THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE READ MY DISCLOSURE FOR MORE INFO

4 min read

One of the most insightful books I read this year was How to Fail at Almost Everything and Still Win Big by Scott Adams. In particular, one idea in this book resonated deeply with me:

The best way to find success is through being pretty good at two complementary skills, as opposed to being excellent at one.

When I read this, I immediately stopped and jotted this idea down. This is a brilliant formula.

Scott used this formula to find his own success in the cartoon industry by creating Dilbert, one of the most successful comic strips of all time.

Scott recognized that his drawing skills were pretty good, but not great. His ability to tell jokes was pretty good, but not great. But through combining these two pretty good skills, he could be a great cartoonist.

I find this strategy so appealing because it’s so realistic. Your chances of becoming world-class at anything are slim. Your chances of becoming pretty good at two complementary skills and combining them to find success are fairly high.

In Scott’s own words,

“My combined mediocre skills are worth far more than the sum of the parts. If you think extraordinary talent and a maniacal pursuit of excellence are necessary for success, I say that’s just one approach, and probably the hardest. When it comes to skills, quantity often beats quality.”

This idea can be applied wonderfully to personal finance.

The Power of Being Pretty Good at Two Skills

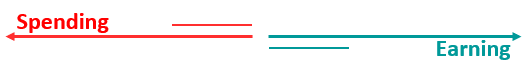

The formula for crushing personal finance is simple. Make the gap between your earning and your spending as wide as possible.

The financial mistake I see so many people make is thinking they need to be world-class at earning or spending to have excellent finances. That’s not the case.

You don’t have to earn a six-figure income to achieve financial freedom. Nor do you have to live on rice and beans to save a significant amount of money. For most people, the most sure-fire approach to improving their finances is through becoming a little better at earning and a little better at saving.

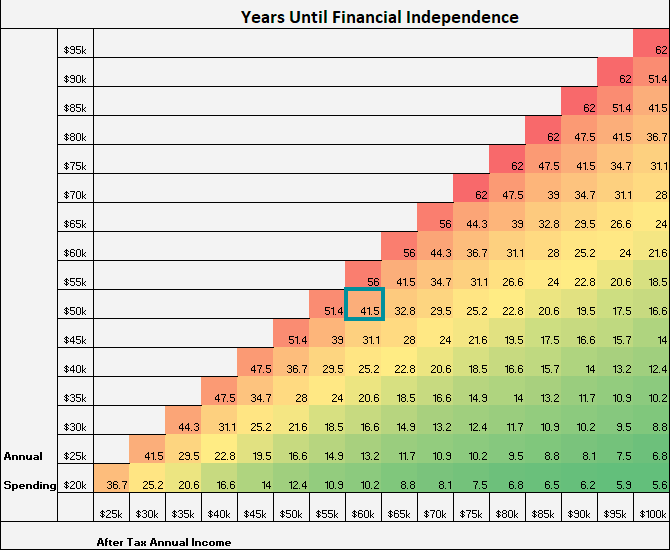

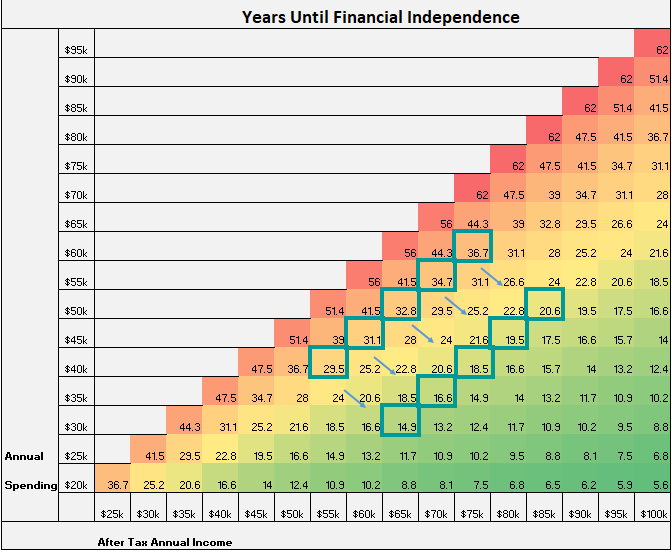

To illustrate this point, let’s check out the early retirement grid. Consider a family who brings in $60k per year and spends $50k per year. Starting from zero, they can achieve financial independence in a little over 41 years:

That’s a long time.

