4 min read

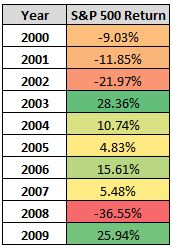

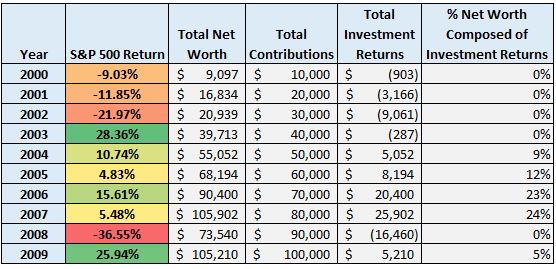

Here are the yearly returns of the S&P 500 from 2000 to 2009:

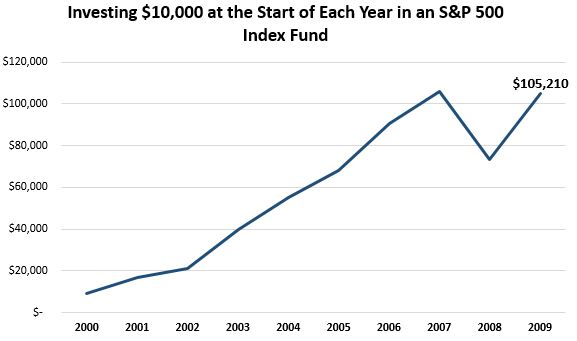

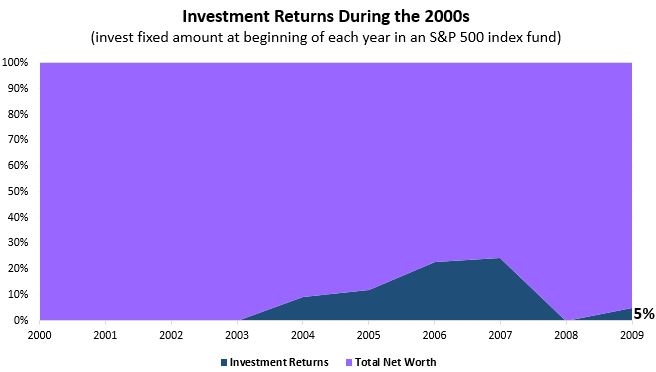

Assuming you started with $0, here’s how your net worth would have grown if you invested $10,000 in an S&P 500 index fund at the start of each year from 2000 to 2009:

Your net worth would have grown from $0 to $105,210 during this decade.

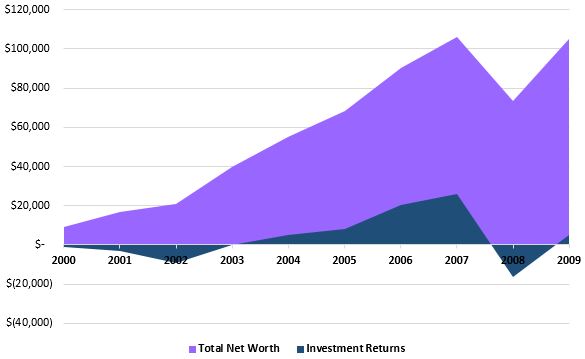

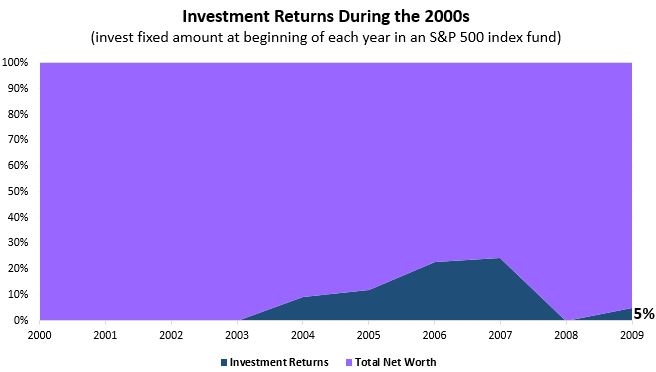

And here is how investment returns would have contributed to this net worth growth:

The purple area represents your total net worth and the blue area represents the percentage of your total net worth that came from investment returns.

