5 min read

Suppose you have a net worth of $5,000 and you decide to take a three-week trip to Japan that costs $3,000. You try a ton of new food, visit a plethora of new places, make a ton of memories, and consider the trip to be a success.

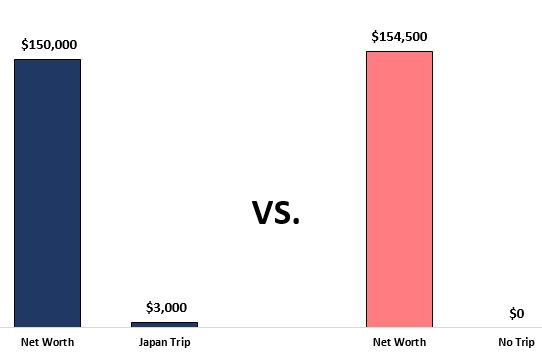

Fast forward five years. You now have a net worth of $150,000. However, if you had skipped out on that trip to Japan and instead invested that $3,000 in the S&P 500, your investment would have grown by about 50% to $4,500.

This means your net worth would instead be $154,500.

If you could go back in time, would you skip that trip so that you could have a higher net worth today?

Personally I would not skip that trip if I had the power to go back in time. In fact, this exact scenario happened to me. Five years ago I went on a study abroad trip to Japan for three weeks with a group of students from my university. At the time I had a net worth of $5,000 and today I have a net worth of about $150,000.

Given the choice, I would not go back in time and skip the trip just to have a higher net worth today. I frequently think about the memories I made on that trip along with how much I enjoyed experiencing a culture that felt like the polar opposite of the U.S. in many ways.

Trips: The Gifts That Keep on Giving

I would wager that, given the choice, most people would not go back in time and skip out on a particular trip just so they could have a higher net worth in the present. One reason is because, as psychology researcher Sonja Lyubomirsky once pointed out, memories of trips tend to get better and better over time:

“In the same way that a family story gets more exaggerated and funny each time Grandpa tells it, memories become more positive as time passes—a phenomenon known as “rosy recollection” (Mitchell et al., 1997).

When recalling college, people may fondly remember cherished friends and zany weekend adventures, but not the homesickness or the stress of term papers.

When replaying experiences in our mind’s eye, like a zealous movie editor, we often leave the boring and forgettable scenes on Thrift 34 the cutting room floor to produce a more enjoyable flick.”

Even if the trip itself wasn’t that enjoyable, humans have a tendency to recall trips as being much more fun and exciting than they actually were. In a fascinating research paper, professor George Loewenstein shared an example regarding college students who went on a three-week California bicycling tour and were later asked how they felt about the tour.

“…only 5 percent of the bicyclers expected to be disappointed beforehand, but 61 percent said they were disappointed during the trip. Then, as early as a week later, only 11 percent remembered they’d been disappointed.”

Good or bad, trips tend to give us memories that we can later recall with fondness over and over again.

In addition to the memories we experience afterwards, trips also give us the gift of anticipation. Just think about any trip you’ve planned in the past. More than likely, you’ve experienced excitement leading up to the trip by thinking about how much fun you’ll have, how many cool places you’ll see, and how many interesting things you’ll do.

For all of these reasons, most of us cherish trips and we rarely regret them.

This brings up an interesting question: How much should you spend on trips?

If trips offer so many psychological benefits both before and after they take place, should you forego saving for the future completely and spend as much as possible on trips?

How Much Should You Spend on Trips?

There probably does exist an upper limit on how much you should spend on trips. For example, over the past few years I could have spent nearly all of my income traveling around the world and saving zero money whatsoever. In that scenario, my net worth would be zero but I’d have a whole bunch of memories and experiences.

While I love the idea of having those experiences, it’s also pretty cool to be in a financial position where I don’t need a day job. I wouldn’t have had the means to quit my day job, though, if I had spent all of my income taking trips over the past few years.

I think there exists a healthy balance between developing the discipline to save and invest while also giving yourself permission to spend on trips.

Perhaps the way to have the best of both worlds – to take trips but also save a significant amount of money – is to minimize your travel costs. Here are a few ways to do so:

Embrace No-Housing-Cost Travel.

Over the past few years I’ve gone to the Bonnaroo Music Festival in Tennessee twice. The price of a ticket for the four-day event is about $275. Once you’re on site, though, camping is free and you’re allowed to bring your own food. By not paying for hotels or any housing accommodations, these trips have been fairly cheap relative to the unique experiences they’ve offered.

Embrace Mother Nature.

I’ve written before that nature offers the greatest form of free entertainment. You can go hiking and exploring for free or relatively cheap in most public parks, forests, and nature centers. One of the best ways to take a cheap trip is to spend most of your time in outdoor areas. Plus, being in nature has serious psychological, mental, and physical benefits.

Embrace Travel Hacking.

I must admit that I’m not an expert at travel hacking, i.e. using credit card rewards to travel for cheap or even free. There are plenty of excellent resources out there, though, that share unique ways you can accumulate credit card bonuses and use them to book flights and/or hotels for free. My personal favorite resource is The Luxe Strategist’s travel hacking articles. If you’re looking to minimize travel costs, travel hacking is an excellent way to do so as long as you’re disciplined with credit cards.

There is no “Right” Amount to Spend on Trips

There is no universal “right” amount to spend on trips.

In many cases, you may actually get more joy and utility from spending money on a quality laptop, a new mattress, new appliances, etc. In general, experiences bring more happiness than possessions, but there are plenty of cases where it makes more sense to spend that money you would have spent on a trip on possessions, material goods, or apps that save you time and enhance your quality of life instead.

It’s also important to keep in mind that some people simply get more enjoyment out of traveling than others. If you’re someone who prefers to stay in one place year-round where you can develop a weekly routine and be in a place you’re familiar with, surrounded by people you know well, there’s nothing wrong with that. Taking trips is not a requirement to live a good life.

As an individual, your job is to develop the self-awareness to know how much value you actually get out of taking trips, and balance your trip-spending with your ability to save and invest for the future. Done correctly, it’s possible to enjoy the benefits that come from taking trips while also moving towards a position of financial flexibility.

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.