5 min read

I’ve always found the topic of compound interest to be fascinating.

Invest $100 now and it could be worth $107 a year later, assuming a 7% annual return. Then that $107 could turn into $114.49 another year later. Then $122.50 a year later. And the process continues.*

*Of course, investment returns are rarely this consistent from one year to the next, but stock market data tells us that the S&P 500 has historically delivered 7% annual returns since the 1920s, even after inflation.

It’s like magic. The money you invest earns money for you, and then that new money earns money for you, and then that new money earns money for you. It’s a beautiful thing.

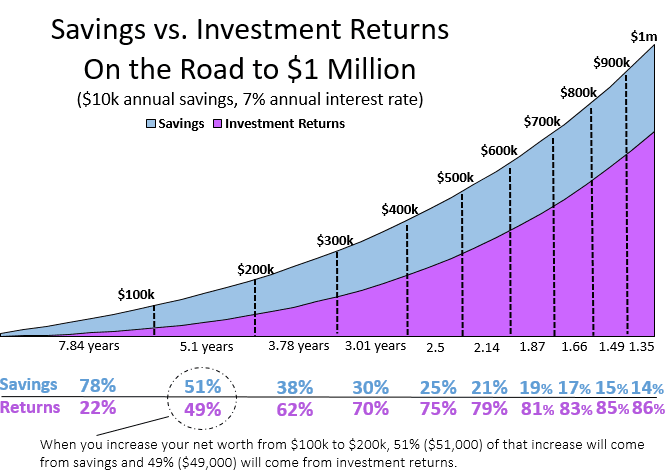

But the ugly truth about compound interest is that it actually sucks early on. Consider someone who invests $10k each year into the stock market and earns 7% annual returns. It will take them about 7.84 years to achieve a net worth of $100k, assuming they start from zero:

A whopping 78% of that $100k will be composed purely of contributions that the individual made. Only 22% will come from investment returns.

Of course, as time goes on investment returns begin to play a more important role. From $100k to $200k, investment returns account for nearly half of that growth. And by the time you go from $900k to $1 million, investment returns account for 86% of that growth.

So, compound interest is weak in the early years and strong in later years.

One way to take advantage of this fact is to invest enough money early on so that you can have a large sum of money several decades from now, even without making additional contributions beyond a certain age.

For example, suppose an individual is able to have $100,000 invested in broad stock market index funds by age 30. Even if they make no additional contributions, this $100k will blossom into $1,067,658 (assuming 7% ann. returns) by time they turn 65, making them a millionaire at retirement without investing a dime after age 30.

This individual could then use more of their income to enjoy their lifestyle during their 30’s, 40’s, and 50’s instead of putting it towards retirement contributions.

There is actually a name for this investment & lifestyle approach: Coast FIRE. The whole idea is to accumulate enough money at an early enough age that you no longer need to invest any more to achieve financial independence by age 65 (or whatever you define as a retirement age). Once you have enough money invested, you can simply “coast” your way to retirement.

In this post, I want to share some fascinating data around investment growth and the idea of Coast FIRE, including:

- How much will each $1 you invest be worth 30 or 40 years from now?

- How much do you need invested by age X to have $1 million by age 65?

- How much could investment returns impact these calculations?

Let’s jump in!

How Much Will Each $1 Be Worth Decades From Now?

You can calculate the future value of $1 using a simple formula: P*(1+r)t

where:

- P = initial principle

- r = annual rate of return after inflation

- t = years

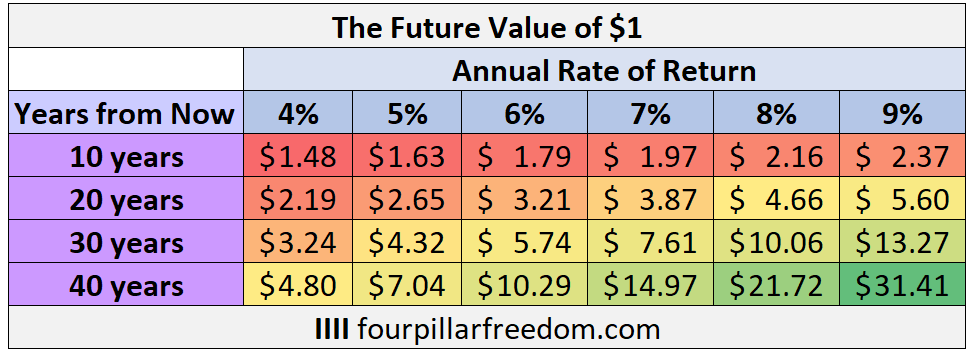

So, if you invest $1 then it will be worth this much in the future, assuming 7% annual returns:

10 years: 1*(1+.07)10 = $1.97

20 years: 1*(1+.07)20 = $3.87

30 years: 1*(1+.07)30 = $7.61

40 years: 1*(1+.07)40 = $14.97

If you invest just $1, then it will be worth $7.61 in 30 years. And if you invest $100,000, it will be worth $761,000 in 30 years.

The following table shows how much $1 will be worth after various time periods, using different annual rates of return:

How Much Do You Need Invested by Certain Ages to Have $1 million by 65?

You can use the following formula to calculate how much you need invested by a certain age to ensure that you’ll have a certain amount by a later age: A/ (1+r)t

where:

- A = amount you want

- r = annual rate of return after inflation

- t = years to for investments to compound

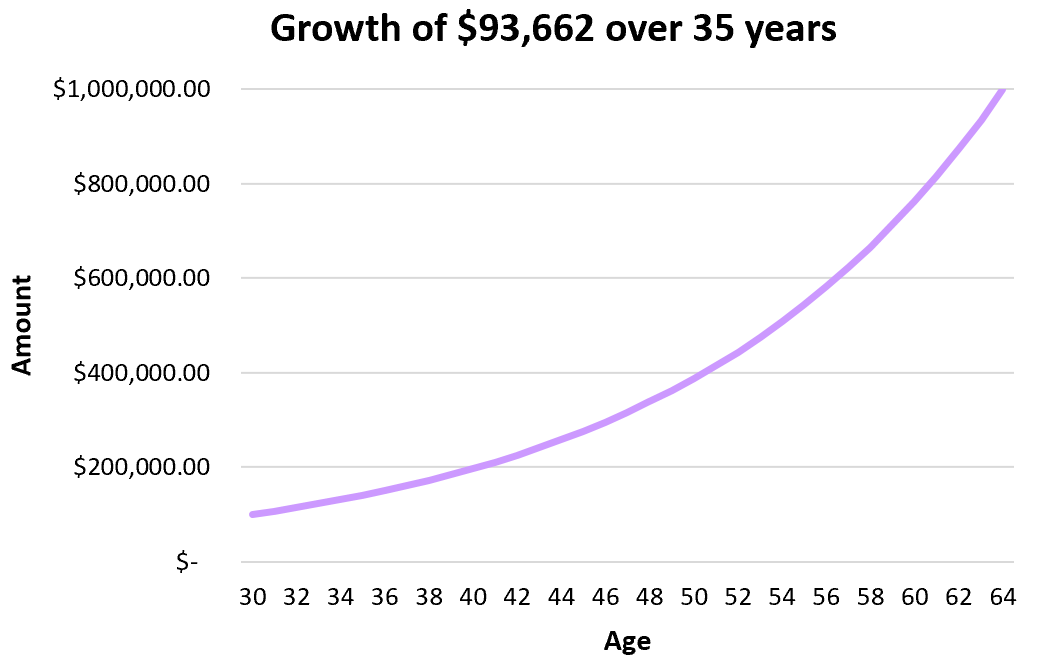

For example, suppose you assume 7% annual returns, you want to have $1 million by age 65, and you don’t want to invest any money after age 30. This means you’ll have 35 years for your money to compound.

Thus, the amount you need invested by age 30 is $1 million / (1+.07)35 = $93,662.

