5 min read

Suppose Ralph is a senior in college. He currently works as a shift manager at a restaurant on campus and earns about $20k per year after tax. Between his rent, meals, transportation, and all his other expenses, Ralph spends about $20k per year. So, he’s unable to save and invest any money but he earns enough to support his college lifestyle.

Now imagine Ralph graduates at the end of the year and lands a job with a starting salary of $40,000 after tax. He has doubled his income.

At this point, Ralph has an important decision to make: should he keep living like a college student and spend about $20k per year or should he upgrade his lifestyle and start spending more of his hard-earned income?

Let’s run the numbers on a few different scenarios.

The Impact of Living Like a Student

Suppose Ralph decides to keep living like a student in his first year out of college. So, in his first year he decides to spend $20k just like he did as a student. Let’s assume that he’s able to increase his income by 4% each year and he also increases his spending by 4% each year. Let’s also assume he invests all of his savings each year into a stock market index fund and earns 5% annual returns each year. We’ll also assume he starts with a net worth of $0.

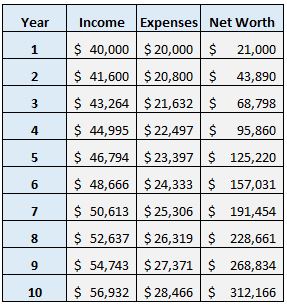

Here’s how his net worth will grow during his first 10 years out of college:

In 10 years, Ralph would be able to accumulate over $312,000.

Notice something interesting here: since Ralph decides to save 50% of his income in year 1 and increases both his spending and income at the same rate each year, he is able to continue to save exactly 50% of his income each year. Effectively, he set the bar for how much he should save in his very first year out of college.

Now consider another scenario: Ralph decides to inflate his lifestyle a bit and start spending $30k in his first year out of college. Again, let’s assume that he increases his income by 4% each year, spending by 4% each year, earns 5% annual returns, and starts with a net worth of $0.

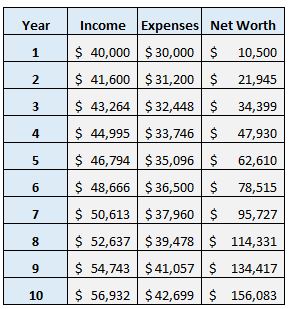

Here’s how his net worth will grow during his first 10 years out of college:

In 10 years, Ralph would be able to accumulate $156,083, which is less than half of the amount in the previous scenario.

Again notice a similar pattern as before: In his first year out of college, Ralph decides to save 25% of his income. Since he increases both his income and spending by 4% each year, he saves exactly 25% of his income in each of the following years as well. Once again, in his first year out of college, Ralph sets the bar for how much he’ll save each year.

Now consider one last scenario: Ralph decides to spend $36k in his first year out of college. Again, let’s assume that he increases his income by 4% each year, spending by 4% each year, earns 5% annual returns, and starts with a net worth of $0.

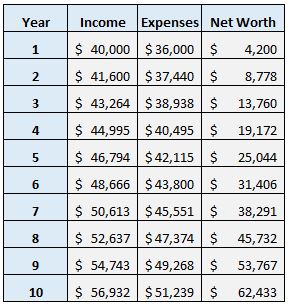

Here’s how his net worth will grow during his first 10 years out of college:

After 10 years, Ralph is able to save just $62,433.

And once again the same pattern emerges: he decides to save just 10% of his income in his first year and continues to save just 10% in each of the following years.

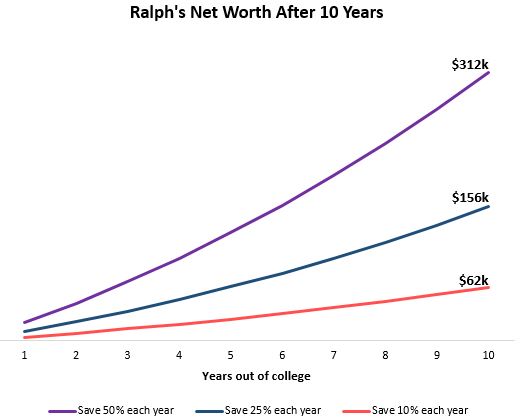

Here’s a look at the difference in Ralph’s net worth after 10 years in each of the three scenarios:

By deciding to live like a college student and spend just $20k per year in his first year out of college, compared to $36k, Ralph would be able to accumulate over five times as much money over the course of 10 years.

