5 min read

Amid fears of a potential Coronavirus pandemic, the S&P 500 took us on a wild ride last week, delivering the following returns:

- Monday: -3.35%

- Tuesday: -3.03%

- Wednesday: -0.38%

- Thursday: -4.42%

- Friday: -0.83%

In total, prices dropped around 13% in a matter of five days. That means each $100,000 turned into $87,000. Each $1 million turned into $870,000. Over the course of just 120 hours.

Ouch.

I can tell this rapid drop has the average investor in a bit of a frenzy because I’ve received messages from friends and family who typically care very little about finance asking what I think about this market activity.

I simply tell them, as Charlie Bilello says, that’s the price of admission. When you invest in stocks, you can expect occasional volatility. In fact, historical data tells us that stocks fall 10% or more about once per year, on average.

Stocks deliver higher returns than bonds because they require you to take on more risk. More risk means more uncertainty. This uncertainty is rewarded with higher returns over the long haul, but it’s anyone’s guess how things will play out in the short term.

Will stocks fall another 10% over the coming weeks? 15%? 20% or more? Nobody knows for sure, but there are several things to keep in mind that can make you better equipped to handle a potential crash.

Coronavirus Resources:

I’m not a health professional so I won’t attempt to predict how the Coronavirus will play out, but I have found these two resources helpful to keep tabs on the global situation:

1. This interactive map by John Hopkins that shows the total case count in each state & country around the world.

2. This Twitter list created by Naval Ravikant that features 15 people who are all keeping a close eye on the coronavirus situation and sharing their candid thoughts about it.

Ignore the permabears

A permabear is someone who is permanently bearish about the stock market – they constantly claim that we’re headed for a crash. Once the crash does arrive (because it always does eventually) they proudly proclaim “I told you so!”

Ignore these people. They miss out on more gains by sitting on the sidelines for too long anyway.

Doug Boneparth illustrated this perfectly in a hilarious tweet:

Bears Then:

Dow 23,000 – “This is the top!”

Dow 24,000 – “This is the top!”

Dow 25,000 – “This is the top!”

Dow 26,000 – “This is the top!”

Dow 27,000 – “This is the top!”

Dow 28,000 – “This is the top!”

Dow 29,000 – “This is the top!”Bears Now:

Dow 25,000 – “Told you!”

— Douglas A. Boneparth (@dougboneparth) February 28, 2020

There will always be a reason to sell

The media always says there is a reason to sell stocks. This image shared by Michael Batnick shows this:

— Michael Batnick (@michaelbatnick) February 28, 2020

The S&P 500 has climbed 431% over the past decade despite the media pumping out new reasons to sell every 3-6 months.

Individuals who have shifted around their asset allocation in response to breaking news events and media-induced fear have likely done more damage than good to their investment returns over the past decade.

Perhaps this time will be different. That’s a real possibility. But the phrase “this time will be different” is also used during each of these crises.

This isn’t the first virus to threaten the global economy

Coronavirus isn’t the first virus to threaten the workings of the global economy. David Quammen pointed this out in this NY Times article:

“This Wuhan emergency is no novel event. It’s part of a sequence of related contingencies that stretches back into the past and will stretch forward into the future…

The list of such viruses emerging into humans sounds like a grim drumbeat: Machupo, Bolivia, 1961; Marburg, Germany, 1967; Ebola, Zaire and Sudan, 1976; H.I.V., recognized in New York and California, 1981; a form of Hanta (now known as Sin Nombre), southwestern United States, 1993; Hendra, Australia, 1994; bird flu, Hong Kong, 1997; Nipah, Malaysia, 1998; West Nile, New York, 1999; SARS, China, 2002-3; MERS, Saudi Arabia, 2012; Ebola again, West Africa, 2014.

And that’s just a selection. Now we have nCoV-2019, the latest thump on the drum.”

At the time, each of these outbreaks seemed to be massive threats to the global economy and yet they each eventually receded into memory.

Again, this time could certainly be different, but it’s important to keep things in perspective.

