5 min read

In The Bogleheads’ Guide to the Three-Fund Portfolio, Taylor Larimore shares the following benefits of investing in index funds:

1. No individual stock risk. “Unlike mutual funds, individual stocks can plunge to zero. On the 50th birthday of the S&P 500 Index, only 86 of the original 500 companies still remained, showing it is possible to turn a large fortune into a small fortune with individual stocks. On the other hand, it is unheard of for a registered mutual fund to go to zero.”

2. Low fees. “To give you an idea of the impact of costs, consider this: If stocks gain an average of 6% annually during the next 30 years, someone who invested $25,000 with a 1% yearly fee will forego more than $35,000 in gains because of the fee – more than the original investment!”

3. Better returns. Larimore cites one study that shows the probability that a basket of ten active funds will outperform a passive total stock market index fund over a 25-year period is only 1%.

For these reasons and several others, Larimore concludes that the average investor is better off investing in a lazy portfolio compose of index funds rather than picking individual stocks.

For U.S. investors, the simplest index fund to invest in to maximize diversification and minimize fees would be a total U.S. stock market fund that holds all 3,600+ publicly traded stocks in the U.S.

However, some investors like Meb Faber argue that you should also invest in international stocks because there’s inherent risk in only investing in your home country. He cites the following research from Bridgewater Capital:

Shit happens in individual countries: “In the past century, there have been many times when investors concentrated in one country saw their wealth wiped out by geopolitical upheavals, debt crises, monetary reforms, or the bursting of bubbles, while markets in other countries remained resilient.”

A single country can’t consistently outperform: “And no one country consistently outperforms, as outperformance can lead to relative overvaluation and a subsequent reversal…So geographic diversification has big upside and little downside for investors.”

Diversifying internationally minimizes drawdowns: “There are plenty of instances in which geographic diversification has been a lifesaver, preventing wealth from being wiped out…Most countries have worse drawdowns in their history than the equally weighted portfolio has ever had…”

Minimizing drawdowns means faster compounding: “The geographically diversified portfolios do so well because they minimize drawdowns, creating a much more consistent return stream that allows for faster compounding.”

Simply put, investing internationally can improve overall returns and can help investors avoid the risk that comes with investing in just one country. And perhaps the easiest way to diversify internationally is to invest in a total world stock fund that holds all 8,000+ publicly traded stocks in the world.

To compare the pros and cons of investing in a total U.S. stock market fund vs. a total world stock market fund, I’ll take a look at the following two index funds offered by Vanguard:

VT: Vanguard Total World Stock Market ETF

VTI: Vanguard Total U.S. Stock Market ETF

No matter which fund you choose to invest in, I highly recommend using Personal Capital to track your investments. It’s a completely free tool that makes it easy to track the value of your investments and ensures that you’re paying the lowest fees possible.

Comparing VT vs. VTI

First, let’s get an overview of each fund:

| VT | VTI | |

|---|---|---|

| Fund Type | Exchange Traded Fund (ETF) | Exchange Traded Fund (ETF) |

| Expense Ratio | 0.09% | 0.03% |

| Minimum Investment | The price of one share | The price of one share |

| Number of Stocks | 8,178 | 3,611 |

| % of Fund in 10 Largest Holdings | 11.0% | 19.4% |

The funds have the following similarities:

- VT and VTI are both exchange traded funds

- Both require a minimum investment equal to the price of one share

The funds have the following differences:

- VT has a slightly higher expense ratio (.09%) than VTI (.03%)

- VT holds significantly more stocks (8,178) than VTI (3,611)

- The top ten holdings of VT account for a much smaller percentage (11.0%) of total fund assets compared to VTI (19.4%)

In a nutshell: Both funds have low fees, but VT (total world stock ETF) holds far more stocks and has a lower concentration of its fund held in the top 10 stocks.

