4 min read

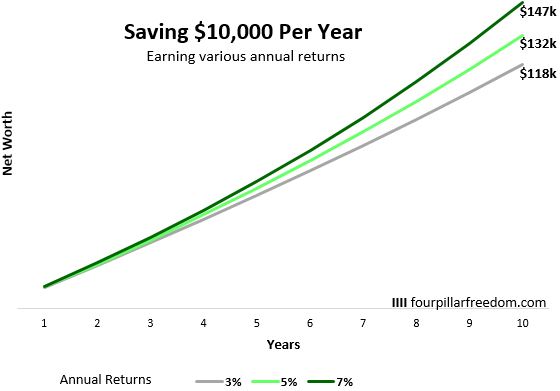

Suppose you invest $10,000 per year for 30 years.

Consider three scenarios: you earn 3%, 5%, or 7% annual returns on your investments. Here’s how much you would have after 30 years in each scenario:

By earning 7% annual returns, your ending amount is more than double the amount you would have by earning 3% returns.

I’m sure you have seen plenty of graphs like this one before, but I’d like to point out a specific piece of it that often gets overlooked: the early years.

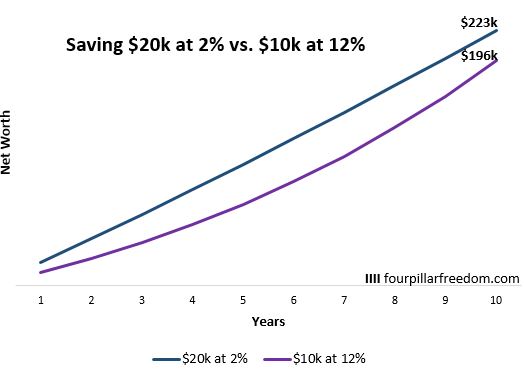

Let’s zoom in on the first 10 years:

Notice how the difference in net worth for the 7% and 3% scenarios is less than $30k after the first 10 years.

Also notice how the net worth lines are more linear than the previous graph. They lack that signature upward curve that comes as a result of compound interest. This is because the amount you save matters far more than your investment returns in your early financial years.

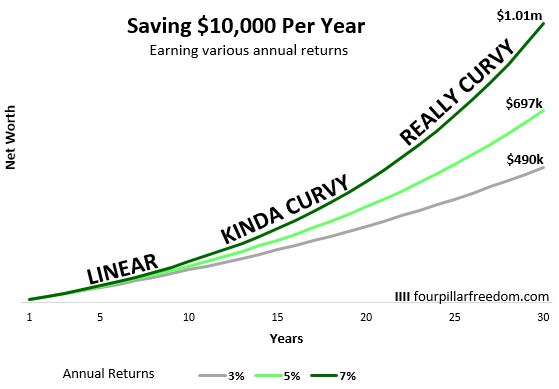

To illustrate this, compare someone who saves $20k per year and earns paltry 2% annual returns with someone who saves $10k per year and earns stellar 12% annual returns:

The person who saves $20k per year comes out ahead by $27k despite earning significantly lower investment returns.

The takeaway here is simple: investment returns matter most when you have a significant amount invested. In the early years, it’s unlikely that you have enough money invested for returns to move the needle. In the later years, however, investment returns matter a lot.

To see this, let’s jump back to our original graph. Notice how net worth growth is linear in the early years, but becomes more “curvy” towards the later years:

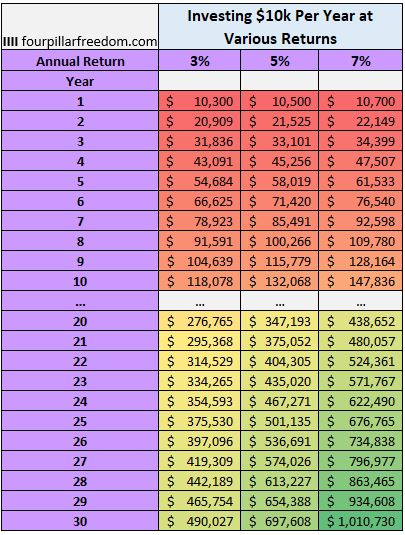

To understand the curvy nature of compound interest, let’s check out the raw numbers for this graph:

Check out the “7%” annual return column. From year 9 to year 10, net worth increases by $19,672. Only $9,672 of that increase comes from investment returns while the other $10,000 comes purely from savings.

