Ever since I was young I thought it was odd that the normal way to spend one’s life was working at a job 40 hours per week for 40 years, only tasting freedom on the weekends and on yearly vacations until retirement at age 65.

This is why when I first discovered Mr. Money Mustache a few years ago in college, I was completely enthralled. I thought the idea of working hard for 8 – 12 years in a high-income job and accumulating enough money to retire from work permanently sounded like a dream.

But the more I read early retirement blogs and forums, the more I kept having an uneasy thought pop up in my head:

I actually enjoy working hard…what would I do with my life if I retired in my early 30’s?

The answer time and time again was:

I would probably find some other projects to work on or things to create or small businesses to start.

The fact is, I enjoy work when I get to choose exactly what I work on and when I get to work on it. There are times when I’m working on coding a website or building a financial visualization tool or even planning out a tutoring session for a student I’m working with and I truly enjoy it. I like creating stuff. I like making something out of nothing.

The more I thought about it I began to realize that early retirement is close to what I want in life….but it’s not quite what I’m looking for. Of course I love the idea of having enough money to never need to work for income again, but I’m not so sure that I need to be completely financially independent in order to live my ideal life.

After all, the three necessary ingredients for living a good life are connection, competence, and autonomy. Early retirement helps, but it isn’t necessary to experience these three conditions.

Financial Paths

The whole point of early retirement is to free up of time to live how you want without being held back by financial worries. But is it necessary to save up so much money that you never have to work again in order to live how you want? Are there potentially multiple paths you could take to achieve an incredible life without being financially independent?

I think the answer is yes.

Early retirement can certainly be the answer for some, but for others there are paths that would better suit their nature and what they want to do in life.

Let’s take a look at the myriad of financial paths you might consider pursuing to live your optimal life:

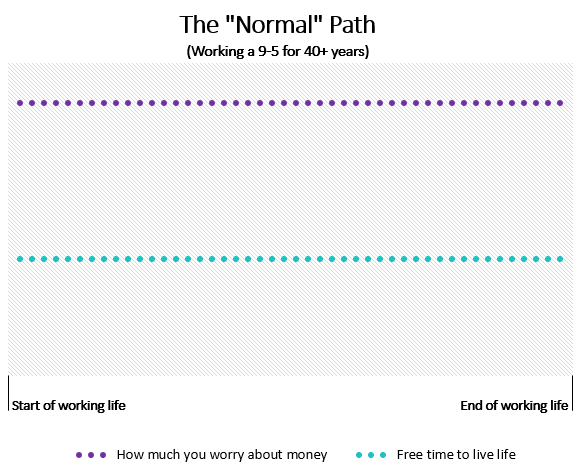

The normal path is the approach most people take. This approach sucks. It entails saving very little of your income your entire working life, working 40 hour weeks until you’re old, and never having a huge amount of free time outside of work. It also includes being worried about money often because you have no savings to support you if you were to lose your job.

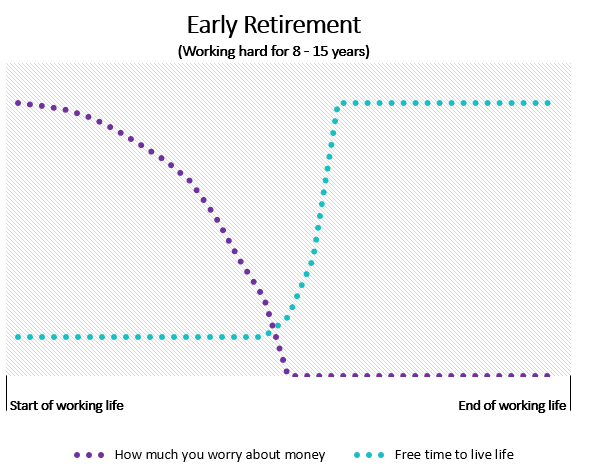

The early retirement approach was made popular by Mr. Money Mustache and Jacob at Early Retirement Extreme. This approach has some serious benefits. It involves working hard for only 8-15 years (typically) and simply quitting the rat race for good. The most obvious perk of this approach is that you essentially don’t have to worry about money ever again once you quit your day job. The only drawback is that for some people it may take 15 or even 20 years to reach this point.

The early retirement approach was made popular by Mr. Money Mustache and Jacob at Early Retirement Extreme. This approach has some serious benefits. It involves working hard for only 8-15 years (typically) and simply quitting the rat race for good. The most obvious perk of this approach is that you essentially don’t have to worry about money ever again once you quit your day job. The only drawback is that for some people it may take 15 or even 20 years to reach this point.

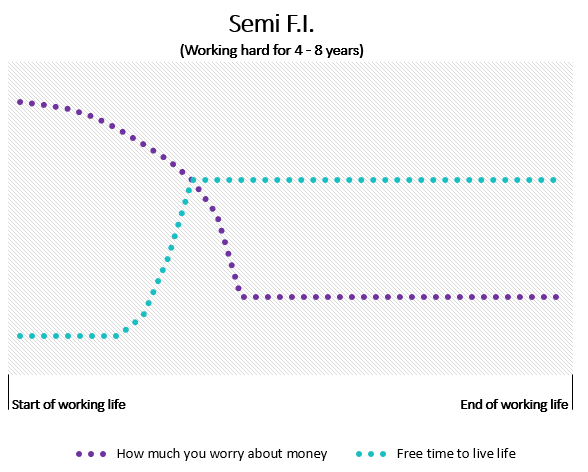

Semi F.I. is a variation of the early retirement approach. It entails working hard for 4 to 8 years, typically saving up a few hundred thousand dollars, and leaving the 9-5 to go pursue other interests. This approach is actually extremely appealing to me and one that I will likely pursue. The major perk of this approach is the ability to leave the rat race in under a decade. The biggest drawback is simply not having enough money saved up to never worry about money again, but for most people this won’t be an issue because they’ll at least be working part-time or side-hustling to maintain a fairly high net worth.

