5 min read

In The Bogleheads’ Guide to the Three-Fund Portfolio, Taylor Larimore gives several reasons for why index funds are better investment vehicles than individual stocks for most investors:

1. Index funds outperform most individual stocks over the long haul.

2. Index funds often have low fees, which means investors keep more money in their pockets and pay out less to active managers.

3. Index funds offer maximum diversification through holding hundreds or thousands of individual stocks.

Once you’re convinced of the benefits of stock index-fund investing, the next step is deciding which index fund(s) to invest in.

For investors who want to own a piece of every publicly traded stock in the world, they can buy something as broad as a total world stock index fund. For investors who want exposure to only U.S. stocks, they can buy a total U.S. stock index fund.

And for investors who want to invest in something more specific like small-cap stocks, international stocks, emerging market stocks, or something else, there exists an index fund for virtually all of these types of investments.

In this post, I’ll take a look at one specific class of index fund: dividend-focused index funds, which are index funds that only hold stocks with high dividends or appreciating dividends. These types of funds are popular among investors who want to receive returns on their investments (through dividend payouts) without needing to sell shares.

In particular, I’ll compare two popular low-cost dividend stock ETFs offered by Vanguard:

VYM – Vanguard High Dividend Yield ETF

VIG – Vanguard Dividend Appreciation ETF

Although these two funds both focus on holding dividend-paying stocks, they use different approaches for doing so. Depending on your investment goals and your time horizon, one of these ETFs may be a better choice than the other.

First we’ll look at some basic information about each ETF, then we’ll compare their composition, then we’ll finish by looking at their historical performance.

Let’s jump in!

Comparing VYM vs. VIG

First, let’s check out some basic information about each fund:

| VYM | VIG | |

|---|---|---|

| Fund Type | Exchange Traded Fund (ETF) | Exchange Traded Fund (ETF) |

| Expense Ratio | 0.06% | 0.06% |

| Minimum Investment | The price of one share | The price of one share |

| Number of Stocks | 419 | 184 |

| Category | Large Value | Large Value |

| Dividend Yield | 3.39% | 1.81% |

Note: You can find the information above on the Vanguard profile pages for both VYM and VIG.

The two funds share many similarities:

- Both are exchange traded funds.

- Both have an expense ratio of 0.06% – if you invest $10,000 into either fund you will pay $6 each year in management expenses.

- Both have a minimum investment equal to the price of one share.

- Both are classified as “large value” funds.

There are only two differences between the two funds:

- VYM is composed of 419 individual stocks, compared to just 184 for VIG.

- The dividend yield for VYM (3.39%) is higher than that of VIG (1.81%).

The reason these two ETFs differ in total number of stocks held and dividend yield is due to the outcomes they seek to achieve:

- VYM: Seeks to pay out high dividends to investors through holding stocks that have high dividend yields.

- VIG: Seeks to pay out increasing dividends over time to investors through holding stocks that have raised dividend payments for at least 10 consecutive years and through screening out stocks that may be at risk for cutting their dividend payment.

Because VYM seeks to pay out high dividends to investors now, rather than at some point in the future, it has a higher dividend yield.

And because VIG has a more strict criteria for vetting stocks, it holds a fewer number of stocks.

Inherently this means the two funds differ in terms of sector composition. So, let’s take a look at this difference in composition and see if it impacts performance at all.

VYM vs. VIG: Differences in Composition

The following table shows the portfolio composition of each ETF in terms of sector:

| VYM | VIG | |

|---|---|---|

| Basic Materials | 3.6% | 3.9% |

| Consumer Goods | 14.2% | 10.9% |

| Consumer Services | 9.6% | 19.9% |

| Financials | 18.8% | 11.8% |

| Healthcare | 12.3% | 12.0% |

| Industrials | 8.3% | 26.9% |

| Oil & Gas | 9.0% | 0.0% |

| Technology | 10.9% | 8.8% |

| Telecommmunications | 4.8% | 0.1% |

| Utilities | 8.5% | 5.7% |

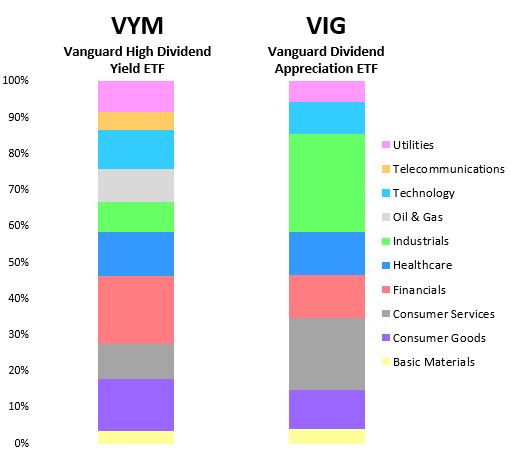

The chart below provides a visual look at these differences in composition:

