6 min read

One of the most common debates in the personal finance blogosphere is whether or not you actually need a high income to achieve financial independence.

Let’s define financial independence as having 25 times your expected annual expenses during retirement. So, if you plan to spend $40k per year in retirement, you need $1 million (25 x $40k) to achieve financial independence.

Related: The origin of the “25 times your expenses” definition.

Although I would argue that saving up 25 times your expenses and never working again might not be a strategy that optimizes for happiness, let’s assume it’s a goal you still want to pursue.

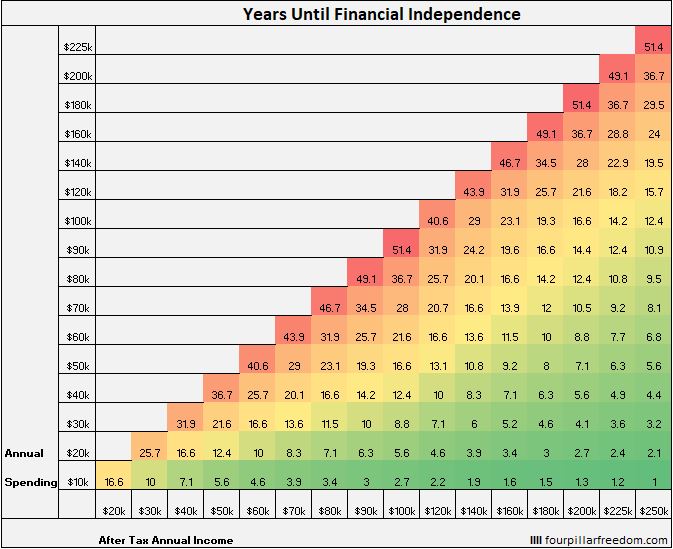

One way to determine if you actually need a high income to achieve financial independence is to look at it from a mathematical perspective. We can do this using the Financial Independence Grid, which assumes that you start with $0 and that you invest the difference between your post-tax income and expenses each year at a 5% return. The grid tells you how many years it will take to reach financial independence based on your annual post-tax income and expenses:

According to the grid, a household that earns $40k per year post-tax and spends just $20k per year can achieve financial independence in 16.6 years.

Likewise, a household that earns $80k per year post-tax and spends just $40k per year can also achieve financial independence in 16.6 years.

The grid illustrates an important concept: the time it takes you to achieve financial independence is dependent on your savings rate. For a household who is able to save and invest 50% of their post-tax income each year, they’ll be able to achieve financial independence in 16.6 years at every income level.

So, if we look at this debate purely from a mathematical perspective then we get a simple answer: No, you do not necessarily need a high income to achieve financial independence. You just need a high savings rate.

Unfortunately, life isn’t lived on pretty grids and spreadsheets. While the math tells us that a household who can survive on just $20k per year only needs to earn $40k per year to achieve F.I. in 16.6 years, the reality is that it’s very difficult for most households to survive on just $20k per year.

The Truth: Income Matters

There are many factors that contribute to how much your household spends each year like your household size, the cost of living in your city, and your general lifestyle.

And it’s certainly possible to lower your annual spending through smart grocery shopping, buying less expensive cars, living in a home that suits your needs rather than impresses your peers, and finding joy in things that are free like spending time in nature.

Related: For Most Americans, the Best Way to Spend Less is to Minimize the Big Three Expenses

But you can only reduce your expenses so much. At some point, you have to increase your income if you hope to reach financial independence in a reasonable amount of time.

This is why I personally don’t try to convince people that they can achieve F.I. at any income level, but rather I try to convince them that they’re capable of increasing their income to a level where they can achieve F.I. in a reasonable amount of time.

Minimize the “Big Three” Expenses

If a household came to me and asked how they could achieve financial independence as fast as possible, I’d tell them: reduce your spending to a reasonable level, then focus on growing your income.

In particular, get your “Big Three” spending under control: your housing, transportation, and food bills. Data tells us that these three expenses account for over 60% of total household spending. Once you get these three to a reasonable level, your attention should shift to growing your income because there is a lower limit that you’ll hit on your spending but there is no upper limit on your income.

For example, consider a household who is able to minimize their “Big Three” spending and reduce their total annual expenses from $60k to $40k. Instead of finding tiny ways to cut costs further and get spending down to $37k, they’re far better off looking for ways to grow their income.

