4 min read

This past weekend one of my good friends ran the Flying Pig Marathon in Cincinnati. The final race times for all of the participants were posted online the following day, so I decided to download the data and check out how long it took most people to run the full 26.2 miles.

It turns out that the median time was 4 hours and 32 minutes. That’s about a 10:23 mile pace. This time varied quite a bit based on gender and age, though, so to get a more granular look at the data I decided to find the median time based on gender and age division.

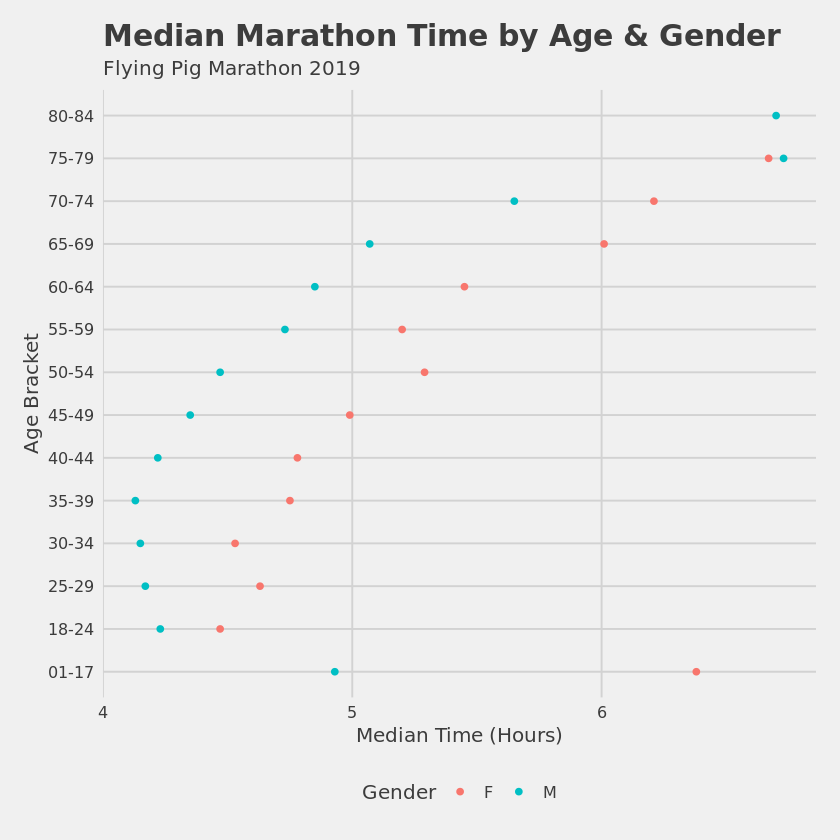

The chart below (created using the free statistical software R) shows the median marathon time by age bracket and gender:

The blue dots represent the median race time for males; the pink dots represent the median race time for females.

This chart illustrates a few interesting points:

- The fastest median race times for males occurred in the 30-34 and 35-39 age brackets.

- Conversely, the fastest median race times for females occurred in the 18-24 age bracket.

- The median race time for males was faster than that of females for every age bracket, except the 75-79 bracket.

So if you want to finish a marathon faster, it helps to be young. It also helps to be male. Unfortunately, you can’t change those attributes. You can, however, following a training program and start running more often. That’s completely within your control.

Thus, the way to improve your marathon time is to focus on the things you can control.

Similarly, the way to improve your finances is also to focus on the things you can control.

You can’t control how much wealth you inherit. You can’t control the advantages or disadvantages you’re presented with when you’re born. You can’t control how the market will perform in any given year.

You can, however, control the following things:

1. Decide to spend modestly, especially on the big three expenses.

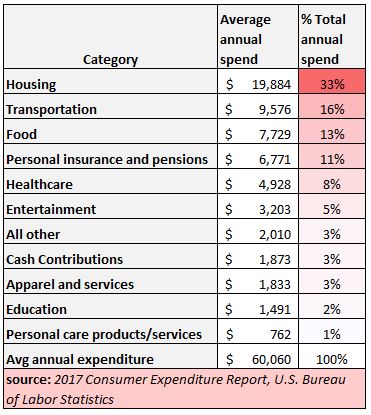

The following chart shows the average annual spend for U.S. consumer units:

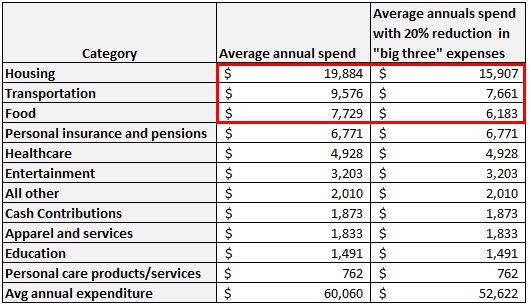

Notice how the top three expenses account for a whopping 62% of total spending. Reducing each of these three expenses by just 20% for the average household would lead to an annual savings of nearly $8,000:

2. Decide to grow your income through acquiring marketable skills, pursuing side hustles, and starting businesses.

In particular, I have been able to boost my own income by picking up the following marketable skills:

- A degree in statistics

- JavaScript – programming language

- D3.js – JavaScript library for data visualization

- R – programming language

I have also found success in tutoring students in statistics as a side hustle.

Also, over at Collecting Wisdom I’ve interviewed people who have generated income in a variety of different ways including:

- Building profitable websites

- Doing freelance writing

- Doing freelance genealogical consulting

- Selling graphic designs online.

3. Decide to invest in low-fee investments.

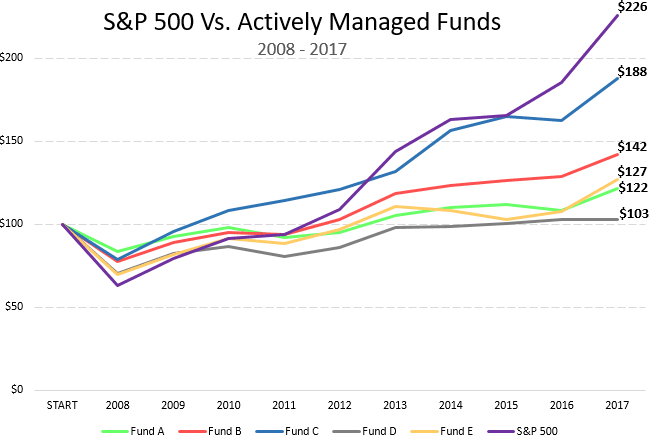

It’s very difficult to outperform stock market index funds. Warren Buffett proved this when he made a bet with asset management firm Protégé Partners in 2007 that the S&P 500 would outperform a group of actively managed hedge funds over the following ten years.

The following image shows how a $100 investment in the S&P 500 performed during this period compared to five actively managed funds:

The S&P 500 crushed the competition.

Part of this outperformance is due to the fact that actively managed funds often jump in and out of stocks, attempting to time the market. Even for professionals, this is incredibly hard to do and is often sub-optimal. In addition, the fees that come with actively managed funds create a serious drag on investment returns.

4. Decide to be a patient investor, resist market timing, and invest in things that match your risk tolerance.

In general, the less you touch your investments, the better they will perform. This is why practicing patience and resisting the urge to constantly buy and sell will leave you wealthier in the long term.

Conclusion

You won’t run faster marathons by wishing you were younger. You’ll run faster marathons by training more.

Likewise, you won’t improve your finances by wishing you’d receive a million-dollar windfall or by hoping to buy the next unicorn stock. You’ll improve your finances by keeping your spending at a reasonable level, boosting your income, minimizing investment fees, and practicing patience.

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.