4 min read

In The Bogleheads’ Guide to the Three-Fund Portfolio, author Taylor Larimore gives several reasons for why index funds are better investment vehicles than individual stocks for most investors:

1. Index funds outperform most individual stocks.

2. Index funds offer maximum diversification, and thus lower risk.

3. Index funds offer the easiest way to minimize investment fees.

One of the most popular index funds is the S&P 500, a stock market index fund composed of the largest 500 publicly traded companies in the U.S. that captures about 80% coverage of the total U.S. market cap.

One of the most well-known supporters of S&P 500 index funds is famous investor Warren Buffett. He believes that the average investor can outperform most actively managed funds if they simply buy and hold shares in an S&P 500 index fund for several decades.

He even once made a bet that the S&P 500 could outperform any group of actively managed funds over a ten-year period and easily won that bet.

Although the S&P 500 isn’t guaranteed to produce positive returns every year, it has an impressive track record of producing positive returns over long time horizons.

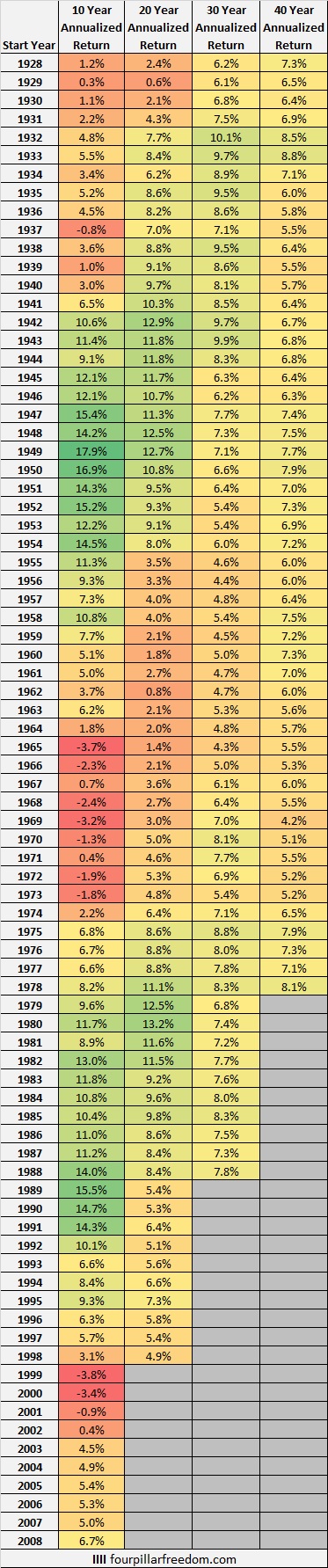

To illustrate this, check out the table below that shows the 10, 20, 30, and 40-year S&P 500 annualized returns for every year since 1928:

Here’s a summary of these returns:

It’s clear that the longer your time horizon, the higher the probability that an investment in the S&P 500 will produce positive returns. This is excellent news for investors who have a long investment time horizon.

Comparing Three S&P 500 Fund Choices

Once you’ve been convinced that the S&P 500 is an excellent investment vehicle, the only decision you have to make is which S&P 500 fund to invest in.

There are several different options for S&P 500 funds on the market, but in this article I’ll compare three popular choices:

SPY – SPDR S&P 500 ETF Trust

VOO – Vanguard S&P 500 ETF

IVV – iShares S&P 500 Index

The following table shows some basic information about each fund:

| SPY | VOO | IVV | |

|---|---|---|---|

| Fund Type | Exchange Traded Fund (ETF) | Exchange Traded Fund (ETF) | Exchange Traded Fund (ETF) |

| Expense Ratio | 0.09% | 0.03% | 0.04% |

| Inception Date | 1993 | 2010 | 2000 |

| Assets Under Management | $262 billion | $119 billion | $185 billion |

Let’s check out the similarities and differences between these funds:

Similarities

1. All three funds seek to track the performance of the S&P 500

2. All three funds are exchanged traded funds, meaning you can buy and sell shares in them just like individual stocks during any time when the market is open for trading.

Differences

1. SPY has been around the longest (1993) and has the most assets under management ($262 billion), which makes it preferable among active investors who want to buy and sell shares with low bid-ask spreads. Conversely, VOO and IVV have only been around since the 2000s and have considerably smaller assets under management. For investors who have long time horizons, this difference is likely unimportant.

2. SPY has a larger expense ratio than VOO and IVV. If you invest $10,000 into each fund, you will pay $9 per year in fees for SPY, $3 per year for VOO, and $4 per year for IVV.

Comparing Performance: VOO vs. SPY vs. IVV

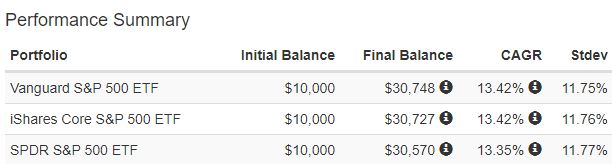

Using Portfolio Visualizer, we can easily compare the performance of each ETF since 2010, the earliest date that all three funds have been around since:

All three funds have produced similar results, which isn’t surprising since they all three seek to track the same collection of stocks.

SPY (SPDR S&P 500 ETF) has produced slightly lower annual returns, likely because the expense ratio is higher.

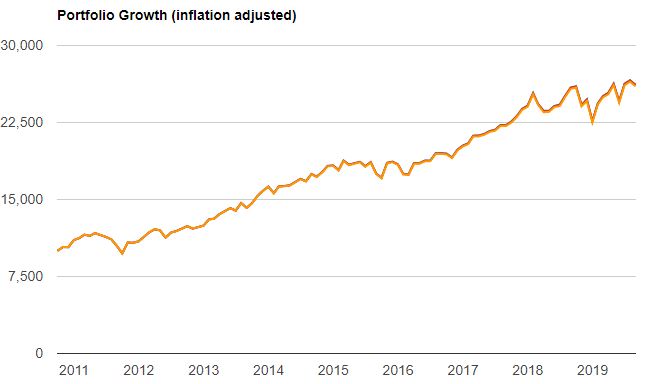

The following chart shows the inflation-adjusted growth of a $10,000 investment in each ETF since 2010:

Notice how all three lines overlap heavily, which makes sense because they should be perfectly correlated considering they hold the same collection of stocks.

Which S&P 500 Fund Should You Invest In?

We’ve seen that all three funds – SPY, VOO, and IVV – track the performance of the S&P 500 index, and thus have virtually identical annual returns. The biggest difference among them is that SPY has a higher expense ratio than VOO and IVV, but this difference is still fairly small.

The one factor that may impact your decision to invest in one of these funds over the other is whether or not you have access to them. For example, you may only have access to one of these funds within your 401(k) account offered by an employer, which means your decision is made for you.

I personally prefer to invest in VOO because most of my other investment accounts are already with Vanguard, so it makes since to invest in a fund with the investment platform I already use. However, no matter which fund you decide to invest in, you can expect roughly similar returns over the long haul.

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.