7 min read

I have always been fascinated by the concept of compound interest.

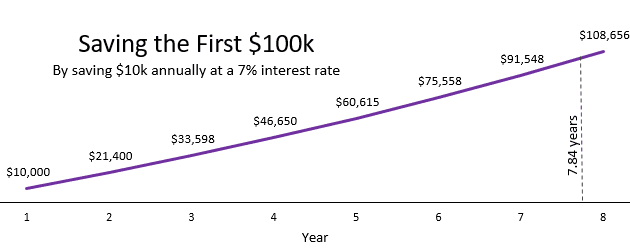

One of my favorite examples that I show people to illustrate the power of compound interest is the following: Consider someone who invests $10,000 each year into the stock market and earns an average annual return of 7%. Assuming they start with $0, it would take this person 7.84 years to accumulate $100,000.

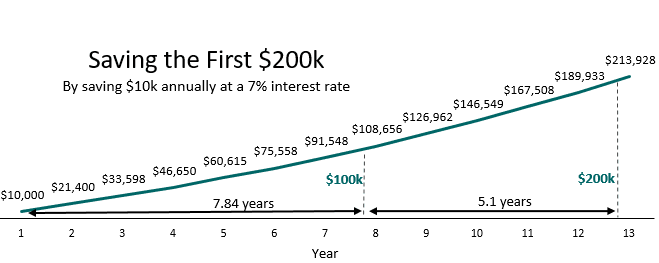

However, if they just keep investing $10,000 each year, it would only take them an additional 5.1 years to accumulate their next $100k:

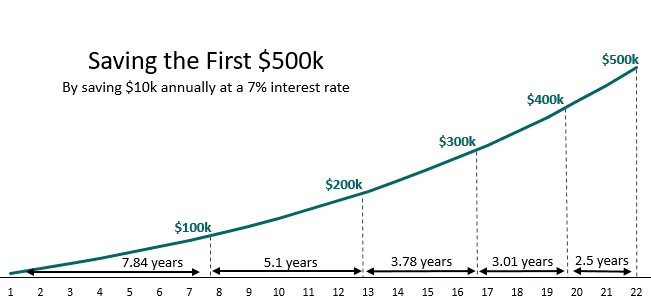

As long as they keep investing $10,000 each year, each additional $100k will come quicker than the last:

This is the power of compound interest at work. It’s weak in the early years, but powerful in the later years.

But the fact that compound interest produces most of the crazy gains towards the tail end has always bothered me.

It’s cool that someone who invests $10k each year at 7% starting at age 25 can stack up half a million dollars by age 47, but they still have to spend 22 of their youngest working years to make it happen.

For people who enjoy their day job, this might not be a big deal. Unfortunately, most people are not actively engaged at their jobs, so sacrificing their youngest years working at a job they don’t love just to earn enough money to get the compound interest flywheel spinning isn’t an enticing proposition.

Fortunately, there are two ways to get around this:

1. Save enough money in a short enough amount of time that you don’t need compound interest to hit your financial goals.

2. Take the slow, traditional approach to saving for retirement to take advantage of compound interest, but actually do work you enjoy along the way so the journey isn’t just a retirement waiting game.

Let’s check out the pros and cons of each approach.

Approach #1: A High Savings Rate and a Short Unenjoyable Journey

The first approach you can take involves saving such a high percentage of your income that you can hit your financial goals in a short amount of time, eliminating the need to earn investment returns over the course of several decades.

Let me explain.

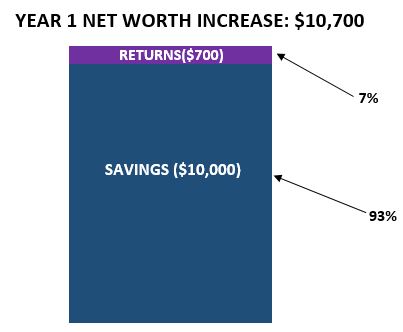

Suppose you invest $10,000 in the stock market in a given year and earn a 7% return on your investment.

At the end of the year, you have your initial $10,000 plus $700 in investment returns for a total of $10,700.

This means 93% ($10,000 / $10,700) of your net worth growth came from savings and only 7% ($700 / $10,700) came from investment returns.

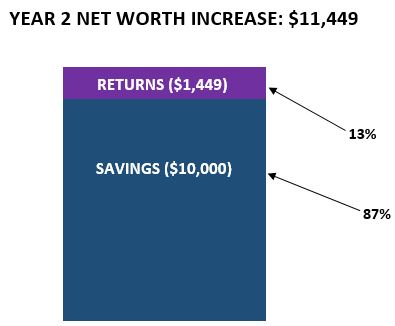

Suppose the next year you invest another $10,000 and again earn a 7% return.

