4 min read

Question: How long does it take to save one million dollars?

Answer: Depends on how much you save each year and what type of return you get on your investments.

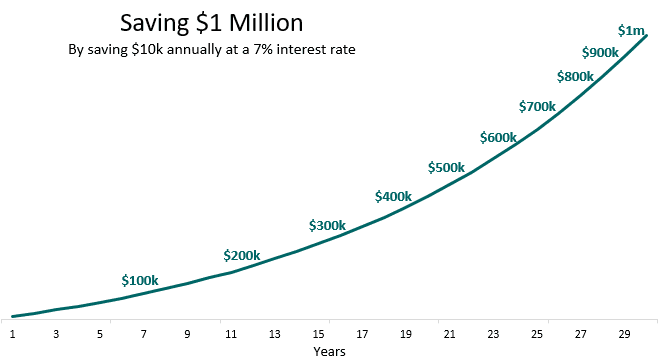

For example, if you save $10,000 every year and earn a 7% annual return on your investments, you can save $1 million in just over 30 years.

To keep things simple, let’s assume you invest all of your savings in the S&P 500, a common stock market index.

Related: I have written about the S&P 500 before here, here, and here.

While it’s convenient to assume 7% returns each year, actual market returns are much more lumpy and unpredictable. This begs the question: How long has it taken to save $1 million based on actual historical S&P 500 returns?

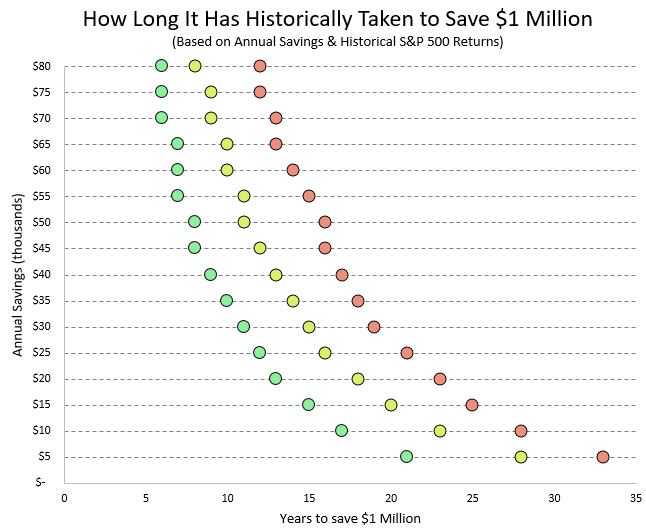

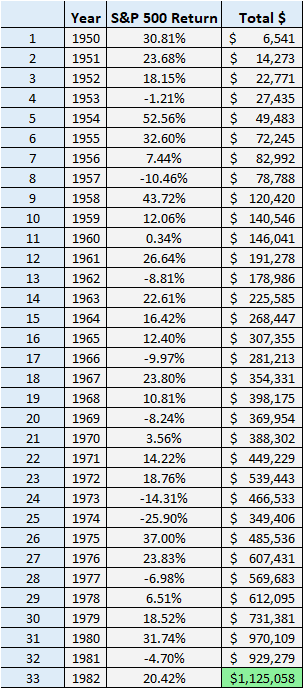

To answer this question I went back and looked at yearly S&P 500 returns since 1950 to find out just how long it took to save $1 million based on different yearly savings amounts. The results are in the chart below.

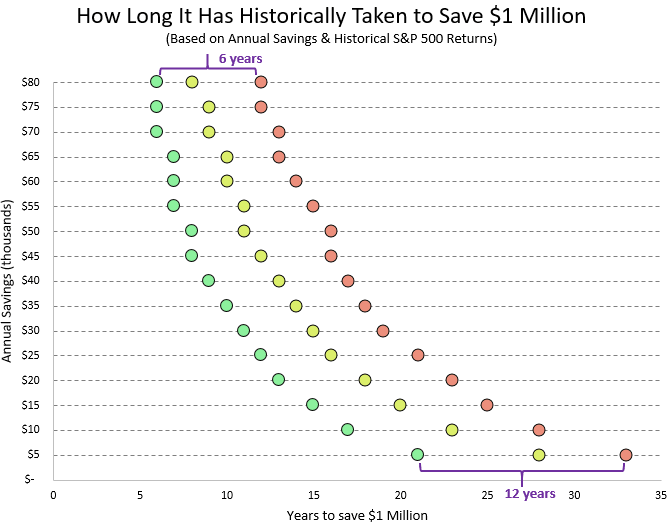

The green circles represent the shortest number of years it took to save $1 million, the yellow circles represent the average number of years, and the red circles represent the longest number of years it took. Each row represents different annual savings amounts.

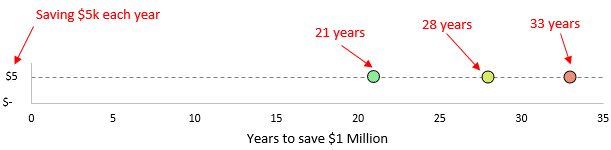

An example of how to interpret this chart: By saving $5,000 each year, the longest time it took historically to save $1 million was 33 years, the average time it took was 28 years, and the shortest time it took was 21 years.

