3 min read

I like to think of my savings as a money machine. The investments in my 401(k), brokerage, and savings accounts all work to earn more money for me while I sleep. It’s a beautiful thing.

Unfortunately, my money machine is pretty weak at the moment. I have around $75k working for me. That’s enough for me to quit my full-time job and survive purely on savings for 3 – 4 years, but there’s a reason I’m sticking it out in Corporate America, at least for a bit longer: my money machine isn’t strong enough to grow substantially on it’s own yet.

Let me explain.

The Power of a Money Machine

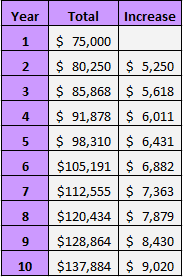

Suppose I walk into my office and quit my day job tomorrow. Let’s also suppose that I cover my annual living expenses of $15k – 20k through tutoring, blogging, and freelancing. Here’s how my $75k in savings would grow over the next ten years at a 7% interest rate if I don’t touch it:

Suppose I got tired of working for myself after 5 years and I wanted to take some extended time off to travel. I would have around $98,000 in the bank. Over that 5 year time period my savings only grew by $23,000. That’s not much to be excited about.

The “power” of my money machine is it’s ability to grow by itself without any help from me. From year 1 to year 2, my net worth grew by $5,250. The next year it only grew by $5,618. It’s picking up speed, but not very quickly.

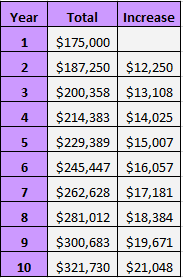

Instead, suppose I stick it out in Corporate America until I have $175,000 in savings before walking away. Here’s how my money would grow on it’s own in that case at a 7% interest rate:

From year 1 to year 2, my money would grow by $12,250 all on it’s own. The next year it would grow by an additional $13,108. Not only is my savings growing by larger amounts each year, but it’s growing at a much faster pace than the previous example.

If I got tired of my working situation after 5 years and wanted to take time off, my savings would be growing by more than $15,000 each year – enough to cover most of my annual expenses.

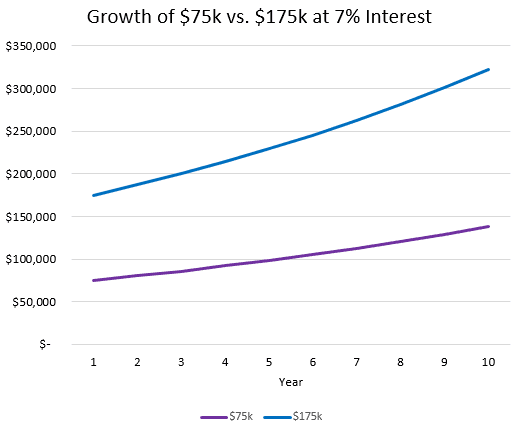

Here’s a look at the difference between the growth of $75k and $175k over ten years:

Notice how the blue curve is steeper. The $175k grows much faster than the $75k.

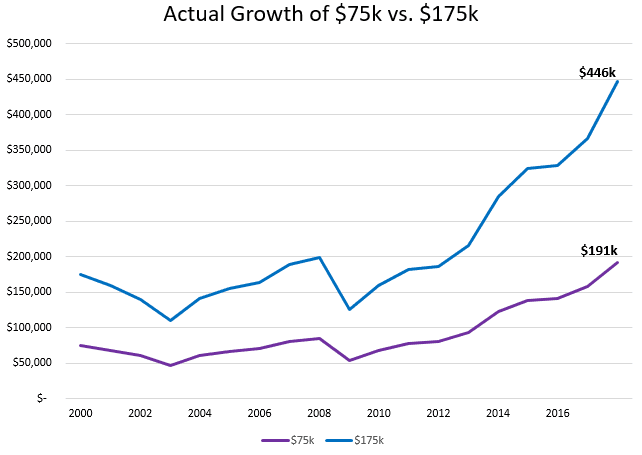

But as we know, earning 7% returns every year on savings isn’t always realistic. The market is much more volatile. Let’s take a look at how $75k and $175k would have grown since 2000 using actual S&P 500 returns:

It’s interesting to see that despite the market drops in 2000-2002 and 2008-2009, the $175k line never drops below $100k. Also, the difference in ending prices in 2017 is $255k, far more than the difference in starting prices of $100k.