Grow Your Damn Income

There are three primary ways you can grow your income. Depending on your situation and how much free time you have outside of your day job, one of these methods might make more sense for you than the others.

1. Invest in assets.

Assets are things that pay you. Examples include stocks, bonds, REITs, websites, or anything else that puts money in your pocket simply for owning it.

Related: Buy Less Stuff. Buy More Assets.

Suppose you earn $4,000 per month after taxes. If you use $2,000 to buy shares in a stock index fund with a 3% dividend yield, you will get paid $66 each year just for owning those shares. That’s $5.50 each month. Now, instead of earning $4,000 per month, you will start earning $4,005.50 per month.

This number seems small, but the more assets you own, the more dividends you’ll receive. If you continue to buy assets each month using income from your day job, your monthly income will continue to increase.

2. Build Your Own Assets

Along with buying assets, you can simply build your own.

One example of an asset you could build is a website. Two years ago I decided to start this site. Now, each month I earn money from mostly through ads and affiliate links. In October alone I made over $1,600.

I also built statology.org, a statistics educational site, which I hope to monetize over the course of the next year. There are virtually no barriers to entry if you want to build a website. You simply purchase a domain name, a hosting plan, and start writing content. Granted, it can take well over a year to earn a single dime from a website, but for those who are consistent and patient, a website can turn into a wonderful income stream.

Websites aren’t the only examples of assets you can build, though. Consider Dave from Accidental FIRE, who sells graphic designs online. Each month he earns $300-400 from selling his designs online.

The best part of all is that he only needs to create a design one time, upload it online, and sit back and wait for people to purchase it. As he continues to build up his online inventory, his income will likely continue to increase over time.

Building assets can be a great way to create your own income stream. The one drawback is that it often takes months or even years to see the payoff from building your own assets. But if you’re patient and maintain a long-term perspective, this isn’t a problem.

Personally, when I feel impatient and wish that I could earn income faster, I think of this quote from Steven Pressfield in Tribe of Mentors:

“I’m 74. Believe me, you’ve got all the time in the world. You’ve got ten lifetimes ahead of you. Don’t worry about your friends “beating” you or “getting somewhere” ahead of you. Get out into the real dirt world and start failing.”

3. Provide a Service

The third way to boost your income is to provide a service. Often people refer to this as a “side hustle” since it’s something you do on the side outside of your day job to earn extra income.

There are hundreds of examples of people earning extra income outside of their day job through providing services.

Personally I earn $40-50 per hour tutoring college students in statistics.

Jennifer Chan, a full-time lawyer, found a way to turn freelance writing into an income stream.

Kenzi from Kenzi Writes was able to turn freelance writing into her full-time job.

Kevin from Financial Panther frequently earns over $3,000 each month with side hustles like Airbnb hosting, Rover dogsitting, and DoorDash food delivery.

Young FIRE Knight found a way to earn over $300 per month charging electric scooters.

Millionaire Dojo earns hundreds per month selling items on eBay.

There are countless ways to earn income outside of your day job. Test out many different side hustles, see which ones are worth your time, and commit a few hours each week to working on them.

Conclusion

To me, it’s silly to spend my time trying to convince people that F.I. is possible at any income level. I’d rather tell it like it is: your income plays a huge role in determining how long it will take you to achieve financial independence, but fortunately there are ways you can increase your income through hard work and patience.

For anyone out there on the road to financial independence, focus on getting your “Big Three” expenses down to a reasonable level, then shift your focus to growing your income. No matter how you look at it, your income matters.

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.

Completely agree with this. You can’t truly become wealthy without working both sides of the coin; cutting expenses and growing income. I think there’s way too much emphasis in the FI world on cutting expenses, because like you said, there is a limit to cutting expenses. However, there is no limit on growing income, so we should be focusing more of our energy on this aspect of financial literacy.

Exactly – there is unlimited upside on your income-earning ability.

I love this approach. It might not be REQUIRED to have a high income to achieve Financial Independence, but it certainly makes it easier. You provided some great actionable ways to increase income.

Agreed – plenty of people achieve F.I. through extreme frugality and minimalism, but no matter how low your spending is, it always helps to simply increase your income.

