3 min read

Without realizing it, all of us constantly use probabilities to make decisions throughout our day.

We know the probability that we’ll make it to our meeting at work if we leave our house at a certain time, the probability that our boss will show up before 9 AM, the probability that the office coffee will taste awful, the probability that we’ll have to wait more than 10 minutes at Chipotle for lunch, etc.

We do this all subconsciously, though.

We don’t literally think,

“Well, if there are 13,300 cars on the road this morning, 14 traffic lights I have to go through, and no road closures, I should make it to work in about 15.3 minutes. That means I should leave in 2.7 minutes to get there by 8:30 AM.”

It’s more like,

“Shit, it’s 8:15 AM, it’ll probably take me 15 minutes to get to work, I need to leave now to catch my 8:30 AM meeting.”

Subconsciously we gather all the data we have stored in our brains on our past commute times over the past few months. Then we use that data to calculate the average time it takes to get to work.

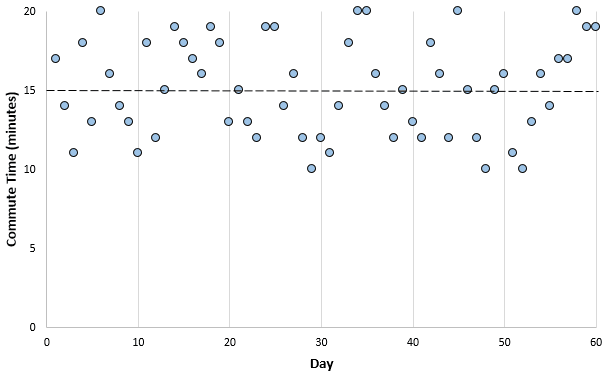

This data might look like:

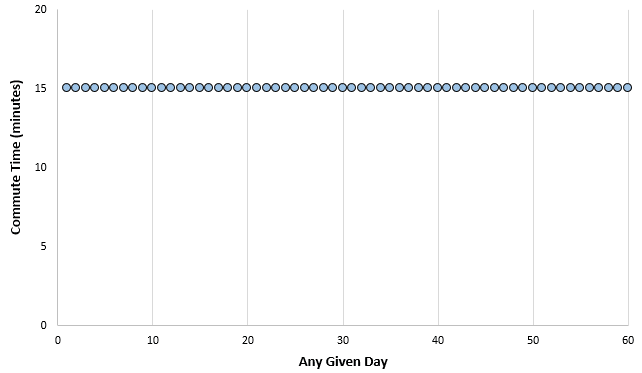

But we distill it into:

Some days it takes 20 minutes to get to work. Other days it takes 10. On average, we know it takes about 15 minutes, so we use that as a rule of thumb. If we leave at 8:15, we’ll probably get to work around 8:30.

We use this same type of probabilistic thinking with investing.

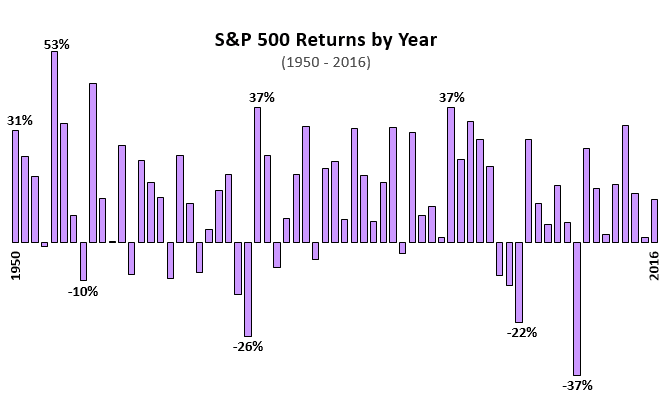

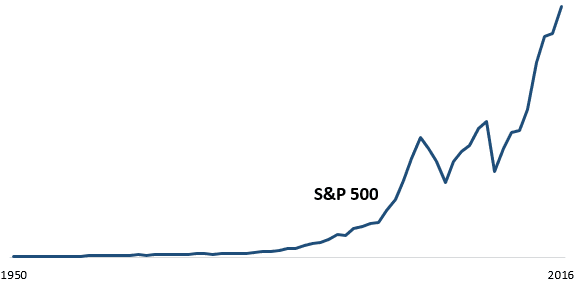

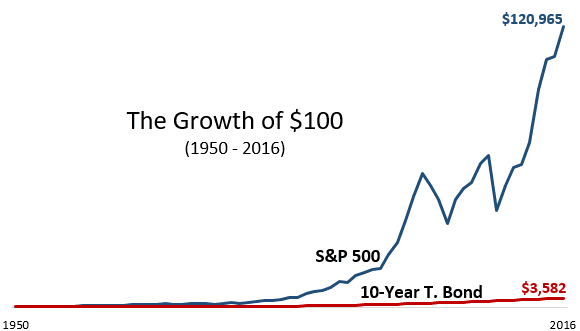

We know that stock returns are hard to predict on a yearly basis:

Over the course of several decades, though, we know stock returns tend to be positive:

Likewise, we know that owning bonds will likely reduce our long-term investment returns, but will provide a much smoother ride:

By looking at historical investment returns, we can make some reasonable guesses at how different asset classes will probably perform in the future.