There are two obvious differences between these two ETFs in terms of composition:

- VIG holds far more industrial and consumer services stocks.

- VYM holds far more financial and oil & gas stocks.

When you consider the differences in strategy between these two ETFs, the differences in composition make sense.

There are far more industrial and consumer services stocks that have a history of increasing dividends, which explains why VIG holds more of them.

Likewise, there are more financial and oil & gas stocks that have high dividend yields without having a history of consistently increasing dividend payouts, which explains why VYM holds more of them.

Next, let’s see if this difference in composition between these two ETFs impacts annual performance.

VYM vs. VIG: Differences in Performance

The following table shows the total annual returns (dividends included) for VYM and VIG from 2007 to 2018:

| VYM | VIG | |

|---|---|---|

| 2007 | 1.57% | 5.43% |

| 2008 | -32.16% | -26.38% |

| 2009 | 17.36% | 19.29% |

| 2010 | 14.18% | 14.69% |

| 2011 | 10.53% | 6.19% |

| 2012 | 12.56% | 11.58% |

| 2013 | 30.27% | 29.01% |

| 2014 | 13.51% | 10.06% |

| 2015 | 0.31% | -1.97% |

| 2016 | 16.89% | 11.90% |

| 2017 | 16.45% | 22.21% |

| 2018 | -5.94% | -2.10% |

Note: Vanguard only provides data dating back to 2007, so keep in mind that this is a fairly short time frame to analyze in the grand scheme of things.

As you can see, the annual returns between the two ETFs are fairly highly correlated, which isn’t too surprising considering they both hold U.S. stocks.

It is interesting to see, however, that VIG outperformed during the crash of 2008 and the subsequent years in 2009 and 2010, while underperforming in most of the years since then.

It’s hard to say which ETF offers better returns because that depends entirely on which time frame you consider.

For example, from 2007 to 2018, VIG offered higher annualized returns (7.36%) than VYM (6.72%). However, from 2010 to 2018, VYM offered higher annualized returns (11.66%) than VYM (10.88%).

Since nobody can predict how the stock market will perform in the future, all we know is that these two funds are likely to provide similar, but not identical annual returns in the years to come.

VYM vs. VIG: Which Should You Invest in?

We’ve seen that VYM and VIG share the following similarities:

- Both are stock dividend-focused ETFs.

- Both are classified as “large value” funds.

- Both have an expense ratio of 0.06%.

We’ve also seen that they have the following differences:

- VYM is composed of 419 individual stocks, compared to just 184 for VIG.

- The dividend yield for VYM (3.39%) is higher than that of VIG (1.81%).

And we’ve seen that their differences can be explained by the outcomes they seek to achieve:

- VYM: Seeks to pay out high dividends to investors through holding stocks that have high dividend yields.

- VIG: Seeks to pay out increasing dividends over time to investors through holding stocks that have raised dividend payments for at least 10 consecutive years and through screening out stocks that may be at risk for cutting their dividend payment.

Lastly, we saw that their annualized returns tend to be similar, but not identical, depending on which time frame you look at.

It’s hard to definitively say that one of these ETFs is “better” than the other because they both have different goals.

For investors who are seeking a higher dividend now, VYM is likely a better choice since it offers a higher dividend yield. For investors who want to hold a collection of stocks with dividends that are likely to appreciate in the future, VIG is likely a better choice.

Either way you look at it, both are excellent choices because they both provide a diversified portfolio of dividend-paying stocks with minimal investment fees.

No matter which funds you decided to invest in, I recommend using Personal Capital to track your investments with their free Investment Checkup tool and Retirement Planner. It’s a completely free platform and it’s the only one I personally use on a monthly basis.

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.