4 min read

When I first discovered the FIRE community, I fell in love with the idea of early retirement. The thought of saving 70% of my income each year and being able to retire in under a decade made me ecstatic.

At the time I had just graduated college so I was at the very beginning of my financial journey. I ended up going head over heels into personal finance, created this blog, and started churning out financial charts to help other people understand the math behind early retirement.

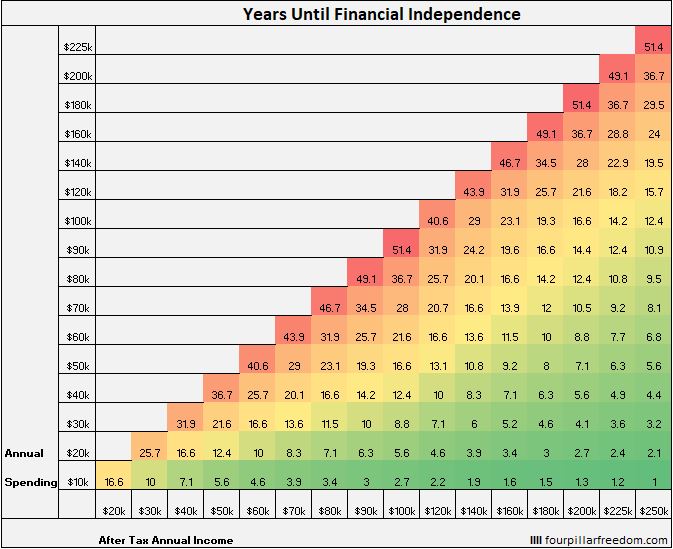

The one chart that seemed to convey the math the best was the Financial Independence Grid, which shows how many years it will take you to achieve financial independence (defined as having 25 times your annual expenses), assuming you start from $0 and earn 5% investment returns each year:

I became obsessed with the numbers in the bottom right corner of the graph.

If I could earn $100k and spend just $20k, I could retire in under 6 years.

If I could earn $120k and spend just $20k, I could move that number down to under 5 years.

