5 min read

For investors who want to minimize their investment fees and maximize their portfolio diversification, an investment in an S&P 500 fund offers one of the easiest ways to do so.

The S&P 500 is composed of the 500 largest publicly traded companies in the U.S. This includes companies that operate in a variety of sectors including information technology, communication services, finance, health care, and more.

Related: Here’s How the S&P 500 Has Performed Since 1928

Some of these companies are considered to be growth companies while others are considered to be value companies.

Growth companies:

- Companies that are expected to grow faster than others. Since growth is their priority, these companies tend to reinvest their earnings in things like more workers, new equipment, and acquisitions.

- Stock prices for these companies tend to be high relative to their profits since the market expects their profits to grow significantly in the future.

- These companies tend to experience higher stock price volatility relative to value companies.

Value companies:

- Companies that trade at a price considered to be a bargain relative to their true value. Since growth is not their main priority, these companies tend to deliver returns to investors in the form of dividends.

- Stock prices for these companies tend to be low relative to their profits since the market doesn’t expect their profits to grow significantly in the future.

- These companies tend to experience lower stock price volatility relative to growth companies.

Some investors like the idea of owning an S&P 500 fund because it contains both growth and value stocks. However, some investors prefer to own one type of stock more than the other. For these investors, their are both growth funds and value funds they can invest in.

In this post, I’ll compare three different index funds offered by Vanguard that give investors exposure to these different types of stocks:

VOO – Vanguard S&P 500 ETF

VOOG – Vanguard S&P 500 Growth ETF

VOOV – Vanguard S&P 500 Value ETF

Note: No matter which fund you choose to invest in, I highly recommend using Personal Capitalto track your investments. It’s a completely free tool that makes it easy to track the value of your investments and ensures that you’re paying the lowest fees possible.

Let’s explore these funds!

VOO vs. VOOG vs. VOOV: An Overview

The following table provides an overview of each fund:

| VOO | VOOG | VOOV | |

|---|---|---|---|

| Fund Type | Exchange Traded Fund (ETF) | Exchange Traded Fund (ETF) | Exchange Traded Fund (ETF) |

| Expense Ratio | 0.03% | 0.15% | 0.15% |

| Category | Large Blend | Large Growth | Large Value |

| Number of Stocks | 508 | 297 | 384 |

| Dividend Yield | 1.97% | 1.42% | 2.43% |

The funds have the following similarities:

- Each fund is an exchange traded fund (ETF), which means the minimum investment for each fund is simply the price of one share.

- Each fund invests in large-cap stocks.

The funds have the following differences:

- The expense ratio for VOO (0.03%) is lower than both the growth (0.15%) and value (0.15%) funds. That is, if you invest $10,000 into each fund you would pay $3 each year in management expenses for VOO and $15 each year for VOOG or VOOV.

- VOO contains the most individual stocks, which means it offers more diversification than VOOG or VOOV.

- The dividend yields differ between the funds. As expected, the growth fund VOOG provides the smallest yield (1.42%) while the value fund VOOV provides the highest yield (2.43%).

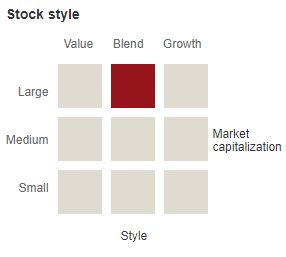

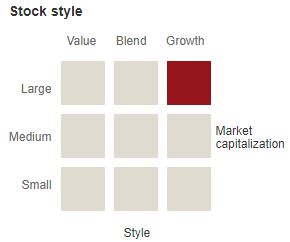

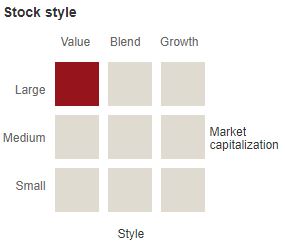

Vanguard also provides a neat grid visualization that shows the size and style of stocks that each fund invests in:

VOO – Vanguard S&P 500 ETF

VOOG – Vanguard S&P 500 Growth ETF

VOOV – Vanguard S&P 500 Value ETF

As mentioned earlier, each fund invests in large-cap stocks; the difference lies in the type of large-cap stocks they invest in.

Differences in Composition

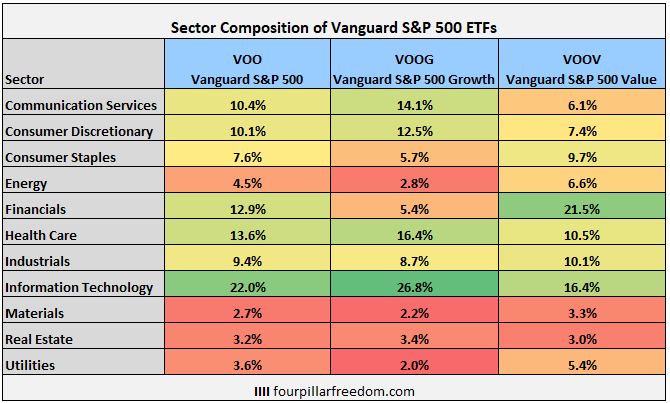

The following chart shows the differences in sector composition between the funds:

It’s clear that the Vanguard S&P 500 Growth Fund is heavily tilted towards information technology stocks, which makes sense considering these are the types of stocks that tend to be high-growth, high-volatility.

