3 min read

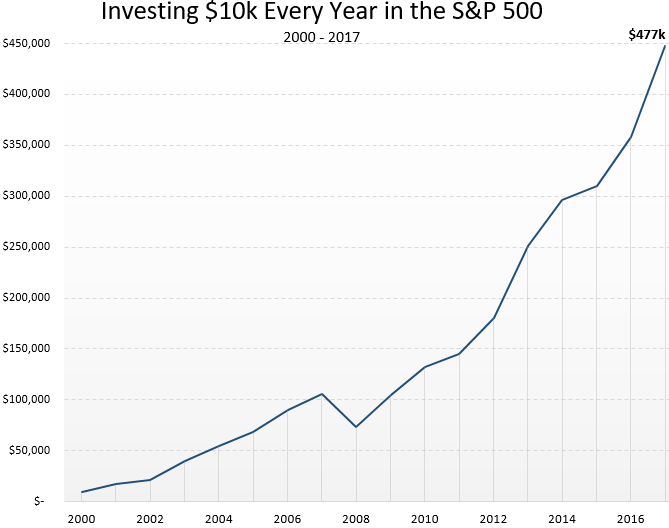

If you invested $10,000 every year in the S&P 500 from 2000 to 2017, you would have accumulated just over $477,000, assuming you reinvested all dividends.

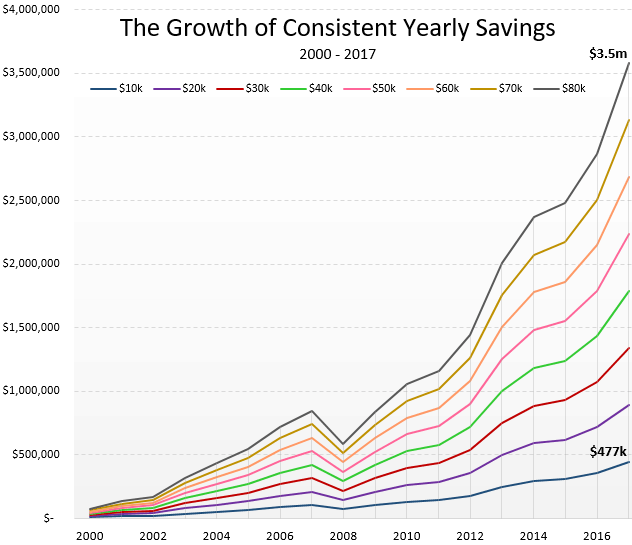

Here’s how much you would have accumulated if you consistently invested $10k, $20k, $30k…up to $80k each year.

Fun fact: You needed to save just over $20k each year to accumulate at least one million dollars during this time frame.

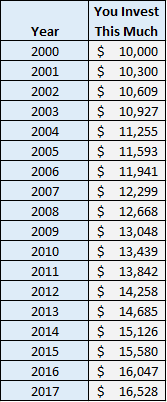

The two charts above assume you invest the same amount each year. However, as you get older, your income will likely increase and you’ll have more money to invest each year.

Let’s see how much you would have accumulated if you increased your investment amounts by 3% each year. For example, in year one you invest $10,000. In year 2 you invest $10,300. In year 3 you invest $10,609…and so on. Each year you invest 3% more than the previous year.

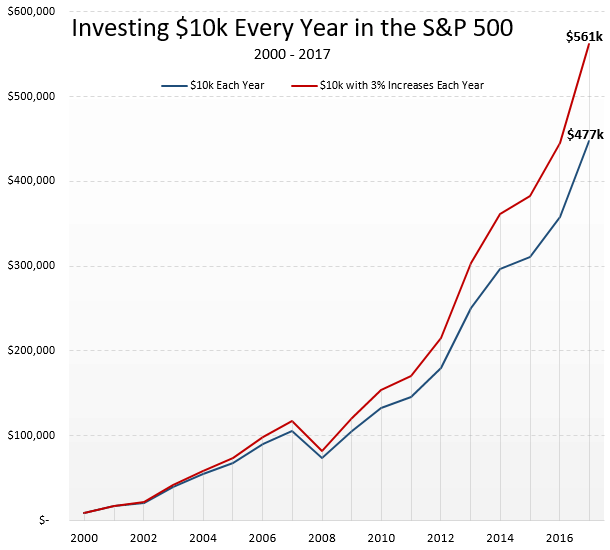

Here’s how much you would have saved if you invested $10,000 in 2000 and increased your investment amounts by 3% each year through 2017:

Just by increasing the amount you invested by 3% each year, you would have come out ahead by $84,000.

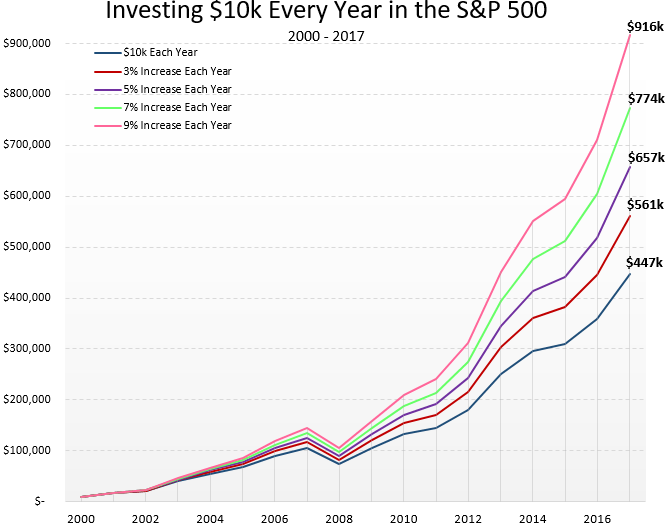

Here’s how much you would have accumulated by increasing the amount you invested by 3%, 5%, 7%, and 9% each year:

It’s incredible how much more you could have accumulated through consistently increasing the amount you invested each year.

If you managed to increase your investment amounts by 9% each year, you would have ended up with more than double the savings compared to just investing the same amount each year.

This is the math that supports the idea of banking your pay raises and unexpected windfalls instead of using them to splurge. By consistently saving each year, you’ll do fine over the long run, but if you’re able to increase the amount you invest each year, compound interest will become even more powerful.

To dramatically increase your savings over time, invest the majority of your annual salary increases, bonuses, and any unexpected windfalls. This will have an incredible impact in the long run.

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.

Agreed! Even if you don’t get annual pay raises, it’s still worth it to increase your contribution to investments annually.

I’m a huge fan of this and call it ninja hacking my 401(k) contributions – because you never see that money coming just like a ninja 🙂 It’s also less painful to go a few percentage points at a time.

Unfortunately most people don’t do this and instead they squander the money away on ‘stuff’.

I’m hoping to earn some more side hustle money this year and will use that to offset additional 401(k) contributions 🙂

Tax return time is coming up soon and for those getting a refund, this is a convincing route to take!

This is some great motivation for me to go out there and get a raise! I don’t want to leave any appreciation on the table. Thanks for the post!