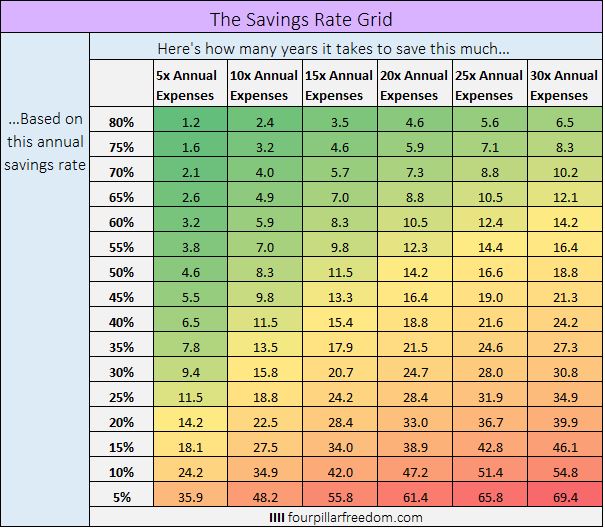

Behold. The Savings Rate Grid.

This grid shows how long it takes to save different amounts based on your annual savings rate. The grid assumes you start with $0 and that all savings are invested and earn 5% annual returns. The numbers in the grid work for any income level.

Let’s walk through an example.

Suppose your household earns $80k per year after taxes. You save and invest $20k each year. This means you have an annual savings rate of $20k / $80k = 25%.

Suppose you want to save up 25 times your annual expenses, which is typically defined as financial independence. According to the grid, it will take you 31.9 years to do so.

Or perhaps you only want to save up 15 times your annual expenses. With a 25% savings rate, according to the grid this will take 24.2 years.

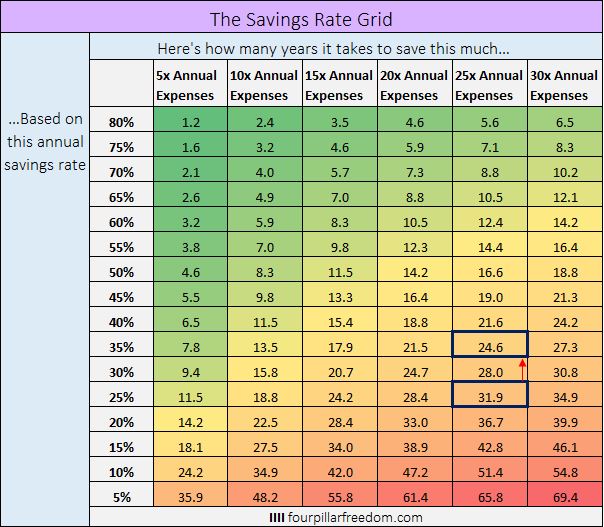

Moving Up & to the Left

This grid illustrates three ways that you can reach your financial goals faster.

The first way is to move up the grid, which means increasing your savings rate. For example, if you increase your annual savings rate from 25% to 35%, you can achieve financial independence seven years sooner.

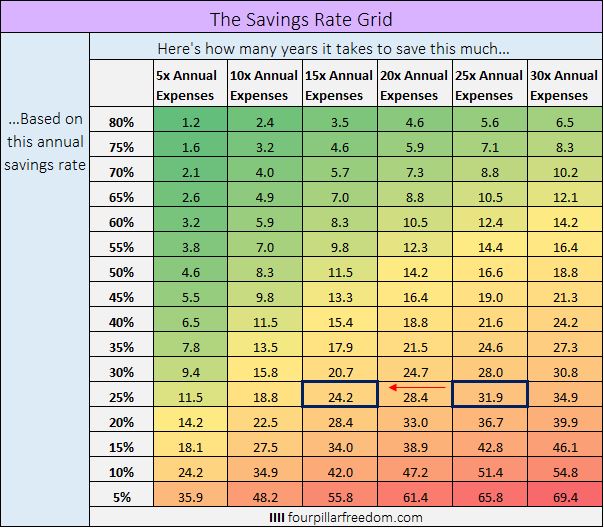

The second way is to move left on the grid, which means setting a smaller savings goal. For example, instead of saving 25 times your annual expenses, if you only wanted to save 15 times ann. expenses before quitting your job, you could achieve this in about seven years less as well:

One reason you may decide to save up less than 25 times expenses before quitting your job is because you plan on earning active income during retirement.

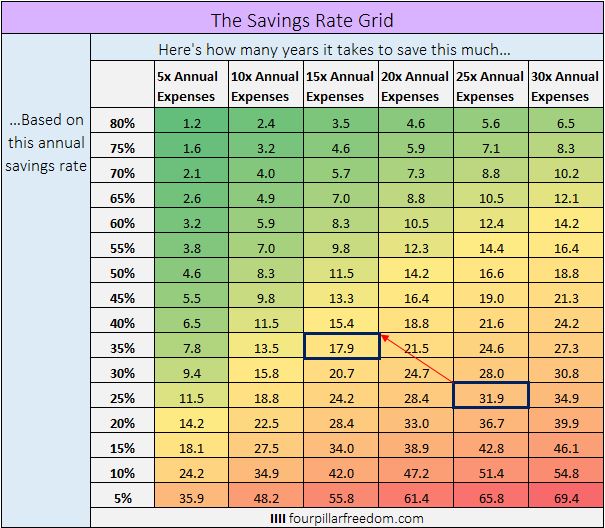

The third way to reach your financial goals faster is to move both up and left on the grid. For example, consider the family that currently saves 25% of their annual post-tax income and plans on saving 25 times their annual expenses.

By increasing their savings rate from 25% to 35% and decreasing their savings goal to 15 times annual expenses, they could cut their mandatory working life from 31.9 years to 17.9 years. That’s a 14-year difference:

Closing Thoughts

The obvious way to reach your financial goals faster is through increasing your savings rate. The less obvious way is through deciding to save less money before quitting your day job and finding other ways to earn active income in retirement.

Depending on your risk tolerance, one or both of these options might sounds like a good idea. That’s up to you to decide.

Related:

Here’s How Income During Retirement Blows the 4% Rule Out of the Water

Here’s How the “25 Times Expenses” Portfolio Has Performed Over the Past 89 Years

The Active Income Grid & The Ticket to a Shorter Cubicle Life

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.