5 min read

A couple days ago at work, one of my coworkers mentioned that he had bought shares in a Fidelity S&P 500 fund (FXAIX) at the beginning of the year when the price was around $87 per share. As of a couple days ago, the price per share had risen to $97.

He was wondering aloud whether or not he should sell his shares, take the quick profit, then simply sit back and wait for the market to drop again to repeat the process.

This simple concept – buy when prices are low and sell when prices are high – sounds like a fantastic idea. The only problem is that nobody actually knows when prices will drop. And when prices do begin to drop, nobody knows how far they will drop. This makes it nearly impossible to buy stocks at the bottom and sell at the top.

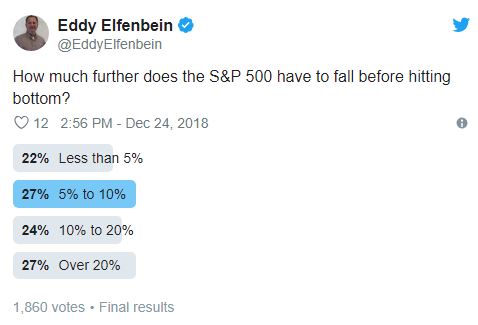

I was recently reminded of this in a blog post by portfolio manager Eddy Elfenbein. On Christmas Eve, Eddy ran a poll on Twitter asking folks how much further the market had to fall.

Eddy shares:

Most respondents thought it had further to go. Some thought it had a lot further. The median answer was about 10%. As it turned out, I posted the poll precisely 64 minutes before the lowest close.

In other words, we were right at the low just as people were worried that the low was still a good way off. Now here we are two months later, and the S&P 500 is up 18% since Christmas Eve.

So yeah, it’s hard to know how far the market will fall when it actually does start falling.

Likewise, it’s hard to know how far the market will rise before it finally experiences a downturn. There has been no shortage of warnings from market pundits, news anchors, bloggers, or that guy that sits near you at work about how the market could collapse at any point.

These warnings were particularly strong back in early 2016 when the market did take a minor tumble. But since then, prices have risen nearly 50%.

This doesn’t mean the market will continue to climb ever higher, but it does mean that it’s incredibly difficult to predict how far the market will rise or fall along with when it will do so.

This brings up the question: if it’s so difficult to time the market, then how exactly should you use the stock market to achieve your financial goals?

How to Use the Stock Market to Achieve Your Financial Goals

When you invest one dollar into the stock market, there’s no telling how much that dollar will be worth one year from now. In most cases, it will be worth more than one dollar, even after inflation. However, the stock market does drop from time to time, which means your dollar might actually be worth less one year from now.

The simplest way to think about stock market investing is this: the longer you leave your dollar invested, the higher the probability that it will increase in value.

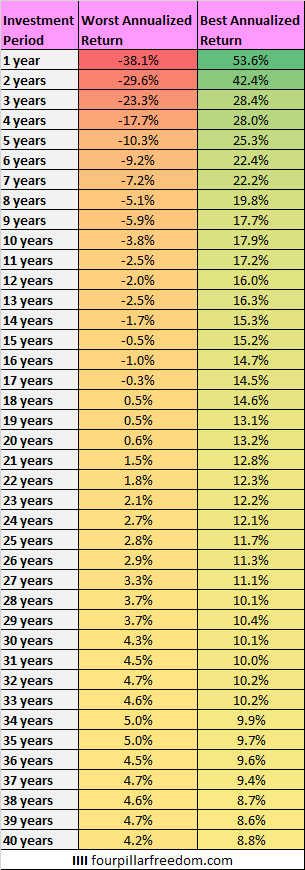

To illustrate this point, I recently visualized the best and worst investment periods in history:

Notice how the “worst annualized return” slowly creeps upward the longer the time horizon. In fact, there has never been an 18-year period in which the S&P 500 lost money, even after inflation.

What this means for you as an investor is that when you decide to invest a dollar into a stock market index fund like the S&P 500, you can expect that dollar to be worth much more a couple decades from now.

