4 min read

Each individual stock in the U.S. stock market can be classified into one of eleven sectors:

- Energy (Exxon Mobile, Chevron, etc.)

- Utilities (Duke Energy, Southern Co., etc.)

- Healthcare (Johnson & Johnson, Pfizer, etc.)

- REITs (Simon Property Group, Public Storage, etc.)

- Financials (JPMorgan Chase, Wells Fargo, etc.)

- Industrials (Boeing, Honeywell, etc.)

- Consumer Staples (Procter & Gamble, Walmart, etc.)

- Materials (DowDuPont, Sherwin-Williams, etc.)

- Information Technology (Apple, Microsoft, etc.)

- Communication Services (Verizon, Comcast, etc.)

- Consumer Discretionary (Amazon, Home Depot, etc.)

While it’s possible to gain exposure to each of these sectors through investing in a total stock market index fund, some investors prefer to tilt their portfolio more towards certain sectors.

For example, investors who are able to stomach more volatility might be more attracted to technology stocks because they’re known to have serious growth potential.

Other investors might be more drawn towards defensive stocks like those in healthcare and consumer staples because they tend to be less volatile and more recession-proof.

Fortunately, most brokerage platforms give you the option to invest in specific sector index funds so that you can gain exposure to several individual stocks in a given sector.

For example, perhaps you like the idea of investing heavily in technology stocks but you’re not interested in picking which individual tech companies will perform best in the future.

If that’s the case, then you might decide to invest in something like VGT – the Vanguard Information Technology ETF, which is composed of over 300 individual tech companies including:

- Apple

- Microsoft

- Visa

- Mastercard

- Intel

- Cisco Systems

- Adobe

- NVIDIA

- Salesforce

- PayPal

By investing in this index fund you’re able to make a bet on the information technology sector without making a bet on any individual company.

Whether you decide to invest in a total stock market index fund or a mix of specific sector index funds, it’s helpful to know how different sectors have performed historically.

In this post, I summarize the performance of each stock sector since 1974.

Summarizing Historical Sector Returns

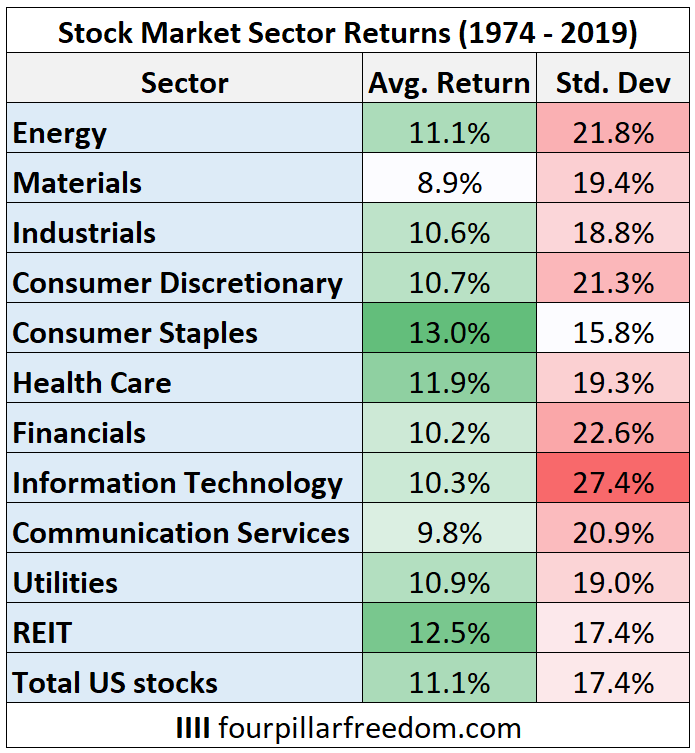

The following table shows the compounded annual returns and the average annual standard deviation for each sector since 1974:

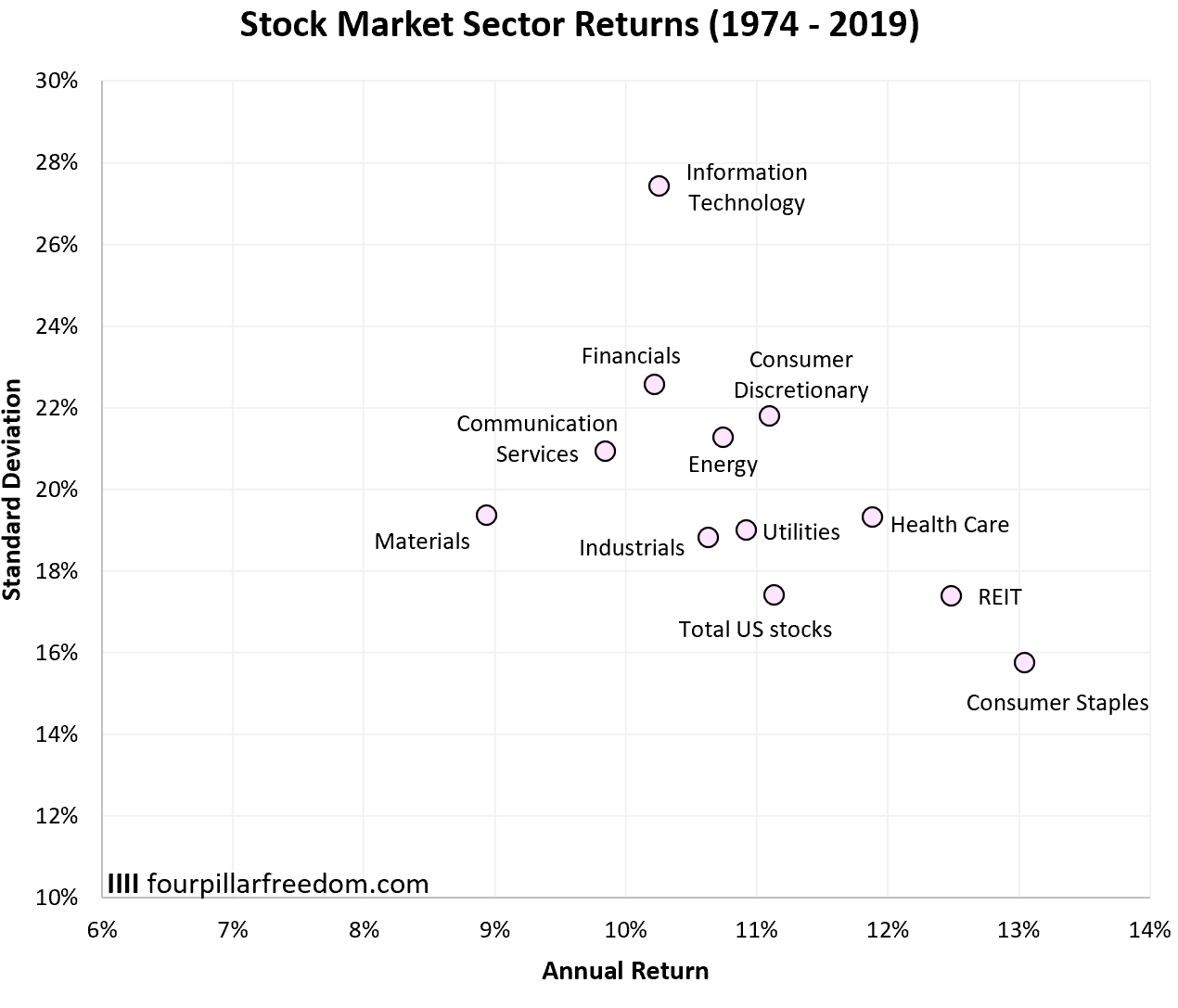

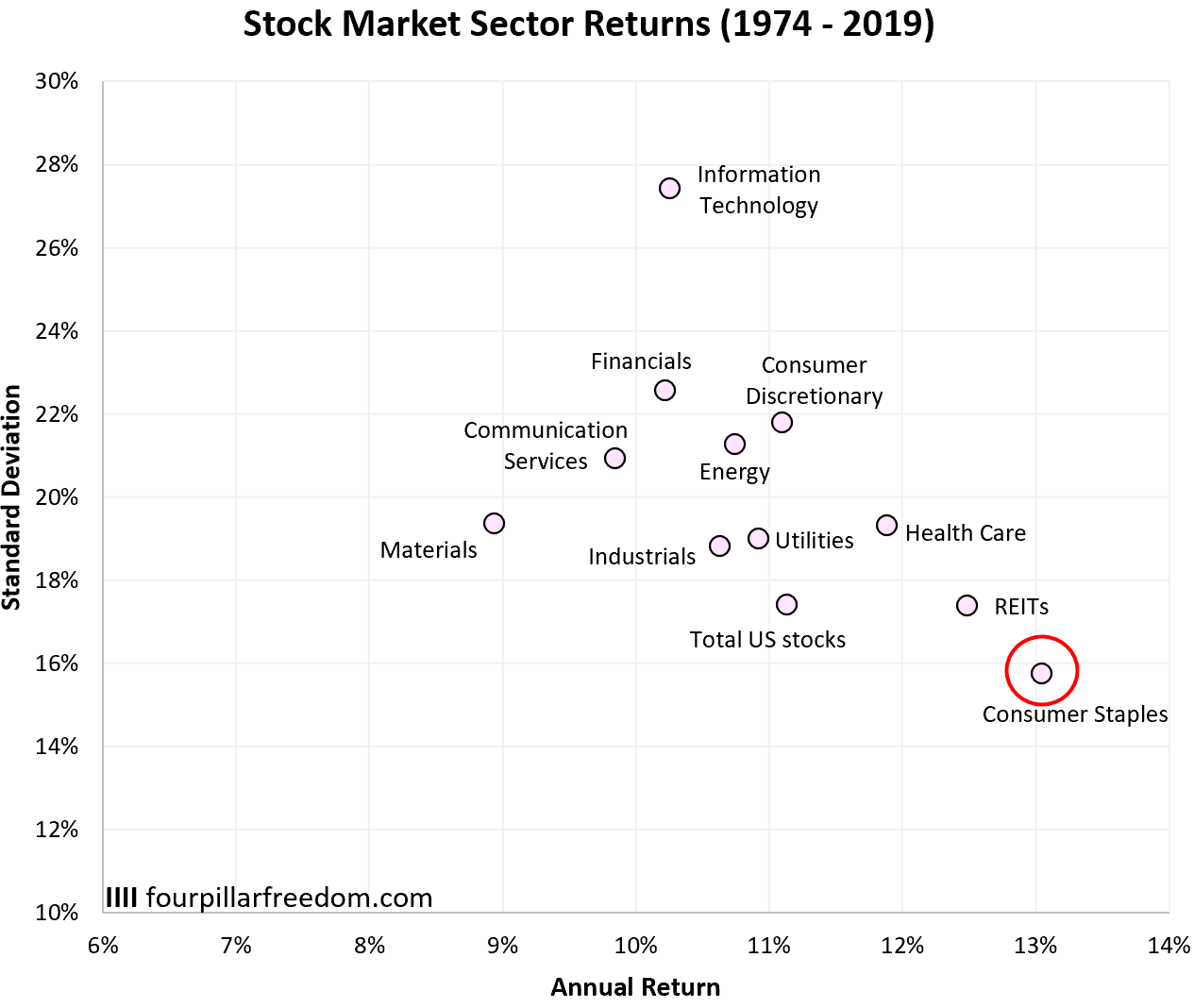

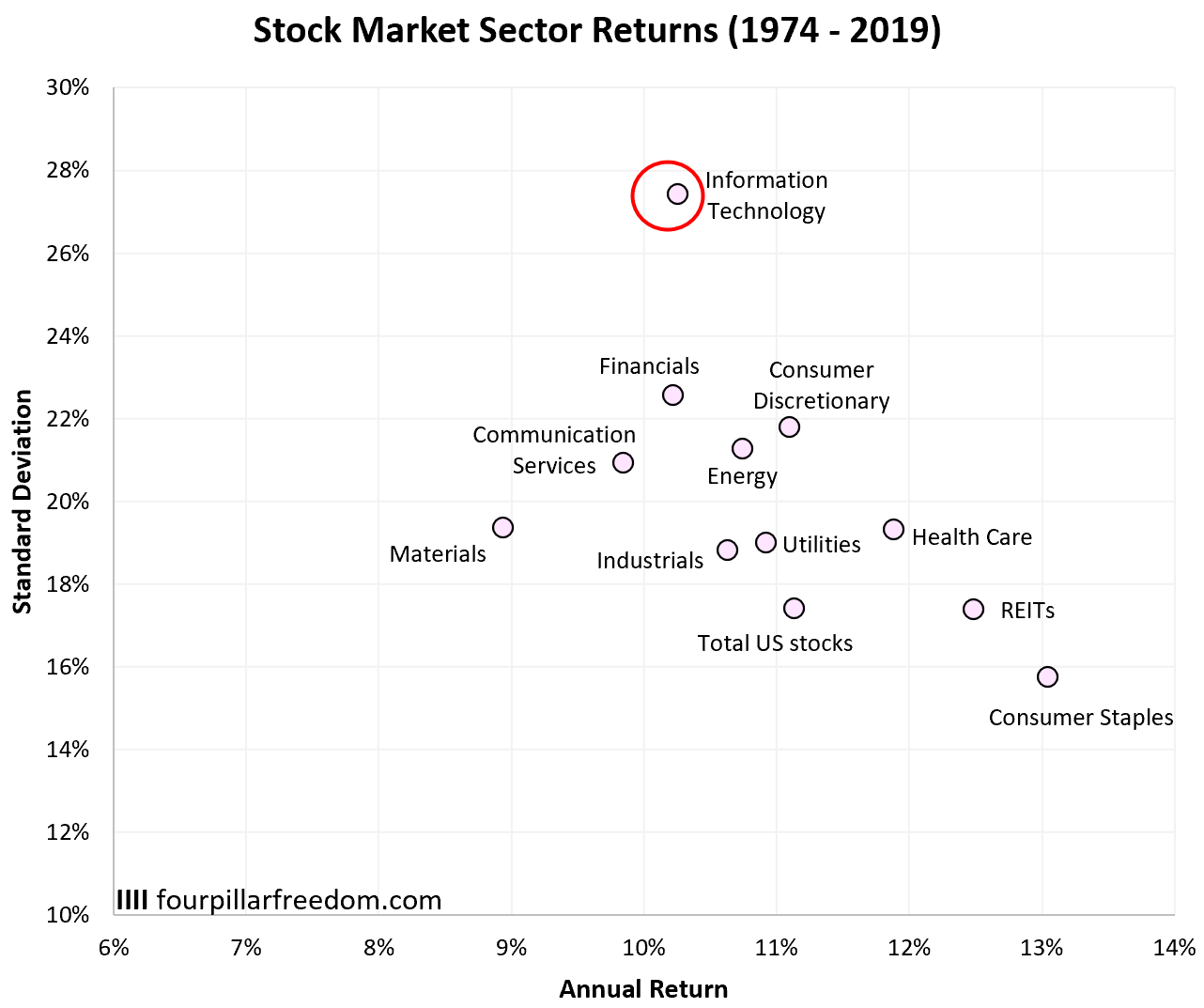

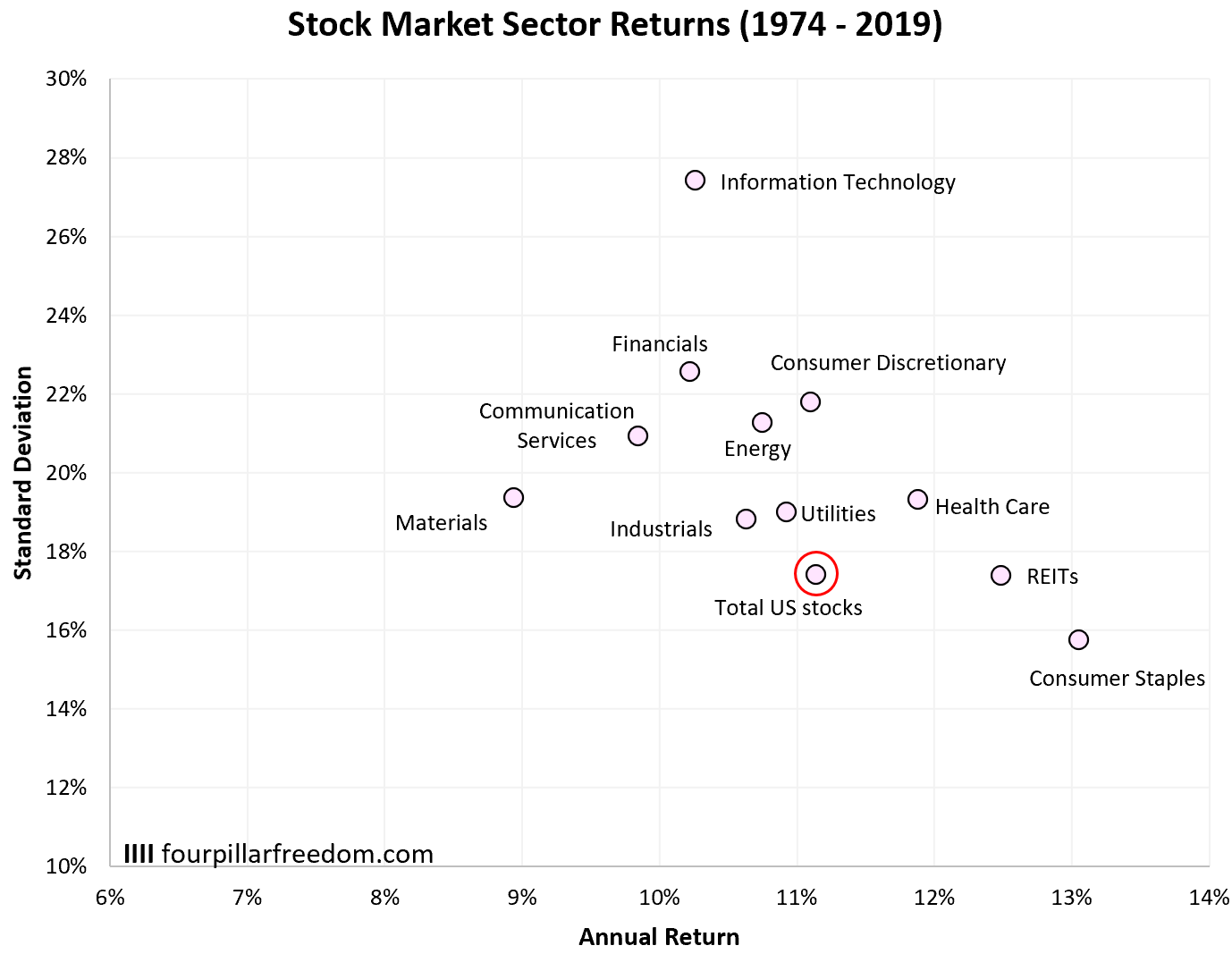

The following scatterplot provides a visual look at these numbers:

It’s absolutely fascinating to see that consumer staples have delivered the highest annual returns while also providing the lowest annual volatility.

The low volatility isn’t surprising given the fact that consumer staple stocks tend to be the types of companies that earn fairly predictable revenues in any type of economic environment. These types of stocks include names like:

- Procter & Gamble

- Coca-Cola

- Walmart

- Costco

- Colgate-Palmolive

- Philip Morris

People will always need toiletries, food, drinks, and other staples.

On the upper end of the scatterplot we see that information technology has delivered returns in the middle of the pack, but with much higher volatility than any other sector.

We can also see that a total U.S. stock market fund delivered the second lowest volatility behind consumer staples. This isn’t too surprising since we know that increased diversification is associated with lower volatility and a total U.S. stock market fund is diversified across thousands of companies in 11 different sectors.

