3 min read

One of my most popular posts is titled Visualizing Financial Independence With Tiny Blocks. In that post, I share a simple idea:

Most people define “financial independence” as having 25 times your annual expenses. For example, if you spend $40,000 per year, you need $1 million (25 *$40,000) to be financially independent.

So, suppose we pretend this tiny red block represents $1,000 in annual expenses:

![]()

And pretend this tiny green block represents $1,000 in savings:

![]()

Then for every tiny red block, you need 25 tiny green blocks to be financially independent:

![]()

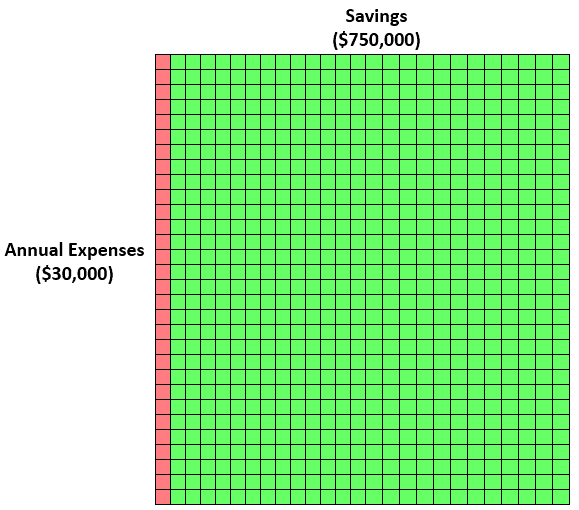

So if you spend $30,000 per year, you need $750,000 to be financially independent. Here’s what that looks like:

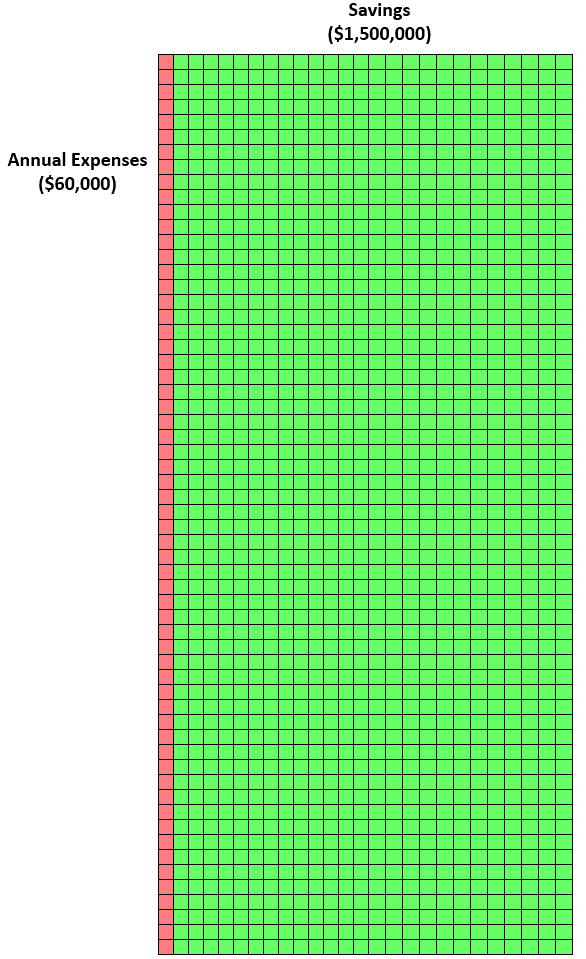

Or if you spend $60,000 per year, you need $1.5 million in savings. Here’ what that looks like:

These charts highlight a simple idea: for every $1,000 less you spend each year, you need $25,000 less in savings to reach financial independence.

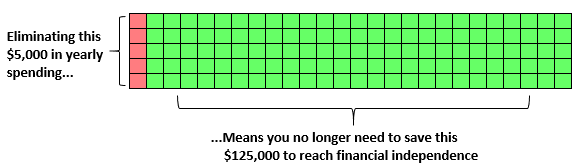

For example, if you can reduce your spending each year by $5,000, you would need to save $125,000 less to reach F.I.

The conclusion here isn’t terribly surprising: the less you spend each year, the less you need to save to achieve financial independence.

But we can take this idea one step further.

The traditional definition of financial independence assumes that you save up 25 times your annual expenses and cover all of your spending purely through passive income, e.g. selling off a portion of your portfolio each year to support your lifestyle.

If you’re open to the idea of earning some active income, though, you don’t actually need 25 times your annual expenses saved up to quit your day job.

