5 min read

In The E-Myth, Michael Gerber shares why most individuals fail at starting small businesses:

- An individual is good at some skill and wants to start a business that revolves around this skill.

- So, this individual quits their day job to open a business in which they can use that skill to earn an income.

- However, as the business grows, the individual becomes overwhelmed by the workload, realizes that if they take a break from working that they won’t earn money, begins to hate the work they once loved, and realizes that they simply traded their old day job for a new day job.

Example: Failing at Starting a Bakery

For example, suppose Marie is an excellent baker and she currently works as an assistant baker at a grocery store. Because she is so good at what she does and because she loves her work, all of her friends tell her that she should start her own business. So, she quits her day job to open a bakery.

After only a couple months, her business is booming. More and more people visit her bakery each week and her sales steadily climb higher.

However, as the business grows, she realizes that she needs to hire staff to keep up with demand. So, she hires a few assistants. Some of them are good hires, but a few are rotten. Now she has suddenly become a baker and also a manager.

She also has to take on the role of accountant to keep track of her income and expenses. In addition, she has to learn about marketing and advertising so that she can get the word out about her bakery.

Slowly, she goes from working 40 hours per week to 50.

Then 55 hours.

Then 60.

She reaches a point where she needs to take a vacation, but she realizes that if she leaves then her business won’t be able to run effectively without her. She could close shop for a week, but then sales would drop.

Without realizing it, Marie traded a day job where she could spend all of her time doing something she loves (baking) for a new day job where she suddenly has to be a manager, accountant, and marketer in addition to being a baker.

Not only that, but she has become so necessary to the day-to-day business that she can’t take a vacation without the business falling apart.

Perhaps worst of all, baking is no longer fun for her. The work that she once loved has become a job.

The Solution: Work On Your Business, Not In It

Gerber shares that the solution to creating a successful business is to work on it, not in it. This is a subtle, yet important distinction.

To work on your business means to set up systems that allow your business to run smoothly and earn income even when you are not present.

To work in your business simply means that you’re showing up each day to do a certain work (e.g. baking) and when you take a break, you stop earning money.

As Gerber shares:

“If your business depends on you, you don’t own a business— you have a job. And it’s the worst job in the world because you’re working for a lunatic! And, besides, that’s not the purpose of going into business. The purpose of going into business is to get free of a job so you can create jobs for other people.”

For Marie, the way to create a successful business would be to automate or outsource most of the work. For example:

Baking: Marie loves baking, so she could keep doing this.

Managing: Marie should outsource this by hiring a manager who can run the day-to-day operations of the business and manage the staff.

Marketing: Marie should also outsource this by hiring someone to do marketing full-time.

Accounting: Marie should use an automated bookkeeping system that tracks all of her income, expenses, and taxes.

Training: Marie should create a guide/manual that explains exactly how new hires can get up to speed as quickly as possible on the protocols, standards, recipes, and expectations of her bakery.

By implementing these processes, not only can Marie focus on the one thing that she loves doing (baking), but she can also take time off when she wants without the business falling flat on its face because most of the necessary work is automated or outsourced.

In addition, if her employees have questions, they can simply refer to the guide or manual she created instead of directly reaching out to her.

Essentially, Marie created a workforce of people and tools that earn money for her, instead of a workload that requires tons of attention, energy, and time from her to earn money.

How to Build a Workforce for Your Finances

The reason that most people never gain financial freedom is similar to the reason that most small businesses fail: Most people create a workload for themselves that requires their time and attention to earn money, as opposed to a workforce that earns money without them.

The most obvious example is a day job. If the only way that you earn money is by exchanging your time for a paycheck, then you have a workload. You must show up and put in work to get money.

The way to shift away from having a workload is to build a workforce. You want to own things that make money for you even when you’re not present. A classic example of this is a stock market index fund like the S&P 500. When you invest in an index fund, your investment tends to grow over the course of many years and you receive a quarterly dividend payment along the way.

Related post: Here’s How the S&P 500 Has Performed Since 1928

One of the most traditional paths to financial freedom is to simply acquire so many assets like stock market index funds that eventually the dividends and the yearly growth from your investments is enough that you no longer need to report to a day job to earn an income. The passive income from your investments is enough to pay the bills.

Related: For individuals who are seeking to acquire a portfolio of high dividend stocks, this massive list of 300+ high dividend stocks from Sure Dividend is an excellent resource.

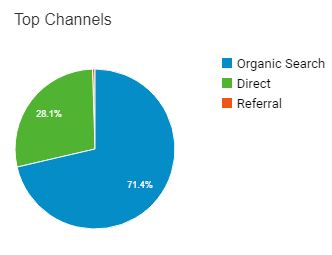

In addition to buying assets like stocks, you can also build assets that can generate passive income for you. One example of this is a website that earns traffic purely from passive sources like organic search traffic.

For example, I created a statistics educational website that earns the bulk of its traffic from organic search traffic (thanks to the power of SEO) and earns revenue from banner ads.

This means people search for certain statistics tutorials, land on my website, read my content, and I earn income without any work on my part. Granted, it took time to write these tutorials, but now the site earns money for me on autopilot each day without my attention.

I also own a few other websites that earn money in similar passive ways. In addition, I hold investments in stock market index funds and REITs (real estate investment trusts) that pay me dividends each month without any work on my part.

Through buying assets like index funds and through building assets like websites, I have created a workforce that earns money without my constant attention and focus.

Transition Away from Being Dependent on a Workload

The way to gain financial freedom is to transition away from being dependent on a workload to earn income. Build a workforce that earns money for you, instead.

Be wary of quitting your day job to start your own small business that requires your constant attention. You might be an excellent painter, but keep in mind that running a painting business means dealing with customers, learning about marketing, doing bookkeeping, and churning out enough paintings to pay the bills each month.

If you’re not careful, you could easily exchange one day job where you have one specific responsibility for a new day job where you have multiple responsibilities.

Seek to own assets that earn money for you without your attention.

Don’t build a workload for yourself. Build a workforce that works for you.

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.