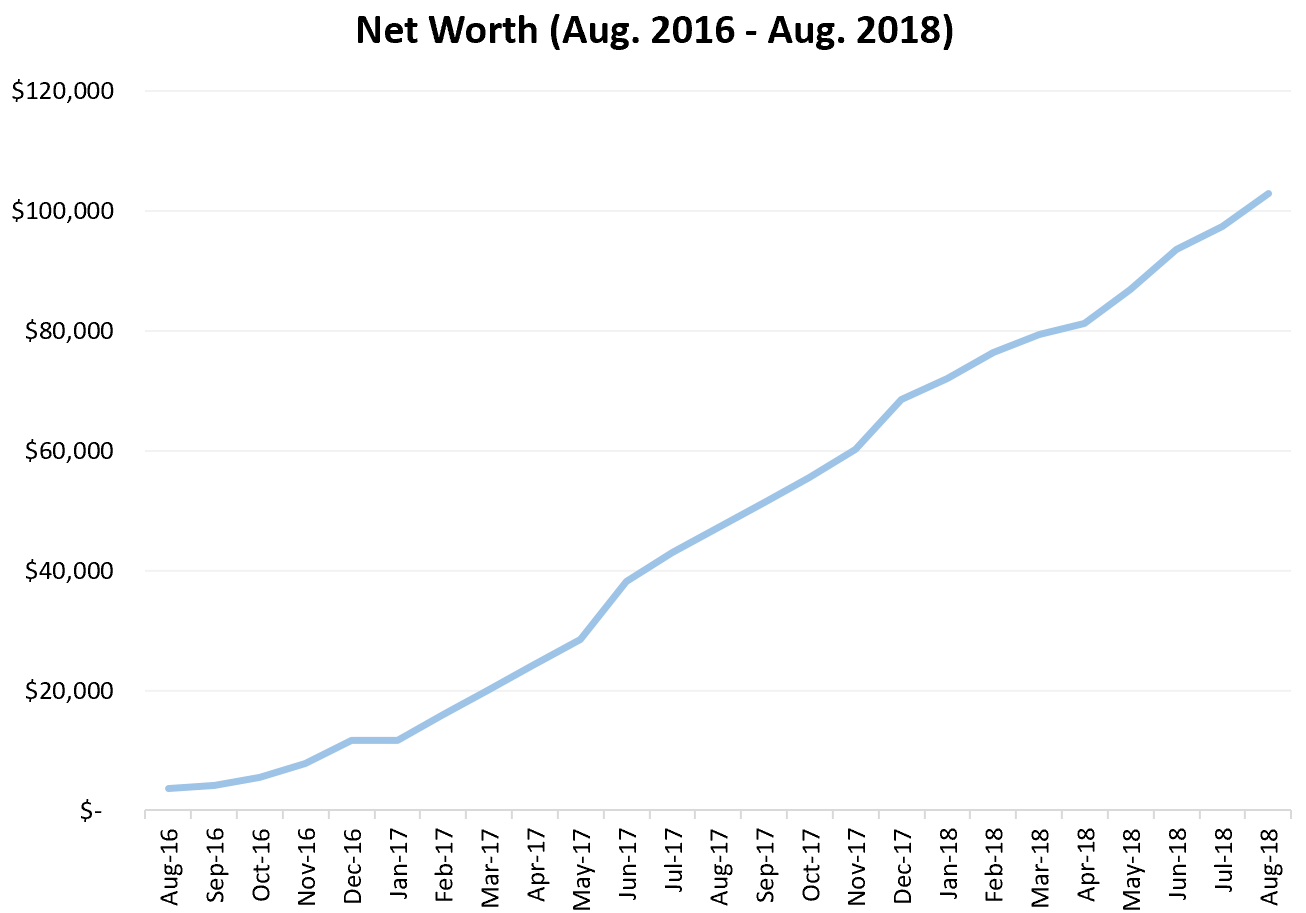

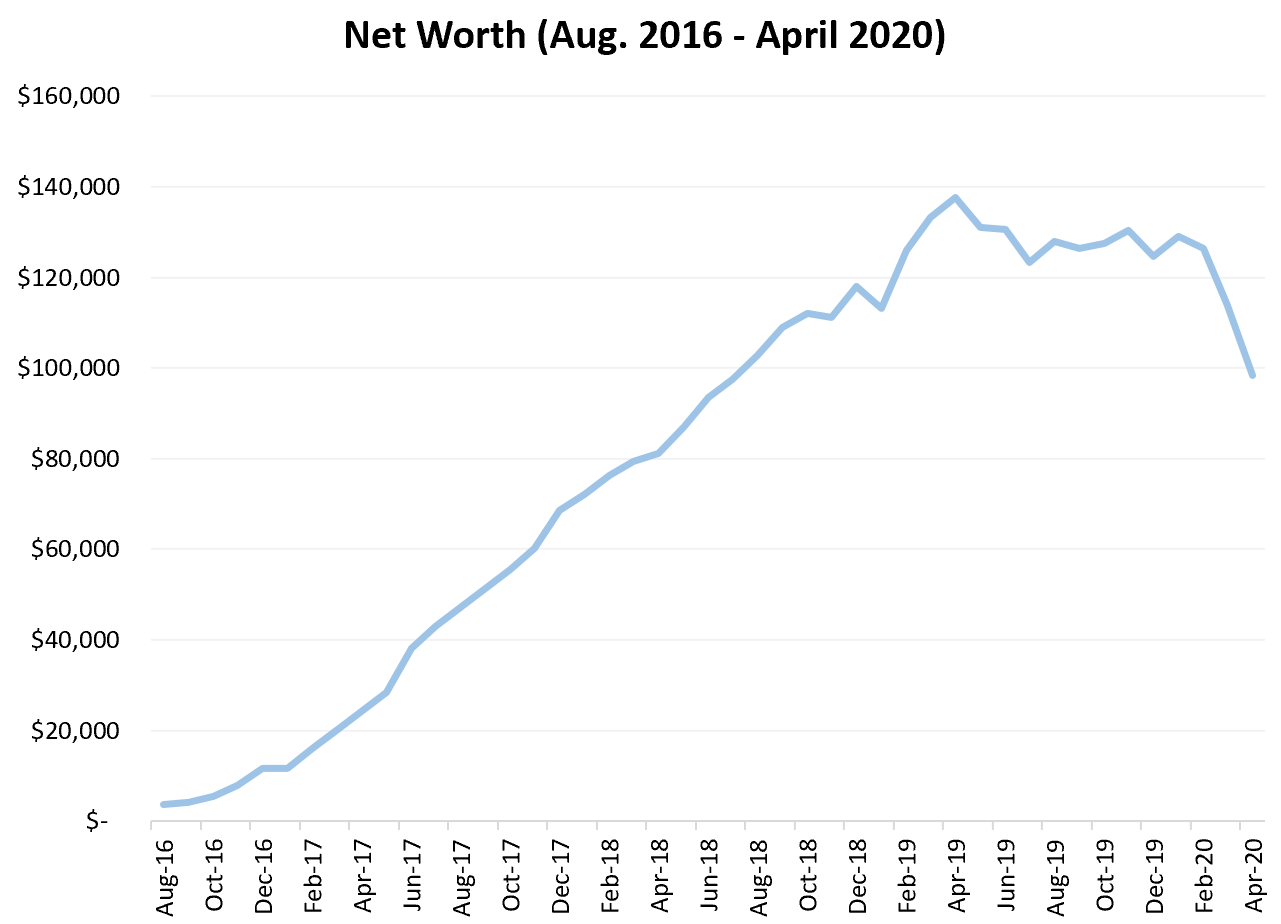

So, I began to save every dollar I could from my data scientist salary and started tracking my net worth each month. In just two years, I went from $0 to $100k:

After a couple years in Corporate America, though, I began to lose my enthusiasm for early retirement for two reasons:

1. I realized that I couldn’t possibly keep my annual spending at $20k once I decided to have a family. This meant I would likely need to stick it out in a cubicle for well over a decade.

2. I discovered that I could make money online and that I really enjoyed it.

These two facts caused me to have the following realization: I only need a portfolio worth 25 times my annual expenses if I never plan on working again. But since I’ve found a way to earn money in an enjoyable way, why don’t I focus all of my time and energy on growing that income while I’m young and don’t have the financial burden of supporting a family?