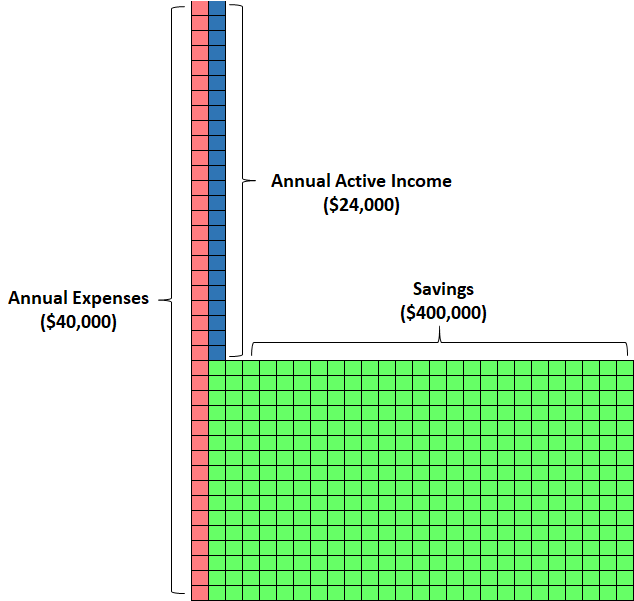

For example, suppose your annual expenses are $40,000. Instead of saving up $1 million (25x annual expenses) before you quit your day job, you may instead opt to work at a lower stress job, at a part-time job, or start your own small business/side hustle.

Suppose you’re able to earn $24,000 each year through active income. Following the traditional 4% rule, that means you only need a portfolio large enough to cover the other $16,000 of your annual expenses, which would be a portfolio of size $400,000 ($16,000 * 25).

Here’s what that looks like visually:

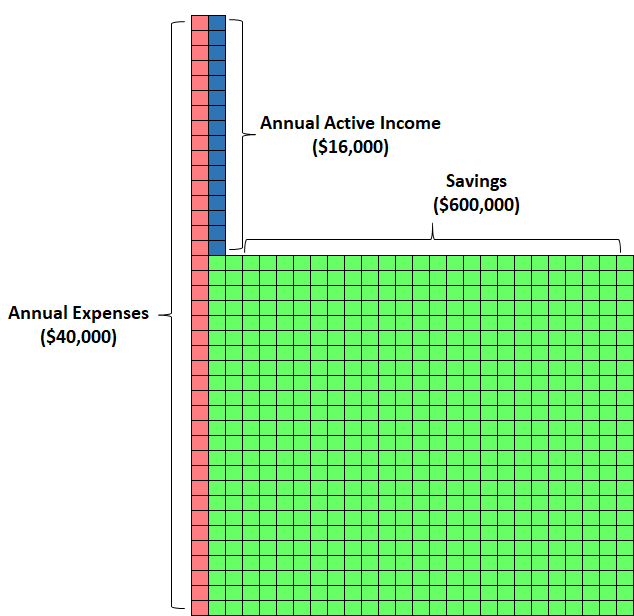

Or suppose you only earn $16,000 each year in active income. Then you’d need a portfolio of size $600,000 to cover your remaining $24,000 annual expenses.

Here’s what that looks like:

A Scoop of Savings & A Scoop of Active Income

For me personally, I’ve found that I enjoy working as long as:

- I control when I work

- I decide what projects to work on

- I decide where I get to work

Unfortunately, a day job has none of these perks. Instead, my company tells me:

- When to be in the office

- What projects to work on

- Where I need to be when I work

This is why I’ve decided that it makes far more sense for me to build up a modest portfolio and then make the leap to work for myself, rather than spend a decade or longer working in a corporate setting that I don’t enjoy just to build up a massive portfolio that can cover all of my annual expenses.

Related: The 4% Rule Only Offers One Way to Cover Your Expenses

The traditional recipe for financial independence calls for a tub of savings. My personal recipe for freedom calls for a scoop of savings and a scoop of active income. This will enable me to gain freedom over my work (and a huge chunk of my life) far before I have enough money to actually be financially independent.

Active Income Takes Many Forms

Active income can take many forms. For me, I currently earn income actively through websites and stats tutoring. These are both entrepreneurial ways to earn income. However, you could also earn income through the form of a part-time job or a low stress full-time job. Depending on your personality and your interests, there is more than one way to earn income in a way that is far less miserable than holding a job you currently hate.

I personally believe that life is about finding fulfilling work, not saving up enough money to never work again. Unfortunately, the only type of “work” that most people are familiar with (including myself) is in the form of a 9-5 job, which forces people to work an outdated, nonsensical schedule that often involves doing work they didn’t choose and attending meetings that are far too often pointless and unproductive.

A high savings rate can help you quit a job you hate and achieve financial independence sooner than most people. But opening yourself up to the possibility of earning active income each year can speed up your path to freedom even sooner.

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.