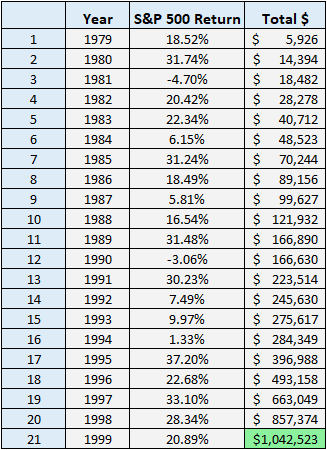

It turns out the 21-year span where you could have saved $1 million through saving $5k yearly was 1979 – 1999:

Conversely, the 33-year span where it took the longest to save $1 million through saving $5k yearly was 1950 – 1982:

The Big Picture

There’s a couple interesting takeaways from this analysis:

1. The more you save each year, the less variability in the time it takes to save $1 million.

Notice that if you only saved $5,000 yearly, you could have gotten lucky and saved $1 million in as few as 21 years. If you weren’t so lucky, it could have taken as long as 33 years. That’s a 12 year difference.

But the more you save per year, the less investment returns influence how long it takes to save $1 million because your savings compose a greater percentage of your net worth. For example, if you were able to save $80k per year you would have saved $1 million between 6 and 12 years historically. That’s only a 6 year difference between the best and worst-case scenario.

2. No matter how much you save each year, investment returns will influence how long it takes you to save $1 million.

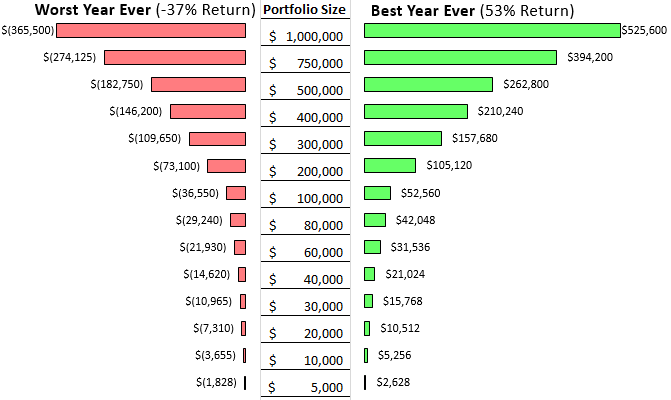

In previous posts, I have explained how investment returns don’t influence small portfolios much. For example, if you have $80k invested completely in stocks and experience a 37% crash (equivalent to the worst year ever since 1950), you would lose about $29,000. If you’re able to save $29,000 in that same year, your net worth would remain exactly the same.

However, the larger your net worth grows and the more savings you have invested in stocks, the more investment returns can dramatically slow down or speed up how long it takes you to save $1 million.

A 37% crash would cause a $500,000 portfolio to drop in value by $182,000. That could set you back considerably. Conversely, a 53% gain in one year (the highest one year return since 1950) would cause that same portfolio to grow by $262,000. That could propel you towards $1 million much quicker than you expected.

This is why the more you have invested, the more investment returns become influential.

That’s all for this analysis, thanks for reading 🙂

Technical Note #1: I retrieved annual S&P 500 returns from this page.

Technical Note #2: I realize that $1 million was worth considerably more in 1950 compared to today, but I’m only concerned with the percentage market returns each year (i.e. if we experience the same market returns in the future as we did historically, I want to know how long it will take to save $1 million).

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.

I love analysis like this, thanks for putting together. Saving more money is a fantastic hedge against market volatility as you have clearly shown.

One additional thought that may be useful to explore: what happens to portfolio value after hitting the $1 million mark? As you said, the quickest path to $1m if you’re saving $5k per year ended in 1999, right before the dot com bubble bust. Returns after hitting $1m are arguably more important than before given the dollars at play. Getting to $1m matters only if you can stay there.

Nice post, Zach. Helpful takeaways as well.

I know how much work it took to put that together so thank you! It really is a great and different way to put handles on such an abstract concept as compound interest. Very nice stuff!

Excellent post. This is Rockstar Finance worthy.

Great post Zach, compound interest is amazing! Saving as much money as you can will make a big difference to your investment returns. Thanks

Money eye candy! Thanks Zach!

I love this article. You put quite a bit of effort in your research to compile this article, kudos!

The larger my net worth has grown the less I have invested in equities, more in cash, Real estate Crowdfunding and CD’s.

I’m only 51 but I’ve grown very risk averse as my liquid net worth (taxable account) crossed the $1 million level.

I still save every year but only to the tune of approx. $40k/year.

Investment returns matter but capital preservation is paramount.

Thanks, Kirk! Best of luck in your financial journey!

Wonderful post! Your graphs are awesome and super motivating! You did a great job of using data and visuals to answer this question! ??

Keep up the great work!

Thanks, Cyn! Glad you found it useful 🙂

Great analysis, Zach… As for us, it took 15 years. We’re a couple with relatively good income, around $150K on average. We’ve contributed %15 to %20 of our gross income in tax-advantaged retirement accounts. Our portfolio reached 1M (excluding our primary home) last year in spite of:

– supporting 7 people

– the 2009 Great Depression

– frequent travels abroad

– having to cash flow in full my son’s college tuition.

Good Lord Menard,

Considering those obligations you mentioned you did an amazing job of accumulating wealth. Kudos!

Thanks, Menard! Congrats on reaching $1M, that is impressive considering all of those factors you listed. I’m guessing the 15-20% gross income contributions to tax advantaged accounts combined with the bull market we have experienced over the last decade certainly made a huge difference. That’s great to hear you were able to travel abroad as well, it sounds like you enjoyed yourselves on the journey to $1M 🙂

This is absolutely fantastic and I really appreciate all the effort that went into researching and then explaining in an easy to understand way. Pretty graphs are always a winner.

As always, I’m in awe.

Have a great day ?

Thank you, glad you found it to be valuable! 🙂

This was such a great post. Congrats on a presenting such an important topic in a concise way – and with real data!

also, what was the 6 year span to get to 1 million?

Thanks, Greg! The 6 year span occurred three times -> 1992 – 1997, 1993 – 1998, 1994 – 1999. The stock market returns in the 90’s were insane.