5 min read

Last month Vanity Fair released a video of billionaire entrepreneur Mark Cuban sharing his 9 rules for getting rich.

Here’s the video:

Here are my thoughts on each of Mark’s rules…

1. Live Like a Student

Love this rule. In fact, I dedicated an entire blog post to discussing the financial benefits of living like a student.

In particular, it’s most important (and probably most doable) to live like a student immediately following college. When you actually crunch the numbers, it’s mind-boggling how important the first five post-college years are for long-term wealth creation.

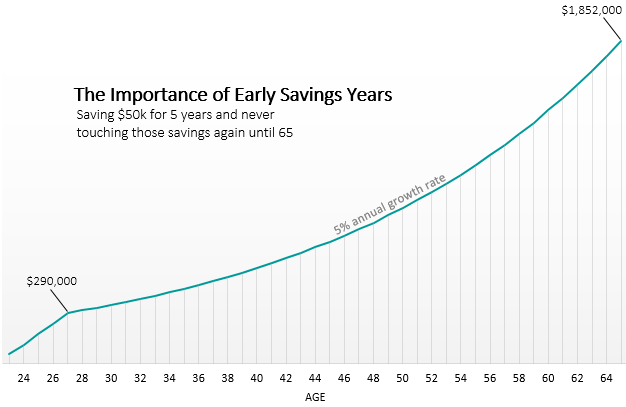

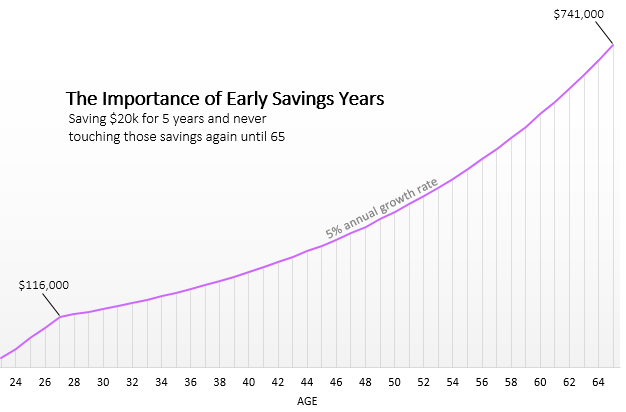

For reference, check out the difference between saving $50k each year vs. $20k each year for the first five years following college and never touching those savings again until 65:

The difference in these five years translates to a million dollar difference over the course of four decades.

Living like a student allows you to maximize your savings rate by keeping your expenses low. And it’s no secret that a high savings rate is the real secret to financial independence.

2. You Shouldn’t Use Credit Cards

Mark advocates using debit cards instead of credit cards to prevent common financial mistakes like overdrawing your account, spending more than you earn, paying high-interest rates, etc. and for many people this is sound advice.

But if you keep a close eye on your spending and you’re financially responsible, credit cards can actually offer tremendous travel rewards and cashback rewards. I personally used a Chase Sapphire card to pay for part of my tuition in my last semester of college and earned over $1,000 in travel rewards as a result.

One great resource for learning about how to use credit cards to earn free travel is the free Travel Miles 101 course. Everything I know about “travel-hacking” and using cards to earn cashback rewards I learned through this course. Another great resource is Luxe Strategist, who knows far more about credit cards than I do and has written some nice posts about the perks of using credit cards here and here.

3. Save Six Months Income

Mark says to save up six months income just in case you lose your job, you have to move, or you face some unexpected expenses. In general I agree with this. I think some people go overboard thinking they need 1-2 years worth of savings in an emergency fund, while others live a little too risky only having 1-2 months worth of savings. Six months is a nice number.

4. Put Savings Into SPX Mutual Fund

SPX is simply an S&P 500 fund. I also love this advice.

All of my current 401(k) contributions are invested into an S&P 500 index fund. Every cent. I like the S&P 500 that much. I admit I have no clue what this fund will do in the next few years, but over the long-term I’m confident that it will continue to deliver healthy investment returns and it’s a wonderful way to remain diversified.

