4 min read

The last two weeks have been particularly volatile in the stock market.

While I had seen a few people on Twitter mention the volatility, I wasn’t actually aware of the exact price fluctuations because I don’t keep tabs on the stock market on a daily basis.

This might sound odd to some, considering I currently have around $100,000 invested in stock market index funds. This means a 5% drop in prices in a given week would drop the value of my holdings to $95,000. Conversely, a 5% increase would cause my portfolio value to balloon to $105,000.

That’s a significant amount of money. Shouldn’t I be watching my investments a little closer?

No, I shouldn’t. Here’s why.

Stock Market Prices: The Annoying Neighbor

Imagine you have a beautiful apple tree in your front yard. It grows a few inches each year and it produces delicious apples that you and your family eat on a regular basis.

Now imagine you have an annoying neighbor who shows up at your house five days per week, each day offering to buy your apple tree from you for a slightly different price.

Each day you tell your neighbor that you are not interested in selling it because you plan on living in that house for at least another fifteen years while you raise a family and you want to enjoy the fruits of the tree year after year.

This means that if your neighbor offers you $100 to buy the tree one day, then comes back a week later and only offers you $95, it makes no difference to you whatsoever because you’re not interested in selling.

This situation is a metaphor for the stock market. Your apple tree represents your investments and your annoying neighbor represents the stock market that presents you with different prices that it’s willing to pay you for your investments five days per week.

What’s obvious in the story is that you plan on owning the apple tree for specific amount of time and so you don’t care how much your neighbor offers you for the tree on a daily basis. Since you’re only interested in selling the tree many years from now, the price that your neighbor offers you from one day to the next is irrelevant.

Similarly, when you invest in the stock market, you should have a specific amount of time that you plan on holding your investments for and any price fluctuations along the way shouldn’t faze you.

For example, if you invest in a total stock market index fund like VTI or VTSAX and you plan on holding your investments for 15 years, you shouldn’t be fazed when the stock market presents you with a lower price that it’s willing to pay you during the short-term.

After all, the stock market only tells you how much money you will receive if you decide to sell your investments on a given day. If you’re not interested in selling, though, then these prices are just noise and they’re not worth paying attention to.

You wouldn’t get nervous over the price that your annoying neighbor is willing to pay you for your apple tree, so why would you get nervous over the price of stocks on a daily basis?

When Your Asset Allocation Matches Your Life Goals, Stock Market Volatility Shouldn’t Bother You

You may have read the previous story and thought, “Yeah I understand that I shouldn’t worry about stock market volatility if I plan on holding my investments for a long time, but what if I need to sell my investments within the next three years, or even sooner? Surely the prices matter then.”

The answer is: Yes, if you plan on selling your investments soon, then short-term stock market volatility does matter. After all, if you need to sell your investments within the next three years, it’s entirely possible that your investments could experience a shitty stretch of three years and that you could receive far less than you want when you decide to sell.

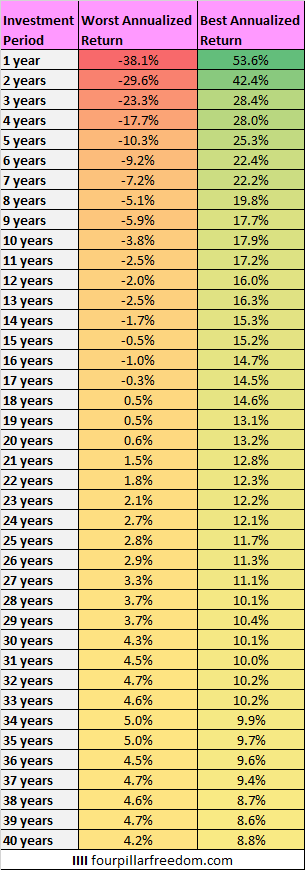

For example, in one post I analyzed the best and worst investment periods for the S&P 500 since 1928:

During the worst three-year period, the S&P 500 experienced -23.3% annual returns. This means that if you had all of your investments in stocks during that period, you would have been hurting pretty bad when you went to sell.

The way to ensure that your investments don’t experience a rapid drop at the exact point when you need to sell is to make sure that your asset allocation aligns with when you need to sell your investments.

Your asset allocation simply refers to what percentage of your money is invested in certain asset classes. For example, two different types of asset classes are stocks and bonds.

As a rule of thumb:

Stocks are high-growth and have high volatility.

Bonds are low-growth and have low volatility.

This means that if you don’t plan on selling your investments for many years, it’s a good idea to have a higher percentage of your money invested in stocks and similar high-growth asset classes since you have many years to ride out the volatility that comes with these types of investments.

Similarly, if you plan on selling your investments relatively soon, it’s a good idea to have a higher percentage of your money invested in low-growth assets like bonds or high-interest savings accounts that are less prone to volatility.

The idea here is simple: The percentage of your portfolio that you have invested in stocks (and other high-growth / high-volatility assets) should align with when you need to sell your investments.

If you don’t plan on selling your stocks for a long time, a stock market drop shouldn’t faze you.

And if you plan on selling stocks soon, a stock market drop shouldn’t be a big deal either because you should have a smaller percentage of your portfolio invested in stocks in the first place.

Why Stock Market Volatility Doesn’t Faze Me

Stock market volatility doesn’t faze me personally because I don’t plan on selling my stock index funds any time soon (if ever) to pay for my lifestyle expenses.

Currently I earn enough from my online businesses to cover my lifestyle expenses each month, which means I don’t have to think about whether or not I should sell my stocks on a daily, weekly, or monthly basis to help pay the bills.

This is exactly why I don’t track the daily price movements of the stock market and it’s why stock market volatility doesn’t faze me.

If the recent market volatility has affected how you personally sleep at night, perhaps your asset allocation doesn’t align with when you need to sell your stocks.

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.