Visualizing the Distribution of Returns by Sector

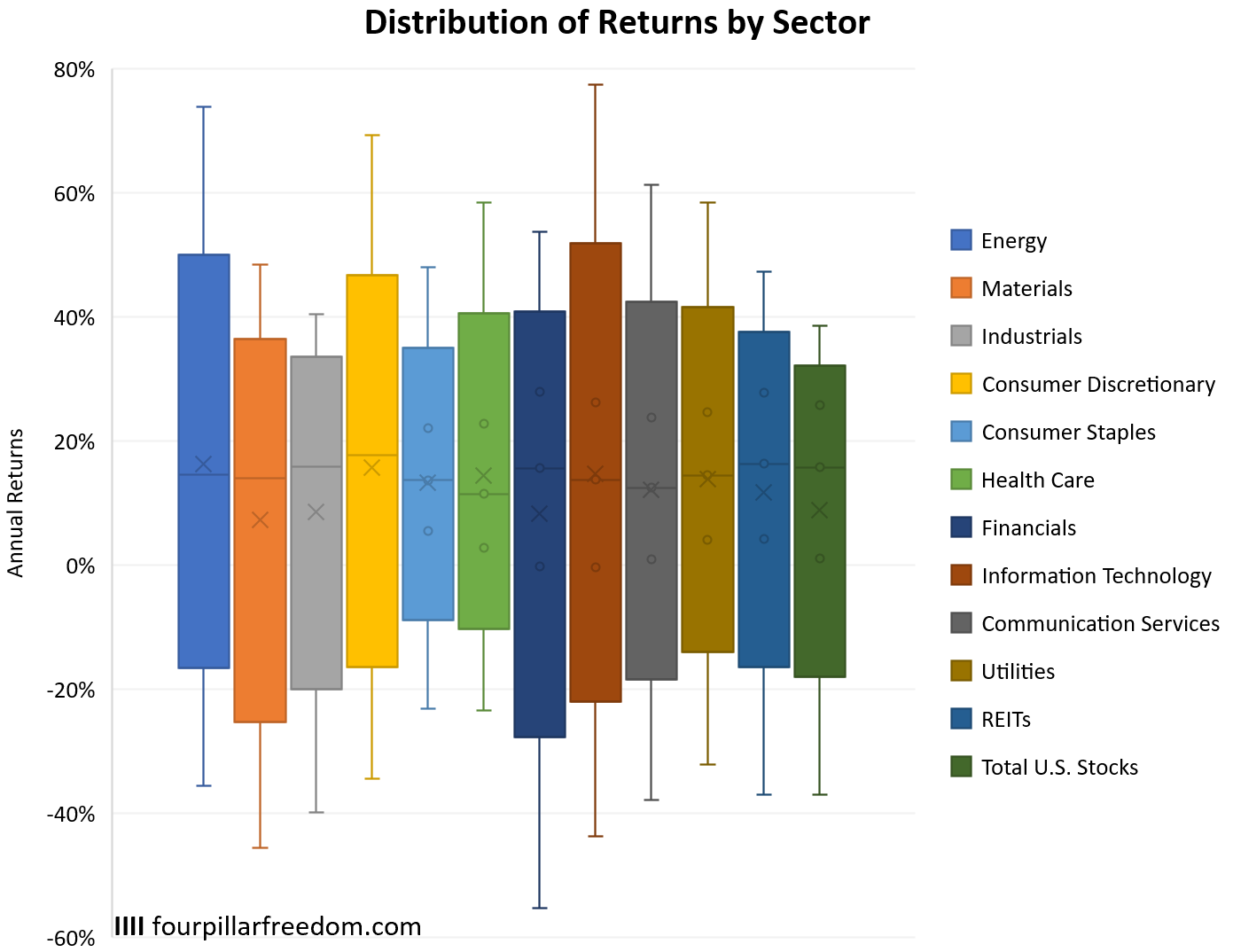

The following boxplots show the distribution of annual returns by sector.

We can see that consumer staples has the lowest variance in returns, as indicated by the shortness of its box. It’s also fascinating to see that the worst year ever for consumer staples was just a 23% drop (in 1974).

Conversely, we can see that information technology has massive volatility in returns, with the highest annual return coming in at 77% (in both 1998 and 1999) and the lowest annual return coming in at -44% (in 2008).