For most people, investing in SPX is the best way to minimize investment fees, it’s the simplest approach to investing, and in the long run it will allow them to beat 90% of investors. That’s a win-win-win situation.

5. Invest Up to 10% of Savings in High Risk Investments.

Mark says if you’re a “true adventurer” you can invest up to 10% of savings in high risk investments like Bitcoin and other cryptocurrencies. Ten percent seems high to me. I think 5% should be the max.

As Mark said, this should be money that you could easily survive without if it went to zero. To me, potentially risking 10% of my net worth being wiped out is something I personally wouldn’t be comfortable with, but I’m also a fairly conservative person. I’m a believer in Warren Buffett’s investing philosophy:

“Rule number one: never lose money.

Rule number two: never forget rule number one.”

I’d feel more comfortable if that 10% was in the S&P 500 instead of speculative investments.

6. Buy Consumables in Bulk & On Sale

Completely agree.

Buying in bulk is a great idea if you know for sure you’ll use the items in the future. I buy most food and toiletries in bulk when I can, which limits the amount of money I have to spend and the number of grocery trips I have to take.

Buying on sale is also obviously a good idea, but only if you actually need something. Remember “10% off” really just means “90% of original price”. You can always save a smooth 100% by not buying unnecessary crap.

7. Negotiate Using Cash

Agreed.

8. Read Books

I love that Mark included this in his list. Reading books is one of the best ways to acquire knowledge. Personally I read all types of books, not just finance books. Some of the most influential books I have read have been about philosophy and psychology. You can find some of my favorite books here.

If I could add on to this, I’d say listen to podcasts as well. I listen to podcasts during my commute to and from work and sometimes during work. I think it’s incredible that you can listen to some of the brightest people in the world literally have discussions with each other for free through podcasts. Pro tip: listen to podcasts on 1.5 – 2x speed to soak up information even faster.

9. “Nice Works”

Mark says when you’re nicer to people around you, you’ll always get better results. This rings true in my own experience. It’s always easier to work with people and gain the trust of others when you’re nice. Not only is it the right thing to do, but it’s the key to working successfully with others in nearly all aspects of life: intimate relationships, professional relationships, and friendships. Indeed, nice works.

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.

He always seems like such a tough person on TV so I was surprised to see the last piece of advice on being nice. It is true though 🙂

I love reading about the rich and their tips and then realizing we are doing so many of the same things; it’s comforting.

I was a bit surprised at his demeanor as well haha. I also expected this post to be all about being an entrepreneur but he gave a ton of real actionable advice that most people can follow to improve their finances.

Awesome to see this, Zach! I ran through my thoughts on the same list a couple weeks ago on my site and it sounds like we had roughly the same reaction. I was pleasantly surprised that it was generally solid advice that would speak well to the average viewer. I’ve been impressed with Mark Cuban in general and I think he did a good job.

Ha! Great minds think alike! I just read your post and saw that we agreed for the most part on all the topics. I was also impressed with Mark and his ability to give sound financial advice to layman. I’d be interested in seeing other billionaires give their 9 tips for getting rich as well.

Hi Zach, out of interest what podcasts would you recommend? I love to listen to them to on the way to and from work but sometimes struggle to find new and interesting things to listen to.

Hey Claire,

I listen to a variety of podcasts, but some of the most common ones I listen to are:

-Tim Ferriss Podcast (self-help)

-The Minimalists Podcast (minimalism)

-Chase Jarvis Live (entrepreneur / self-help)

-James Altucher Show (all over the place)

-Mad Fientist Podcast (financial)

-Choose FI (financial)

Point 6 buying FMCG in bulk is something even I am looking for, thanks for sharing Zach

Buying in bulk is always a great way to save – thanks for the feedback, Subbu 🙂

Big fan of Mark Cuban, I love his story of living like a student where he’d sleep on the floor and eat ketchup & mustard sandwiches when he was low on money. He was willing to do anything it took to build his business, and it all paid off.

I love Mark as well. He’s also the owner of my favorite basketball team, the Dallas Mavericks, so I like him that much more haha. And his work ethic is definitely an inspiration. He’s just a hustler at heart and I love his hard work mentality.