Your Asset Allocation Should Reflect Your Risk Tolerance

If this recent market drop scares you, it means your risk tolerance doesn’t match your asset allocation.

If you’re 100% invested in stocks but you’re not emotionally prepared to see your portfolio drop 10% without warning, then you’ve probably got too much invested in stocks. The percentage of your portfolio invested in stocks should reflect your risk tolerance.

How to Think About Market Drops

The way that you should think about this market drop is completely dependent on when you want to sell your stocks to fund your lifestyle.

If you don’t plan on selling your stocks for several decades, this drop shouldn’t bother you. In fact, it actually presents an opportunity to pick up more shares at cheaper prices. After all, you shouldn’t care about how much you can get if you sell now. You should care about how much you can get several decades from now when you actually need to sell.

And if you’re someone who needs to sell your stocks in the next few years to fund your lifestyle, hopefully your asset allocation isn’t heavily tilted towards stocks. It’s nearly impossible to predict where the stock market will be 1, 2, or 5 years from now. If you need to sell your stocks to fund your lifestyle in the short-term, your asset allocation should reflect this.

Prices Only Tell You How Much You Can Get If You Sell Now

I’ve seen so many people online say things like:

“Sucks to lose [INSERT SOME AMOUNT] in just five days.”

Actually, you haven’t lost anything if you haven’t sold. Stock prices only tell you how much money you can get if you sell them now.

If you buy one share of stock for $100 and the price drops to $90, it simply means you can get $90 if you sell it now. But if you have no interest in selling it for several years or decades, you shouldn’t care about how much you can get for it now.

Stocks Typically Perform Well Following Big Drops

Ben Carlson did a neat analysis recently that looked at how stocks perform after a big down month, similar to the one we just had in which the S&P 500 dropped 8.2% on a total return basis during February.

He looked at every 8-9% down month in history and found:

- Stocks were higher 59% of the time just one year later.

- Stocks were higher 82% of the time three years later.

- Stocks were higher 82% of the time five years later.

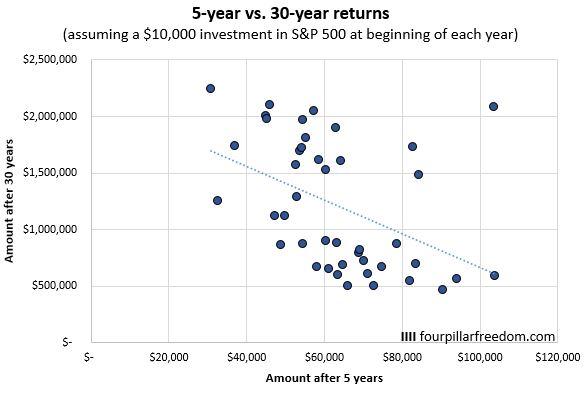

In general, the lower stocks go the higher the expected returns are in the future. I recently did an analysis of my own that confirms this fact. I looked at stock returns during every five-year and thirty-year period since 1926 and found that, in general, the worse stocks performed in the initial five years the better they performed over a thirty-year period.

It’s not fun to see stock prices drop in the present, but historical data tells us that poor early investment returns tend to be associated with higher long-term returns.

Focus on What You Can Control

As an investor, you can control:

- Your asset allocation

- Your behavior

- How much you pay in fees

- How long you remain invested

You cannot control:

- Investment returns

This seems obvious, yet most investors have a tendency to obsess over their investment returns even though these are largely out of their control.

As an investor, it’s your job to:

- Make sure your asset allocation reflects your risk tolerance.

- Avoid the temptation to buy and sell based on short-term news in the media.

- Ensure that you’re invested in low-cost funds.

- Keep a long-term vision.

Do these things and let the investment returns take care of themselves. There’s no point in stressing out excessively over things you can’t control.

A Guided Meditation for When the Stock Market is Dropping

Lastly, here’s a guided meditation from JL Collins that may help ease your anxiety about a potential market crash and serve as a reminder to keep your eyes focused on the long-term. It’s mostly a joke, but it actually has a ton of helpful advice on how to handle market drops.

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.