The Takeaway

As a young person, I’m naturally impatient. I want to quit my day job sooner than later so I can work for myself and spend my time on projects I find interesting. But first I need enough money in the bank that actually has the ability to grow substantially on it’s own, without my help.

If I were to leave my day job tomorrow with only $75k in savings, I could cover my annual expenses of $15k – 20k fairly easily, but my savings wouldn’t grow much without my help. In the future, if my expenses increase or I want to work less, I wouldn’t have a strong money machine to support my lifestyle financially.

I personally enjoy working, so I’m not looking to save $1 million by 30 and retire early. I think I’ll always work in some capacity. So instead, I want to build a decent-sized money machine as fast as possible that will grow on it’s own over time without my help. This way I can leave Corporate America as fast as possible without screwing my future-self financially.

By deploying some patience, I plan on continuing to save over 70% of my monthly income until I have a money machine that is strong enough to grow on it’s own, endure future market drops, and support me financially when I need it.

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.

I like the comparison, Zach, and I think the visualization showing faster growth is really useful. I’m in a similar situation of sticking it out with a job that’s good, but not amazing so I can build a stronger money machine. Still not sure yet if I’ll wait until I’m 100% FI to move on or if I’ll do it sooner.

You mentioned wanting to build a “decent-sized” money machine; do you have a concrete point in mind for leaving corporate America or is it still a bit amorphous?

It’s a bit amorphous still. I think something in the $150k – $200k would make me feel comfortable, but it just depends. Best of luck in making your own FI decision!

Great comparison. 🙂

One of the things I really like to do is look at my old retirement accounts (which have rolled into IRA’s, but I still have one 401(k) from a former employer) and see how much it’s grown even though there’ve been no contributions. It’s pretty cool seeing net worth grow knowing it’s all because of things I did years ago.

I do the exact same – it’s awesome to see how my old 401(k) account at my old job has grown since I left the company about 8 months ago.

Hmm the Personal Capital hyperlink does not open for me (at work, where the security settings may have been set-up tighter … or there might be Network restrictions) . … not sure about at Home.

I am using Chrome.

I also tried Edge … same problem.

Does it require some particular setting in Pop-Ups, Java etc ?

Hey Wayne, I just checked the link and it seems to be working fine on my end. I’m using Chrome. It could be the security settings at your work. I’d give it a try on your home network. If it still doesn’t work, let me know. Thanks!

Hi Zach,

tried it also, does not work on Firefox and Edge with my computer at home.

Lejero

Very odd. I’ll look into it more. Thanks for letting me know, guys.

As much as it sucks having to put off being a “jobless bum” (winky face), it seems like keeping the ol’ 9-5 for a bit longer is pretty much a no-brainer when you lay it out like this.

It’s important that you eventually work up the nerve to leave the “safety” of your day job eventually but it’s also important to not do it too soon either! And depending on how risk tolerant you are, what “too soon” means can vary greatly. Quitting your job is more difficult than you might think!

At the rate in which you save, your money machine is going to be well fed and primed growing itself.

Curious to know what the plan is for deploying the capital for growth? Dividend portfolio?

Thanks, Church! Dividend investing is certainly part of the equation, along with general index-fund investing, a few REIT’s, and continuing to grow online income. Over time, my side hustles and dividend income should reach a point where I can cover most of my expenses without a 9-5 job.

Great post, Zach! My plan is very similar to yours in that I plan to always work in some capacity, and I’m also trying to build a money machine. Like your plan, I’m not planning to save a 1 million to retire and do nothing. I plan to escape the corporate world with approximately $200,000 to $250,000 down the road. Thanks for laying out your strategy. I’m looking forward to seeing your plans come to fruition.

That’s awesome to hear! I think more and more people are starting to consider this path as well. Once you open yourself up to earning income in “retirement”, you realize that you can quit your day job so much sooner. I think the biggest hurdle is overcoming the belief that “work is evil” and that it should be avoided at all costs.

Hi all,

Figure is just a number. You will know when the figure is reached. It’s just the matter of mustering the courage in tendering the resignation letter.

Ben

Thanks for the feedback, Ben!