VT vs. VTI: Differences in Composition

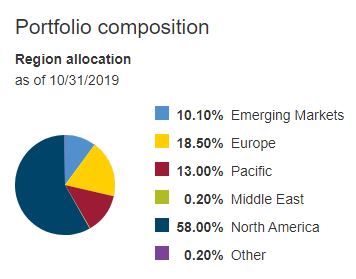

VTI (total U.S. stock market ETF) obviously holds only U.S. stocks, but VT holds stocks from all over the world. The following pie chart from Vanguard shows the portfolio composition of VT by region:

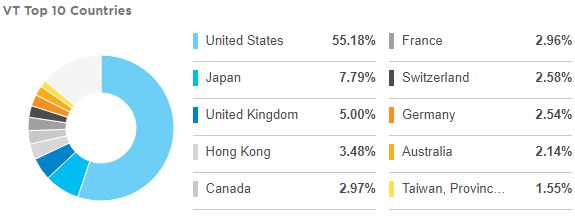

And this chart from ETF.com shows the top 10 countries represented in VT:

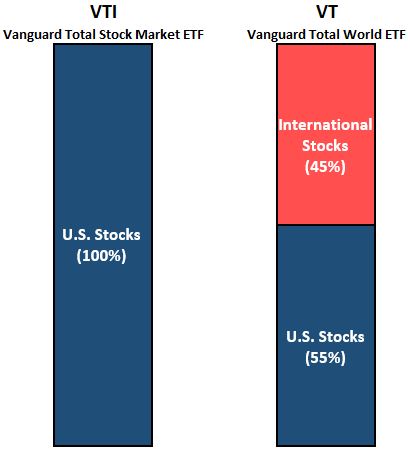

We can see that VT is roughly composed of 55% U.S. stocks and 45% international stocks. Here’s a simple way to visualize the differences in composition between VT and VTI:

What’s interesting to note is that the top 10 holdings of each fund are nearly identical simply because most of the largest stocks in the world are from the United States:

| VT | VTI |

|---|---|

| 1. Apple | 1. Apple |

| 2. Microsoft | 2. Microsoft |

| 3. Alphabet | 3. Alphabet |

| 4. Amazon | 4. Amazon |

| 5. Facebook | 5. Facebook |

| 6. Berkshire Hathaway | 6. Berkshire Hathaway |

| 7. JP Morgan Chase | 7. JP Morgan Chase |

| 8. Johnson & Johnson | 8. Johnson & Johnson |

| 9. Visa | 9. Visa |

| 10. Nestle SA | 10. Procter & Gamble |

VT vs. VTI: Differences in Performance

Unfortunately historical data only goes back to the early 2000s for these two index funds, but researchers from Vanguard were able to analyze annual returns of international stocks compared to U.S. stocks dating all the way back to 1970 using MSCI data.

Here are some fascinating findings from that research:

Finding #1: U.S. stocks and international stocks have taken turns outperforming since the 1970s.

Finding #2: A global portfolio experienced lower volatility than a U.S. portfolio, in general.

Finding #3: A global portfolio experienced a higher risk-adjusted return.

VT vs. VTI: Which Should You Invest In?

Here’s what we learned in this article:

1. Investing in index funds is the easiest way to maximize diversification while minimizing fees.

2. Investing exclusively in VTI will give you exposure to every publicly traded stock in the United States, but it will not give you exposure to any international stocks.

3. Data shows that U.S. stocks have outperformed international stocks in recent history, but that has not always been the case historically.

4. Research shows that investing in a globally diversified portfolio has historically produced better risk-adjusted returns than investing elusively in a total U.S. stock market portfolio.

Based on these findings, you could take one of the following actions:

1. Invest exclusively in VTI and accept the risk that comes with only investing in your home country.

2. Invest in VT and gain exposure to every publicly traded stock in the world.

3. Invest in some mix of VT and VTI. The higher percentage of VTI you hold in your portfolio, the more you’re making a bet that U.S. stocks will outperform international stocks in the future. This may or may not happen.

Conclusion

Data shows that U.S. stocks have outperformed international stocks recently, but history tells us that this outperformance is unlikely to last forever. To minimize home country bias, it makes sense for most investors to invest at least a portion of their portfolio in international stocks.

Investing exclusively in VT is the easiest way to diversify internationally, but for those who want to tilt their portfolio more towards U.S. stocks, they can invest a higher percentage in VTI.

No matter which fund(s) you decide to invest in, you can rest assured that you will be paying low fees and that you’ll be diversifying your investments more than if you simply bought individual stocks.

And, as always, keep in mind that investing in index funds is a way to build long-term wealth. The best way to actually enjoy investment returns is to avoid actively buying and selling funds. Choose your asset allocation, automate your investments, then be patient.

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.