This year you would earn $1,449 (($10,700 + $10,000) * 7%) from investment returns.

This means 87% ($10,000 / $11,449) of your net worth growth came from savings and 13% ($1,449 / $11,449) came from investment returns.

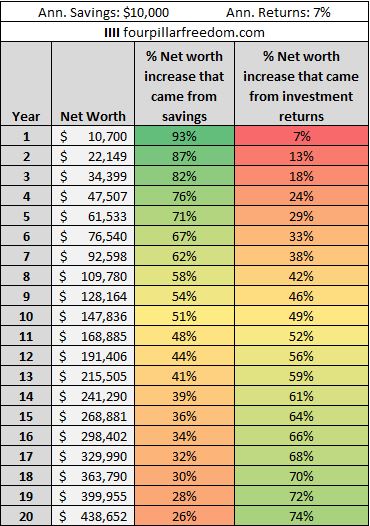

If we keep doing these calculations each year, we’ll find that investment returns account for more and more of yearly net worth increases as time goes on:

In year 1, investment returns only account for 7% of net worth growth. In year 2 they account for 13% of net worth growth. Then 18% in year 3, and so on.

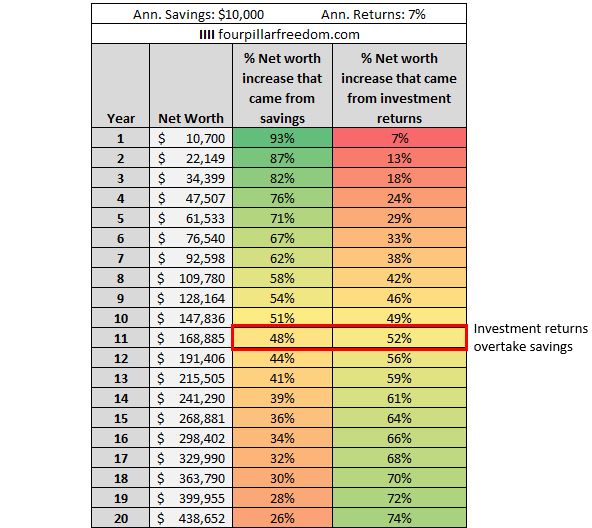

Notice how it takes about 11 years for investment returns to account for more yearly net worth growth than savings:

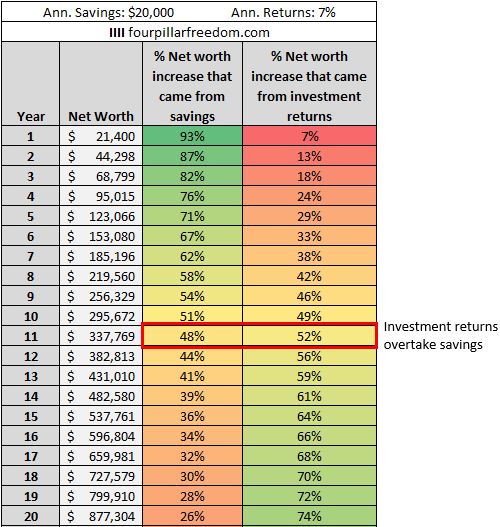

It turns out that no matter how much you save each year, these numbers hold true. For example, suppose you saved $20,000 consistently each year instead of $10,000:

Only the net worth numbers change. The percentages stay the same.

So, if your journey to financial independence is short enough, the amount you save actually matters more than the returns you earn.

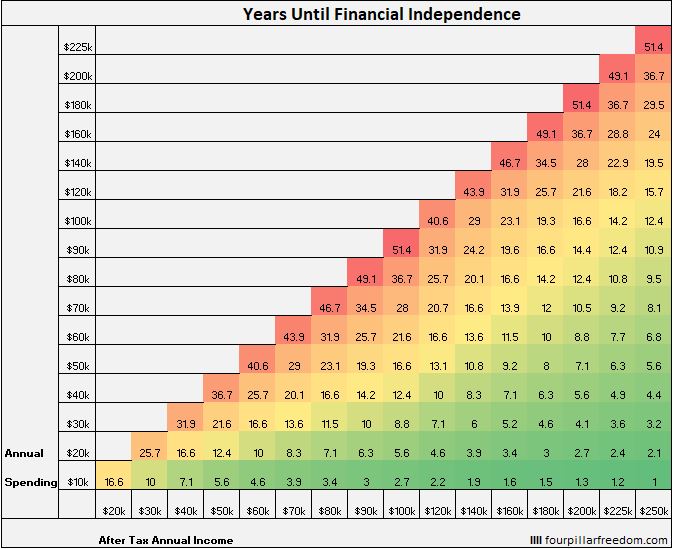

We can reference The Financial Independence Grid to see just how long it will take to achieve financial independence based on various annual income and spending levels.

