4 min read

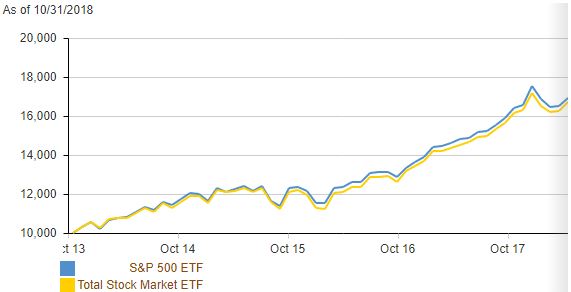

I recently read an interesting post from Freddy Smidlap that compared the performance of a total stock market index fund (VTSAX) to a Nasdaq 100 index fund (QQQ) from October 1, 2001 to October 1, 2018. The results were astounding. During that time period, QQQ rose by 402% compared to just 191% for VTSAX:

Link: QQQ vs. VTSAX Chart

This made me curious, has the Nasdaq 100 always beaten a broad stock market index fund historically?

To answer this question, I compared historical returns for both the Nasdaq 100 and the S&P 500 since 1972. I realize that the S&P 500 only contains the largest 500 publicly traded companies in the U.S. and VTSAX contains every publicly traded company in the U.S., but these two indices have nearly identical annual returns:

Since I was able to easily find historical data for the S&P 500, I’ll be using it for this comparison instead of VTSAX.

The S&P 500 vs. The Nasdaq 100

Both the S&P 500 and the Nasdaq 100 track the performance of a basket of stocks, but the stocks they track are quite different:

S&P 500: tracks the 500 largest publicly traded companies in the U.S. and captures about 80% coverage of total U.S. market cap.

Nasdaq 100: tracks the 100 largest non-financial companies on the Nasdaq stock market. This group of stocks is heavily weighted in the technology sector, which typically experiences high growth and high volatility.

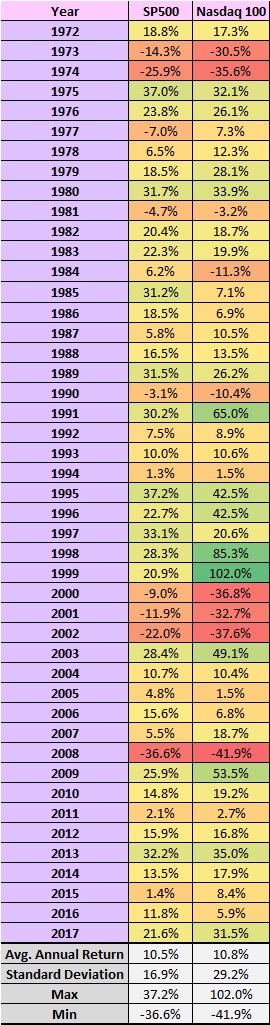

Here’s a look at the annual returns for the S&P 500 and the Nasdaq 10 since 1972:

Summary Stats

- Since 1972, the Nasdaq 100 has experienced slightly higher annual returns (10.8%) than the S&P 500 (10.5%), but it has also experienced much higher volatility.

- During the bull markets, the Nasdaq 100 has crushed the S&P 500 (the 1990s and the post-2008 market).

- However, during bear markets, the S&P 500 has performed much better than the Nasdaq 100 (1973-1974, early 2000s, the 2008 financial crisis).

- The Nasdaq 100 beat the S&P 500 in 25 out of these 46 years (54% of years).

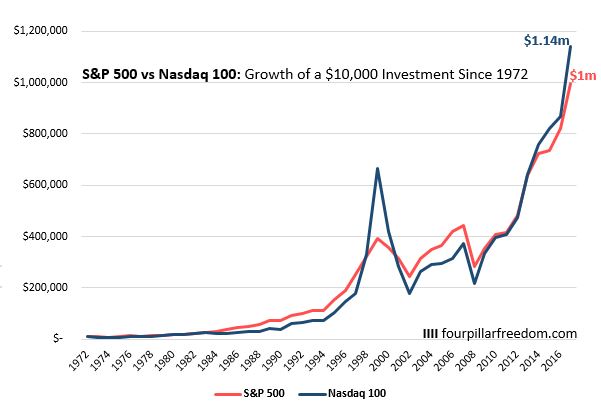

The Growth of a $10,000 Investment

Here is how a $10,000 investment in both the S&P 500 and the Nasdaq 100 would have grown from the start of 1972 to the end of 2017:

A $10,000 investment in an S&P 500 index fund would have grown to $1 million by the end of 2017 and an equivalent investment in a Nasdaq 100 index fund would have grown to about $1.14 million.

