4 min read

I think we’ve all come across at least a couple articles that talk about the latte factor, which is this simple idea that spending ~$5 per day on a latte might not seem like a lot on a daily basis, but if you instead invest that $5 per day it would grow into some enormous number 30 years from now.

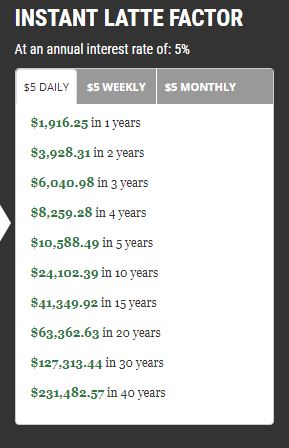

For example, according to the David Bach Latte Factor calculator, investing just $5 per day at a 5% annual rate of return would leave you with $127,313 in 30 years from now.

Investing that same $5 per day at a 7% annual rate of return would leave you with a whopping $184,458 in 30 years from now.

When I first got into the personal finance space a few years ago, I was a big fan of this idea.

Yeah, it does make sense to cut out the little expenses. I should invest that money instead!

But recently I’ve started to like this idea less and less. I don’t deny that investing a small sum of money each day for 30 years will grow into some huge number thanks to compound interest, but it’s silly to focus on cutting out tiny expenses when most people could instead reap enormous benefits from focusing on nailing a few of the biggest expense categories.

In particular, half of the spending for most America households comes from just three categories: housing, transportation, and food. I like to call these the big three.

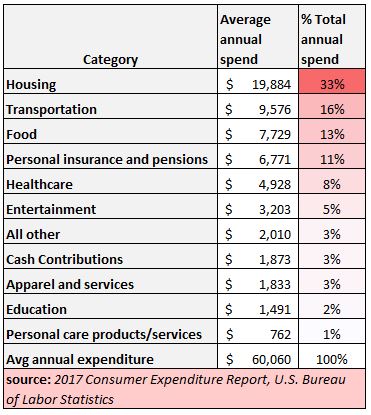

In the most recent version of the Consumer Expenditure Report, the U.S. Bureau of Labor Statistics found that the average consumer unit spent a total of $60,060 in 2017. Here’s the breakdown of that spending:

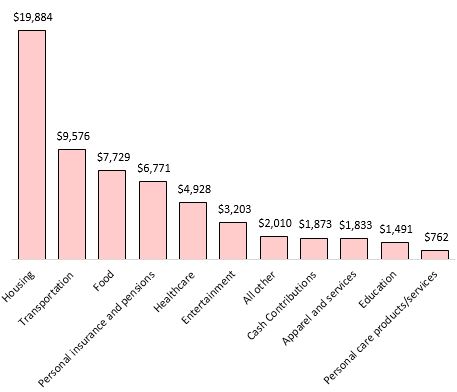

And here’s a quick visualization of those numbers:

For the typical American household, about one-third of all their spending goes towards housing.

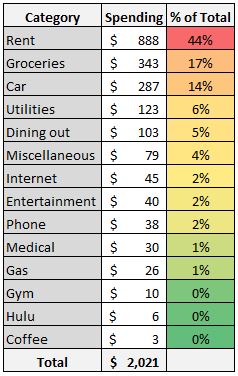

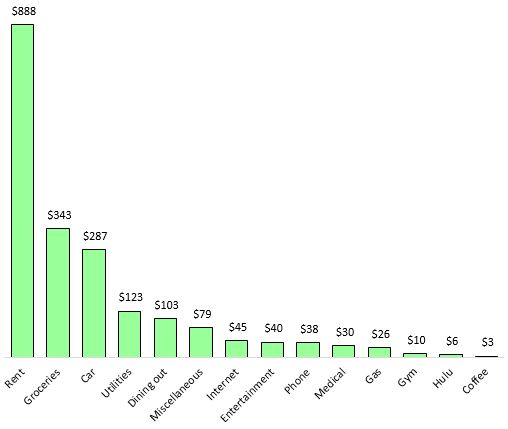

I dug up my monthly expenses for this past January to see how well my housing expenses matched this report:

It turns out that an even larger percentage of my own spending (44%) goes towards rent. In fact, my rent payment is just slightly less than all of my other expenses combined.

A quick visualization of these spending categories reveals just how influential my rent payment is on my overall spending:

This tells me one thing: If I can nail my housing expenses, I can afford to mess up in a lot of other areas.

I’m lucky to have found a fairly cheap area to live, but there are plenty of places within a 10-mile radius of me where rent prices for a similar one-bedroom one-bath apartment go for $1,300 – $1,700.

Just for fun, let’s imagine I did choose to live in a place with a $1,300 monthly rent. And let’s suppose I was a strong believer in the Latte Factor and decided to cut out all spending on lattes. Thus, my combined spending on housing and lattes would be $1,300 per month.

Combined housing and latte spending = housing ($1,300) + latte($0) = $1,300

Now let’s compare that to my current monthly rent of $888. And let’s suppose I think the Latte Factor is a bit irrelevant and decide to spend $5 per day on a delicious latte. In this case, my combined spending on housing and lattes would be $1,038 per month.

Combined housing and latte spending = housing ($888) + latte($150) = $1,038.

By nailing my housing expenses and ignoring the latte factor, I’d be able to save $262 per month.

Low Housing Expenses = More Financial Flexibility

Low housing expenses allow you to mess up in more areas than just latte spending. By minimizing the biggest monthly expenditure, you give yourself financial flexibility in other areas.

Not that you should try to inflate your spending in other areas, but there are simply other areas where you may feel the desire to spend more than may be deemed “acceptable” by some personal finance aficionados. When you nail your housing expenses, you give yourself permission to do so.

For example, I probably spend more money at Chipotle each month than I should, but I have an innate weakness for the siren calls of the burritos whenever I drive by one of their fine establishments.

On average, I’d say I eat at Chipotle about twice per week. That’s about $15 per week. Or $60 per month.

Going back to our example from earlier, suppose I chose to live in a place that had a $1,300 monthly rent. If I decided to spend zero dollars on both lattes and chipotle, my combined housing / latte / chipotle spending would be $1,300 per month.

Contrast that with my current monthly rent of $888. Suppose I decided to get both a latte and a burrito every single day of the month. That’s about ($5 + $7.50) $12.50 per day. Or $375 per month. In this case, my combined housing / latte / chipotle spending would be $1,263 per month. That’s still less than my total spending from the previous example, all because I was able to nail my housing expenses!

Why Not Target the Big & Small Expenses?

Ideally you should try to nail your housing expenses and keep the small recurring expenses in check. This leads to the most savings.

But the big idea I’m trying to get across in this post is that your housing expenses likely account for a disproportionately large percentage of your total spending. So, if you can manage to keep your housing expenses fairly low, you have more flexibility to “overspend” in other areas that bring you joy like Chipotle, lattes, or whatever else.

One of my favorite examples of someone who keeps their housing expenses fairly low so they can “overspend” in other areas is my friend The Luxe Strategist. Her pinned tweet sums up this idea nicely:

When you nail your housing expenses, you give yourself greater financial flexibility in all other areas.

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.