You can use this same formula to calculate any scenario where you want to quit contributing additional money beyond a certain age.

For example, suppose I want to have $1.5 million by age 70, I assume a 5% annual rate of return after inflation, and I want to stop contributing to my investments by age 30, which gives my investments 40 years to compound.

I would simply plug the following numbers into the formula:

Amount needed = $1.5 million / (1+.05)40 = $213,068.

Thus, I would need $213,068 invested by age 30 in order for my investments to grow to $1,500,000 by age 70.

How Much Could Investment Returns Impact Your Calculations?

The biggest assumption you have to make when performing future value calculations is the annual rate of return for your investments.

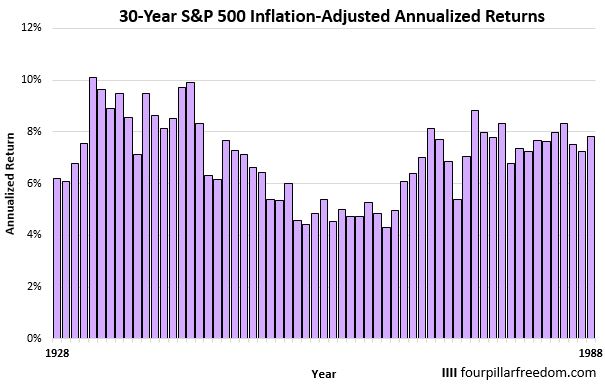

I mentioned earlier that the typical long-term annual rate of return for the S&P 500 is about 7%. But there have certainly been time periods in history when the actual rate of return was above or below 7%.

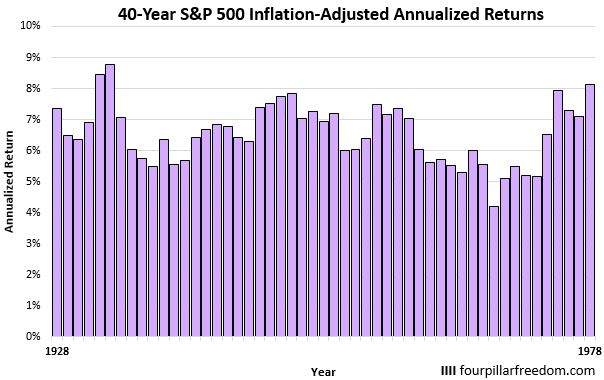

The following chart shows the inflation-adjusted annualized returns of the S&P 500 for every 30-year time period since 1928:

Worst 30-year period: 4.3% annualized returns

Best 30-year period: 10.1% annualized returns

Median 30-year period: 7.1% annualized returns

And this next chart shows the inflation-adjusted annualized returns of the S&P 500 for every 40-year time period since 1928:

Worst 40-year period: 4.2% annualized returns

Best 40-year period: 8.8% annualized returns

Median 40-year period: 6.5% annualized returns

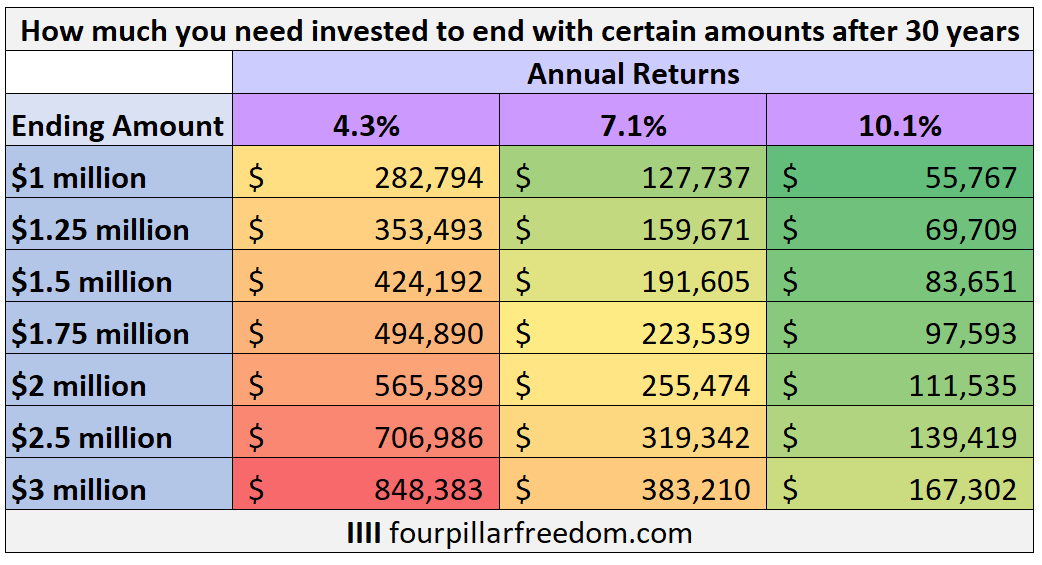

The following table shows how much you would need invested in order to accumulate a certain amount after 30 years, using the worst, best, and median 30-year annualized rate of returns:

How to read this table: If you want $1.5 million in 30 years from now, then you need $424,192 invested if you were to earn just 4.3% annual returns. If you earn 7.1% annual returns, you only need $191,605 invested. And if you earn 10.1% annual returns, you only need $83,651 invested.

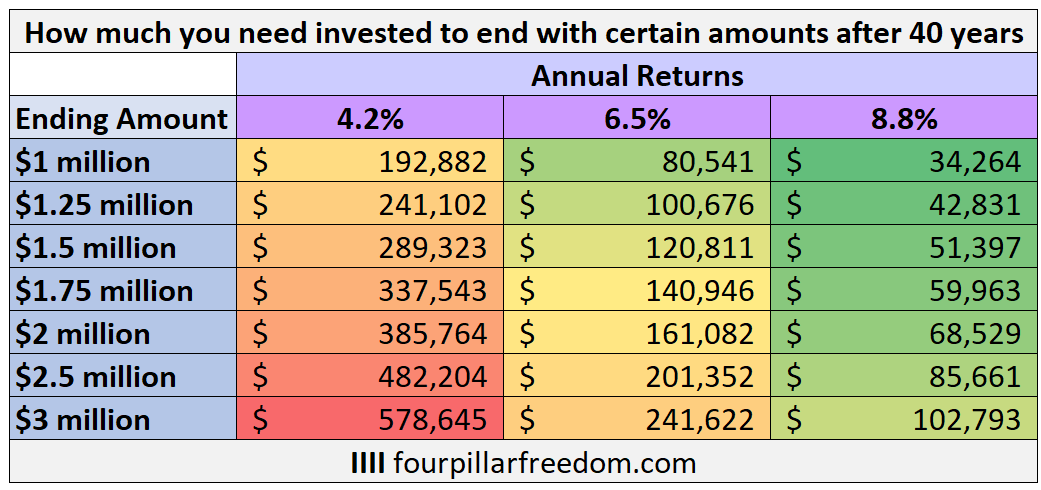

And this next table shows how much you would need invested in order to accumulate a certain amount after 40 years, using the worst, best, and median 40-year annualized rate of returns:

How to read this table: If you want $1.5 million in 40 years from now, then you need $289,323 invested if you earn just 4.2% annual returns. If you earn 6.5% annual returns, you only need $120,811 invested. And if you earn 8.8% annual returns, you only need $51,397 invested.

Conclusion

Compound interest is a powerful force in the long-term, but not in the short-term. One way to take advantage of this fact is to get enough money invested early on so that you give compound interest plenty of time to multiply your investments.

Keep in mind that each $1 you invest now will be worth $7.61 in 30 years, assuming 7% annual returns. And while nobody can predict how the market will behave in the future, history has shown that even during the worst 30-year and 40-year periods, the market has never delivered less than 4% annual returns, even after inflation.

This information should be encouraging for long-term investors. Get your money invested when you’re young, then enjoy the investment growth that will occur over the decades.

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.