Here are a few examples of how to use historical data and probabilities to improve investment decisions.

1. Investment returns probably won’t make or break you when you’re just starting out.

This is counter-intuitive to most beginner investors. Investment returns just don’t matter that much when you’re starting out since you don’t have enough money invested for market booms or crashes to impact your net worth.

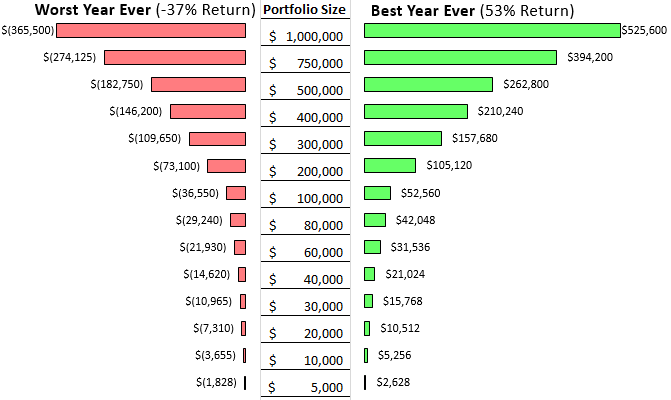

For example, here’s how the best and worst years for the S&P 500 impacted different-sized portfolios. Notice how smaller portfolios are barely moved by massive market gyrations.

This is why I often say it’s better to be an income machine than an investment guru, especially when you’re just starting out. Simply saving more money will help you increase your net worth much faster than earning higher investment returns.

2. It’s probably a good idea to hold bonds and cash in your first few years of retirement.

I covered this in-depth in this post on sequence of return risk. The idea is simple: To survive a multi-decade retirement, you basically need to make sure your portfolio maintains or increases its value during the first decade.

The best way to do this is by holding bonds that you can sell to support your lifestyle in the event of a stock market crash. This way, you don’t have to sell your stocks when their prices are dirt cheap.

If you can cover your living expenses through using cash and selling bonds during market slumps, you can give your stocks enough time to increase in price and allow your portfolio to recover.

3. It’s probably a good idea to invest the bulk of your savings into index funds

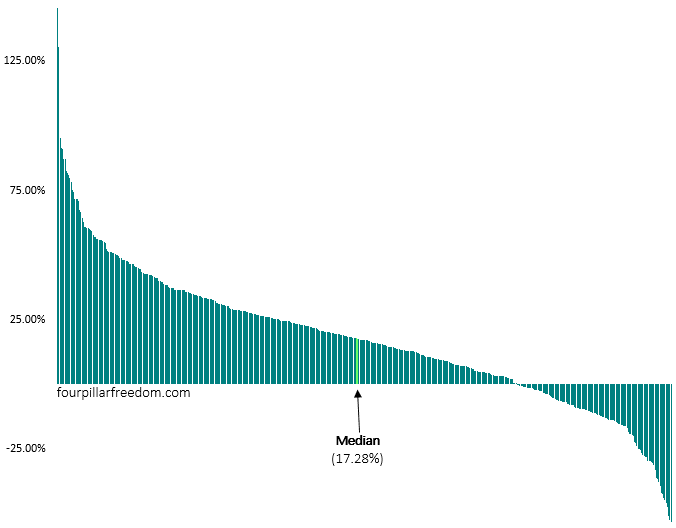

During most years, there are a handful of individual stocks that severely outperform the market average. For example, here’s a look at every S&P 500 individual stock return for 2017, sorted from highest to lowest:

Notice how there were a few individual stocks that handily beat the market average.

Your odds of picking any of these stocks with abnormally high returns is low. If you invest in a stock market index that holds all of these stocks, though, you’re guaranteed to own the winners.

These extreme winners tend to pull the returns of the entire index higher, which is why index funds are so hard to beat.

By using simple probabilities and knowing how the market tends to behave, you can make better investment decisions.

My favorite free financial tool I use is Personal Capital. I use it to track my net worth, manage my spending, and keep an eye on my monthly cash flow. It only takes a few minutes to set up and it makes tracking your finances simple and easy. I recommend trying it out.

You can also sign up to have my most recent articles sent straight to your email inbox for free ?

[jetpack_subscription_form subscribe_text = “” title=””]

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.

I never thought of it that way. I really distill a lot of variable things into an average. Maybe if I allowed myself a buffer I wouldn’t always be late for my 7:20 gym session! Thanks for this post Zach!

I think we all use averages more than we realize – it makes life easier 🙂

One of your best articles. Should help people for a long time, especially with these great graphics.

As your investments get larger, so do your risks and returns.

Thanks Robert, much appreciated!