The grid assumes you start with $0, invest the difference between your post-tax income and spending each year, and earn 5% annual investment returns.

With a 50% savings rate (e.g. after tax annual income of $80k and annual spending of $40k), it will take 16.6 years to hit F.I.

With a 66% savings rate (e.g. after tax annual income of $90k and annual spending of $30k), it will take 10 years to hit F.I.

The higher your savings rate, the shorter the path to financial independence.

And the shorter your path to financial independence, the less compound interest plays a role in building your net worth.

The Pros & Cons of this Approach

The obvious pro of this approach is that you can achieve financial independence in 10 to 15 years with a high enough savings rate and never need to worry about earning money ever again, assuming you follow The 4% Rule.

The con of this approach is that you most likely have to work at a job you don’t enjoy for a decade or more during the best physical years of your life.

Caveat: It’s possible to maintain a high savings rate and also enjoy your day job, which provides you with a short, enjoyable journey. This scenario is rare but it’s not impossible.

Approach #2: A Low Savings Rate and a Long Enjoyable Journey

The second approach requires you to take a fundamentally different view of financial independence. Instead of saving up enough money to never need to work again at a young age, consider instead if you actually did work you enjoyed for several decades, saving and investing a little bit each year.

This would allow you to take advantage of the power of compound interest over the course of several decades without spending the best physical years of your life stuck in a cubicle doing work you hate.

Of course, you may have to forego a lucrative day job, which means you’d have a lower savings rate and a longer journey to financial independence. What’s important, though, is that this journey would be far more enjoyable if you could do work you find meaningful on your own terms and on your own schedule.

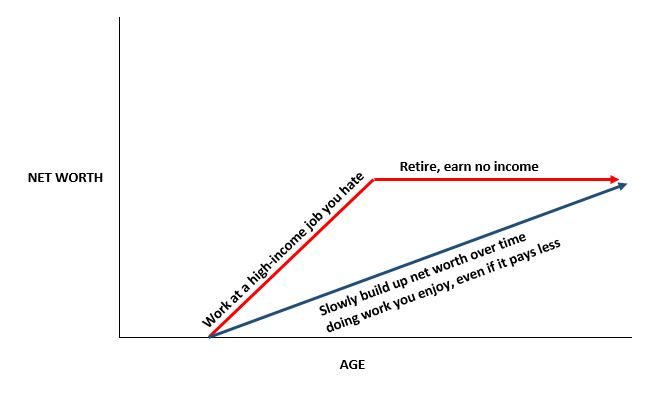

The following chart highlights the difference between this approach and the high savings rate approach:

Working at a high-income job you hate may allow you to stack your net worth at a faster rate, but you can still achieve that high net worth by taking a slower path while doing work you enjoy along the way.

The Pros & Cons of this Approach

The pro of this approach is that you can gain freedom over your time and your work at a young age, as opposed to spending the best physical years of your life in a cubicle.

The con of this approach is that if you aren’t able to cultivate the right skill set, you may not be able to actually find work you enjoy that pays enough to allow you to pay the bills and invest along the way.

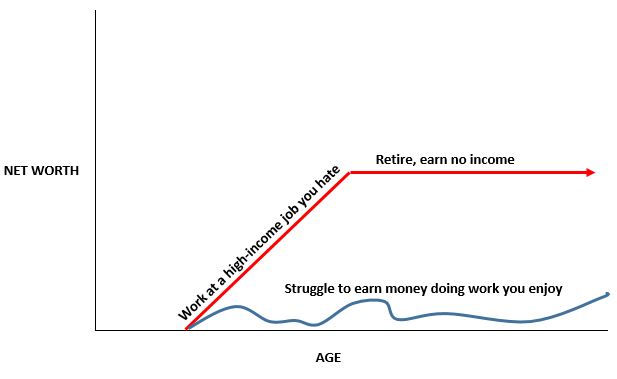

In the worst-case scenario, your path may look something like this:

This outcome might be worse than working at a high-income job you hate for a short period of time because it means you would always have to stress about paying the bills and you’re never able to invest enough to allow compound interest to propel you towards financial freedom.

How to Maximize the Likelihood of Having a Long Enjoyable Journey

One way to mitigate the risk of the approach outlined above is to save up a chunk of money before quitting your day job and to already be earning income from some source outside of your day job before you quit.

