6 min read

There are three basic steps that anyone can use to build wealth:

1. Generate income. You can do this by providing value to society using unique skills and knowledge. The more unique your skill set and the more people you’re able to provide value to, the more income you earn.

2. Reduce expenses. Don’t spend every dollar you earn.

3. Invest what’s left over. Don’t just hide your cash under a mattress. Invest it into assets that will grow over time and thus add to your wealth.

When it comes to that third step of investing, one of the best assets available for most people to invest in are stocks.

Since 1928, the S&P 500 (a collection of the 500 largest stocks in the U.S.) has averaged roughly 7% annual returns, even after adjusting for inflation.

This means that a $100 investment in the S&P 500 is typically worth $107 a year later. Then $114.50 a year after that. Then $122.50…you get the idea. It’s the gift that keeps on giving.

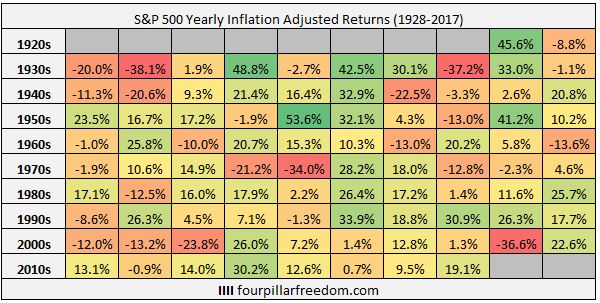

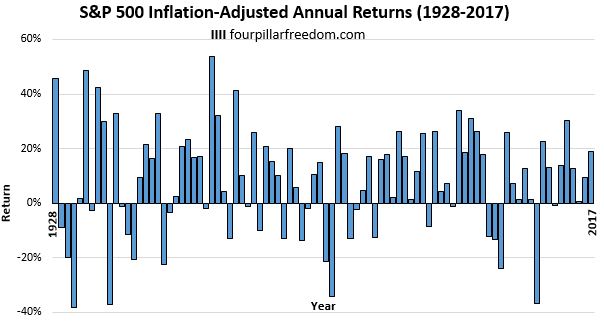

Granted, stocks don’t go up every year. There is certainly volatility over time, as the following chart of yearly S&P 500 returns shows:

But there are far more up years than down years:

And the longer your investment time horizon, the higher the probability that you’ll earn positive returns.

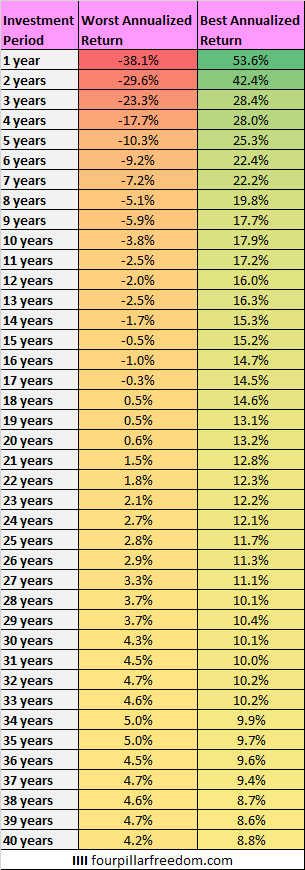

The following table shows the best and worst annualized returns for every investment period since 1928 ranging from a period of 1 year up to 40 years:

The S&P 500 has never lost money over any 18-year period and during the worst 30-year period it still delivered 4.3% annual returns even after inflation, which was good enough to triple an original investment.

Simply put, stocks go up over time.

But why?

In this post, I’ll share the underlying reasons for why the stock market tends to go up over time.

What is a Stock?

Before we can understand why the stock market as a whole goes up over time, we first need to understand individual stocks.

A stock is a share in a company. When you purchase a share of stock in a company, you actually become a partial owner of that company.

The percentage of the company that you own is dependent on how many total shares there are. For example, suppose the company is divided into 100 shares. If you buy one share, then you own 1% of the entire company. Or if the company is divided into 1,000 shares, then one share would represent just 0.1% of the company.

In the real world, the largest companies have millions or even billions of total shares. For example, at the time of this writing Apple has 4.38 billion shares. So, if you own one share of Apple then you own less than 0.0000000003% of the company. That’s a pretty tiny piece of the whole thing.

Because anyone can go out and buy Apple, though, it means millions of people out there all own tiny pieces of it.

How Can You Make Money Through Owning Stocks?

When a company like Apple generates profits, it can do a few different things with those profits:

(1) Pay out part of the profits to shareholders. These are called dividends.

(2) Reinvest in the company through hiring more employees, building more stores, conducting more research and development, and other activities to earn even more money.

(3) Buy back shares from other shareholders.

Recall that if you own a share of stock in Apple, then you have a right to these profits. This means you’ll receive (1) any dividends the company pays out and the value of your share will tend to increase over time as the company (2) reinvests profits in a myriad of ways and (3) buys back shares – which reduces the total number of shares and thus increases the value of your individual shares.

Thus, you earn money when Apple pays you a dividend and when the value of your shares increase.

Why Does a Stock Price Go Up Over Time?

When you buy a share of stock in a company, you’re buying a stake in the company’s future cash flows. For example, Apple will generate cash flows in 2021, 2022, 2023, and so on. The price that you pay for one single share of stock in Apple today is equal to the sum of all of its future cash flows.

To determine the value of the sum of its future cash flows, we must understand a concept known as discount rate.