Conversely, the Vanguard S&P 500 Value Fund tends to hold more financial stocks that experience low growth but are more predictable and pay higher dividends. In addition, the value fund holds higher percentages of utility, energy, materials, industrials, and consumer staples stocks compared to the growth and balanced fund.

To get an idea of the actual companies that these funds invest in, check out the following table that shows the top 10 holdings for each fund:

Notice how the growth fund holds tech giants like Amazon, Google (Alphabet), and Facebook, while the value fund holds large financial companies like JPMorgan Chase, Bank of America, and Wells Fargo.

It’s interesting to note that there is a bit of overlap between the holdings in the growth fund and the value fund, though. For example, both funds hold Johnson & Johnson, Walt Disney, and Berkshire Hathaway to name a few. While the funds do hold different types of stocks, they aren’t mutually exclusive.

Differences in Performance

There are differences in composition between these three S&P 500 funds, but do these differences lead to different investment performance?

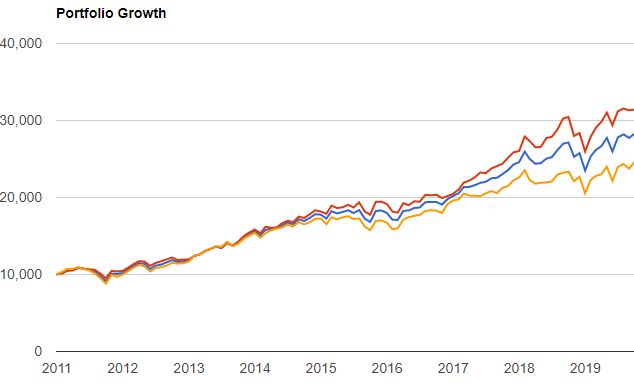

To find out, we can use Portfolio Visualizer to analyze how an initial $10,000 yearly investment into each of these funds performed since 2011. (I am using 2011 as the starting point because that’s the earliest year that each of the these three specific Vanguard funds existed)

Note: Red = Growth fund, Blue = Balanced fund, Yellow = Value fund

The following table shows a summary of the investment returns for each fund:

| VOO | VOOG | VOOV | |

|---|---|---|---|

| Fund | Vanguard S&P 500 ETF | Vanguard S&P 500 Growth ETF | Vanguard S&P 500 Value ETF |

| Final Ending Amount | $28,290 | $31,416 | $24,637 |

| Annual Return | 12.62% | 13.98% | 10.85% |

| Standard Deviation | 11.66% | 11.55% | 12.52% |

During this time period the growth fund performed the best, delivering incredible 13.98% annualized returns. Not only that, but it also experienced lower volatility than both the value fund and the balanced fund.

Although the growth fund offered the best performance during this period, it’s important to keep in mind that this is a relatively short time frame in the grand scheme of things.

To get an idea of how growth funds and value funds perform over longer stretches of time, we can refer to some data by Fidelity that summarizes how both large-cap growth and large-cap value stocks performed from 1990 through 2015:

S&P 500: Average annualized return = 9.29%, Standard deviation = 17.99%

Large-cap growth stocks: Average annualized return = 8.60%, Standard deviation = 21.42%

Large-cap value stocks: Average annualized return = 9.03%, Standard deviation = 16.67%

Note: Growth stocks are defined as the average of the Russell 1000 Growth Index and the Lipper U.S. Index of Large Growth Funds. Value stocks are defined as the average of the Russell 1000 Value Index and the Lipper U.S. Index of Large Value funds.

So, during this 26-year period value stocks actually delivered higher annual returns with noticeably lower volatility compared to growth stocks. This is the exact opposite of the results that we saw from 2011 to present.

The unsatisfying answer to “do growth or value stocks deliver better returns?” is it depends on the time period. Recently growth stocks have dominated. Historically, value stocks have outperformed over the long haul. It’s difficult to predict which type of stock will perform best in the future.

VOO vs. VOOG vs. VOOV: Which Should You Invest In?

The decision to invest in an S&P 500 fund, an S&P 500 growth fund, or an S&P 500 value fund is highly personal. Some investors prefer to own growth stocks that have the potential for explosive gains while others prefer the higher dividends and lower volatility that tend to come with value stocks.

Personally I choose to invest in VOO because I have no interest in predicting whether or not growth or value stocks will outperform in the future and I prefer the slightly lower management fees of VOO compared to VOOG and VOOV.

Fortunately, both large-cap growth and large-cap value stocks have a historical track record of delivering positive returns over the long haul.

At the end of the day, whether you choose VOO, VOOG, or VOOV, you can be sure that you’re investing in funds with lower-than-average management fees that offer significant diversification across a variety of sectors.

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.