4 min read

An emerging market is the name given to a country that is in the process of establishing a more mature marketplace, but does not yet have the economic strength of a powerful country like the United States or Japan.

Currently MSCI classifies the following countries as emerging markets:

- Argentina

- Brazil

- Chile

- Colombia

- Mexico

- Peru

- Czech Republic

- Egypt

- Greece

- Hungary

- Poland

- Qatar

- Russia

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- China

- India

- Indonesia

- Korea

- Malaysia

- Pakistan

- Philippines

- Taiwan

- Thailand

These are all countries that have growing economies, but are not yet at the level of the most developed countries in the world.

For investors, these countries are particularly appealing because their economies have more potential to grow compared to developed countries, which means investing in stocks in these countries could offer higher investment returns.\

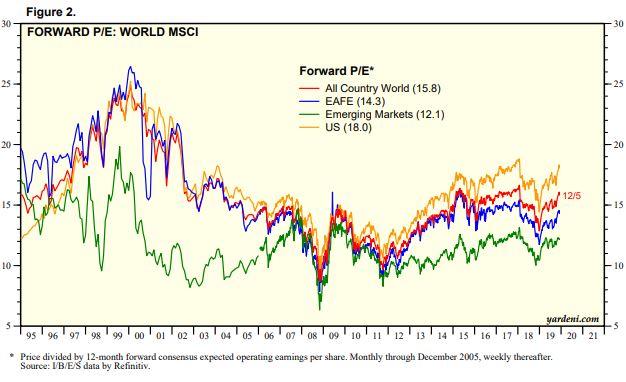

Plus, they tend to have cheaper valuations compared to developed countries, as the following chart from Yardeni Research shows:

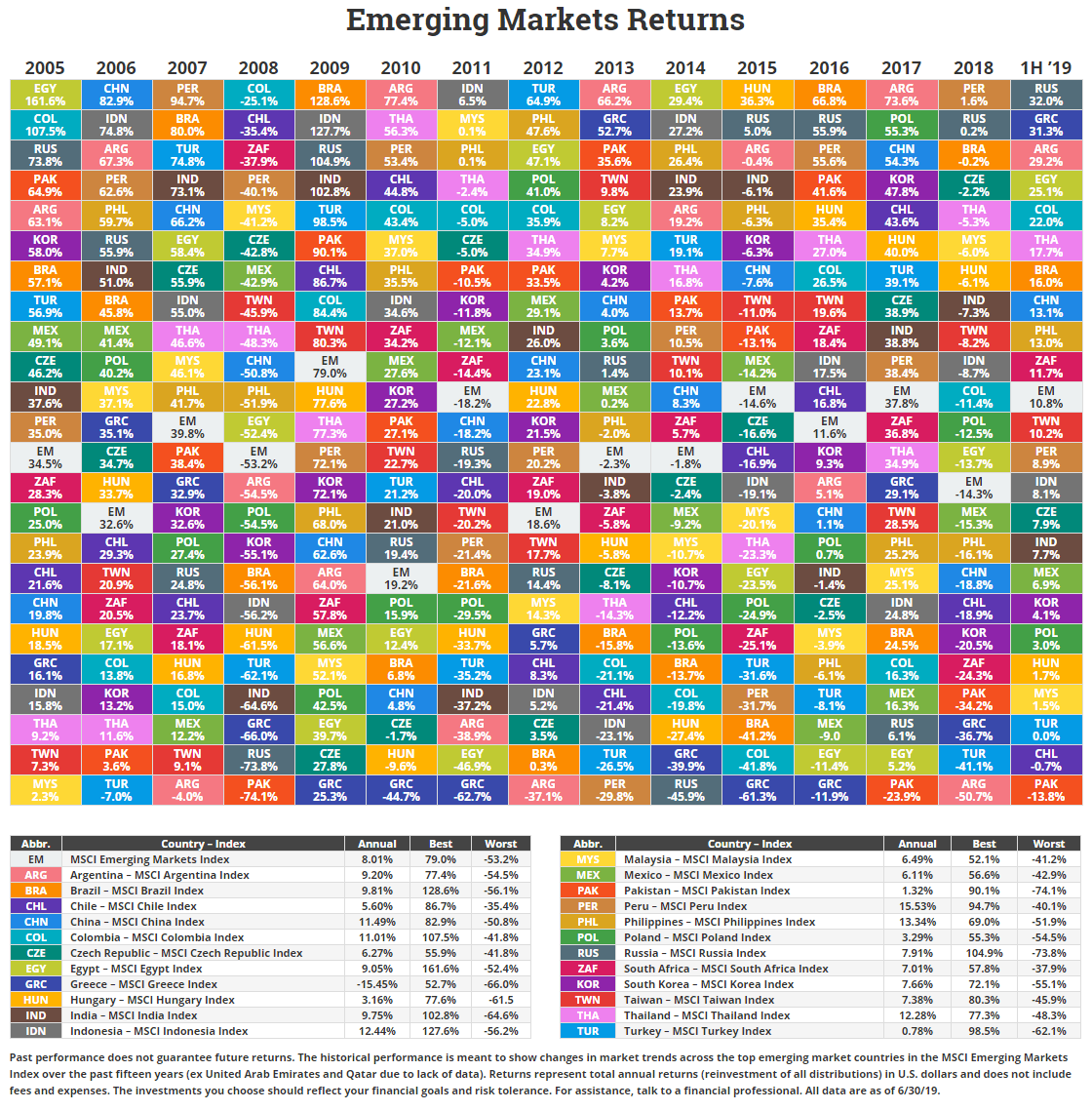

However, it’s tricky to know which countries will perform best from one year to the next. As evidence, check out the following chart from Novel Investor that shows the annual returns of different emerging market countries since 2005:

Source: Novel Investor

Source: Novel Investor

It’s virtually impossible to predict how each country will perform from one year to the next. It’s not uncommon for a given country to deliver the best returns in one year, followed by the worst returns in the next. This is the nature of emerging market countries: they’re volatile.

That’s why one of the easiest ways to sprinkle in some emerging market stocks into your portfolio is to buy an emerging market index fund that holds every emerging market country. This eliminates the need to pick and choose which countries to invest in.

However, do you actually need to invest in emerging markets at all? Can you just hold a total U.S. stock market fund like VTI or VTSAX and call it a day?

To answer these questions, let’s take a look at the historical returns of emerging market stocks and see if there is any benefit to adding them into your investment portfolio.

Visualizing Historical Returns of Emerging Markets

To analyze the historical returns of emerging market stocks, I used data from Portfolio Visualizer.

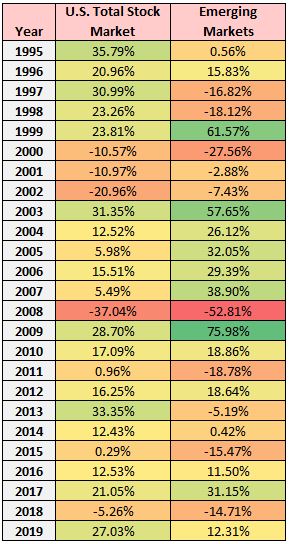

The following table shows the annual returns of emerging market stocks compared to U.S. stocks since 1995:

The correlation between the two is 0.55, which indicates that they’re positively correlated – they tend to experience positive and negative returns in tandem – but they’re far from perfectly correlated.

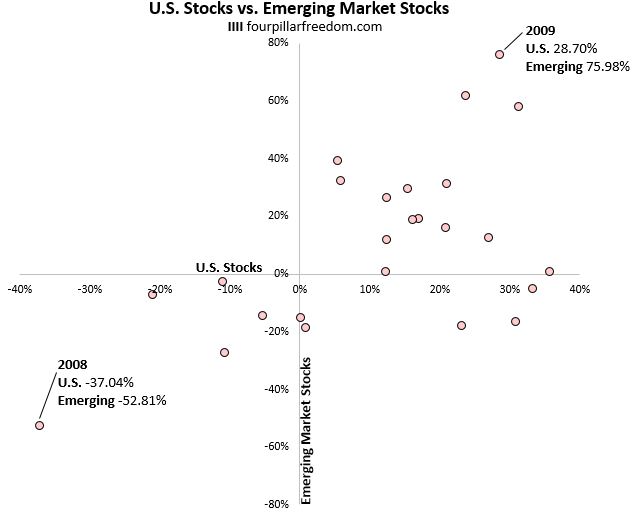

To illustrate this, check out the following scatterplot that shows the returns of U.S. stocks (x-axis) vs. emerging stocks (y-axis) for every year since 1995:

When U.S. stocks are up, emerging market stocks tend to be up as well, but the degree to which they’re up varies quite a bit.