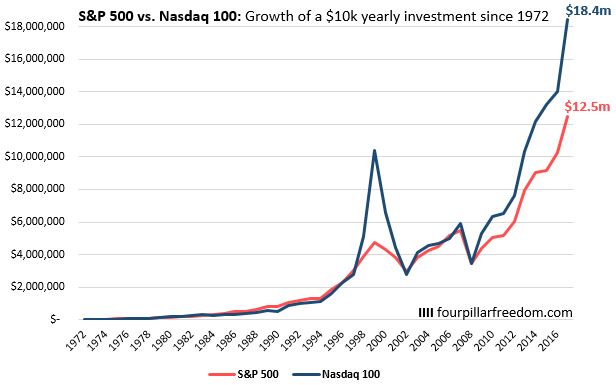

Growth of a Recurring Yearly $10,000 Investment

Here is how a recurring yearly $10,000 investment in both the S&P 500 and the Nasdaq 100 would have grown from the start of 1972 to the end of 2017:

A recurring yearly $10,000 investment in an S&P 500 index fund would have grown to $12.5 million by the end of 2017 and an equivalent investment in a Nasdaq 100 index fund would have grown to $18.4 million.

20-Year Returns

We’ve seen that the Nasdaq 100 outperformed the S&P 500 from 1972 to 2017, but what about during other time periods?

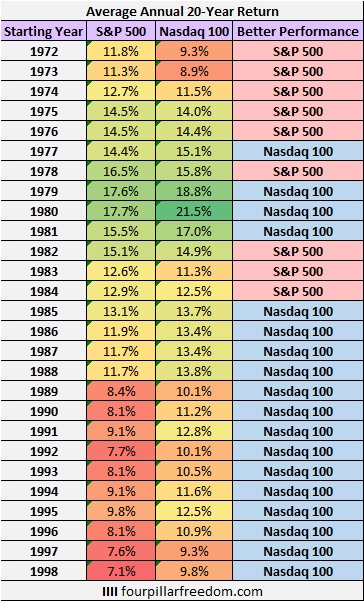

To answer this, I analyzed the average annual returns for these two indices during every 20-year period since 1972. Here are the results:

The Nasdaq 100 outperformed the S&P 500 in 18 out of the 27 20-year periods. It’s interesting to see that most of this out-performance has come in recent years, though.

It’s encouraging to see that the worst 20-year period for either index came from 1998 to 2017, in which the S&P 500 delivered 7.1% returns.

During the best 20-year period, the Nasdaq 100 delivered incredible 21.5% returns from 1980 to 1999.

Conclusion

So, which index is better? The unsatisfying answer: it depends.

We have seen that the Nasdaq 100 is much more volatile than the S&P 500, which makes sense considering it is heavily weighted in tech stocks. The Nasdaq 100 tends to perform better than the S&P 500 during bull markets, but worse during bear markets. For an investor who has decades ahead of them and is able to stomach this volatility, the Nasdaq 100 may be a better choice.

But just because the Nasdaq 100 has performed better in recent years doesn’t mean it will continue to do so. After all, the S&P 500 delivered better average annual returns in one-third of the 20-year periods since 1972.

It’s difficult to predict which index will deliver the best returns over the coming decades. The good news is that both indices have historically performed well over long investment horizons, so even if you pick the index that underperforms in the decades ahead you likely won’t regret your choice too much.

As an investor, it’s your job to keep your investment fees low, your savings rate high, and your patience jar full. No matter which index you choose to invest in, remain patient and resist the urge to time the market.

Nerd Notes: I gathered data for S&P 500 annual returns here and Nasdaq 100 annual returns here.

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.

Really great, Zach. I clearly remember 2000 and the bursting “dot com” bubble. But tech is at least 10x more interwoven with all aspects of modern life now. There was a fervor then of IPOs and companies without any product, but with their stock prices climbing sky high. A lot of “tulip fever.” That last graph in this post of yours is particularly enlightening; thanks for the food for thought!

Thanks, Lin! I think the last graph in the post paints a nice picture as well. Yes, the Nasdaq 100 has outperformed in recent history, but it hasn’t always been that way and it might not necessarily always be that way.

VTSAX, S&P500, NASDAQ100, it’s win/win/win. Like you mentioned in your article that there isn’t one that is clearly better than the other, and none of them are bad choices. Even though all-in-vtsax might disagree with me…

Most stock market index funds are fairly highly correlated, so although it’s tough to predict exactly which funds will perform best over the coming years, they’ll all likely deliver decent returns over the long term.

Personally, I’d go with the S&P for more inclusion and over the long-term, the difference in return is not much, but you get the comfort of a lot less volatility. Thanks for the graphs!

I like the lower volatility associated with the S&P 500 as well, but that’s just my preference. Investors with more appetite for risk may find QQQ to be a better investment.

Hey Zach,

As I read through the article, I was already coming to the conclusion that “it’s not clear cut”, so I was glad to see you always were leaning on the side of “it depends”. It looks to be a bit variable in terms of when your start/end periods are.

The great thing as investors is that it’s always possible to just own them both! That’s how I play situations where I can’t definitely make a choice (as with the Canadian Banks, Railways, etc.).

Take care,

Ryan

Hey Ryan, glad to hear you came to the same conclusion! It’s true, depending on your objectives and your risk tolerance, it’s tough to say if one index is actually “better” than the other. That’s why I try to simply present the data and let the readers make their own decisions. Thanks for the feedback!

Did the performance comparison use total returns (that is, including dividends and reinvestment of dividends)?

Yes, I assumed dividends were received and also reinvested.