Summarizing Drawdowns by Sector

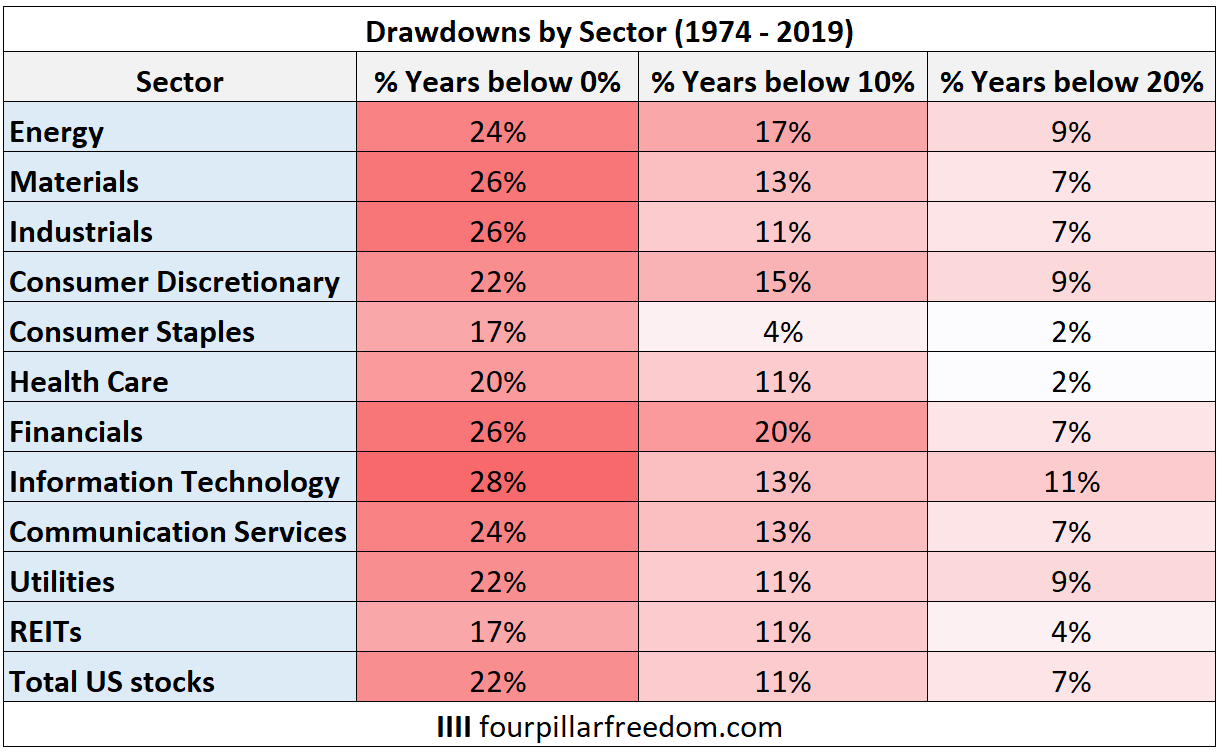

The following table shows the percentage of years in which each sector experienced a certain drawdown:

Once again we can see that consumer staples is quiet resilient to drawdowns. It has only experienced a 10% drawdown or worse in just 4% of years since 1974 and has only experienced a 20% drawdown or worse in just 2% of years.

We can also see that health care and REITs tend to be fairly resilient to drawdowns.

On the flip side, the information technology sector tends to experience extreme drawdowns more often than any other sector.

Conclusion

I was personally shocked to see just how well consumer staple stocks have performed over the years. Not only have they experienced the highest annual returns, but they’ve done so with the least volatility.

If you’re looking for a deep-dive into the historical performance of consumer staple stocks, I recommend this article from The Investor Field Guide.

Although historical returns can’t predict future returns, it seems safe to assume that consumer staples and health care stocks will continue to be resilient to market drops in the future simply because individuals will always need health care and basic living essentials no matter how the economy or the stock market is performing.

It also seems safe to assume that information technology will continue to be the most volatile sector moving forward simply because tech companies have the potential to scale much faster and larger than traditional companies. This naturally leads to extreme booms and busts in the stock prices of these companies.

As an individual investor, you can make bets on which individual sectors will perform best in the future by simply investing in specific sector index funds. This offers the advantage of being able to bet on an entire sector rather than an individual stock.

Or if you’re interested in keeping your investing strategy, you can simply invest in total stock market funds which allows you to gain exposure to every individual stock in the stock market. We saw from this analysis that the total stock market tends to deliver higher returns than most individual sectors while also providing lower volatility than most sectors.

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.