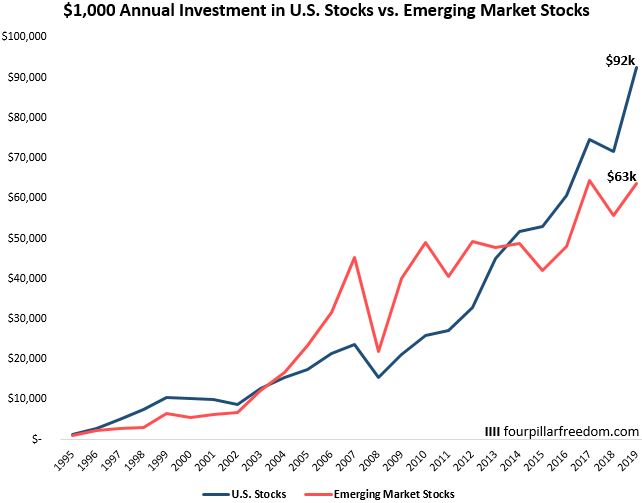

Since 1995, U.S. stocks have delivered 10.0% annual returns while emerging market stocks have delivered just 5.9% annual returns. The following chart shows the growth of a recurring $1,000 annual investment in each index fund performed since 1995:

Although a recurring investment in U.S. stocks performed better during this time period, emerging market stocks delivered higher returns in nine out of 10 years from 2001 through 2010.

Although a recurring investment in U.S. stocks performed better during this time period, emerging market stocks delivered higher returns in nine out of 10 years from 2001 through 2010.

In fact, emerging market stocks delivered better returns than U.S. stocks from 1995 through 2013. It has only been from 2014 through 2019 that U.S. stocks have significantly outperformed.

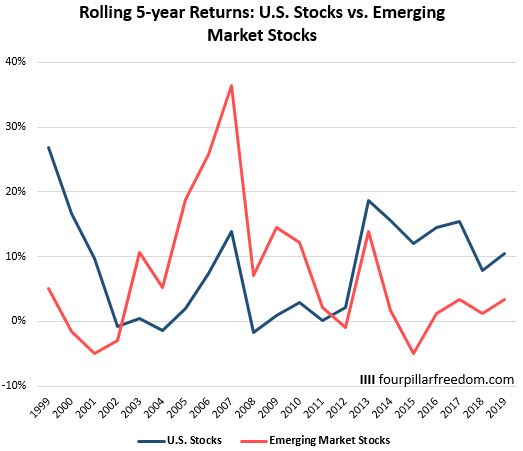

And if we take a look at the rolling five-year returns for both U.S. stocks and emerging market stocks, we can clearly see that the two took turns outperforming during this time period:

During the late 1990s, it was a wonderful time to hold U.S. stocks. Then, for most of the 2000s it was an excellent time to hold emerging market stocks. Then, in the 2010s it was more beneficial to hold U.S. stocks again.

Conclusion

While it’s difficult to predict how U.S. stocks will perform relative to emerging market stocks in the future, it’s reasonable to assume that the two will once again take turns outperforming during different time periods. For this reason, it could make sense to hold a mix of both U.S. stocks and emerging market stocks.

This might not lead to significantly higher returns, but it could lead to lower volatility since these two types of stocks tend to take turns delivering higher returns.

This is the whole idea behind diversification: through holding a variety of asset classes, you can earn similar investment returns that one asset class can provide, but with lower volatility.

As mentioned earlier, if you’re interested in sprinkling in some emerging market stocks into your portfolio, a simple emerging market index fund offers the easiest way to do so.

Most major investment platforms like Vanguard, Fidelity, and Schwab all offer this type of index fund. For example, Vanguard offers the Vanguard Emerging Markets Stock ETF (VWO) with an expense ratio of just 0.12%. This single ETF holds over 5,000 individual stocks from a variety of emerging market countries and offers a simple way to gain exposure to emerging market stocks.

I personally recommend using M1 Finance to create your investment portfolio because they offer the ability to invest in fractional shares, they have no trading fees or annual fees, and they allow you to set up automated target-allocated investments.

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.