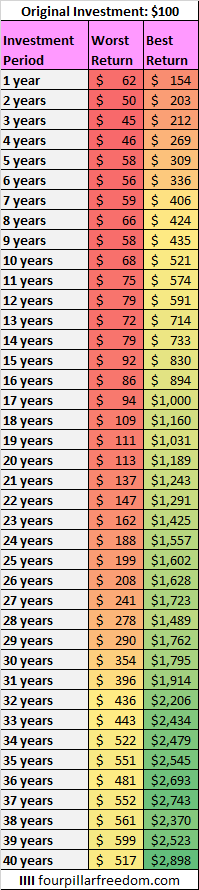

The following table shows what a $100 investment in the S&P 500 grew to during the best and worst time periods in history:

Notice how even during the worst periods, that $100 multiplied several times over if you simply let it sit for several decades. In fact, during the worst 30-year period, an investment in the S&P 500 more than tripled in value.

This means that the easiest way to benefit from the stock market is to invest in a low-fee index fund and simply let that investment sit for several decades untouched.

The bad news is that investing in stock market index funds will not make you rich in the short-term.

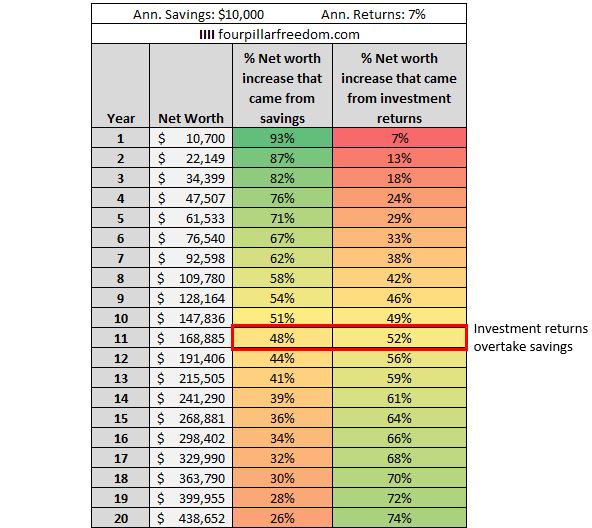

To illustrate why, consider someone who invests $10,000 each year and earns 7% annualized investment returns. The following table shows how much of their net worth increase each year is due to savings and how much is due to investment returns:

In this example, it takes over a decade for investment returns to become more important than savings. This is the nature of investment returns. They don’t impact your net worth much in the early years, but they become incredibly important in the later years.

For example, notice that 74% of your net worth growth would come purely from investment returns in year 20. At that point, your investment returns become the primary force that carries your net worth higher.

Conclusion

The stock market won’t make you rich in the short-term, but it can bring you serious wealth over the course of several decades. For those who want to get rich sooner, you need to focus purely on growing the gap between your income and expenses. One of the best ways to do so is to build a skill set that allows you to demand a high income for your time.

I have personally been able to grow the gap between my income and spending by doing the following:

- Landing a job as a data scientist with a starting salary of $80k

- Tutoring students in statistics for $40-50 per hour

- Building websites to earn $1,000+ per month in online income

- Keeping my big three expenses of housing, transportation, and food fairly low (monthly rent = $888, car = Honda Civic, food = cook most meals)

And I personally invest between $1,000 – $2,000 each month into a simple low-fee S&P 500 index fund that I don’t plan on touching for several decades.

No matter where you are on your own financial journey, I would encourage you to:

- Grow your income by picking up skills that most people consider hard.

- Keep your “big three” expenses of housing, transportation, and food manageable.

- Invest money now into low-fee stock market index funds and don’t touch those investments for several decades

- Avoid timing the market and resist the urge to buy and sell sporadically. Be patient and let the market do what it does.

In conclusion: The stock market rewards the patient. The economy rewards the rare. If you’re a patient investor, you’ll build wealth in the long-term. And if you possess a rare skill set, you’ll grow your net worth quickly in the short-term.

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.