But then from year 29 to year 30, net worth increases by $76,123 and only $10,000 of that increase comes from savings. In the later years, with hundreds of thousands of dollars at work, investment returns become incredibly important.

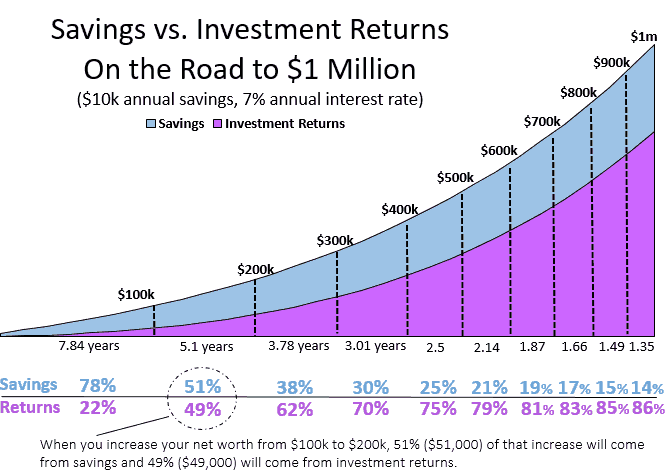

As I illustrated in this post, investment returns begin to take over net worth growth in later years:

Notice how investment returns account for 86% of net worth growth when you move from $900k to $1 million (assuming $10k annual savings, 7% annual investment return).

The Takeaways

Don’t be anxious about investment returns early on in your financial journey. The amount you save matters far more than your returns in the early years.

Over time, investment returns will account for more and more of your net worth growth.

The real power of compound interest is revealed in the later years. Compound interest will not make you rich in the short-term (<10 years), but when you give it several decades to work, its “curvy” nature in the later years can generate real wealth.

Grind it out in the early “linear” years. Enjoy the ride in the later “curvy” years. As Charlie Munger said, the first $100,000 is a b*tch, but once you cross that six-figure threshold and beyond, the curvy nature of compound interest begins to propel your net worth higher at a faster rate than you would expect.

Spreadsheet: Curvy Nature of Compound Interest

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.

Wow, this paints a very accurate financial picture for those just starting out in the stock market. Don’t be too concerned about getting all your investment choices right, just focus on contributing as much as possible. That’s a really vivid take away from your illustrations.

What I’ll add is, the more you make, the more you can shovel away. I think focusing on increasing income at an early age will be very important as well, and shouldn’t be taken for granted.

Awesome post!

Thanks, HLT! Glad you enjoyed this one 🙂

+1 to HLF comment. Saving paired with a rapidly increasing income is a powerful force.

I wrote something along these same lines about how your savings rate and income growth are far more important when aiming to build wealth rapidly. Would be interested to get your input.

https://www.genyfinanceguy.com/2015/11/30/savings-rate-important-variable-wealth-building-math-prove/

I’ll be sure to check out your article Dom, thanks for sharing!

This is exactly what I tell anyone starting out – it doesn’t matter what happens in the beginning of your investing career because you have SO LITTLE invested in the grand scheme of things. The changes don’t matter at all.

You see so many people online talking about the minutiae of investing – wait for the market to go down, invest in X thing that gets X return, go for the homerun on some stupid stock – but its with such small numbers. 10% return in a year on 100k is 10k. 3% in a year on 100k is 3k. It’s a 7k difference – it doesn’t mean anything and doesn’t change your life!

But once the numbers get big, then you can start worrying about that kind of stuff.

Couldn’t agree more. I was the same way when I first started out – attempting to maximize investment returns and obsessing over trades rather than focusing on increasing my income and thus my savings rate, which is the one variable that matters most when you’re just starting out.

Zach,

I really love the charts you do. They really paint the picture of compound interest and the value of time. I notice your examples also use some pretty conservative numbers and small investment amounts (by my standards anyway). I think a blog like yours makes for great example for all those people who respond to FI discussions with the attitude that it isn’t possible.

I think your blog lays out the road map to retirement for the majority of the United States. Not everyone will achieve early retirement, but a couple maxing out their respective IRAs and having no other savings would still be able to retire comfortably (and in their late 50s early 60s if starting in their late 20s early 30s).

Great job, you’ve given me a lot of inspiration and I may have to extend your charts so I can make them work for my situation.

~Kit

Kit, I’m stoked to hear that you have found the charts so valuable, thanks so much for the kind words 🙂