5 min read

Last week I shared that I quit my day job as a data scientist so that I could work on my online businesses full-time. I was confident enough to make this decision because the numbers made sense financially.

Today I’ll explain what I mean by “the numbers made sense financially” using some simple math and some cool charts.

Do I Have Enough Money to Quit My Job?

One of the most common rules of thumb people use for determining whether or not they have enough money to quit their day job is The 4% Rule, which states that once you build up a portfolio of 25 times your annual expenses you can then withdraw 4% of the portfolio each year to pay for your expenses with a high likelihood that you won’t deplete your portfolio.

However, The 4% Rule assumes that you earn zero money after you quit your day job. As I’ve written before, if you’re willing to earn income once you quit your job then the 4% Rule doesn’t apply and you don’t actually have to save up 25 times your annual expenses before leaving the rat race.

Related post: The 4% Rule Only Offers One Way to Cover Your Expenses

Personally I spend around $2,000 per month. Or $24,000 per year. That means I would need to save up 25*$24,000 = $600,000 if I wanted to follow The 4% Rule.

Unfortunately, at the time when I was contemplating quitting my job I only had a net worth around $140k. Here’s the exact breakdown of my financial assets at the time when I decided to quit:

Cash: $29,310

Tax-Advantaged Accounts: $53,711

Brokerage Accounts: $57,460

Alternative Investments: $2,945

Net Worth: $143,426

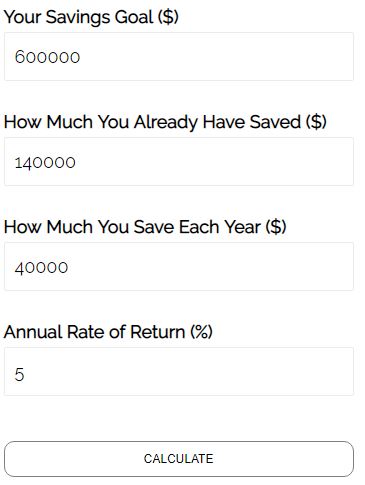

With a day job as a data scientist, I was able to save and invest around $40k each year. Assuming a 5% annual rate of return, The Savings Goal Calculator tells me that I would have to save and invest for another 8.2 years to build up a portfolio of $600,000:

Since I couldn’t fathom working in Corporate America for eight more years, I knew that following The 4% Rule wasn’t a good strategy for me.

Instead, I developed a plan to earn active income through my online businesses so that I could cover my living expenses entirely through enjoyable income streams instead of waiting until I had a portfolio large enough to cover all of my expenses passively.

Before I could quit my day job, though, I had to answer an important question: Do I have enough money in the bank and a strong enough growth trajectory with my online income to feel comfortable quitting?

To answer this question, I ran through some possible scenarios using some math and charts.

The Math Behind Different Financial Scenarios

I ran through several different scenarios.

Scenario 1: Earnings Drop to Zero

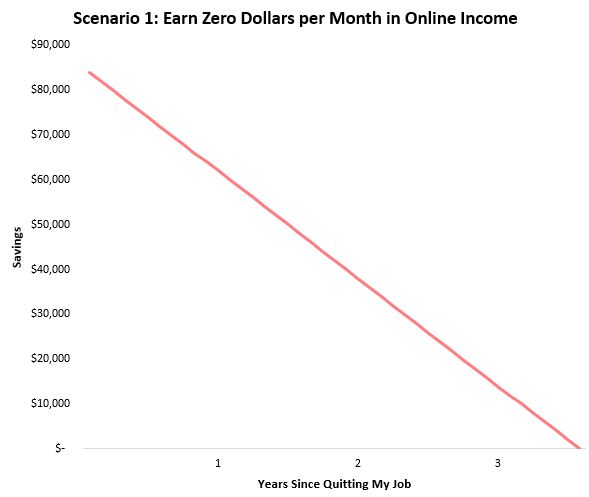

At the time when I decided to quit my job, I was already earning income online, but I still wanted to run the numbers on the worst possible scenario of suddenly earning $0 each month online and being in a position where I would have to rely completely on my savings to pay the bills each month.

When I decided to quit, I had $29k in savings and $58k tied up in investments in a brokerage account that I was willing to sell if I needed to.

I also had a little over $55k in tax-advantaged accounts and alternative investments, but these were investments I wanted to leave untouched for several decades so that they could grow on their own into huge sums of money one day.

So, I had about $86k in the form of savings and brokerage account investments that I could use to pay the bills. With average monthly expenses of $2k, this meant that I had enough money to last me $86k / $2k = 43 months (or 3.58 years) without earning a single dime of income online.