This is the exact strategy I followed when I decided to quit my day job.

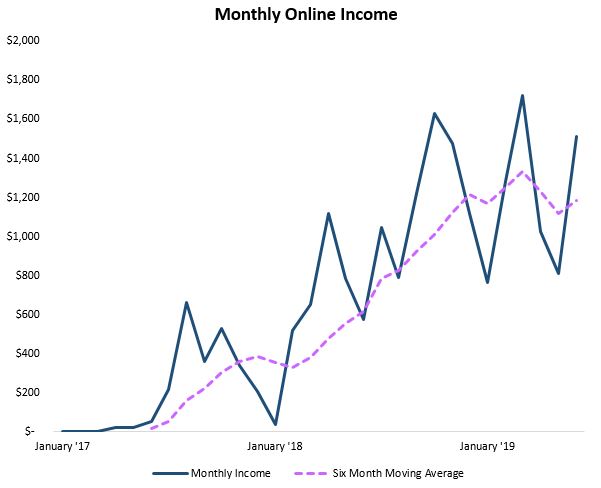

First, I looked at my income growth outside of my day job for the 2.5 years prior:

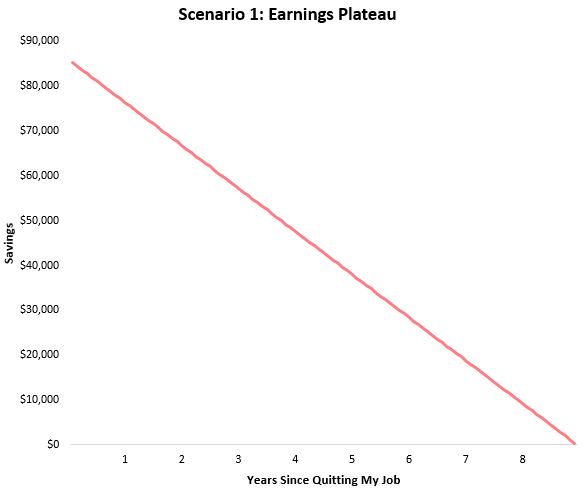

Then, despite a clear upward trend, I considered the scenario that my earnings could plateau at about $1,200 per month indefinitely. Based on the amount I had saved when I quit my job and my typical $2,000 monthly expenses, this meant I could still pay the bills for about nine years before completely running out of money.

Even for a worst-case scenario, this wasn’t bad at all.

Related Post: The Math That Explains My Decision to Quit My Job

So, because I had money saved up and because I had an increasing income stream outside of my day job, I felt comfortable with quitting. This meant I could gain a tremendous amount of freedom now while I’m young and still be able to save and invest for years to come so I can still enjoy the benefits that compound interest produces over the course of several decades.

It turns out that this cautious, conservative approach to quitting a job and pursuing work you enjoy is common among successful entrepreneurs.

In the book Originals: How Non-conformists Move the World, Adam Grant shares how entrepreneurs who keep their day jobs for a while are actually more likely to succeed in the long run:

Entrepreneurs who kept their day jobs had 33 percent lower odds of failure than those who quit. If you’re risk averse and have some doubts about the feasibility of your ideas, it’s likely that your business will be built to last. If you’re a freewheeling gambler, your startup is far more fragile.

Like the Warby Parker crew, the entrepreneurs whose companies topped Fast Company’s recent most innovative lists typically stayed in their day jobs even after they launched. Former track star Phil Knight started selling running shoes out of the trunk of his car in 1964, yet kept working as an accountant until 1969.

After inventing the original Apple I computer, Steve Wozniak started the company with Steve Jobs in 1976 but continued working full time in his engineering job at Hewlett-Packard until 1977.

And although Google founders Larry Page and Sergey Brin figured out how to dramatically improve internet searches in 1996, they didn’t go on leave from their graduate studies at Stanford until 1998.

The long, enjoyable path to financial independence offers the best of both worlds: freedom now and a large portfolio later. The key to making it work, though, is to have a plan in place for being able to do work you enjoy and for being able to earn enough income to pay the bills and invest along the way.

Conclusion

Here’s a quick recap of the big ideas in this post:

- Compound interest is a powerful force, but only if you give it several decades to work.

- Unfortunately, most people don’t enjoy their day jobs so waiting several decades for compound interest to propel them toward financial freedom isn’t enticing.

- One way to get around this problem is to simply save enough money in a short enough amount of time that you don’t need compound interest to achieve financial freedom.

- Another way to get around this problem is to cultivate a skill set that enables you to do work you enjoy on your way to financial freedom, while saving and investing along the way so that you can take advantage of compound interest over the course of several decades.

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.