6 min read

The first financial book I ever read was one that I randomly picked up one day while walking through a Barnes & Noble bookstore. I forget the title of the book, but essentially it taught you how to analyze the financial statements of different companies so that you could “invest in stocks like Warren Buffett.”

This caught my attention. Buffett was a rich guy. I’d like to become rich too. Nevermind the fact that I only had a few hundred bucks in my bank account to work with.

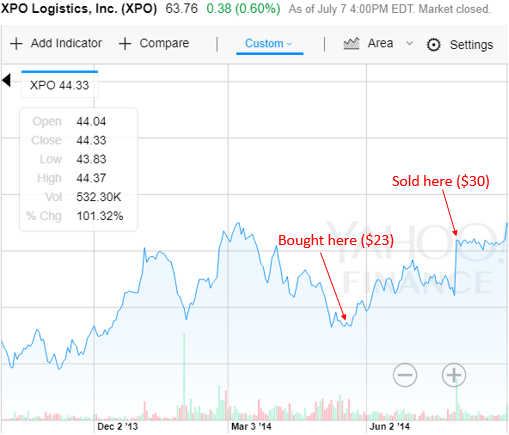

So, I bought the book and read it from cover to cover. I took detailed notes on what to look for on the financial statements of different companies and shortly after I invested in my first stock ever: XPO Logistics.

I bought roughly $500 worth of shares in May 2014 at $23 per share and promptly sold two months later at $30 per share. In only two months I had made a 30% return on my investment!

What that book failed to teach me, though, was that you actually need a decent amount of capital to invest to become wealthy from investment returns. In addition, the book never mentioned trading fees or capital gains taxes.

At the time, I was using TD Ameritrade as my online broker, so I spent $10 to buy the shares and $10 to sell. On top of this, I only invested $500 total and had to pay short term capital gains tax since I held the stock for less than a year. So my actual return was:

$650 (total with capital gains) – $20 (trading fees) – $22.50 (short term capital gains tax) = $607.50

Percentage return: (607.50 – 500) / 500 = 21.5%

Dollar return: $107.50

While a 21.5% return on investment in only two months is impressive, the actual dollar amount that I walked away with was not so impressive.

In the months that followed, I bought a handful of other stocks. I made money on some, and lost on others. After about a year of individual stock picking, I had very little to show for my efforts. I had not become Warren Buffett after all.

I did, however, start reading more personal finance books like Rich Dad Poor Dad, The Richest Man in Babylon, A Random Walk Down Wall Street, The Behavior Gap, and many others. With each new book, I added a tiny block to my pyramid of financial knowledge.

Most fascinating of all was the fact that I started to gain enough knowledge to question the financial advice I heard being thrown around by authors, news pundits, and even coworkers.

When I came across authors who touted the benefits of individual stock picking, I began to question whether or not they had something to gain from giving this advice since I had already read about how difficult it was to outperform index funds.

When I heard financial gurus give their annual stocklist recommendations, I knew that their recommendations were essentially random predictions.

And when older coworkers would tell me that renting was “throwing away my money,” I knew not to take them at face value since renting can be a better financial decision than buying depending on your unique situation.

As my financial knowledge grew, I was able to create my own investment approach. From analyzing the raw historical data and reading about the simplicity of index fund investing, I decided to become a simple index fund investor with a long-term investment horizon.

But there was one part of my financial life that still needed some work: my lifestyle.

The Influence of Personal Finance Blogs

Shortly after reading a plethora of financial books, I started reading more financial blogs. The first personal finance blog that I ever read was Mr. Money Mustache. I was captivated by his hardcore approach to personal finance. In particular, he advocates for riding a bike everywhere, avoiding gym memberships, cooking most meals at home, and becoming a DIY expert.

Then, I stumbled across Jacob from Early Retirement Extreme who lives on just $7,000 per year and recommends spending virtually no money on new clothes, living in an RV, and cooking the cheapest meals humanly possible.

Next, I discovered The Minimalists who live with very few personal belongings and household clutter.

Later, I came across Wall Street Playboys who recommend getting a high-income job in the finance sector to earn a shit ton of money in your 20s so you could be a millionaire by 30 and have plenty of money to spend on a nice lifestyle.

I continued this process of discovering new blogs, each one with authors who advocated for a specific lifestyle approach and who had seemed to find success with their approach.

Applying the Advice of Personal Finance Blogs

I began to take the advice of these various financial bloggers and apply it to my own life. What I soon discovered was that some pieces of advice improved my life, while others did not. Namely:

Gym Memberships: When I read this post from Mr. Money Mustache on why gym memberships are a waste of money, I decided to forego joining a gym when I moved out of my parents house and into my own apartment.