Scenario 2: Earnings Plateau

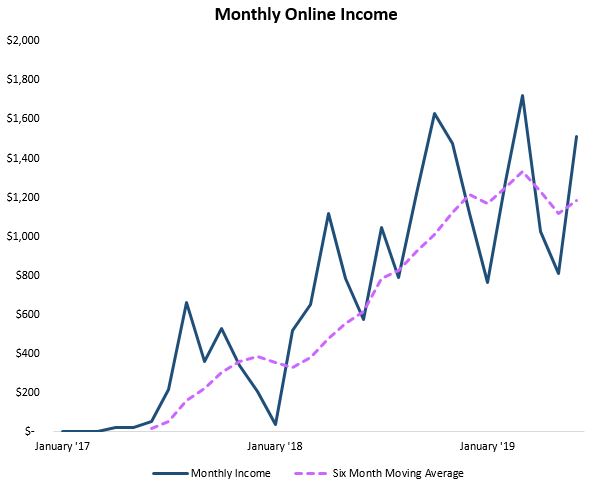

Although the worst-case scenario is technically possible, it’s highly unlikely. It’s far more likely that my online income will continue to follow the trajectory it has been on the past two and a half years.

Here’s a look at how much income I’ve earned online each month since January 2017:

It’s a bit sporadic from month to month, but there is a clear upward trend.

It might help if we throw a line on the graph to show the six-month moving average:

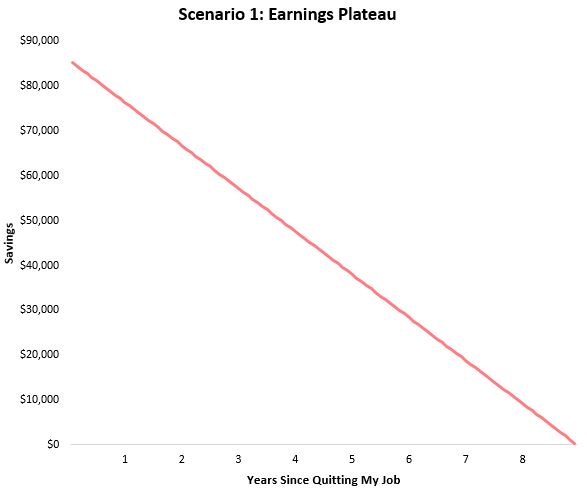

Despite a clear upward trend, it’s possible that my earnings could hit a plateau. For example, in 2019 I am averaging around $1,200 in monthly income. One possible scenario is that I simply remain at $1,200 in monthly income indefinitely.

In this case, with monthly expenses of $2,000, I’d have to dip into my savings for about $800 each month to cover the bills. In that scenario, my savings would last me $86k / $800 = 107.5 months, or about 9 years.

Scenario 3: Earnings Continue to Increase

A more optimistic and realistic scenario is that my earnings will continue to increase over time. The main reason for this is because I will be working on these income streams full-time as opposed to just in the mornings and weekends outside of my day job. With this extra time and effort, I expect my income to continue to increase, just as it has when I have been working on these income streams in my free time.

It’s incredibly difficult to predict just how much my income will increase, but even with a simple assumption of a $50 increase each month, I would be able to hit $2,000 in online income each month in just 15 months by September 2020:

Keeping Increased Costs in Mind

So, in the worst-case scenario I would run out of savings in about 3.5 years.

In the earnings-plateau scenario, I would run out of savings in about 9 years.

In the optimistic, yet seemingly realistic, scenario of increasing my monthly income by $50 each month, I would hit $2,000 in monthly income in about 15 months, which means I would never run out of savings since my online income would be able to cover all of my monthly expenses.

It’s important to note that in all of these scenarios I assume my monthly spending will remain constant at $2,000. While I do expect this spending to jump around from month to month, I expect it to remain fairly constant for the next two to three years anyway.

At some point in the future, though, I’d like to start a family and I know that my monthly expenses could increase to $4k per month or higher. That means I need to get my online monthly income beyond just $2k in the coming years.

Fortunately, I’m optimistic about being able to do this. If I have been able to grow my monthly income to $1,200 in just two short years in my spare time, I’m confident that I can grow it much higher with my full time and attention over the coming years.

Conclusion

I feel good about my decision to quit my day job because the numbers simply make sense.

In the worst-case scenario, I have enough savings to pay my bills for over three years. In the gloomy scenario that my earnings plateau, I have enough savings to pay the bills for nearly nine years. And in the most realistic scenario that my earnings continue to increase slowly over time, I’ll be able to pay for all of my monthly expenses in just over a year through my online income.

By running these numbers, I was able to feel confident in quitting my day job and gaining freedom over my daily schedule long before I had a portfolio large enough to never need to work again.

If you’re in a situation where you’re considering quitting your day job before you have enough money to follow The 4% Rule, I encourage you to run the numbers on some different scenarios yourself to see just how long your savings and your side hustle income could support you. Freedom might not be as far away as you think.

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.