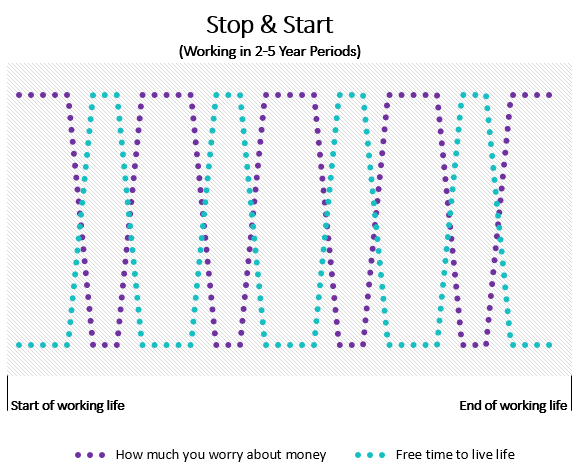

The stop & start method is popular among serial world-travelers. It involves working for 2-5 years, saving up enough money to go off on some huge trip or possibly try to start a business, and repeating this process over and over. The major perk of this approach is that you’re never forced to work at a job you hate for a long period of time. The obvious drawback of this approach is that you never actually build up a significant amount of savings to live on and financial stress could hold you back from doing what you want to do.

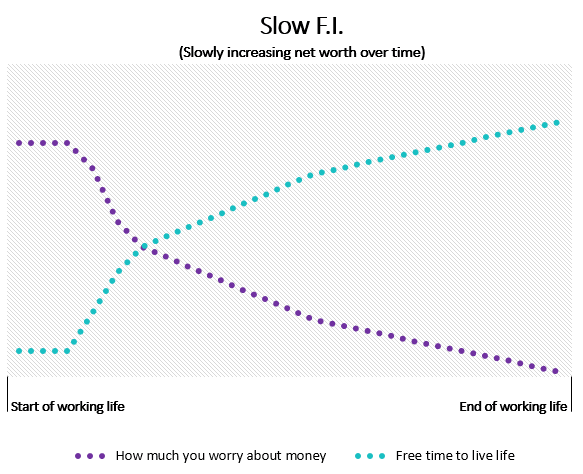

The slow F.I. approach involves working hard for 2-5 years to save up a chunk of cash and then starting your own business, side-hustling, or freelancing and slowly increasing your net worth more and more as time goes on. The biggest perk of this approach is that it allows you to start doing work you enjoy near the start of your working life. The potential drawback to this approach is that it may be stressful if you don’t have enough money saved up initially and there’s always the possibility that you may run out of money and be forced to go back to a traditional 9-5.

Warning: Not All Paths Are Made Equal

There are literally thousands of different financial paths you could take to achieve your ideal life. It all comes down to what your unique goals are in life. Are you itching to go out and see the world and you’re fine with living extremely frugally? The stop & start method might be perfect for you. Are you looking to start your own small business and grow it over time? Slow F.I. could be the answer. Or do you just never want to have to think about money again? Early retirement will do the trick.

There is no “right” financial path to take. Zero in on your unique situation and your goals in life and choose a financial path that will best let you live in a way that brings the most joy and happiness.

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.

I agree 100% Zach!

The thought of working 40+ years until I’m old and crusty has never appealed to me.

Thanks for the informative post!

I think many people are looking for an alternative to the traditional 40 hour week + 40 year working life approach. It’s nice to remember that there are plenty of alternative approaches to saving money. There’s not a “one size fits all” path to saving that works for everyone.

Thanks for the feedback 🙂

I used to do the start and stop approach because it was nice taking a break every couple of years. I’ve since discovered the early retirement approach and that’s what I’ll be working towards. I may dislike my job but it pays well. I have a visual board at my desk that reminds me that it will all be worth it in the end.

I won’t “retire” but I’ll have plenty of time to do the things I like.

The stop and start definitely seems popular among younger crowds like students fresh out of college who would rather start taking trips than be tied down to a job right away. It’s nice to know that different approaches work better depending on where you’re at in life. I also like that you have a visual board as a reminder of what you’re working towards, I’m sure that helps quite a bit 🙂

I think we are hoping for a Semi-FI/Slow -FI hybrid, but we’ll see! Great representations with the graphs here 🙂

I’m a huge fan of the Semi-FI/Slow-FI approach. It’s a great approach for people who actually do have hobbies/projects they enjoy doing and are able to earn money from. It lets you quit your full-time job earlier and continue to do work you love for as long as you want.

Thanks for the kind words 🙂

Great visual on the different ways to reach what you want in life: worry free from money and freedom.

I totally agree that there are many paths. Since I discovered FI 3 years ago, I switched path. We are now more on a sort of slow path to FI In order to enjoy life now. This is driven by my need to be with the kids while still young. I appreciate and enjoy spending time with them on experiences like holidays, adventure days out, going to a public parc,… That means working less hard, in paid holiday and a bigger than initial planned travel budget.

Congrats on choosing the slow path to FI! That approach is particularly awesome for people in your situation with young kids who actually want to see them grow up. It’s also less stressful to slowly build up net worth over time in an enjoyable manner rather than the traditional early retirement approach. Enjoy your slow path to FI and the increased time available for hanging out with family and traveling 🙂

There are many types of paths opened for retirees just like sell and stay of home sale and lease back plan. It not only provides them a chance to live in the same house where they are grown as well improve their finances. That’s why in my view it is the best path for retirees.

Interesting, I’m not familiar with that tactic. I’ll have to explore it further. Thanks for sharing!