For about a month, I tried to simply do bodyweight exercises around my apartment. What I soon discovered was that I missed the atmosphere of a gym along with the ability to use machines during my workouts. I even became somewhat depressed because weightlifting was such an important part of my life and I felt like I had lost it.

So, I got a $11/monthly membership to a gym nearby and found that it was well worth the money. I actually had something to look forward to each day after work again.

Minimalism: I have been captivated by the idea of owning less stuff ever since I watched the documentary Minimalism on Netflix. This film inspired me to sell a bunch of my old clothes and shoes that I rarely wore. It also inspired me to embrace living with less clutter.

Today, I live in an apartment with very few personal belongings and I love it. I have less stuff to clean, less things to take care of, and less clothing and furniture to haul whenever I move from one apartment to the next.

I’ve found that hardcore minimalism doesn’t appeal to me, though. I still buy things that are unnecessary if they bring me joy. For example, I recently paid a friend $200 to create a custom painting for me:

I also love houseplants. I have several different plants scattered throughout my apartment because it brings me joy when I look at them. Paintings and plants are certainly two items I could eliminate from my spending, but I choose not to.

Cooking: Nearly every personal finance blog I’ve ever read has advocated for cooking most meals at home to take advantage of both the financial and health benefits. While I completely agree with this idea, I still haven’t been able to reduce my food expenses much over the past few years because I find dining out with friends to be too fun and eating Chipotle for lunch to be too delicious.

I know deep down that I could save $50 to $100 each month easily if I simply stopped dining out so much, but this just isn’t a spending category I want to crack down on because I get too much joy from dining out.

The Importance of Knowing Thyself

From reading and applying the advice from various financial bloggers, I’ve had an important realization: My lifestyle doesn’t need to be an exact replica of Mr. Money Mustache, The Minimalists, or anyone else. Instead, I’m free to pick and choose certain aspects of different lifestyles and apply them to my own life as I see fit.

For me, I’ve found that the approach that makes sense both financially and personally for me includes:

- Living with very few belongings because it saves me time and money

- Rarely buying new clothes because I don’t care about clothes

- Buying Chipotle more often than I should because I love it

- Owning a gym membership because it brings me joy

- Driving a Honda Civic because I don’t care about owning a fancy car

- Buying tickets to sporting events because I enjoy sports

- Spending on travel because I cherish the memories

- Buying plants, paintings, and other “unnecessary” things because they make me happy

Undoubtedly there are things on this list that other people will look at and deem to be a waste of money, but that doesn’t matter because the things that bring me joy only need to make sense to me, not you.

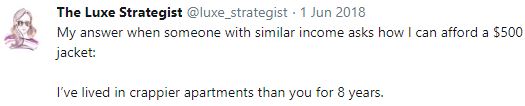

As my friend Luxe from The Luxe Strategist once tweeted:

She’s able to spend money on expensive clothing because she’s willing to save money on rent. This is a perfect example of someone who knows what brings them joy and has aligned their spending to reflect this.

Wherever you are on your own financial journey, just know that you don’t have to perfectly replicate the lifestyle and financial habits of an author or blogger you look up to. You’re free to pick and choose bits and pieces of advice from different writers and apply them uniquely to your own life. This way, you’re able to save money without sacrificing your quality of life.

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.

Great post! Love that you supported your friends’s art. Curious: what were your best selling venues for going minimalist?

Thanks Lin! By “best selling venues” do you mean sources that influenced me to pursue minimalism? If so, the big one that influenced me was the documentary Minimalism on Netflix. It also helped that the guys who made that film grew up in the same city as me. I’d recommend checking it out if you haven’t seen it before!

This is so similar to my journey into financial independence, all the way down to Chipotle. It’s interesting to read about the extreme cases because it reveals what is possible. We can pick and choose from there in moderation 🙂

Very cool to hear that we’ve had a similar journey up to this point! And agreed, it’s all about adopting what works for you and letting the rest go. Also good to hear that you’re a Chipotle fanatic as well 🙂

Great post Zach. Average Americans accept the lie of keeping up with the Jones’. I think in the FIRE community we have the problem of trying to keep up/emulate our favorite bloggers, podcasters, etc.

That being said, I’ve personally grown by trying each new idea at least once to determine if it is for me or not. One thing that has resonated has been riding bikes. I now cycle to work and enjoy it.

Thanks for the feedback Jim! Also awesome to hear that you cycle to work. I imagine that has health and wallet benefits!

This is something that needs saying more often. There is so much advice out there it can feel like you need to follow someone else’s path. While that may get you part of the way to where you want to get to unless you work out what it is that you want it’s going to harder to get all of the way there.

As you say, the way forward is to pick and choose and, dare I say it, even make it up for yourself if no one else’s clothes fit!

Exactly! Pick and choose what works best for you, and if nothing out there resonates then feel free to blaze your own path 🙂