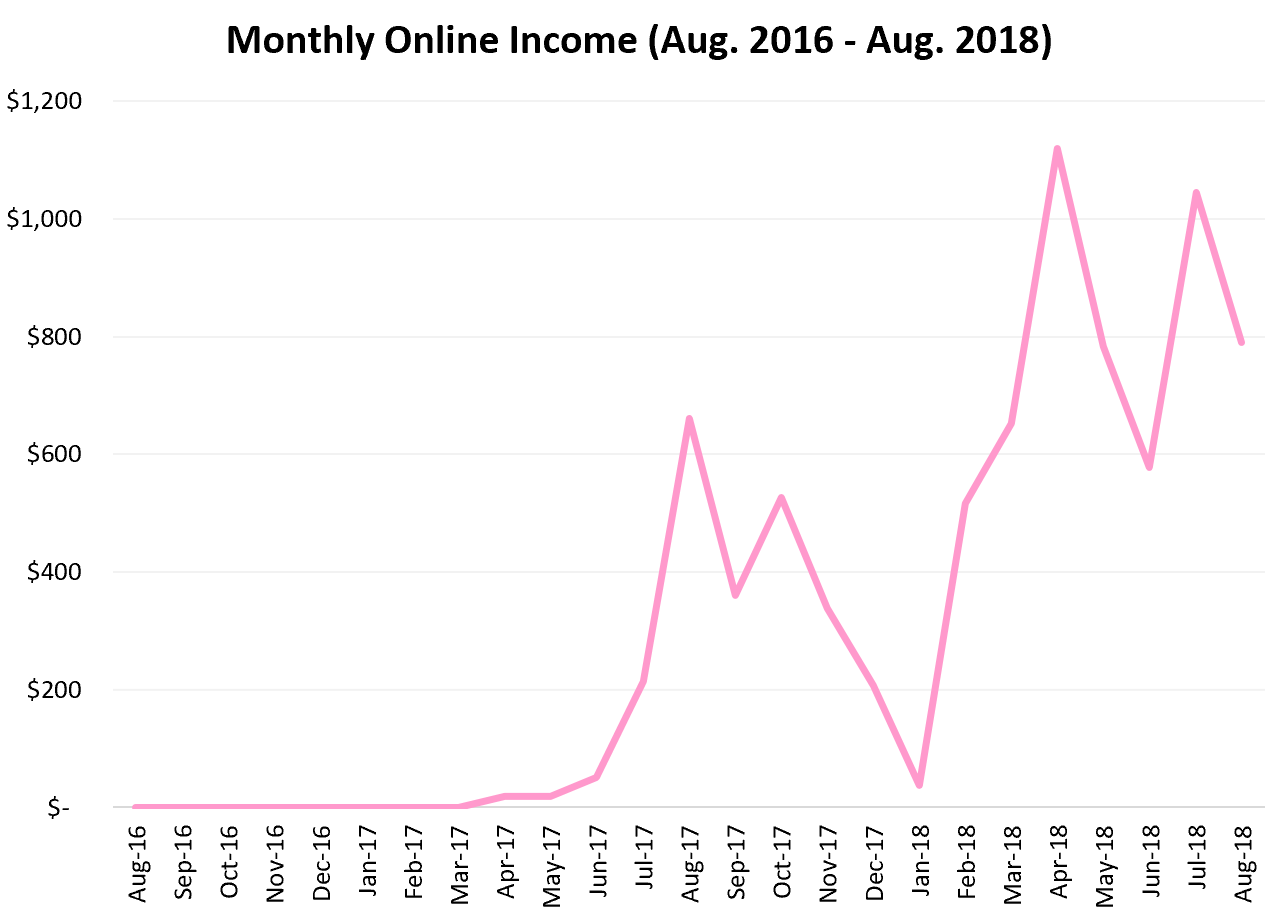

At the time, I had experienced a couple months of earning $1,000+ from online income in the form of ads and affiliate links from this website and dividends from REITs and stocks I owned.

