2 min read

If you have a dollar in your pocket and buy something with it, that dollar is gone forever. It has a value of $0 to you.

If instead you choose to invest that dollar in the stock market, you’re technically putting it “at risk”, meaning it could increase or decrease in value over the short-term. This means it’s difficult to predict what that dollar will be worth in one week, one month, or even one year from now.

Since we know that historical stock market returns can’t predict future returns, it’s nearly impossible to predict how the S&P 500 will perform in any given year.

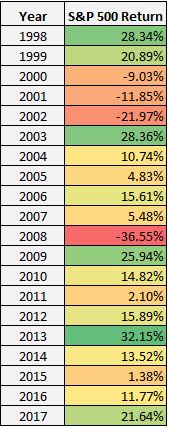

For reference, let’s take a look at the past 20 years of S&P 500 returns:

Notice how the S&P 500 has a positive return in most years, but occasionally it does have negative years.

Consider this thought experiment: It’s January 1st and you have two options:

(1) Buy [insert random item here] for $1.

(2) Invest $1 in an S&P 500 index fund.

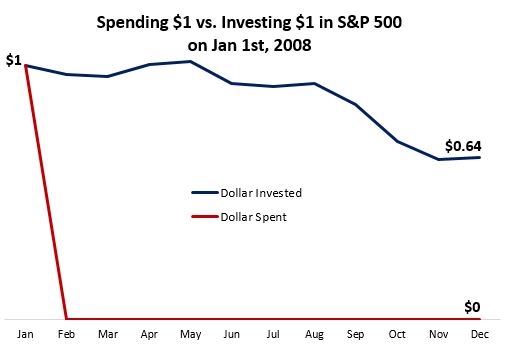

With option (1), for 20 out of the past 20 years that dollar would be worth $0 by the end of the year.

With option (2), for 16 of the past 20 years, that dollar would have been worth more by the end of the year. In fact, in the best year (2013) your dollar would have increased in value to $1.32 (not including dividends).

But even during the worst year in option (2), where your dollar dropped in value to 64 cents, that’s still 64 cents more than if you had chosen option (1).

This brings up an important point: A dollar that experiences an investment loss will always be worth more than a dollar spent on something you don’t need.

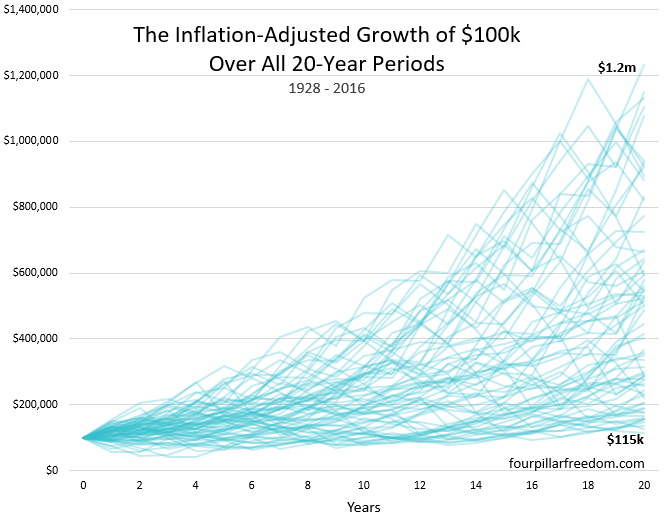

The good news is that over longer time horizons, your invested dollar is virtually guaranteed to increase in value. Check out this chart I used in an earlier post that shows the growth of $100k invested in the S&P 500 during all 20-year periods since 1928. Each blue line represents a distinct 20-year period.

During the worst 20-year stretch (1929 – 1948), your $100k increased in value to $115k, even after adjusting for inflation. During the best stretch (1980 – 1999), your $100k grew to over $1 million.

This means that during any year you could have invested one dollar, taken a nap for 20 years, and woken up to find that your dollar was worth more than just 100 cents.

I try not to laugh when I hear someone say “investing in the stock market is risky.” You know what’s even riskier? Choosing to spend all of your income. That comes with a guaranteed loss of capital.

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.

I like the S&P 500 as it’s gained over the years. Will it continue to earn 7% a year? Dunno. I hope so.

My 401k has lost 20% since I’ve had it. My company contributes $0 to it. The people at my job have been complaining how horrible the 401k is…….Well, yeah. The choices they give us are pretty crappy. But I’m hoping that it will turnaround at some point. If it doesn’t, well, so be it. But here’s the thing:

I don’t INVEST ANYTHING that I’M NOT WILLING TO LOSE.

My brother laughed when I told him that yesterday. Apparently, he’s a wanna be day trader. Buys stocks, sells in a few days and pays a 28% penalty. I have NO IDEA if he’s making any money.

I’ll buy some stocks, buy rental properties, own an annuity, IRA and keep this lousy 401k. Yes, inflation will decrease the value of the dollar. Stocks and investments can do that too. That’s why I diversify.

As for stock purchases, I don’t drink the Kool-Aid by believing every email or magazine article that tells me to buy a penny stock or invest in a company that they believe will make me an overnight millionaire. I research a company, look at its trends over 5 or ten years and take a calculated risk. I also look at expense ratios to make sure I’m not paying a lot in fees.

I also invest with the awareness that my stocks could go down in value in a crash at some point. I’m highly optimistic about the overall market over the long-term, though. It’s great to hear that you’re diversifying across different asset classes as well, best of luck on your journey 🙂

Hey Zach,

Great post, are you familiar with any index funds with initial investments less than $1k?

Hey Joe,

Most ETF’s (exchange-traded fund) don’t require a minimum investment. For example, you only need enough money to buy one share of VTI (total stock market ETF) through Vanguard, which is currently about $140.

DUDE! I am so excited right now after reading this! Thaaaaankkk you!

Not only does spending the dollar guarantee a loss of capital, it probably comes with a ~25% penalty on top of that in the form of taxes. Depending on your marginal tax bracket, you actually had to earn $1.25 or so to get that dollar to spend, and are left with nothing having spent the dollar and paid 25 cents to Uncle Sam.

If you had put that dollar in a traditional IRA, you’re not paying anything to Uncle Sam (yet).

Great point, Matthew!