Recently I was discussing the idea of financial independence (go figure) with one of my coworkers and he made the remark that “the only way to retire early or rich is to have phenomenal investment returns”. Besides the fact that I knew this wasn’t true, it did spark an interesting question in my head: how much do investment returns actually matter? In particular, I wondered how much they mattered for someone looking to retire early and escape the rat race in 10 years or less.

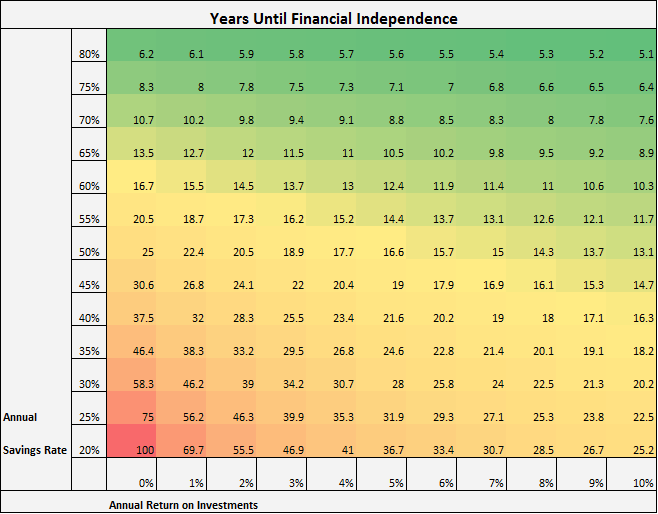

Per usual, I decided to make a grid (you can see my other financial grids here, here, and here) to look at how many years it would take to reach F.I. based on different savings rates and investment returns.

Here’s the end result:

Now, a 0% annual return on investments probably isn’t realistic, but I threw it in the grid just to prove a point: If your savings rate is around 70% or higher, you can reach financial independence in roughly 10 years or less even if you have a 0% annual return on your investments. This is mind-boggling to me.

It’s highly unlikely you’ll experience such an awful return on your investments, especially if you invest in index funds. But it just shows that a powerful savings rate can make up for pathetic investment returns.

On the other extreme, you will probably be hard pressed to earn 10% annual investment returns, but I also threw it in the grid to illustrate an important point:

- The higher your savings rate, the more your savings can offset poor investment performance and still allow you to reach F.I. extremely fast

- The lower your savings rate, the more you rely on investment returns to reach F.I. quickly

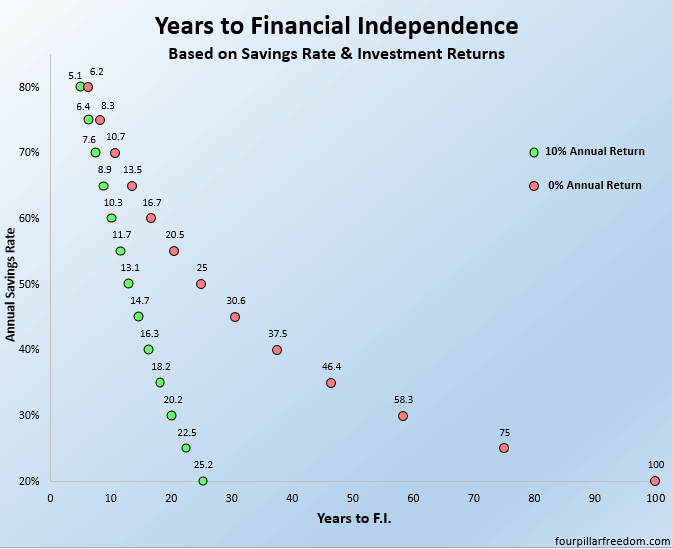

To visualize this concept in a different way, check out this graph:

As you can see, the higher your savings rate is, the less variability in the time it will take you to reach financial independence. For example, if your savings rate is 80%, you can have 0% investment returns and still retire in 6.2 years. On the other hand, if you have incredible 10% investment returns, this still only allows you to retire a year earlier (in 5.1 years).

Conversely, the lower your savings rate, the more your investment returns make a difference. If you’re only saving 20% of your income yearly, 10% annual investment returns can save you and allow you to retire in 25.2 years. But if you receive 0% annual investment returns, you won’t reach F.I. for 100 years.

But Isn’t Compound Interest the 8th Wonder of the World?

Compound interest is still a powerful force and investment returns still do matter. But here’s what’s important to realize: compound interest is a beast in the long run. In the short run, savings rate is far more important.