Agree with your takeaway that income does impact your timeline. A lot of people shout that you can reach FI regardless of your income without acknowledging that it’s a lot easier to do if you earn 10x more.

Yes, exactly! Income matters.

I still love your Financial Independence Grid. I had to expand it out a bit for my personal situation since I am part of a dual income no kids household, but the same theory applies. It also allowed me to modify it based on different expected rates of return.

I love the fact that you pointed out investment income and how it starts out small, but that it will get bigger over time. We made about $2,000 on investment income this year (dividends), and that number will go up each year as we continue to add to it.

A lot of emphasis in the FIRE community is put on side hustles. They can be great for some people, but there are other situations where a larger return could be gained from pursuing advancement in your chosen career field. For example, my wife is a Veterinarian and she could spend her time doing some sort of side hustle or she could pick up extra relief shifts which pay about $1000 a day. A second example is my job which I took a large pay cut when I accepted, but I could put in extra hours to get my advancement sooner, be eligible for bonuses, and then be eligible for overtime which would be paid at a significantly higher rate than recharging scooters or delivering food.

I realize not all people have careers with these potentials. I think benefits of side hustle vs. extra time at your primary career changes depending on if you plan on switching from your career to a side hustle (i.e. running a blog, tutoring, etc.) or if your primary job does not have a high hourly rate/potential for advancement.

Great points, Kit. For some people, side hustles make sense and they can make a big difference financially. For other people in high-paying professions like your wife, it actually makes more sense to focus all of your energy on advancing through the ranks as a professional.

I think FI is absolutely doable with a higher savings rate. Of course, more income means you can dig yourself out of a hole more quickly, provided you slash expenses and save.

It comes down to how deep of a hole you’re in and how big of a shovel you have. You can get out with a spoon (small income, low savings), but it will likely take longer.

Haha love that line – “you can get out with a spoon, but it will likely take longer.”

Im slightly confused w the grid. Am I inferring wrongly as it seems to me that a 250k annual income with 10k expenses take just 1 yr to reach FI?

Yes, the assumption is that your expenses will continue being 10k

You are inferring correctly. If your annular expenses are only 10k then with an after tax income of 250k you would have 25 times your annular expenses after 1 year which would allow for a 4% safe withdrawal rate.

This is correct- if you define FI as having 25x your expected annual expenses (as many people do).

Although technically it would be slightly more than one year, because someone earning $250k per year and spending $10k would have $240k saved after a year, which is only 24x annual expenses.

Excellent post Zach

High income associated to a Frugal Mind is the Win-Win situation to reach FI in a timely fashion…no doubts about it

Unfortunately most of the time we witness Win-Lose scenarios of people making a lot of money and spending even more or Lose-Lose cases of Low earners piling up debts constantly eating outside or buying junks.

In the middle we have Lose-Win situation of frugal low earners who slower will reach FI and keeping the course thanks to their low spending habits.

The bottom line is knowledge (yes you can be FI and paycheck to paycheck is not the only alternative) and intelligence …

Agreed – the trick is not just to earn a high income, but to earn a high income while simultaneously keeping expenses fairly low.

Thanks for the shout out Zac! There’s no better time in history than now to increase your income. And it’s not all computer based stuff either, the lady up the street from me makes decent money dog-sitting.

No problem, Dave! And great point – there are tons of ways to earn income without being tech savvy.

PREACH!! I agree wholeheartedly with this post. There are two factors that millennials should consider though:

1. As you state, grow your income. There’s a big assumption in our space that incomes stay static, like, forever. If that were the case, I’d be royally screwed. I started out at a salary under $30K and now make over six figures. That sh*t doesn’t happen overnight. It happens with part time MBA classes and (gulp) incurring some debt in the process. It’s also important to have the self-awareness to mimic successful types around you so you can grow into an indispensable leader.

2. You might wind up getting married, thereby doubling, or at least increasing your income substantially, while sharing many of the major expenses. You just have to avoid spending like a knucklehead on houses, cars, and vacations to Cancun.

Great points, Cubert. I agree with both!

Yes and amen. A lot of people get wrapped up in extreme frugality, but at some point you just can’t cut expenses anymore.

I’ve always found it more fun to find ways to earn more money than slash expenses to the bone.

I also find it more fun and interesting to find ways to increase income rather than, as you said, “slash expenses to the bone.”