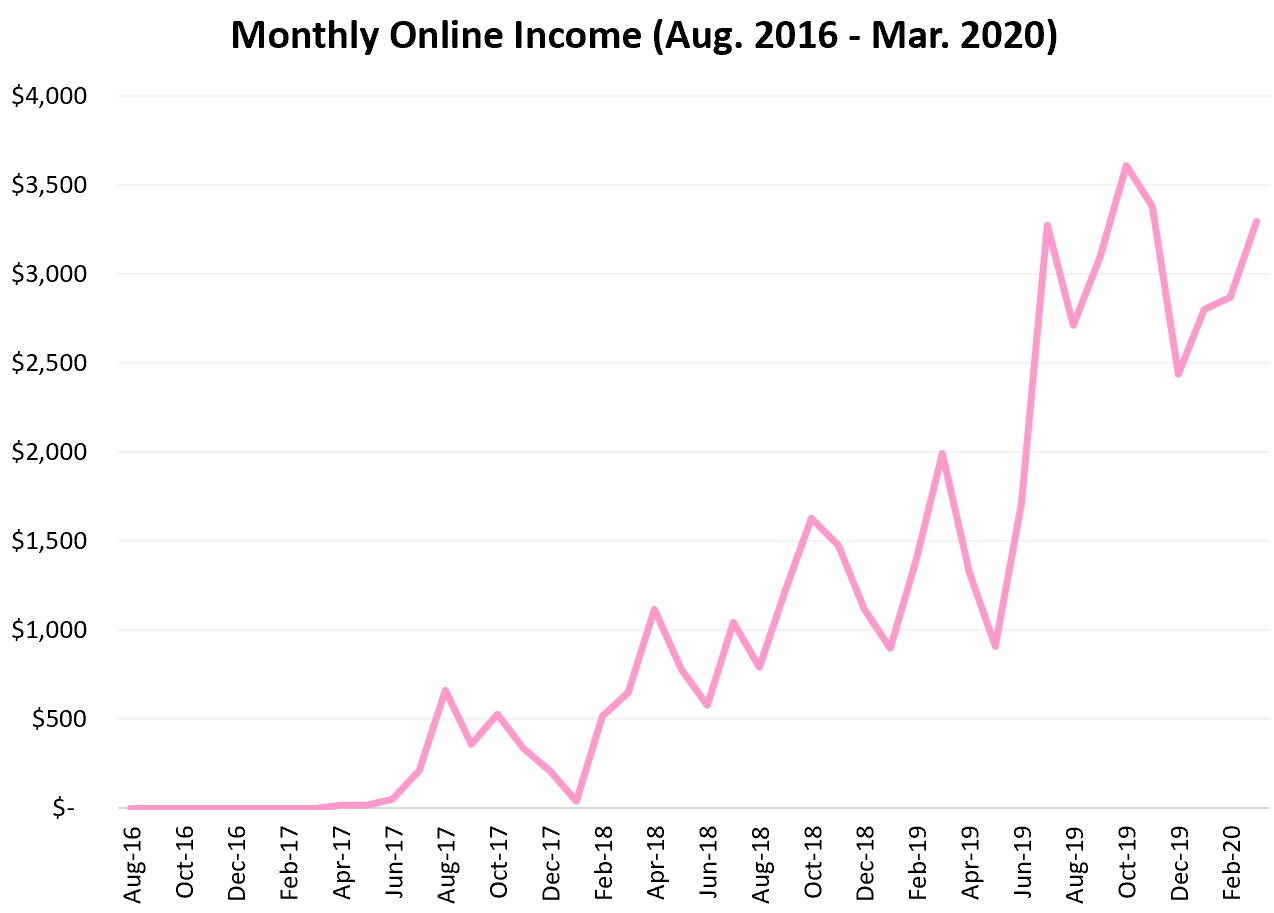

Long story short, I worked on increasing my online income for about another year before I decided to quit my day job as a data scientist in June of 2019. Here’s what my online income looked like at that point:

I was close to earning $2,000 per month consistently and at the time my monthly expenses were around $2,000. This meant that I could pay most of the bills purely with online income.

I decided to take the leap to full-time entrepreneurship, knowing that I could likely increase my online income with my full-time attention.