Suppose there was some savings account out there that paid 10% annual interest. If you put $100 into this account, it would be worth $110 one year from now. The future value of the future $110 discounted at a rate of 10% makes the present value equal to $100.

The whole idea behind this is that a dollar today is worth more than a dollar in the future. Most people would rather have $100 guaranteed today rather than the possibility of $110 in one year from now.

When you invest in a stock, you do something similar. You apply a discount rate to the future cash flows. If you invest $100 today and expect to have $110 a year from now, then your discount rate is 10%. This is the return that you earn as an investor to compensate for the risk that you’re taking since it’s entirely possible that the company could fail to deliver the cash flow.

The further out the cash flow is into the future, the less you’re willing to pay for it because it involves more risk and uncertainty. We can use the following formula to calculate how much we should pay for cash flow depending on how many years it is in the future:

Amount to pay: cash flow / (1 + discount rate)t

where t = number of years

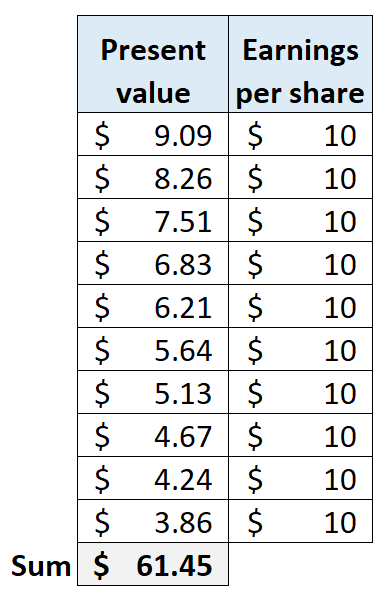

For example, using a 10% discount rate if we think we can earn a return of $10 per share in one year, then we’ll pay $10 / (1.10)1 = $9.09 right now.

If we think we’ll earn $10 again in year two then we’ll pay $10 / (1.10)2 = $8.26 for that $10. We pay less for that $10 because it’s further away and involves more uncertainty. We want to get compensated for our uncertainty, so we pay less.

Now imagine that we think a company will earn $10 per share every single year for the next 10 years. Using a 10% discount rate, we’ll pay $61.45 for one share to have the rights to that cash flow for the next 10 years:

As a company is able increase its earnings per share due to inventing new products, reducing costs, or gaining more customers, then its projected earnings per share could increase over time and be projected to increase at a faster rate.

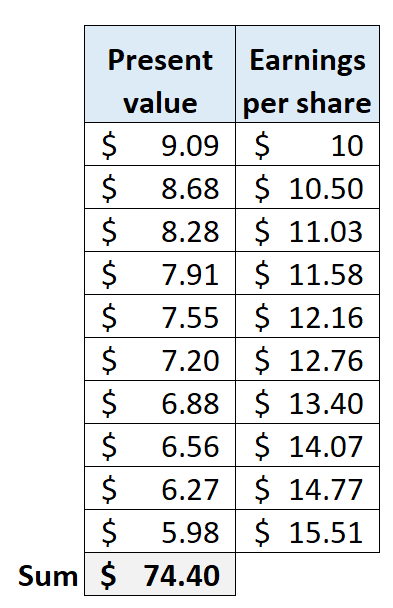

For example, suppose a company is able to grow their earnings per share at a rate of 5% per year. In this case we’d be willing to pay $74.40 to own a share.

For companies that are able to successfully grow their earnings, their stock price for one share will rise as the sum of their potential future cash flows rises.

As Apple has delivered higher returns over time, the price of one share of their stock has increased dramatically since it became a public company in 1980:

Individual Stocks vs. The Stock Market

Up to this point, we’ve used the example of buying a single share of stock in Apple, but there are actually thousands of different companies you can buy shares in. These thousands of companies make up the total stock market.

As an investor, you can choose to buy shares of stock in a single company like Apple, or you could buy shares in several companies – Apple, Walmart, Home Depot, Microsoft, etc. – or you could buy something called an index fund, which is a fund that holds hundreds or thousands of individual companies.

There are even total stock market index funds like VTSAX that hold every single publicly traded company in the United States. When you buy shares in this index fund, you’re effectively buying a tiny piece of ownership in every single publicly traded company in the U.S.

The benefit of buying shares in index funds is that they tend to deliver higher returns than most individual stocks.

In a fascinating study on stock performance, Longboard Capital Management analyzed the annual returns of 14,500 individual stocks from 1989 to 2015 and found that the top-performing 20% of stocks accounted for all of the gains in the stock market, while the bottom 80% provided an aggregate total return of 0%.

It’s hard to predict which individual companies will perform well in the future, let alone predict which companies will still be around. When you buy a stock index fund, you’re not making any predictions about individual companies. Instead, you’re betting on the success of the total stock market as a whole, which history tells us has been an excellent bet to make.

Why Should the Stock Market Go Up Over Time?

The underlying reason that the stock market should go up over time is because innovation, technological progress, and increases in productivity should lead to increased future cash flows for certain companies.

Granted, most companies will go out of business over a long enough time period, but the big winners – think of Apple, Amazon, Microsoft, Google, Netflix, etc. – will experience so much success and growth that they’ll lift the value of the entire stock market higher.

When you invest in the stock market, you’re making a bet on the progress of humanity. By owning shares of stock in hundreds or thousands of different companies, you give yourself a chance to take part in the upside of this growth and progress.

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.