4 min read

A reader recently emailed me with the following question:

“Is it true that small cap and mid cap stocks tend to deliver higher returns over the long haul compared to large cap stocks? If so, would it make sense for a young person to invest more heavily in small and mid cap stocks rather than a total stock market fund?”

In this post I’ll provide an answer to this question, including:

- The difference between small cap, mid cap, and large cap stocks

- The historical performance of each type of stock since the 1970s

- How to decide which type of asset allocation makes sense for you

The Difference Between Small Caps, Mid Caps, and Large Caps

The term “cap” is short for market “capitalization,” which describes the size of a company. The market cap of any company can be calculated through multiplying the number of outstanding shares by the share price, which gives you the company’s market cap.

In general, the market caps of companies can be classified as followed:

Large cap: $10 billion +

Mid cap: $2 – $10 billion

Small cap: $250 million – $2 billion

Most index funds can be classified as large cap, mid cap, or small cap funds. For example, an S&P 500 index fund would be classified as a large cap fund because it holds the 500 largest publicly traded stocks in the U.S.

Historical Returns: Small Cap vs. Mid Cap vs. Large Cap

To analyze the annual returns of small caps vs. mid caps vs. large caps, I used historical data from Portfolio Visualizer dating back to 1972.

For those who are curious, check out Portfolio Visualizer’s data sources to see which indices they use to calculate annual returns.

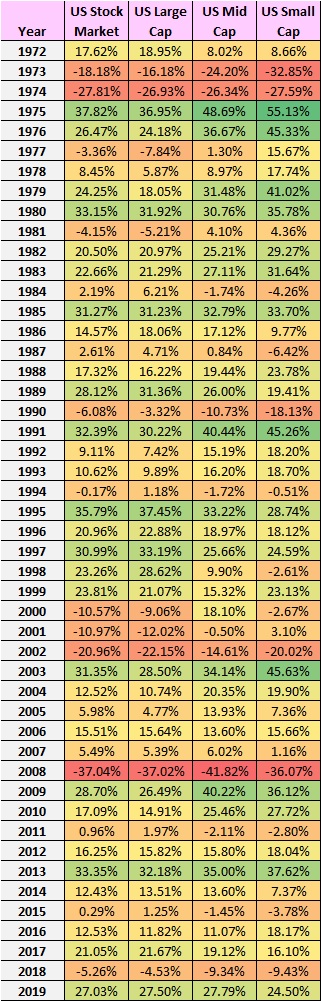

The following table shows the annual returns for each type of stock:

It’s easy to see that each type of stock is fairly highly correlated. Small caps, mid caps, and large caps all tend to have up and down years in lockstep. There are differences in performance, though.

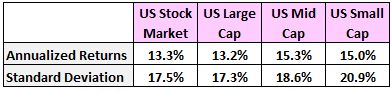

The following table shows the annualized returns along with the standard deviation of each type of stock during this time period:

Interestingly, mid cap stocks delivered the highest annualized returns during this time period. They even delivered higher returns than small cap stocks with less volatility.

Unsurprisingly, large cap stocks delivered almost identical returns to the total stock market because roughly 75% of a total stock market fund is composed of large cap stocks.

The following chart shows the growth of a recurring $1,000 investment in each type of stock at the beginning of each year since 1972:

While mid cap stocks absolutely crushed it during this time frame, it’s important to remember that this represents a specific starting year of 1972.

To see how each type of stock performed over time, it can be helpful to look at rolling returns.

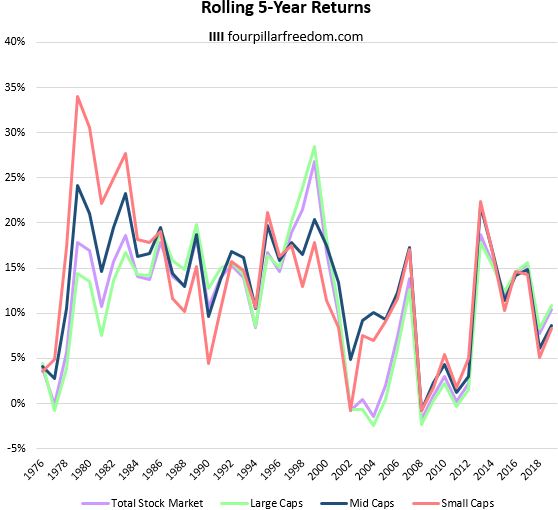

5-Year Rolling Returns

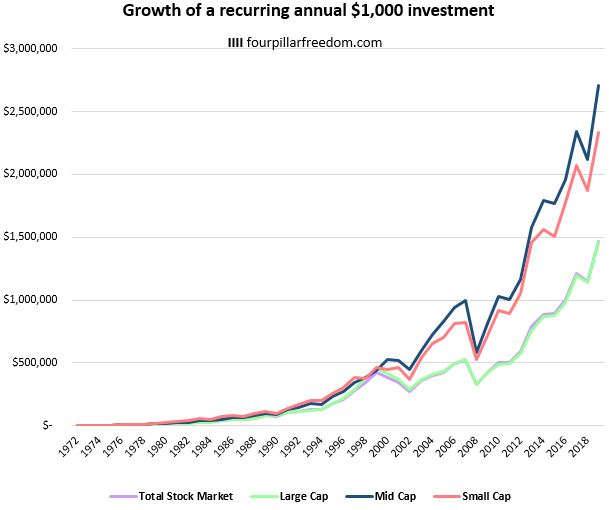

The following table displays the 5-year returns for each type of stock:

The chart below shows a visual representation of these numbers:

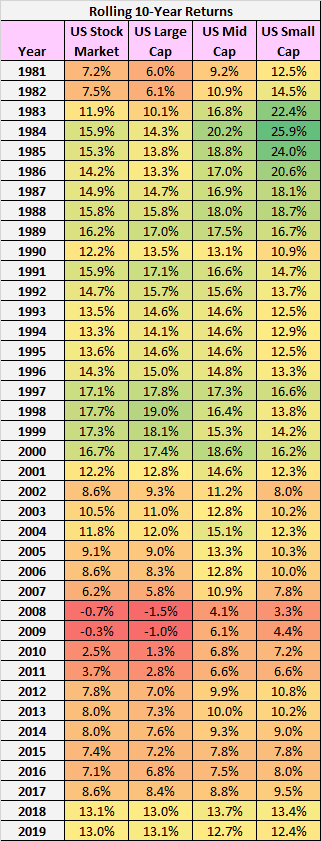

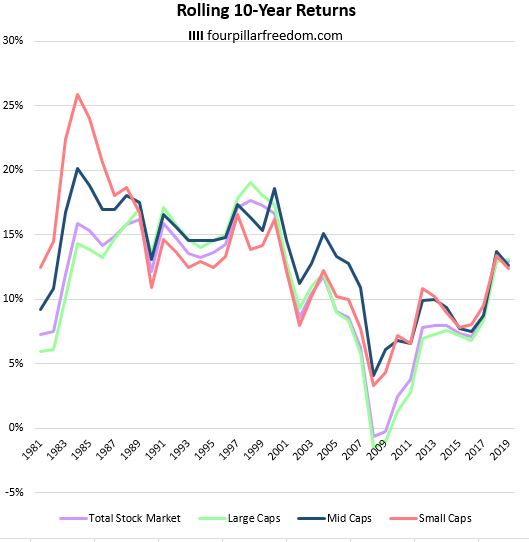

10-Year Rolling Returns

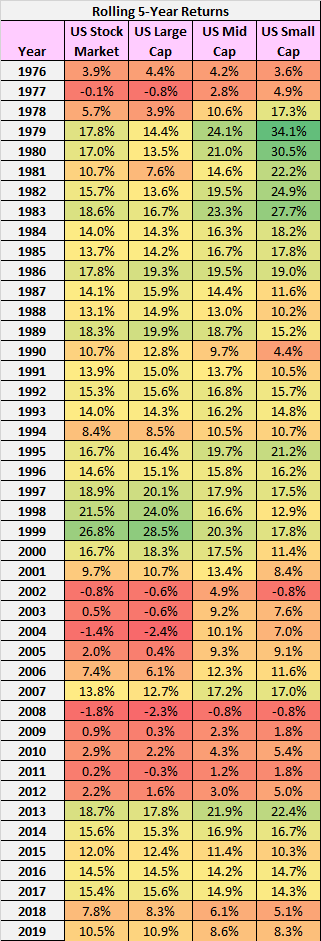

The following table displays the 10-year returns for each type of stock:

The chart below shows a visual representation of these numbers:

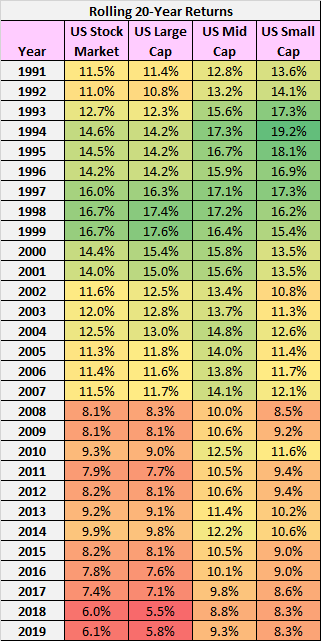

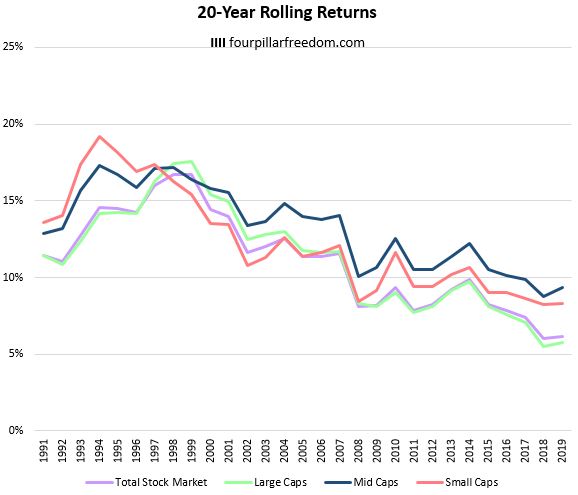

20-Year Rolling Returns

The following table displays the 20-year returns for each type of stock:

The chart below shows a visual representation of these numbers:

On Choosing Your Asset Allocation

Historical data shows that small cap and mid cap stocks do tend to outperform large cap stocks (and, as a result, the total stock market) over most long term periods, although there have been some stretches where large cap stocks have outperformed.

It’s important to keep in mind that this outperformance by small cap and mid cap stocks also tends to come with higher volatility, which is something to consider when tilting your portfolio towards these types of stocks.

Ultimately your asset allocation is a highly personal decision and historical returns are not necessarily indicative of future returns, but for investors who have long time horizons and a higher appetite for volatility, tilting your portfolio towards small and mid cap stocks could make sense.

One of the easiest ways to tilt your portfolio towards small and mid caps stocks is to simply invest a higher percentage in index funds that target these types of stocks. For example, if you use Vanguard then you could invest in the Vanguard Mid Cap ETF (VO) and the Vanguard Small Cap ETF (VB) to gain exposure to these stocks.

I personally recommend using M1 Finance to create your investment portfolio because they offer the ability to invest in fractional shares, they have no trading fees or annual fees, and they allow you to set up automated target-allocated investments.

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.