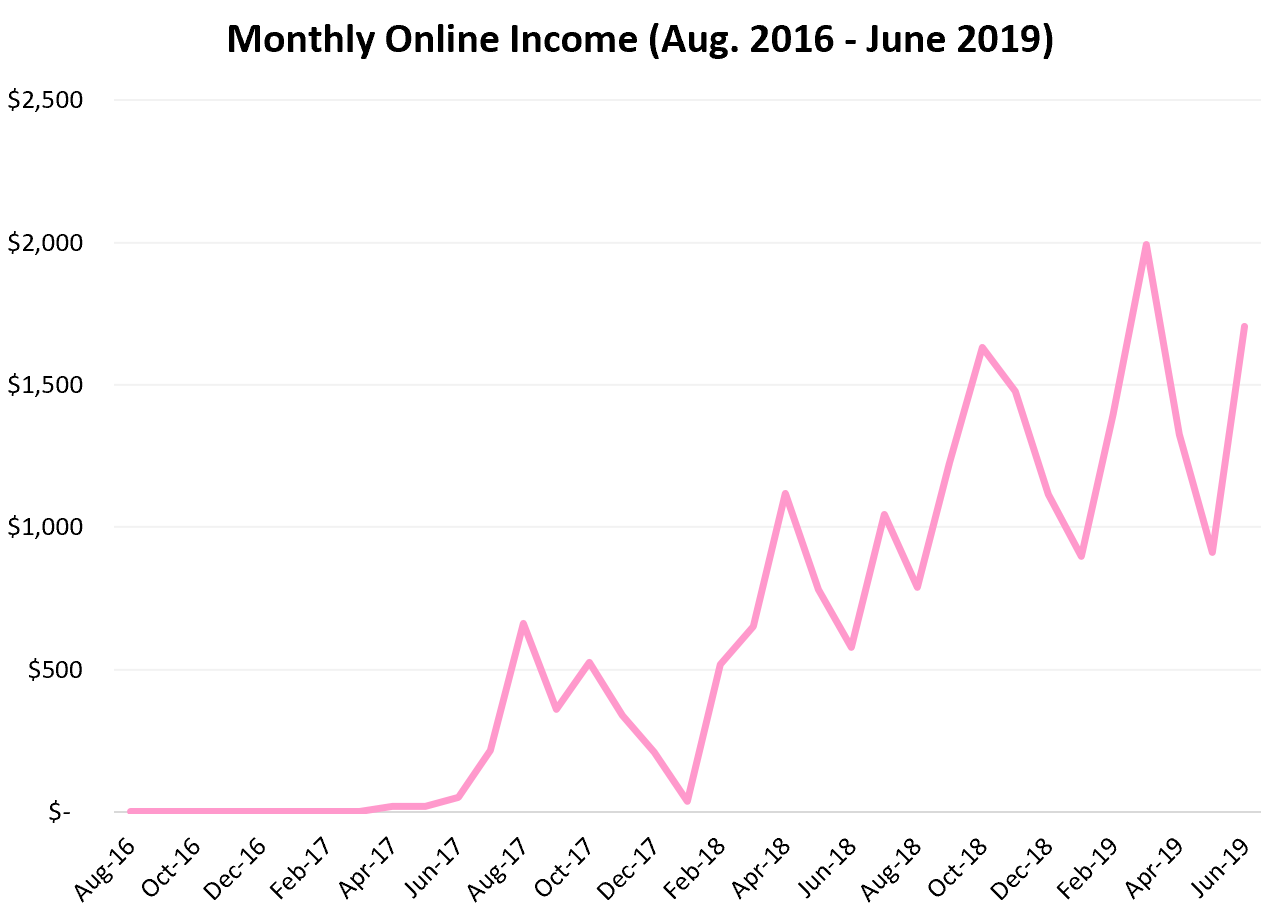

Here’s what my monthly online income has looked like since quitting my day job:

I’ve successfully grown it to around $3,000 – $3,500 per month, due to a few reasons:

1. This blog has grown considerably, which has lead to more income in the form of ads and affiliate links.

2. I also started a few new sites (Statology, Collecting Wisdom, and Wander Cincinnati) that generate additional income.

3. I bought my first site ever (a food blog) for $7,000 that currently generates around $700 per month in income.

Note: I share my online income each month on this page, updated on the first day of each month.

I’m also excited to share that I’m on pace to experience my first $5,000 month in April and I fully expect to experience a $6,000 month or higher by the end of the year.

Despite the incredible income growth, my net worth has remained mostly flat since quitting my day job and has even dipped back below $100k following one of the worst quarters ever for the U.S. stock market:

This doesn’t bother too much because I simply don’t care about my net worth as much as I used to.

I have come to realize that as long as my monthly online income is growing, the following two things will hold true:

1. I’ll never have to go back to a day job.

2. My net worth will eventually increase over time, assuming my expenses never exceed my income.

For these reasons, I don’t actually care if my net worth is $50k, $100k, or $200k at this point in my life because it wouldn’t change my lifestyle in any way. And because I never plan on quitting working, I know that my net worth will continue to increase as I get older.

Although my net worth hasn’t grown much in nearly two years, I don’t mind because right now I have complete freedom over my time thanks to my reliable monthly online income.