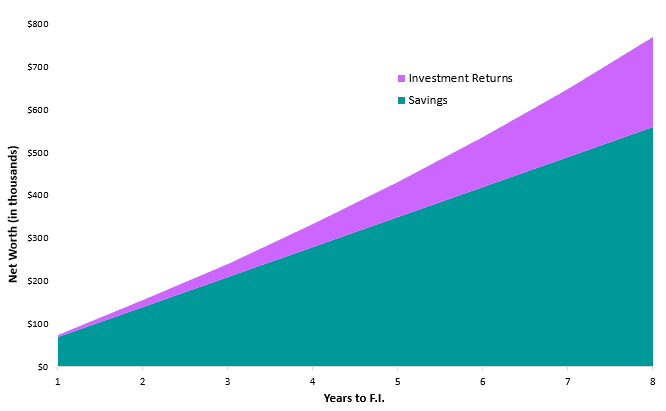

To illustrate this point, consider our friend Angela who has a 70% savings rate and receives a 7% annual return on her investments. At this rate, it will only take about 8 years for her to reach F.I. This graph shows how much of her net worth is comprised of savings (in blue) and how much is comprised of investment returns (in purple):

By the time Angela reaches financial independence, about 73% of her total net worth is comprised purely of savings. (For this example, I assumed an income of $100,000 and savings of $70,000 each year)

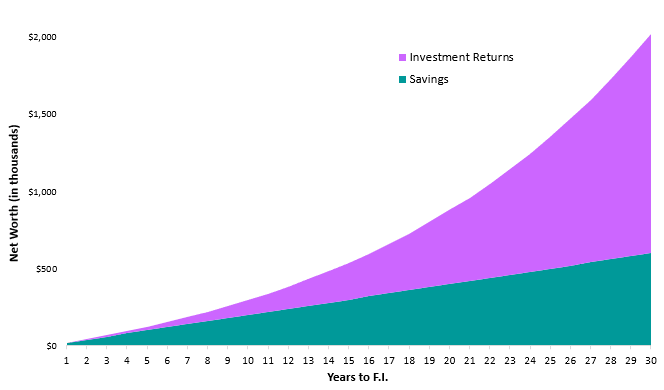

Now consider our friend Mike who has a 20% annual savings rate (Again I use an income of $100,000 and savings of $20,000) with the same 7% return on investments. It will take him about 30 years to reach financial independence. Here’s what his net worth journey looks like in terms of savings and investment returns:

Just like Angela, most of Mike’s net worth in the early years is comprised of his savings. But as time goes on, Mike’s investment returns completely dwarf his savings. By the time he actually reaches financial independence, a whopping 71% of his net worth comes entirely from his investment returns.

The Big Takeaway

In the long run, no one deny that compound interest is a powerful force. But in the short run, savings rate is far more powerful. For anyone who wants to reach financial independence in 10 years or less, your focus should be on your savings rate more than your investment returns. Your savings rate is the number one factor that will determine how soon you reach F.I.

Sign up to have my most recent articles sent straight to your email inbox for free

[jetpack_subscription_form subscribe_text = “” title=””]

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.

Thank you, Zach! My entire family thanks you! Simple advice that makes a difference! Especially for those addicted to Amazon who have to get up and go to work this AM! Kate

I’m glad you found this helpful, Kate! Thanks for stopping by 🙂

The great part about compounding is once you reach FI it will continue to compound because you won’t be withdrawing everything all at once anyway. Good charts by the way, I’m right in the middle 🙂

Exactly! Ideally your wealth will just continue to grow even after you reach FI. And thanks, Excel charts never let me down 🙂

Great post Zach! This is a really fascinating comparison between the two factors. I knew savings rate was very important, but seeing it illustrated in this way was helpful to put it in better perspective. It’s great knowing that something within our control (savings rate) makes such a big impact on the road to FI.

Matt, I couldn’t agree more! My favorite part about these charts is that it just shows you how much control you actually have through your savings rate. Getting a return on your investment is great, but sometimes this can be outside of your control. Savings rate is key. Thanks for the feedback 🙂

I’m a huge fan of graphs and charts and this one speaks to me :). Now, I absolutely need to figure out how long it will take to reach FI with our current savings rate. It’s on the list :).

I’m a big fan of visuals myself as well, obviously. I think they help illustrate a point better than words can sometimes. And cheers to focusing on your savings rate 🙂