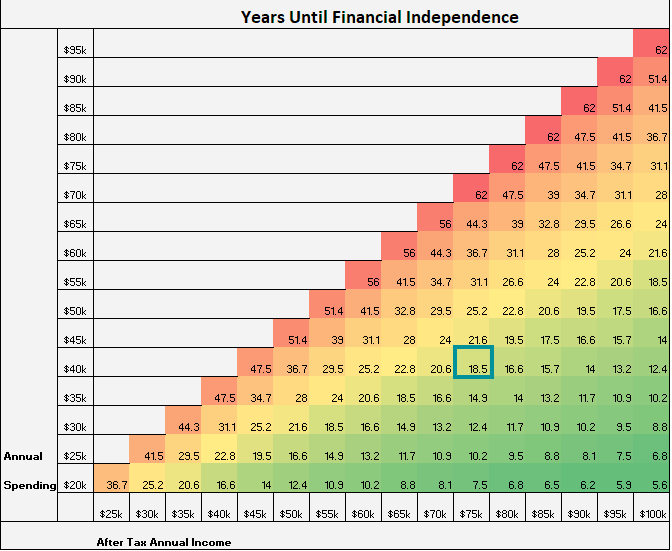

But if this family can bump up their annual income to $75k and reduce their annual spending to $40k, they can achieve financial independence in only 18 years.

This is the magic of being pretty good at both earning and spending. A household income of $75k is not astronomically high by any means. Annual spending of $40k isn’t unusually low. Yet, when you combine these two, the results are incredible. It enables a family to achieve F.I. 23 years sooner.

This holds true for any income level. Moving down and to the right on this grid is pure financial magic:

Simply by increasing your annual income $5k – $10k and reducing your annual spending by $5k – $10k shaves decades off of your mandatory working life.

You don’t have to be a world-class frugal saver. You don’t need an executive salary at a Fortune 500 company. You just need to be pretty good at both saving and earning.

As Scott says in his book,

“Notice I didn’t say anything about the level of proficiency you need to achieve for each skill. I didn’t’ mention anything about excellence or being world-class. The idea is that you can raise your market value by being merely good — not extraordinary — at more than one skill.”

My Own Approach

I’m using this approach myself to create an excellent financial situation.

As a 24-year-old with an $80k salary, I have an above-average income for my age, but by no means am I a world-class earner. There are plenty of people who make over $100k per year straight out of college in fields like investment banking. I’m pretty good at earning money, but I’m not great.

On the spending side of the equation, my annual expenses are fairly low. I live on about $15k per year. There are certainly people my age who live on less, who spend less at Chipotle, bike more to work, and spend less on rent. I’m pretty good at keeping my expenses low, but I’m not great.

Fortunately, my ability to be pretty good at both earning and saving is enough to help me save over $50k per year.

Pushing the Gap

To save more money, do some pushing.

Push your annual income a little higher through side hustles, promotions, or job-hopping.

Push your spending a little lower through practicing daily gratitude, frugal habits, and a little discipline.

Bit by bit, push the gap between your earning and spending a little wider each year. Become an above-average earner and an above-average saver. Use the combination of these two skills to achieve any financial goal you may have.

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.

I probably agree with 80% of this.

1. It’s true that success is often at the intersection of something. E.g. for Steve Jobs and apple, it was the intersection of arts and tech. It’s rare when someone can combine 2 very different skills.

2. However, I think you still need to be better at one than the other. every business/endeavor has 1 component that’s more critical than the other, and you have to be better at that component than the other.

I agree, in many cases one skill is likely more important than the other. I think as long as you have two skills that complement each other and can be used in tandem, you’ll be in a great position to succeed.

Fantastic insight Zach. I think you are absolutely correct and in fact, you have perfectly described how my wife and I have built an above average net worth.

Our income is not astronomically high (we know couples that make double) and our spending is definitely not rice and beans, but the combination of being a little above average in earning power and a little below average in spending has been the key to our success.

The combination of a slightly above average income and slightly below average spending is really the secret sauce to financial success. Glad to hear that you and your wife have been able to use that formula to build up an above average net worth. Thanks for sharing and stay in touch! 🙂

Great post! I’ve been reading this book and it’s been a great read so far! Both insightful and entertaining!

I love how you applied his formula to personal finance. It’s pretty amazing to see the effects with the early retirement chart. I’ve become more intentional with my finances this year to try to widen the gap between my annual income and expenses. It’s so nice to visually see how those efforts will pay off. 😀

That’s awesome to hear, Cyn! It really is amazing how much of a difference spending a little less and earning a little more can make on your finances, especially over the long haul 🙂

I’ve heard Scott Adams talk about this point on the Tim Ferriss Show podcast, and it really resonated with me. I consider myself a bit of a “renaissance man” (pretty good at a variety of different things), and not one who is world-class at one skill. It’s such a great tactic to take 2 of your skills and try to blend them together to enhance your value. Really like how you relate it to spending/earning as well.

Thanks, Kyle! Agreed – blending two “good” skills is often a more realistic path to success rather than becoming world-class in one skill.