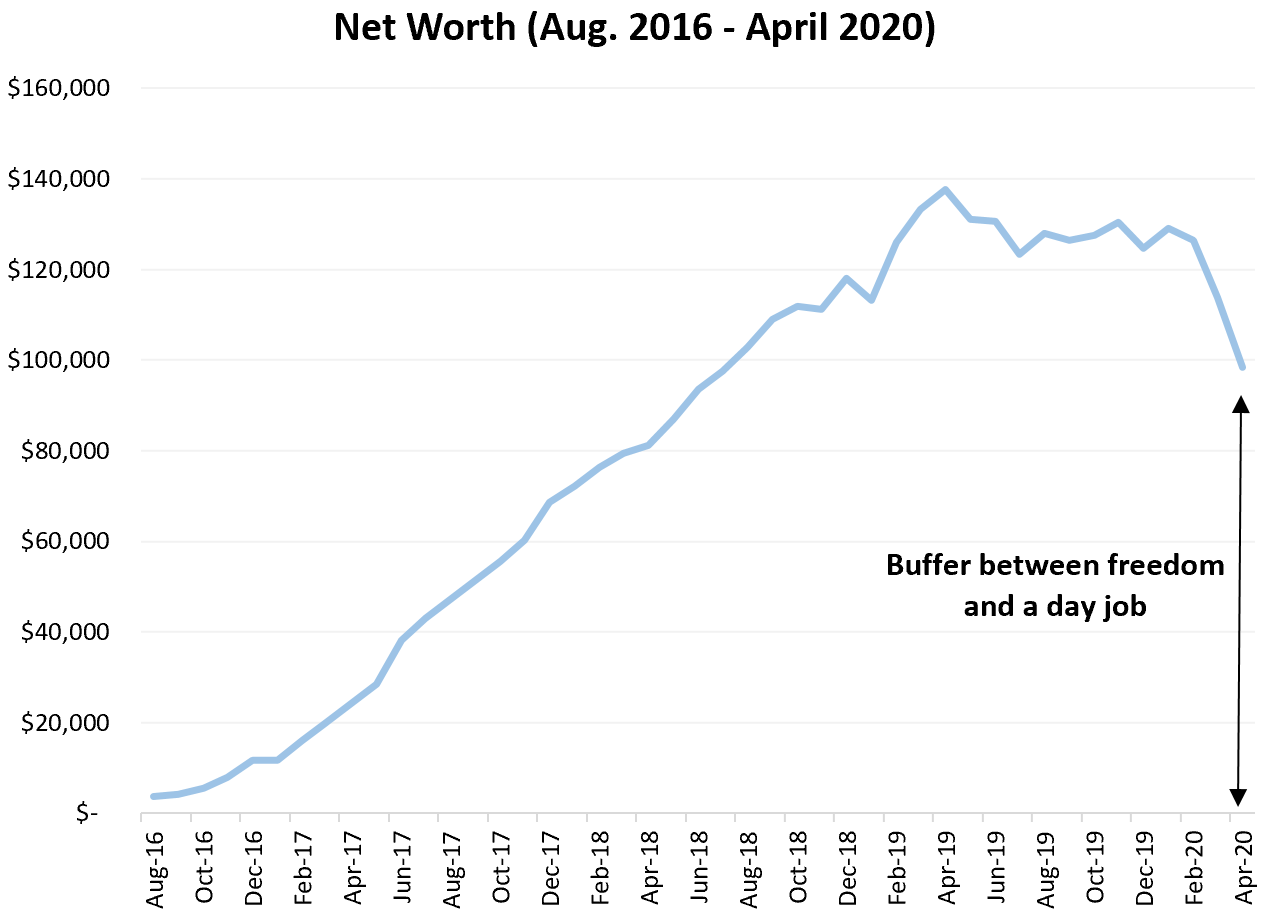

I simply view my net worth as a buffer between my freedom and my need for a day job. Of course I would love to see my net worth grow, but I’m mostly concerned with making sure it doesn’t dip too low that I would ever need to get a job again.

I would love to be a millionaire some day and I fully expect to be eventually, but I don’t actually need a million dollars right now to be free. All I need is reliable monthly online income streams that have the potential to grow over time.

I know that if I focus most of my time and attention on increasing my income that my net worth will take care of itself.

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.