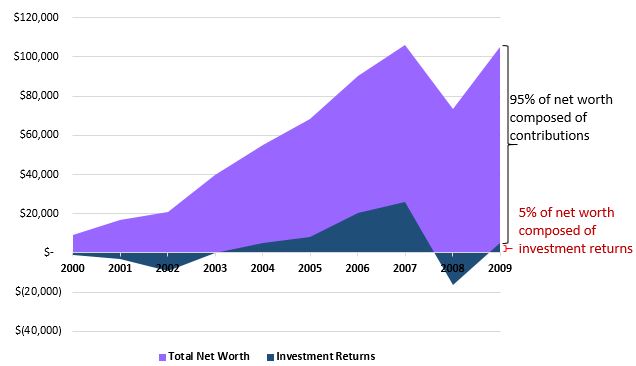

Since this was an awful decade for the S&P 500, investment returns barely contributed to your net worth growth during this time frame. In fact, by the end of this decade only 5% of your total net worth would have come from investment returns:

Here are the actual numbers from the chart above:

And here’s a look at investment returns as a percentage of total net worth during this decade:

During this decade, you would have invested $100,000 and ended with a net worth of $105,210. This means only $5,210 (about 5%) of your net worth would have been composed of investment returns.

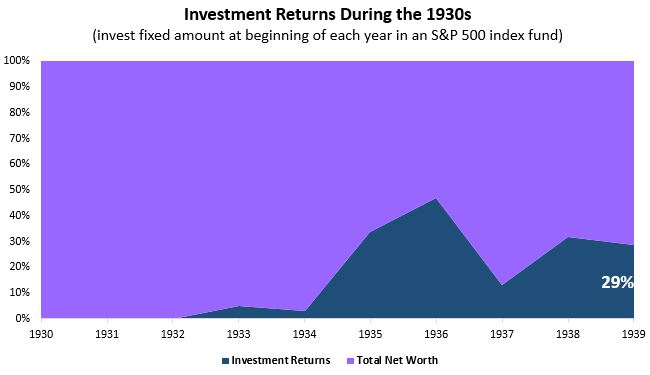

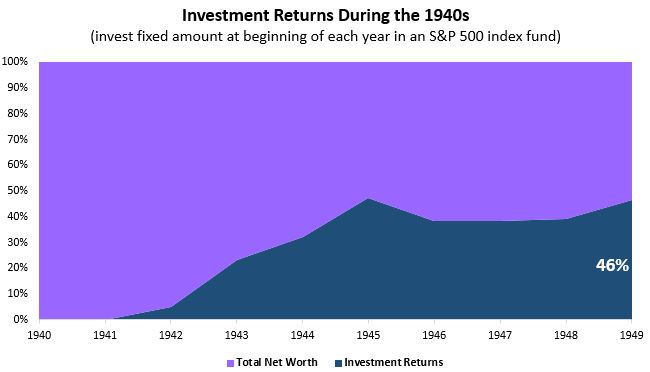

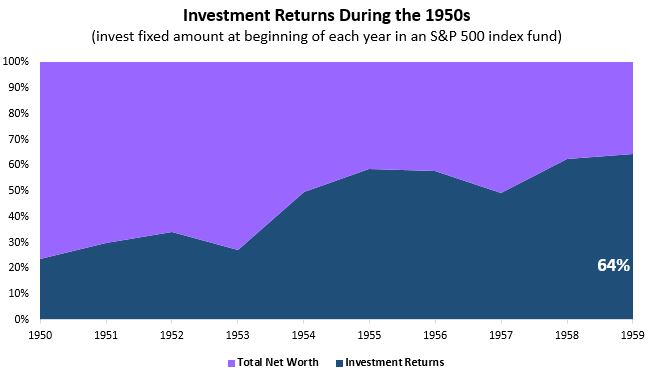

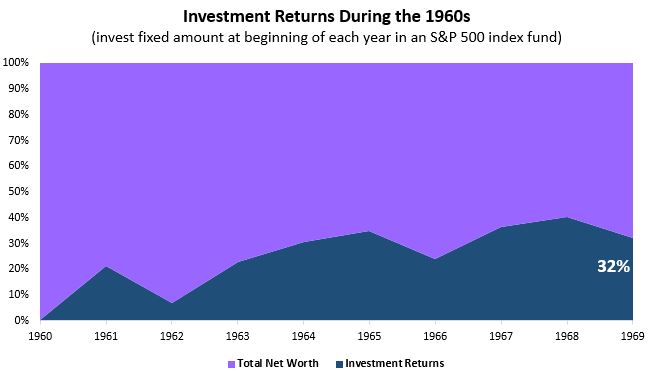

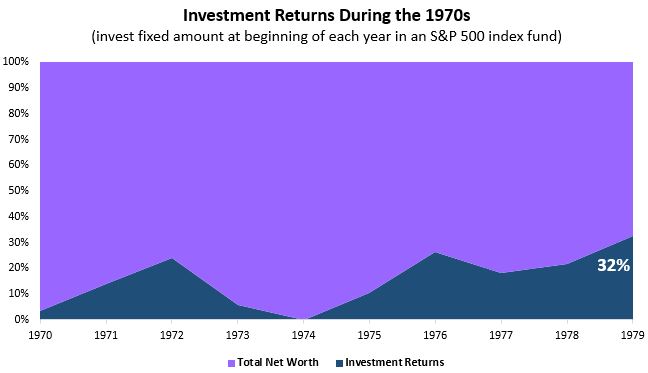

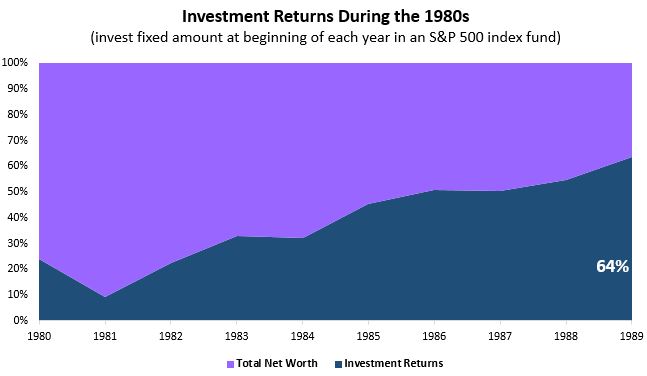

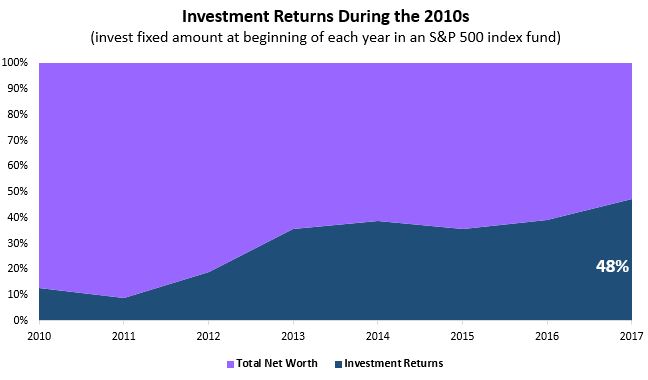

Now let’s generate this same chart for every decade since 1930. Again, we’ll assume you start each decade with $0, invest the same amount in the S&P 500 at the beginning of each year (the actual amount doesn’t matter since we only care about percentages), and we’ll find out how much of your ending net worth would have been composed of investment returns:

Conclusion

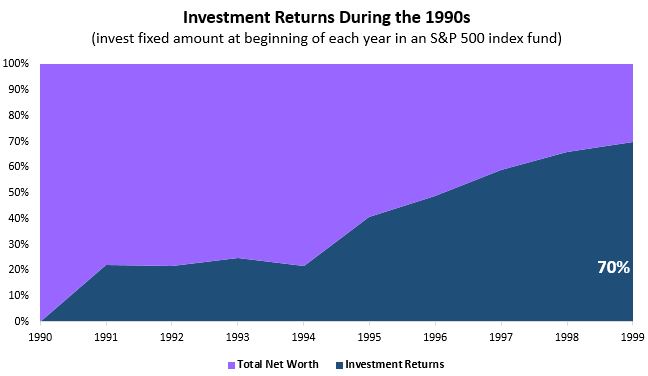

The best period for S&P 500 returns was the 1990s, where returns accounted for a whopping 70% of net worth growth.

The worst period for S&P 500 returns was the 2000s, where returns accounted for a pathetic 5% of net worth growth.

These charts highlight a simple truth: you can’t always count on investment returns to propel your net worth higher. This is particularly relevant for anyone who hopes to achieve financial independence in just one to two decades. While we know the S&P 500 generally increases over the course of several decades, there is no guarantee that it will produce decent returns over the short-term.

This is the exact reason why most people are better off focusing on growing the gap between their income and expenses, rather than hoping for decent investment returns. Instead of stressing out about how the market may perform, it’s best to:

- Grow your income by acquiring marketable skills.

- Keep your spending at a reasonable level by minimizing the “big three” expenses.

- Minimize investment fees by investing in low-cost index funds.

As long as you do these three things, you will be able to increase the likelihood that you’ll hit your financial goals. Let the stock market do whatever it may. Focus on what you can control.

S&P 500 data for this analysis came from this NYU Stern spreadsheet.

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.