millionaire.

For most households, achieving millionaire status in just five years or less is unlikely simply because it requires such a high income. The longer you extend your investment horizon, however, the more reasonable the numbers become.

No matter how much you’re able to save and invest each year, it’s important to keep in mind the following things:

1. Investing in low cost index funds is the easiest way to gain maximum investment diversification while minimizing investment fees.

2. While the stock market rarely delivers “average” returns in any given year, it has historically delivered 7% annual returns even after inflation.

3. While having $1 million in the bank sounds like a dream, it’s unlikely that you actually need that much money to gain significant freedom and flexibility over your time.

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.