The Impact Over Longer Time Horizons

If we run the numbers over longer time horizons, the differences become even more mind-blowing.

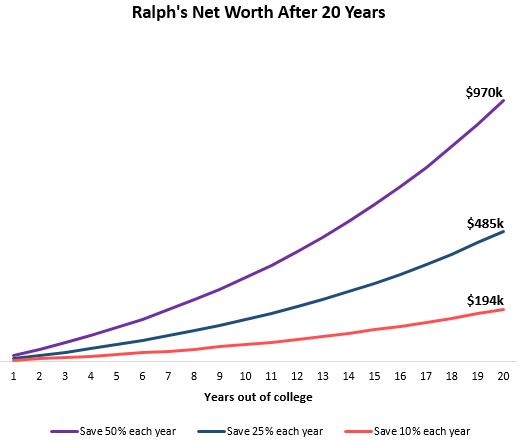

For example, here’s how Ralph’s net worth would grow over the course of 20 years using the same three scenarios as before:

By saving 50% of his income each year, Ralph could nearly become a millionaire over the course of 20 years. By contrast, if he only saved 10% of his income each year, he would accumulate less than $200k over the same time horizon.

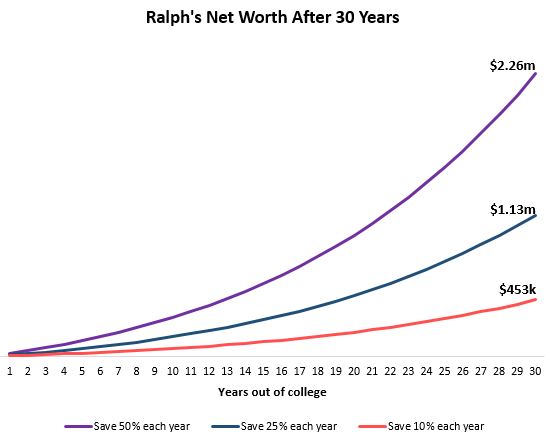

And here’s a look at the same three scenarios over a 30-year time horizon:

These differences are even more incredible!

Living Like a Student Has a Massive Impact on Wealth

There are two main reasons why living like a student in your early years has such a massive impact on your long-term wealth:

1. The money you save and invest in the early years is impacted most by compound interest over the long-term. Each dollar that you save and invest in your early years has the ability to compound for several decades. And while compound interest won’t make you rich in the short-term, it has the potential to generate incredible wealth over the course of several decades.

So, even if the actual amount you invest early on doesn’t seem like much, the amount of time that you’re giving that money to grow is what makes those early dollars multiply several times over the years. This is why saving and investing 50% of his income each year would allow Ralph to accumulate $2.26 million over the course of 30 years compared to just $453k if he only saved and invested 10% of his income.

2. The amount you spend in the early years sets the psychological bar for how much you think you should spend in the following years. If you only spend $20k in your first year out of college, then spending $36k per year a decade later will seem like a nice upgrade. Conversely, if you spend $36k in your first year out of college, you’re setting the bar much higher for what is a “normal” amount to spend.

So, if you’re in the early years of your financial journey, I recommend living like a college student. The financial benefits over the course of the years are tremendous.

Technical notes: I assumed Ralph started with no debt in his first year out of college. If I instead assumed he started with a negative net worth, the ending net worth numbers for the three scenarios would have changed but the actual differences in his net worth numbers across the three scenarios would have been the same. I also made a conservative assumption that he earned 5% annual investment returns, although from a previous analysis we know that the long-term inflation-adjusted annual returns for a stock index fund like the S&P 500 are closer to 6 – 7%.

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.

Hey,

Nice article! Good simple explanation power of saving coupled with compound interest.

Thanks! Glad you enjoyed this article 🙂

Great article Zach. I am a registered nurse. I see new freshly minted nurses enter our department every few months. After the first couple of paycheck, their Instagram feed is blowing up with, new cars, vacations, and new clothes. The draw of consumerism is strong but made even stronger by the lean college years.

Your post lays out all the reasons why living on half is a mindset that needs to begin on day one.

Thanks for the great read.